Today’s Biggest Housing Market Myths

Today’s Biggest Housing Market Myths

Have you ever heard the phrase: don’t believe everything you hear? That’s especially true if you’re thinking about buying or selling a home in today’s housing market. There’s a lot of misinformation out there. And right now, making sure you have someone you can go to for trustworthy information is extra important.

If you partner with a real estate agent, they can clear up some common misconceptions and reassure you by backing them up with research-driven facts. Here are just a few misconceptions they can help disprove.

1. I’ll Get a Better Deal Once Prices Crash

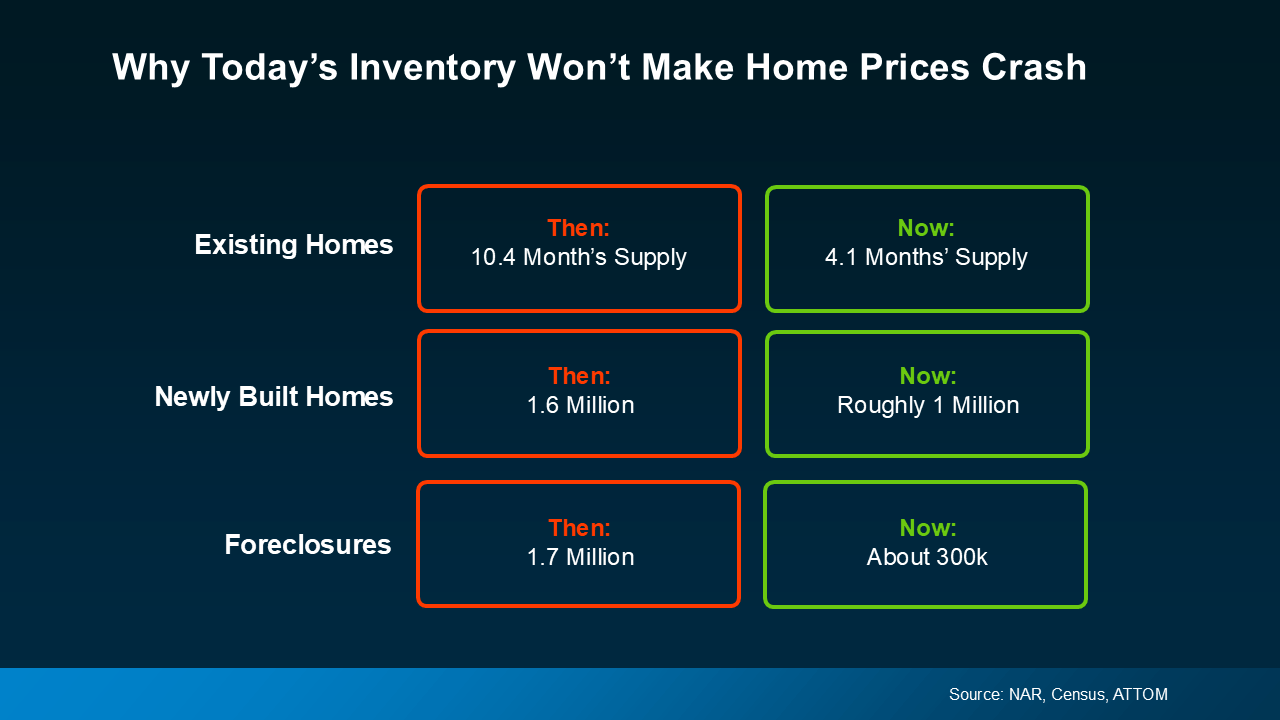

If you’ve heard home prices are going to come crashing down, it’s time to look at what’s actually happening. While prices vary by local market, there’s a lot of data out there from numerous sources that shows a crash is not going to happen. Back in 2008, there was a dramatic oversupply of homes that led to prices crashing. Across the board, there’s an undersupply of homes for sale today. That makes this market a whole different scenario (see chart below):

So, if you think waiting will score you a deal, know that data shows there’s not a crash on the horizon, and waiting isn’t going to pay off the way you’d hoped.

So, if you think waiting will score you a deal, know that data shows there’s not a crash on the horizon, and waiting isn’t going to pay off the way you’d hoped.

2. I Won’t Be Able To Find Anything To Buy

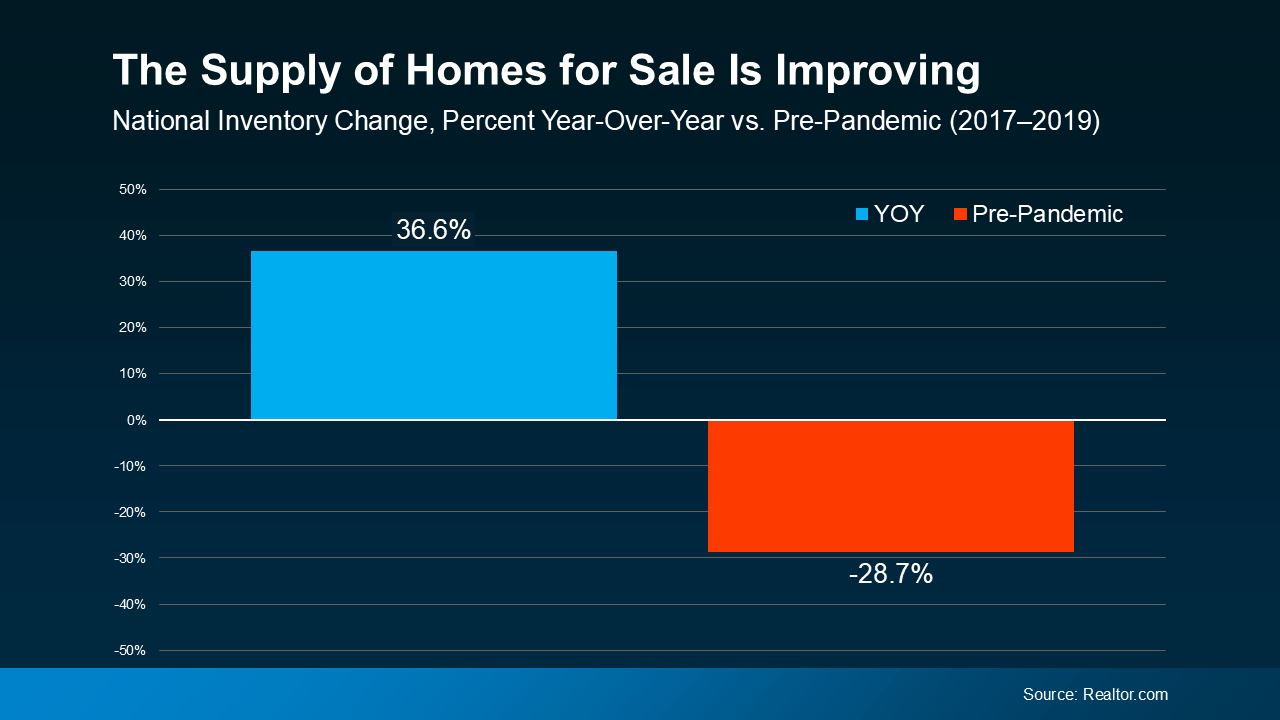

If this nagging fear about finding the right home if you move is still holding you back, you probably haven’t talked with an expert real estate agent lately. Throughout the year, the supply of homes for sale has grown. Data from Realtor.com helps put this into context. While there are still fewer homes on the market than in a more normal year like 2019, inventory is still above where it was at this time last year (see graph below):

So, if you’re remembering all that media coverage about record-low supply during the pandemic, you can rest a bit easier. While the market isn’t back to normal just yet, inventory is moving in a healthier direction. And that means as your options improve, you can let go of this now outdated myth because finding a home to buy won’t feel quite so impossible anymore.

So, if you’re remembering all that media coverage about record-low supply during the pandemic, you can rest a bit easier. While the market isn’t back to normal just yet, inventory is moving in a healthier direction. And that means as your options improve, you can let go of this now outdated myth because finding a home to buy won’t feel quite so impossible anymore.

3. I Have To Wait Until I Have Enough for a 20% Down Payment

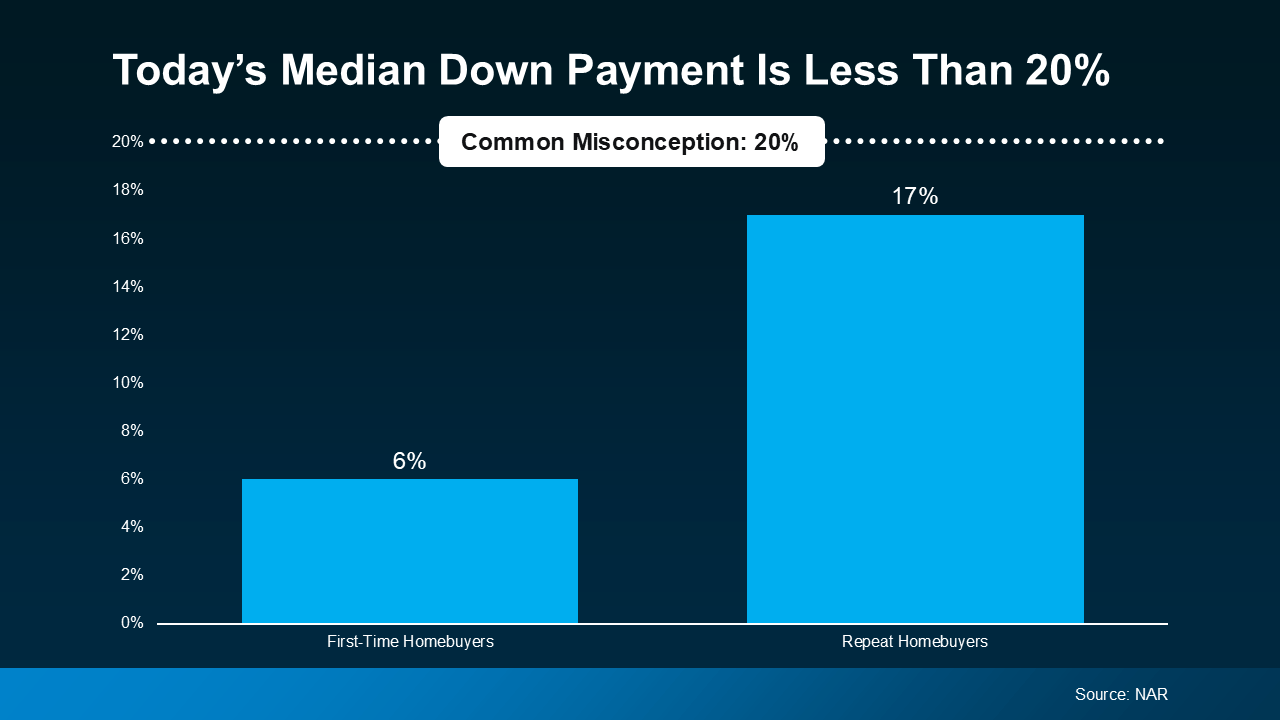

Many people still believe you need a 20% down payment to buy a home. To show just how widespread this myth is, Fannie Mae says:

“Approximately 90% of consumers overstate or don’t know the minimum required down payment for a typical mortgage.”

And if you look at the data from the National Association of Realtors (NAR), you can see the typical homeowner isn’t putting down as much as you might expect (see graph below):

First-time homebuyers are typically only putting down 6%. That’s far less than the 20% so many people think they need. And if you’re looking at that graph and you’re more focused on how the number for repeat buyers is closer to 20%, here’s what you need to realize. That’s only because they have so much equity built up in their current house that can be used to make a larger down payment for their next move.

This goes to show you don’t have to put 20% down, unless it’s specified by your loan type or lender. Many people put down a lot less. Not to mention, depending on the type of home loan you get, you may only need to put 3.5% or even 0% down. So, if you’re buying your first home, you likely don’t need nearly as much for your down payment as you may think.

An Agent’s Role in Fighting Misconceptions

If you put your move on pause because you heard one or more of these myths yourself, it’s time to talk to a trusted agent. An expert agent has more data and the facts, just like this, to reassure you and help break through any misconceptions that may be holding you back.

Bottom Line

If you have questions about what you’re hearing or reading, let’s connect. You deserve to have someone you can trust to get the facts.

.jpg)