Pre-Approval is Key to your Mt. Hood Purchase

Displaying blog entries 341-350 of 1910

The Mt. Hood real estate market has been driven by remote working over the past two years during COVID. It's only one of the factors impacting our local market but it definitely has increased demand for Mt. Hood properties! When 19% of sellers say they are moving due to remote working, we know why the mountain is a popular move.

![How Remote Work Impacts Your Home Search [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/02/03134442/20220204-MEM-1046x2435.png)

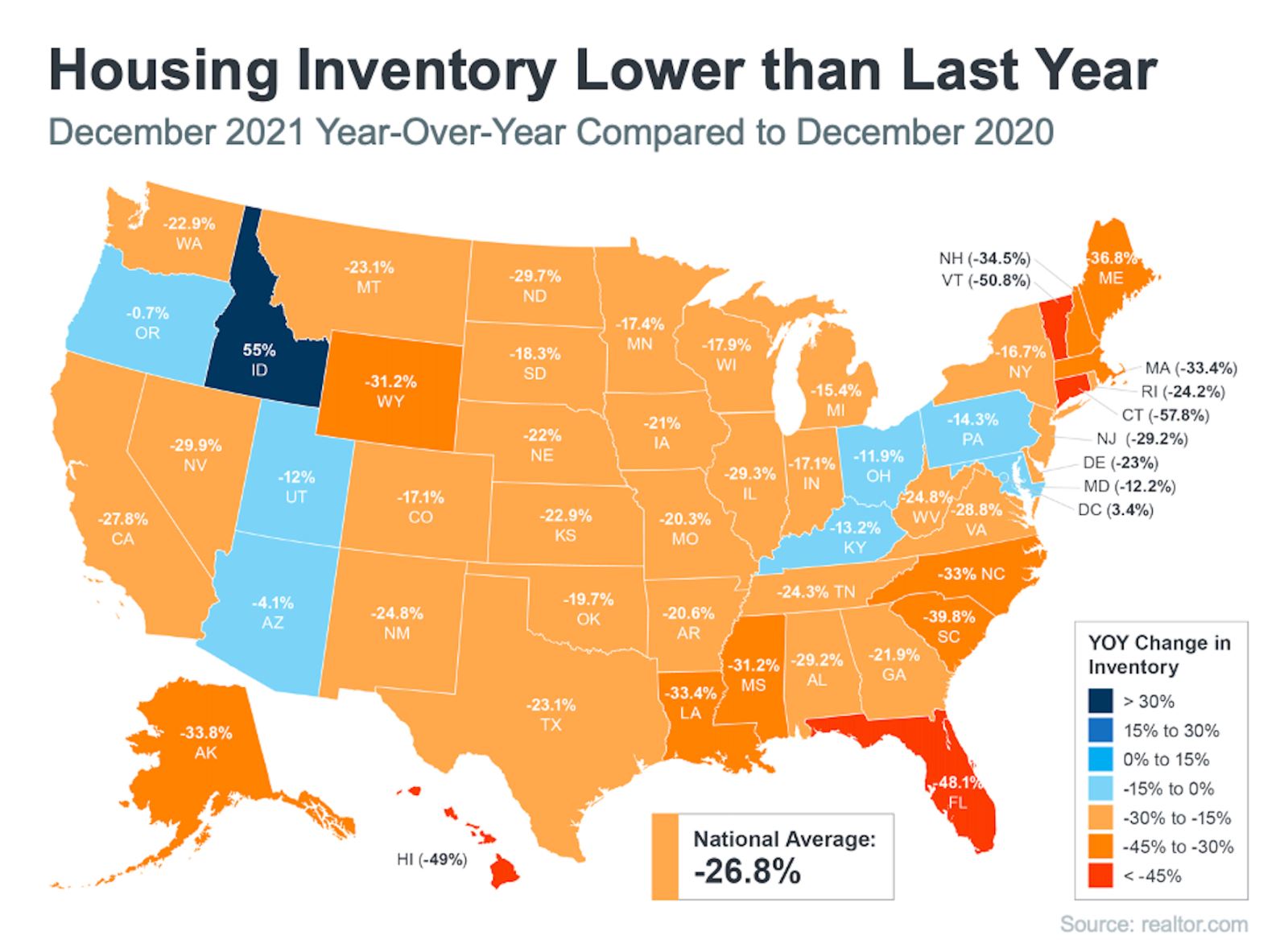

Where has all the inventory gone? Nationally it's down nearly 27% year over year. Mt. Hood area, which is Government Camp, Welches, Rhododendron and Brightwood has constantly been under 10 properties for sale for a couple of months now. We have the opportunity of a lifetime for sellers.

Buyer demand has never been this high. Six properties are currently on the market and four over a million dollars! If you are a seller, this is time to make your move for maximum profits. The two properties under a million will be gone by next week.

If you were thinking about buying a home this year, but already pressed pause on your plans due to rising home prices and increasing mortgage rates, there’s something you should consider. According to the latest report from ATTOM Data, owning a home is more affordable than renting in the majority of the country. The 2022 Rental Affordability Report says:

“. . . Owning a median-priced home is more affordable than the average rent on a three-bedroom property in 666, or 58 percent, of the 1,154 U.S. counties analyzed for the report. That means major home ownership expenses consume a smaller portion of average local wages than renting.”

Other experts in the industry offer additional perspectives on renting today. In the latest Single-Family Rent Index from CoreLogic, single-family rent saw the fastest year-over-year growth in over 16 years when comparing data for November each year (see graph below):

Molly Boesel, Principal Economist at CoreLogic, stresses the importance of what the data shows:

“Single-family rent growth hit its sixth consecutive record high. . . . Annual rent growth . . . was more than three times that of a year earlier. Rent growth should continue to be robust in the near term, especially as the labor market continues to improve.”

While it’s true home prices and mortgage rates are rising, so are monthly rents. As a prospective buyer, rising rates and prices shouldn’t be enough to keep you on the sideline, though. As the chart above shows, rents are skyrocketing. The big difference is, when you rent, that rising cost benefits your landlord’s investment strategy, but it doesn’t deliver any sort of return for you.

In contrast, when you buy a home, your monthly mortgage payment serves as a form of forced savings. Over time, as you pay down your loan and as home values rise, you’re building equity (and by extension, your own net worth). Not to mention, you’ll lock in your mortgage payment for the duration of your loan (typically 15 to 30 years) and give yourself a stable and reliable monthly payment.

When asking yourself if you should keep renting or if it’s time to buy, think about what Todd Teta, Chief Product Officer at ATTOM Data, says:

“. . . Home ownership still remains the more affordable option for average workers in a majority of the country because it still takes up a smaller portion of their pay.”

If buying takes up a smaller portion of your pay and has benefits renting can’t provide, the question really becomes: is renting really worth it?

If you’re weighing your options between renting and buying, it’s important to look at the full picture. While buying a home can feel like a daunting process, having a trusted advisor on your side is key. Let’s connect to explore your options so you can learn more about the benefits of homeownership today.

Last week, the average 30-year fixed mortgage rate from Freddie Mac jumped from 3.22% to 3.45%. That’s the highest point it’s been in almost two years. If you’re thinking about buying a home, this news may have come as a bit of a shock. But the truth is, it wasn’t entirely unexpected. Experts have been calling for rates to rise in their 2022 projections, and the forecast is now becoming a reality. Here’s a look at the projections from Freddie Mac for this year:

As the numbers show, this jump in rates is in line with the expectations from Freddie Mac. And what they also indicate is that mortgage rates are projected to continue climbing throughout the year. But should you be worried about rising mortgage rates? What does that really mean for you?

As rates increase even modestly, they impact your monthly mortgage payment and overall affordability. If you’re looking to buy a home, rising mortgage rates should be an incentive to act sooner rather than later.

The good news is, even though rates are climbing, they’re still worth taking advantage of. Historical data shows that today’s rate, even at 3.45%, is still well below the average for each of the last five decades (see chart below):

That means you still have a great opportunity to buy now with a rate that’s better than what your loved ones may have paid in decades past. If you buy a home while rates are in the mid-3s, your monthly mortgage payment will be locked in at that rate for the life of your loan. As you can see from the chart above, a lot can change in that time frame. Buying now is a great way to protect yourself from rising costs and future rate increases while also securing your payment amount for the long term.

Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says:

“Mortgage rates surged in the second week of the new year. The 30-year fixed mortgage rate rose to 3.45% from 3.22% the previous week. If inflation continues to grow at the current pace, rates will move up even faster in the following months.”

Mortgage rates are increasing, and they’re forecast to be even higher by the end of 2022. If you’re planning to buy this year, acting soon may be your most affordable option. Let’s connect to start the homebuying process today.

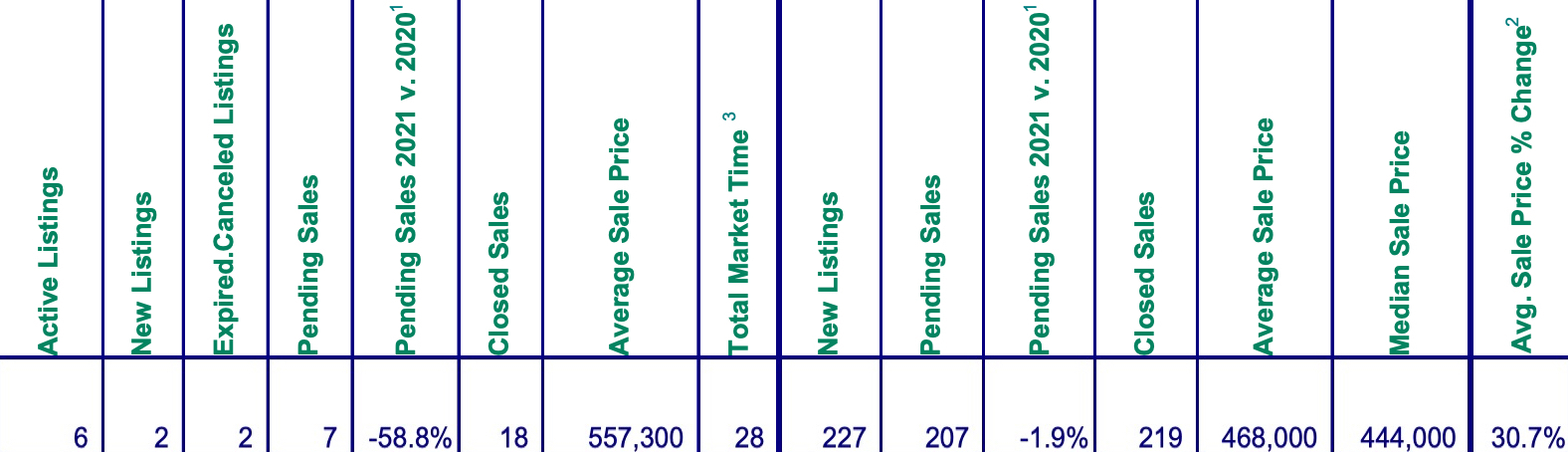

Check out the Mt. Hood Real Estate statistics for November 2021 from our multiple listing service. Some crazy highlights include an average sale price of $557,300!! Pending sales down nearly 59% compared to last year at this time. Only six active listings for the month! Hard to believe but a whopping 18 closed sales for the month. The Average Sales Price is up 30.7% for the year!

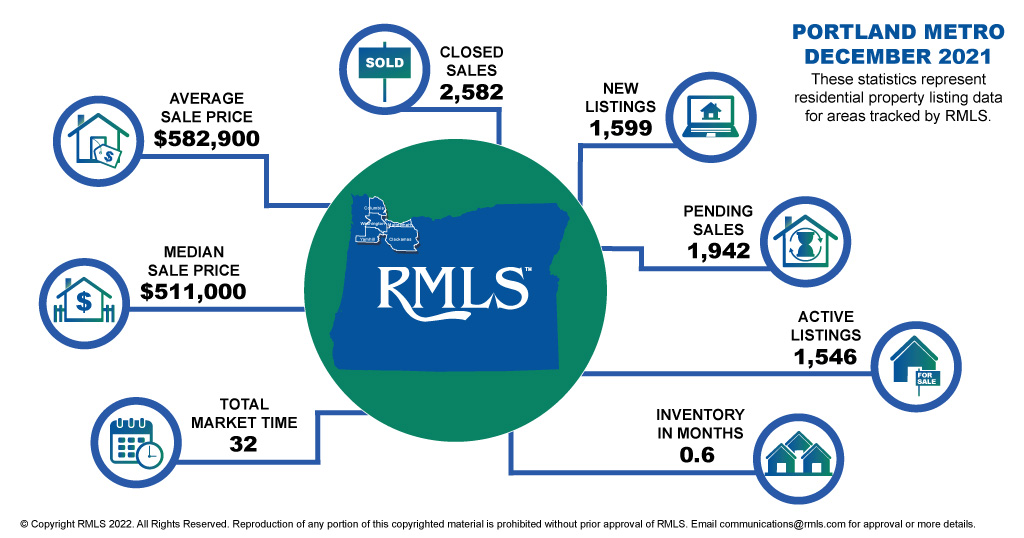

Statistics for the Portland Metro area for December are below. Inventory sits at a tab more than a half of a month!!! I don’t know anyone who has ever seen anything like this. Where are the sellers right now?

![When Is the Right Time To Sell [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/01/13133345/20220114-MEM-1046x1950.png)

Displaying blog entries 341-350 of 1910