How Long Will It Take To Sell My House on Mt. Hood?

How Long Will It Take To Sell My House on Mt. Hood?

You want your house to sell fast. And you may be wondering how long the whole process is going to take. One way to get your answer? Work with a local real estate agent.

They have the expertise to tell you how quickly homes are selling in your area and what’s impacting timelines for other sellers. That way you have realistic expectations and can work together to come up with a plan that’s based on today’s market.

Here’s a high-level overview of just one of the factors a great agent will walk you through – the supply of homes for sale and how that impacts your process.

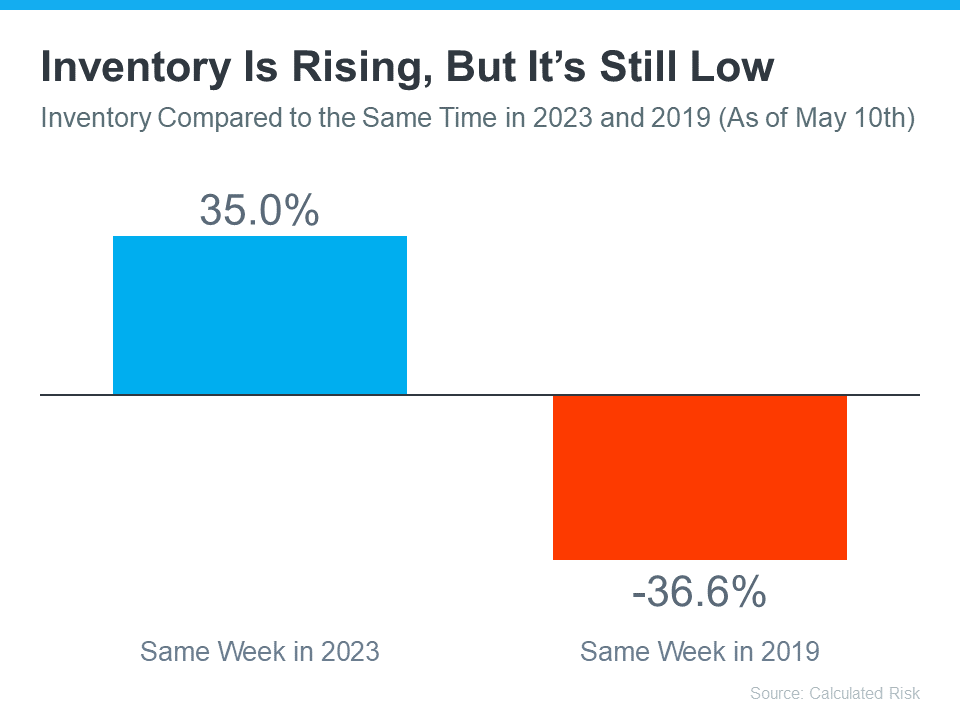

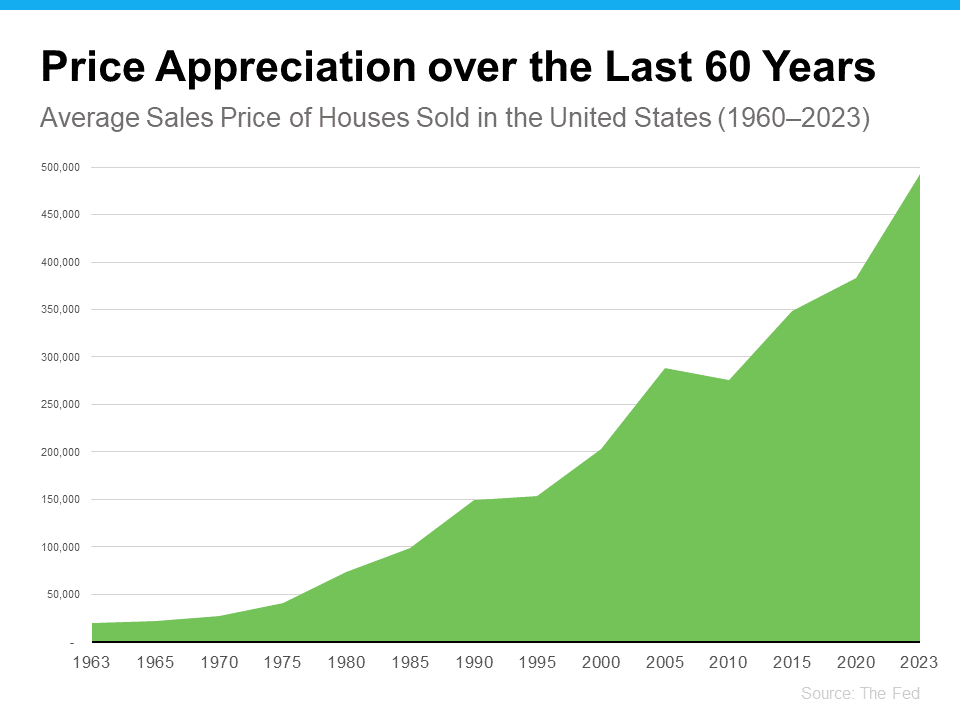

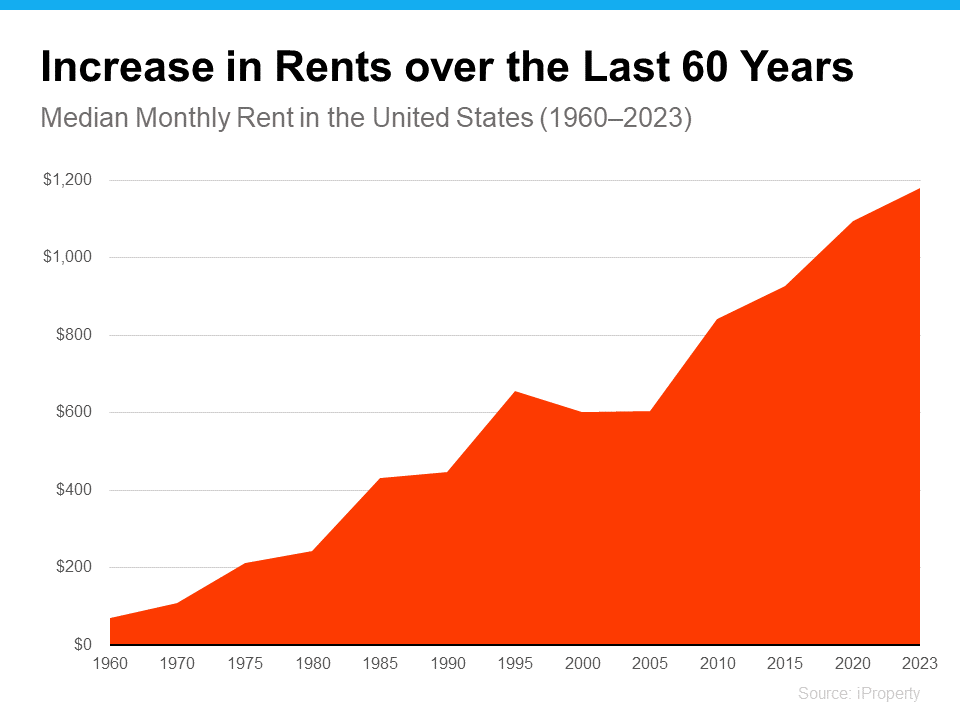

The Growing Supply of Homes for Sale

Over the past few months, the number of homes for sale has increased. This is good news when you move because it means you’ll have more options as you search for your next home. But it also means buyers have more to choose from, so if your house doesn’t stand out – it may take a bit longer to sell.

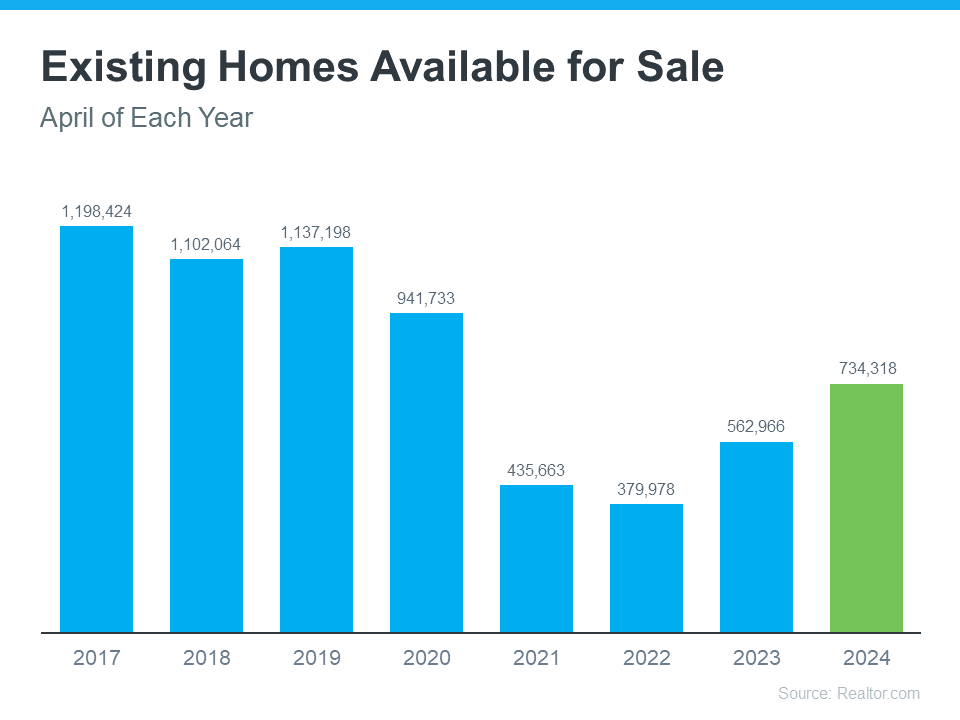

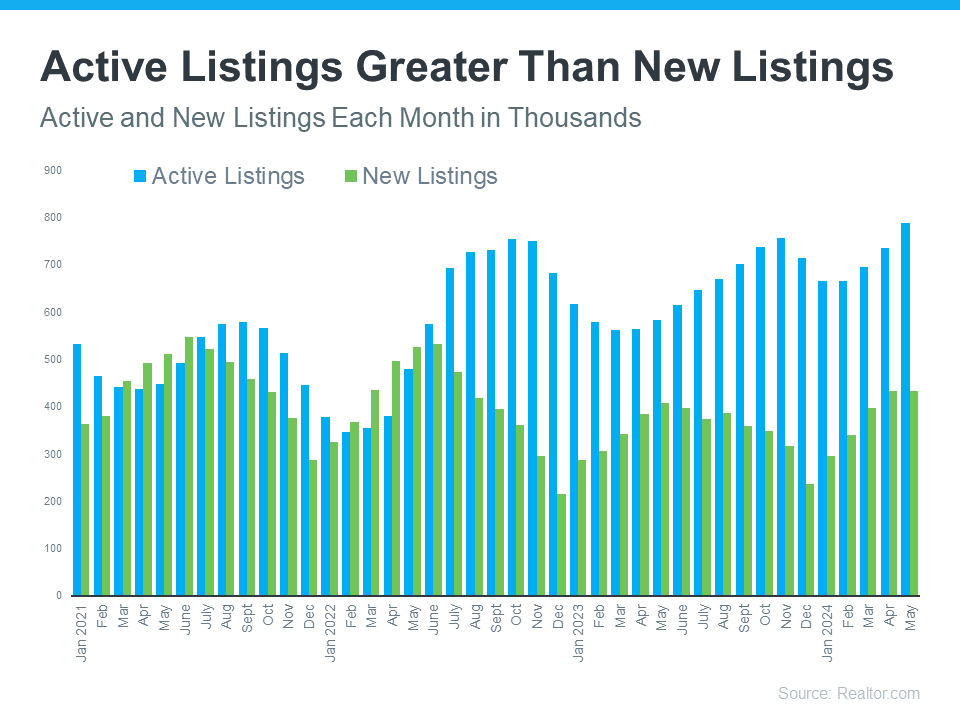

Available inventory is made up of new listings (homes that were just put up for sale) and active listings (homes that were already on the market but haven’t sold yet). And if you look at data from Realtor.com you can see a good portion of the recent growth is from active listings that are sticking around (see the blue bars in the graph below):

How It’s Impacting Listings Today

Think of the homes on the market like loaves of bread for sale in a bakery. When a fresh batch of bread is put out, everyone wants the newest and hottest one. But if a loaf sits there too long, it starts to get stale, and fewer people want to buy it.

The same goes for homes. New listings are the freshest and most sought-after. But if a home isn’t priced correctly, doesn’t show well, or it doesn’t have an effective sales or marketing strategy behind it, it can sit on the market and become less appealing to buyers over time.

An Agent Will Help Your House Stand Out and Sell Quickly

Timing is important to you. You want to get this done, fast. By leaning on a pro, they’ll make sure your listing is fresh and doesn’t stick around long enough to go stale. As the National Association of Realtors (NAR) explains:

“Home sellers without an agent are nearly twice as likely to say they didn’t accept an offer for at least three months; 53% of sellers who used an agent say they accepted an offer within a month of listing their home.”

Your agent will factor the recent inventory growth into their plan and create a customized selling strategy for your house. The supply of homes for sale can vary a lot by area. So they’ll do things like share their valuable insights into what’s happening with supply in your market, help you price your home correctly, and create a marketing plan that gets your home noticed.

Don’t let your listing get stale—reach out to a real estate agent today to make sure your listing is fresh and appeals to buyers from the start. It makes a big difference.

Bottom Line

If you want your house to sell fast, you need to work with a pro. Let’s connect so you’ve got someone who understands the current market trends and how to build a strategy around those factors, so your house is set up to sell quickly.