Real Estate Information Archive

Blog

Displaying blog entries 331-340 of 1910

Supply and Demand in the Mt. Hood Real Estate Market

How Supply and Demand Can Impact Your Buying and Selling Goals in the Mt. Hood Market

In today’s Mt. Hood housing market, there are far more buyers looking for homes than sellers listing their houses. Based on the concept of supply and demand, this means home prices will naturally rise. Why is that? When there are more people trying to buy an item than there are making that item available for sale, that drives prices up. And that’s exactly the case in today’s housing market. So, knowing what’s happening with the inventory of homes for sale and the demand for housing is crucial for today’s buyers and sellers.

Nationally, Demand Is High and Supply Is Very Low

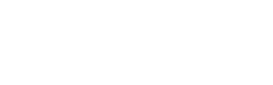

The latest buyer and seller activity data from the National Association of Realtors (NAR) indicates buyer traffic heavily outweighs seller traffic today, as shown in the maps below. There are far darker blues (strong buyer activity) on the left and much lighter blues (weak seller activity) on the right. In other words, this shows how the demand for homes is significantly greater than what’s available to purchase.

What Does This Mean if You’re a Mt. Hood Seller?

Supply is struggling to keep pace with demand. In fact, the inventory of homes for sale recently hit an all-time low. That gives you an incredible advantage when you sell your house. With so few listings, it’s likely more potential buyers will view your house – especially if you work with an agent to price it right. That means there’s a high chance you’ll receive multiple offers or buyers will enter a bidding war for your house. And that dynamic can drive the sale price of your home up.

What Does This Mean if You’re a Buyer?

As a buyer with fewer options available, you’re likely to see more competition, so you need to be strategic to win. First, make sure you have a trusted professional on your side. Your real estate agent will help you understand your local market and work with you to act quickly when the time is right. Even when it’s challenging to find a home, you can still succeed as a buyer today if you have a trusted advisor on your side every step of the way.

Bottom Line

Whether you’re a homebuyer, seller, or both, knowledge truly is power. Let’s connect today so you can better understand what’s happening in our local market and achieve your home buying and selling goals this year.

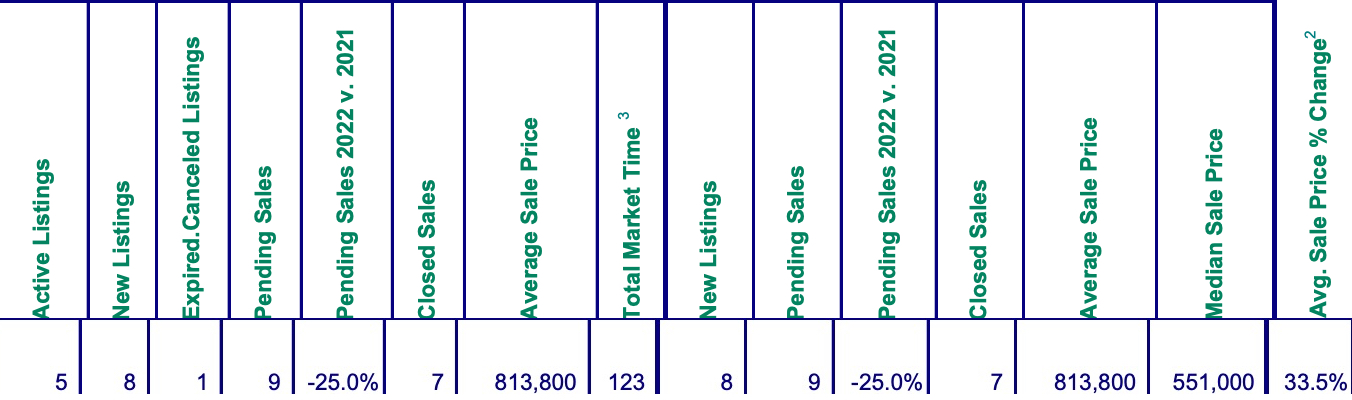

January 2022 Sales Numbers for Mt. Hood

January 2022 stats are in for Mt. Hood area sales. We started off the year with five new listings . We saw 25% less pending sales compared to 2021 in the same month. The big shocker is the average sales price for January at $813,800! With only seven sales, the $2,750,000 price of the ski camp lodge near Wapinitia surly shifted numbers upwards for the month. This did raise the median sales price up to $551,000 for the mountain. Needless to say, we’ve never seen a market like this!

One More Reason Folks Buy on Mt. Hood

The Perks of Owning More Than One Home

Many things have changed over the past couple of years, and real estate is no exception. One impact is an increased desire to own more than one home. According to the recent Luxury Market Report from Luxury Home Marketing:

“As trends such as remote working and flexi-hours took hold in 2021, so too did the flexibility of relocating as well as the growth of second homeownership.”

This may be because the pandemic has altered how we think about our homes. Where we live has become, more than ever, our safe space and our getaway. And with the rise in remote work, more people are reconsidering where they want to live and buying second homes to give them greater flexibility. If you fall in that category, here are just a few of the perks you’ll enjoy, and how owning a second home may be a great decision for your lifestyle and your future.

Enjoy a Change in Scenery (or Weather)

When you have two homes, you can alternate between them as the weather changes or as you crave different scenery. Do you want to live in an area with a particular season? Would alternating between a resort and a suburban setting be ideal? With two homes, you have those options. Being able to move between homes based on which location best suits you at the time gives you added flexibility and variety that can help increase your happiness.

Build Your Wealth Faster

You may have heard that home equity is skyrocketing, thanks to ongoing home price appreciation. CoreLogic reports that the average homeowner gained $56,700 in equity over the last year. With home prices projected to continue rising, if you purchase a second home, you could benefit from rising equity on both properties to build your wealth (and your net worth) even faster.

Be Closer to Loved Ones

The pandemic has also reignited the importance of being near our loved ones. One option worth exploring is whether you want your second home to be near the people who matter most in your life. This makes it easier to see your loved ones but still gives you your own dedicated, private space so you can be nearby for major life events or longer visits.

Lock in Your Expenses

Buying a second home today and locking in your mortgage rate may be a good option if you’re looking to stabilize your housing costs for the long haul. If you’re approaching retirement or are looking to use your second home as your permanent residence in the future, buying that house now with today’s rate and price may be a good financial decision. That way, no matter what happens with rates and prices in years ahead, your monthly payment is locked in for the next 15-30 years.

Bottom Line

Having multiple homes has considerable benefits. If owning a second home is something you’re interested in, let’s connect to explore your options, discuss the benefits, and take the next step to start your home search.

What’s Driving Today’s High Buyer Demand on Mt. Hood?

![What’s Driving Today’s High Buyer Demand? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/02/16141917/20220218-MEM-1046x1947.png)

Some Highlights

- There’s an influx of buyers looking for homes today, and that means your house is in high demand. Here are a few reasons why so many people are looking to buy a home.

- Buyers are motivated to beat rising mortgage rates, and many want to escape rising rents. There’s also additional demand from millennials who are reaching peak home buying age.

- If you’re thinking about selling your house, today’s demand is great news. Let’s connect to begin the process of listing your house while buyers are ready to purchase.

Housing Bubble?

4 Simple Graphs Showing Why This Is Not a Housing Bubble in the Country or on Mt. Hood

A recent survey revealed that many consumers believe there’s a housing bubble beginning to form. That feeling is understandable, as year-over-year home price appreciation is still in the double digits. However, this market is very different than it was during the housing crash 15 years ago. Here are four key reasons why today is nothing like the last time.

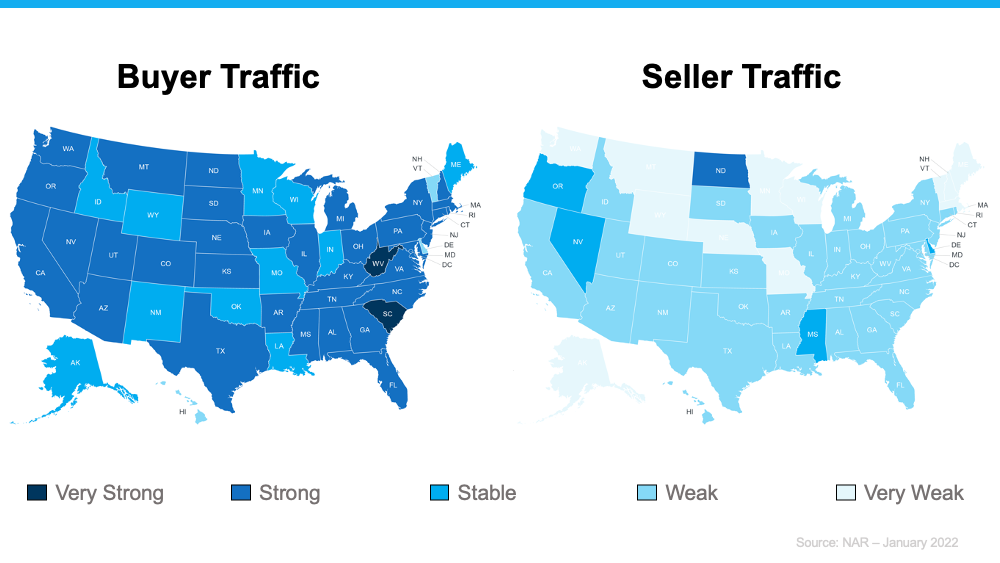

1. Houses Are Not Unaffordable Like They Were During the Housing Boom

The affordability formula has three components: the price of the home, wages earned by the purchaser, and the mortgage rate available at the time. Conventional lending standards say a purchaser should not spend more than 28% of their gross income on their mortgage payment.

Fifteen years ago, prices were high, wages were low, and mortgage rates were over 6%. Today, prices are still high. Wages, however, have increased, and the mortgage rate, even after the recent spike, is still well below 6%. That means the average purchaser today pays less of their monthly income toward their mortgage payment than they did back then.

In the latest Affordability Report by ATTOM Data, Chief Product Officer Todd Teta addresses that exact point:

“The average wage earner can still afford the typical home across the U.S., but the financial comfort zone continues shrinking as home prices keep soaring and mortgage rates tick upward.”

Affordability isn’t as strong as it was last year, but it’s much better than it was during the boom. Here’s a chart showing that difference:

If costs were so prohibitive, how did so many homes sell during the housing boom?

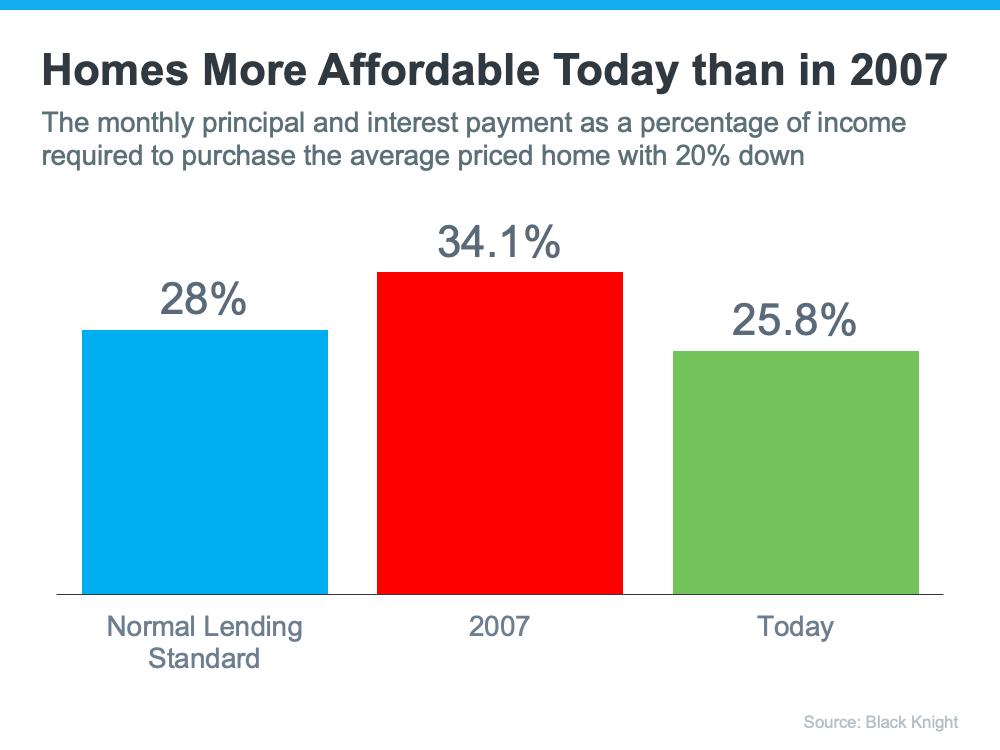

2. Mortgage Standards Were Much More Relaxed During the Boom

During the housing bubble, it was much easier to get a mortgage than it is today. As an example, let’s review the number of mortgages granted to purchasers with credit scores under 620. According to credit.org, a credit score between 550-619 is considered poor. In defining those with a score below 620, they explain:

“Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk.”

Buyers can still qualify for a mortgage with a credit score that low, but they’re considered riskier borrowers. Here’s a graph showing the mortgage volume issued to purchasers with a credit score less than 620 during the housing boom, and the subsequent volume in the 14 years since.

Mortgage standards are nothing like they were the last time. Purchasers that acquired a mortgage over the last decade are much more qualified. Let’s take a look at what that means going forward.

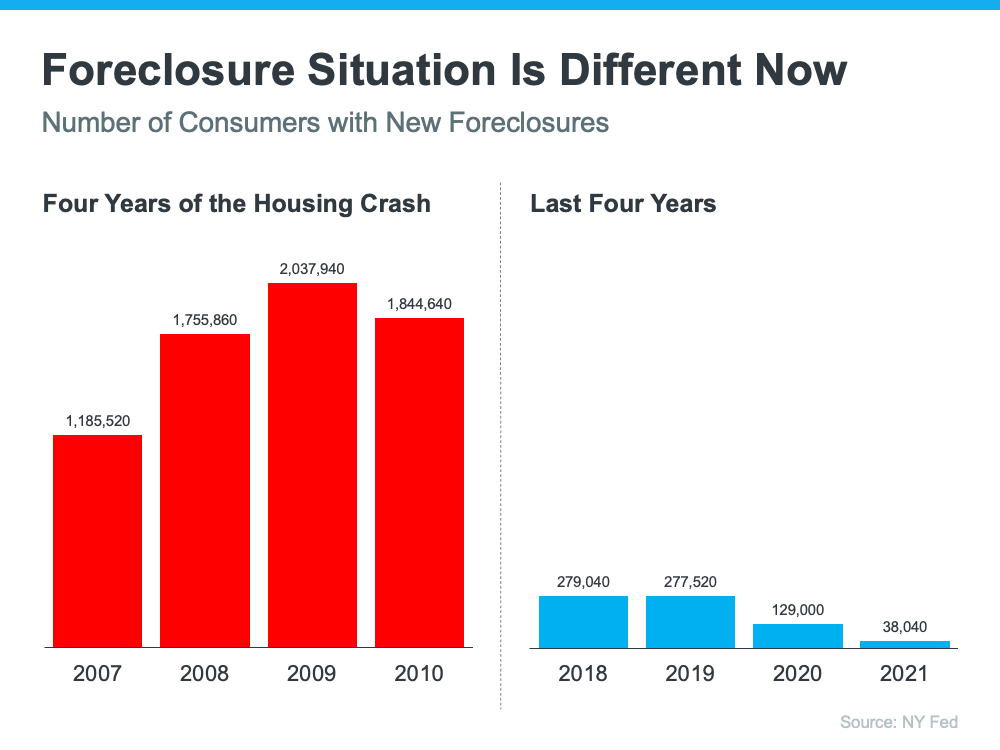

3. The Foreclosure Situation Is Nothing Like It Was During the Crash

The most obvious difference is the number of homeowners that were facing foreclosure after the housing bubble burst. The Federal Reserve issues a report showing the number of consumers with a new foreclosure notice. Here are the numbers during the crash compared to today:

There’s no doubt the 2020 and 2021 numbers are impacted by the forbearance program, which was created to help homeowners facing uncertainty during the pandemic. However, there are fewer than 800,000 homeowners left in the program today, and most of those will be able to work out a repayment plan with their banks.

Rick Sharga, Executive Vice President of RealtyTrac, explains:

“The fact that foreclosure starts declined despite hundreds of thousands of borrowers exiting the CARES Act mortgage forbearance program over the last few months is very encouraging. It suggests that the ‘forbearance equals foreclosure’ narrative was incorrect.”

Why are there so few foreclosures now? Today, homeowners are equity rich, not tapped out.

In the run-up to the housing bubble, some homeowners were using their homes as personal ATM machines. Many immediately withdrew their equity once it built up. When home values began to fall, some homeowners found themselves in a negative equity situation where the amount they owed on their mortgage was greater than the value of their home. Some of those households decided to walk away from their homes, and that led to a rash of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of other homes in the area.

Homeowners, however, have learned their lessons. Prices have risen nicely over the last few years, leading to over 40% of homes in the country having more than 50% equity. But owners have not been tapping into it like the last time, as evidenced by the fact that national tappable equity has increased to a record $9.9 trillion. With the average home equity now standing at $300,000, what happened last time won’t happen today.

As the latest Homeowner Equity Insights report from CoreLogic explains:

“Not only have equity gains helped homeowners more seamlessly transition out of forbearance and avoid a distressed sale, but they’ve also enabled many to continue building their wealth.”

There will be nowhere near the same number of foreclosures as we saw during the crash. So, what does that mean for the housing market?

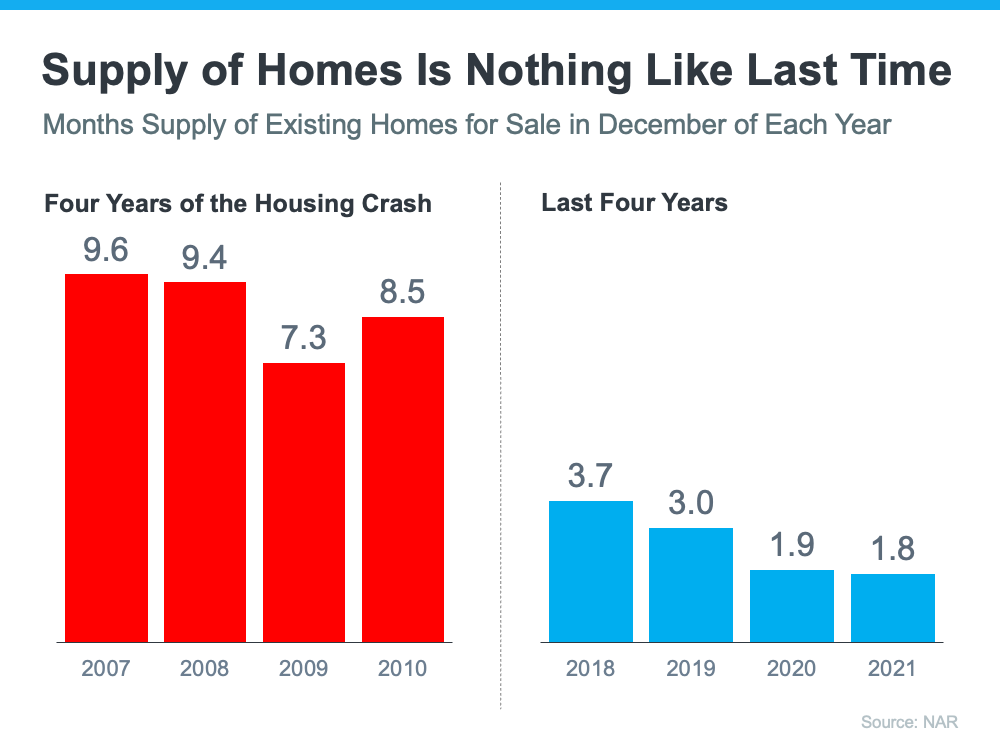

4. We Don’t Have a Surplus of Homes on the Market – We Have a Shortage

The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation. As the next graph shows, there were too many homes for sale from 2007 to 2010 (many of which were short sales and foreclosures), and that caused prices to tumble. Today, there’s a shortage of inventory, which is causing the acceleration in home values to continue.

Inventory is nothing like the last time. Prices are rising because there’s a healthy demand for homeownership at the same time there’s a shortage of homes for sale.

Bottom Line

If you’re worried that we’re making the same mistakes that led to the housing crash, the graphs above show data and insights to help alleviate your concerns.

Buyers Are Lining Up to Purchase on Mt. Hood

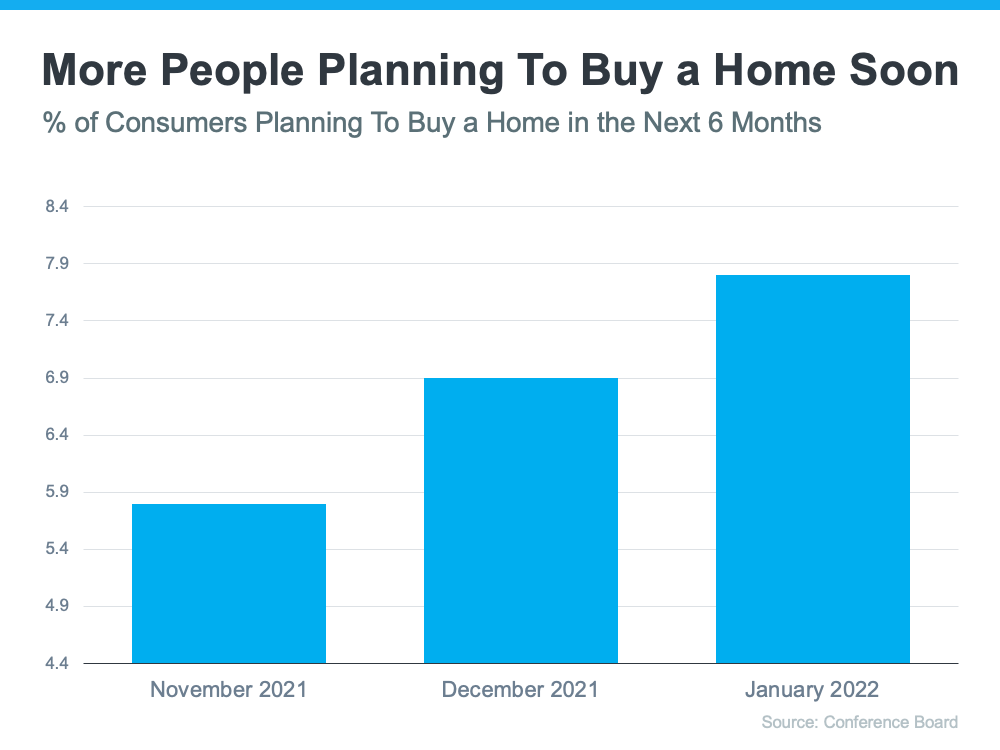

More People Are Planning To Buy a Home Soon

While some homeowners may be tempted to hold off until spring to list their houses, you should know – homebuyers aren’t waiting. Demand is high today as more people are trying to beat rising mortgage rates. As a result, eager buyers are entering the market or moving their plans up so they can make their purchases as soon as possible.

The most recent Consumer Confidence Survey finds that, of those surveyed, the percentage of people planning to buy over the next six months has increased substantially since last fall (see graph below):

As the graph shows, the number of consumers fast-tracking their plans to purchase a home has crept up over the past three months. That indicates many buyers are evaluating their strategy and realizing they should act sooner rather than later. And for homeowners planning to sell, it’s a signal that now may be the time to list.

While more people are moving their plans up, others are actively putting theirs in motion. Time on the market is a great indication that homebuyers are motivated and moving quickly. According to a recent realtor.com report, the average home sold faster this January than any January on record.

Danielle Hale, Chief Economist at realtor.com, notes:

“Homes sold at a record-fast January pace, suggesting that buyers are more active than usual for this time of year.”

What Does That Mean for You?

Homebuyers are rethinking their strategies and moving their plans forward. Others are making their moves today. That means demand for your house isn’t just increasing – it’s high right now.

And because there are so few homes available for determined purchasers to choose from, if you’re planning to sell your house this year, doing so sooner means you can take advantage of high buyer demand before more houses are listed in your neighborhood. Why is this important? Because as more houses are put up for sale, buyers will have more options. But until then, your house will be in the spotlight.

Bottom Line

With so many buyers eager to make a purchase, you could benefit by listing your house soon. To understand how strong buyer demand is in our area, let’s connect so you can start making your plans today.

How To Win as a Buyer in a Sellers’ Market On Mt. Hood

Some Highlights

- Even in today’s sellers’ market, there are still ways for buyers to win big.

- Build a team of trusted professionals and make strategic plays as you budget and pick your desired neighborhoods. Then, be ready for the competition by getting a pre-approval letter and leaning on your expert advisors to draft a winning offer.

- In a sellers’ market, you can still be the champion if you have the right team and strategy. Let’s connect today to make your game-winning play.

Do You Want Top Dollar For Your Mt. Hood Property? Now Is The Time To List

Want Top Dollar for Your Mt. Hood House or Cabin? Now’s the Time To List It.

When you’re selling any item, you usually want to sell it for the greatest profit possible. That happens when there’s a strong demand and a limited supply for that item. In the real estate market, that time is right now. If you’re thinking of selling your house this year, here are two reasons why now’s the time to list.

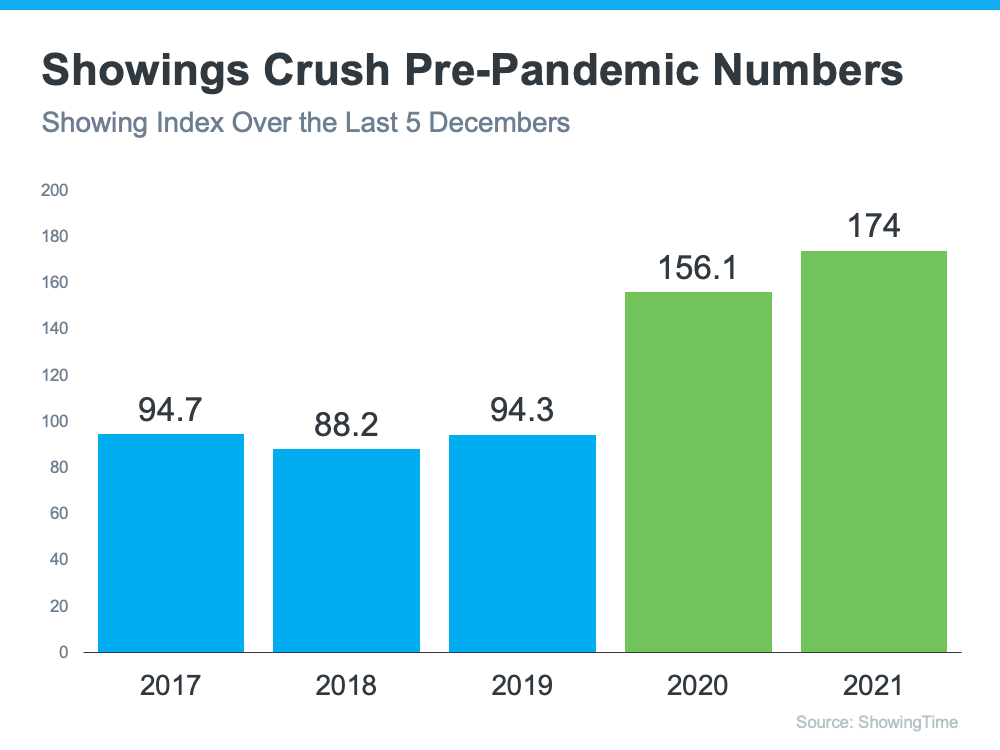

1. Demand Is Very Strong This Winter

A recent article in Inman News explains:

“Spring, the hottest time of year for homebuyers and sellers, has started early, according to economists. . . . ‘Home shopping season appears to already be in full swing!’”

And they aren’t the only ones saying buyers are already out in full force. That claim is backed up with data released last week by ShowingTime. The ShowingTime Showing Index tracks the average number of monthly buyer showings on active residential properties, which is a highly reliable leading indicator of current and future trends for buyer demand. The latest index reveals this December was the most active December in five years (see graph below):

As the data indicates, buyers are very active this winter. Last December saw even more showings than December of 2020, which was already a stronger-than-usual winter. And remember – you want to sell something when there’s a strong demand for that item. That time is now.

2. Housing Supply Is Extremely Low

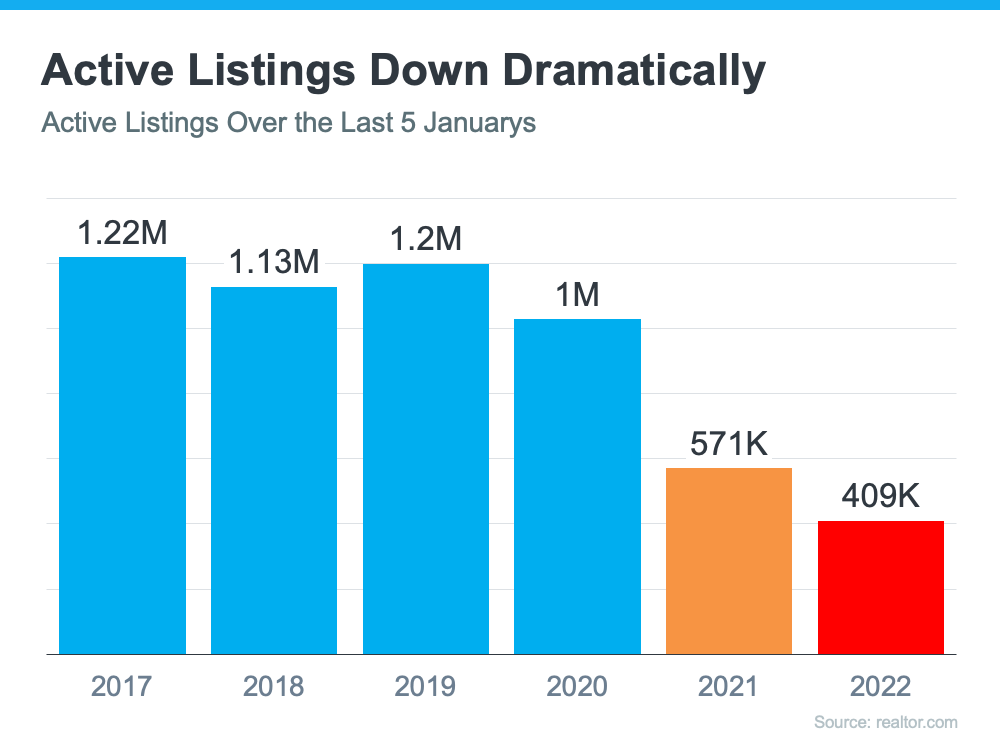

Each month, realtor.com releases data on the number of active residential real estate listings (listings currently for sale). Their most recent report reveals the latest monthly number is the lowest we’ve seen in any January since 2017 (see graph below):

And don’t forget, the best time to sell an item is when there’s a limited supply of it available. This graph clearly shows how extremely low housing supply is today.

Even Though Supply Is at a Historic Low, Home Sales Are at a 15-Year High

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), existing-home sales totaled 6.12 million in 2021 – the highest annual level since 2006. This means the market is hot and homeowners are in a great place to sell now while sales are so strong.

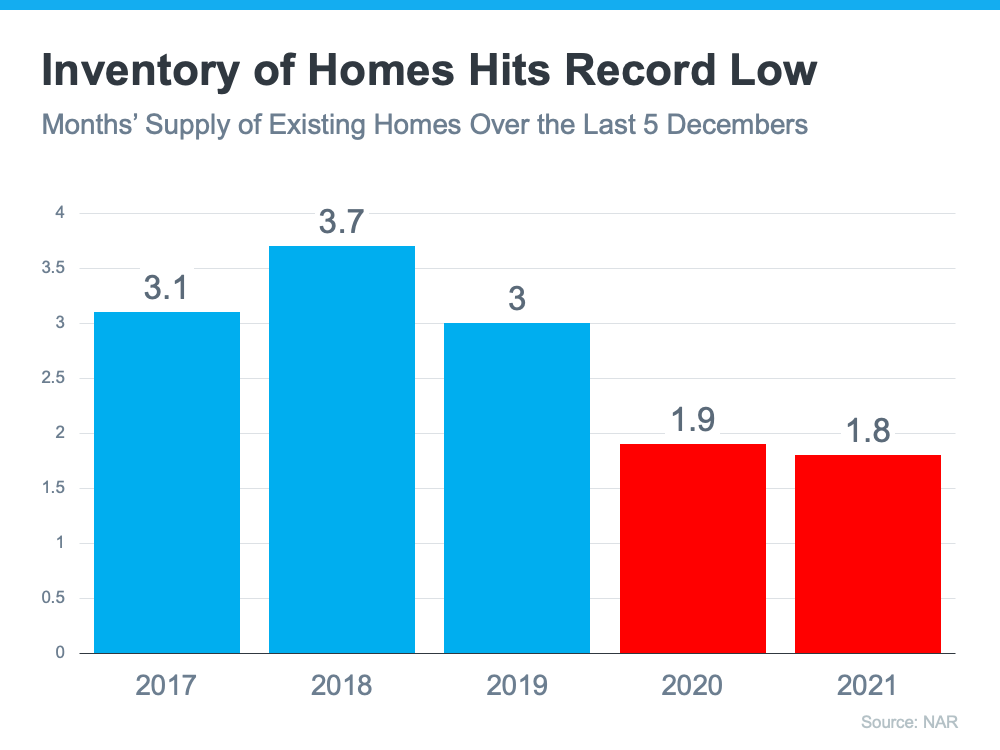

NAR also reports available listings by calculating the current months’ supply of inventory. They explain:

“Months’ supply refers to the number of months it would take for the current inventory of homes on the market to sell given the current sales pace.”

The current 1.8-months’ supply is the lowest ever reported. Here are the December numbers over the last five years (see graph below):

The ratio of buyers to sellers favors homeowners right now to a greater degree than at any other time in history. Buyer demand is high, and supply is low. That gives sellers like you an incredible opportunity.

Mt. Hood has ONLY six properties for sale. Four of those are over a million dollars. There is nothing under $500,000!

Bottom Line

If you agree the best time to sell anything is when demand is high and supply is low, let’s connect to begin discussing the process of listing your house today.

Displaying blog entries 331-340 of 1910

Categories

- Government Camp Real Estate (712)

- Mt Hood Inspiration-Morning Coffee (256)

- Mt. Hood 1031 Tax Exchanges (67)

- Mt. Hood Economic Conditions (785)

- Mt. Hood Local Events (362)

- Mt. Hood Mortgage and Financing Information (379)

- Mt. Hood National Forest Cabins (474)

- Mt. Hood New Properties on Market (309)

- Mt. Hood Sales Information (353)