What to Expect for the Spring Mt. Hood Market

What You Can Expect from the Spring Mt Hood Market

As the spring housing market kicks off, you likely want to know what you can expect this season when it comes to buying or selling a house. While there are multiple factors causing some uncertainty, including the conflict overseas, rising inflation, and the first rate increase from the Federal Reserve in over three years — the housing market seems to be relatively immune.

Here’s a look at what experts say you can expect this spring.

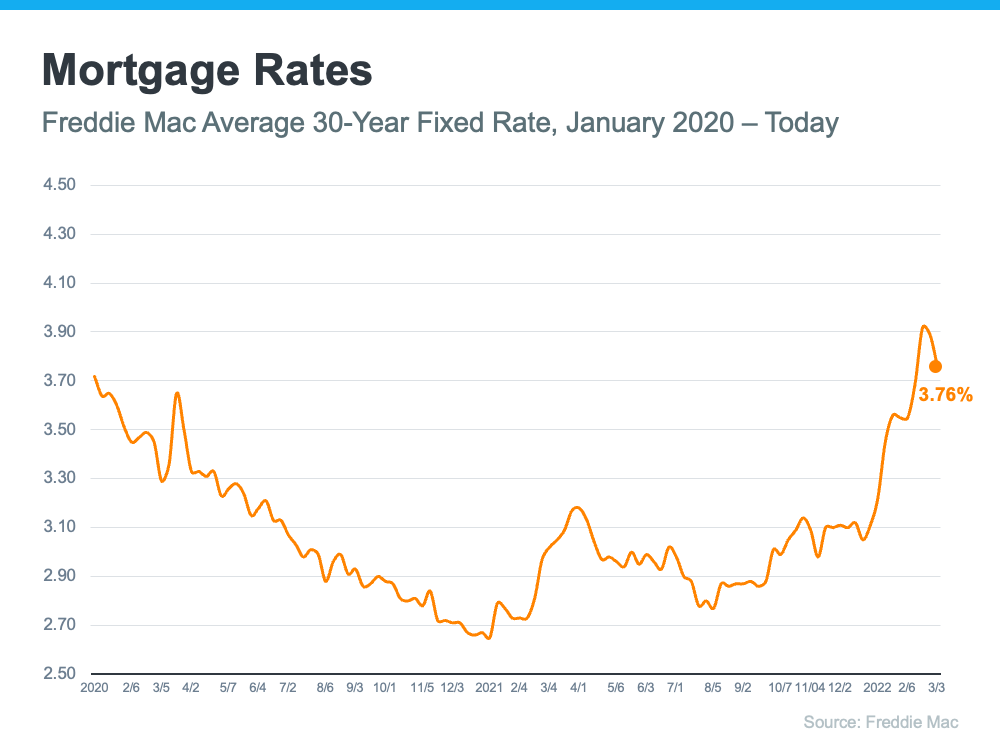

1. Mortgage Rates Will Climb

Freddie Mac reports the 30-year fixed mortgage rate has increased by more than a full point in the past six months. And despite some mild fluctuation in recent weeks, experts believe rates will continue to edge up over the next 90 days. As Freddie Mac says:

“The Federal Reserve raising short-term rates and signaling further increases means mortgage rates should continue to rise over the course of the year.”

If you’re a first-time buyer or a seller thinking of moving to a home that better fits your needs, realize that waiting will likely mean you’ll pay a higher mortgage rate on your purchase. And that higher rate drives up your monthly payment and can really add up over the life of your loan.

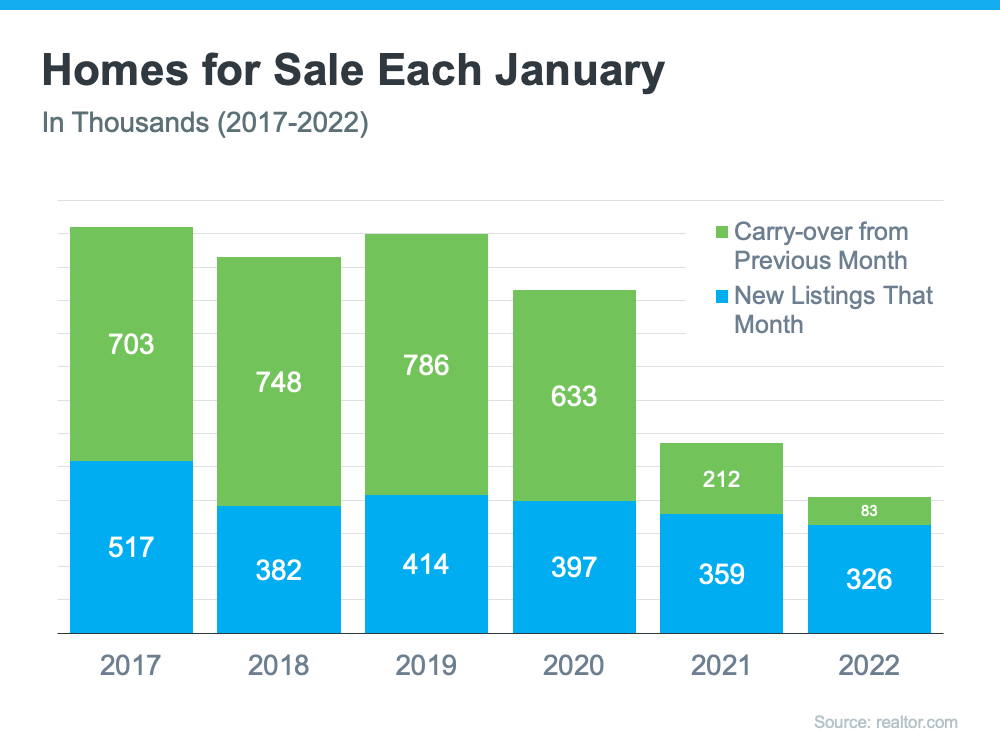

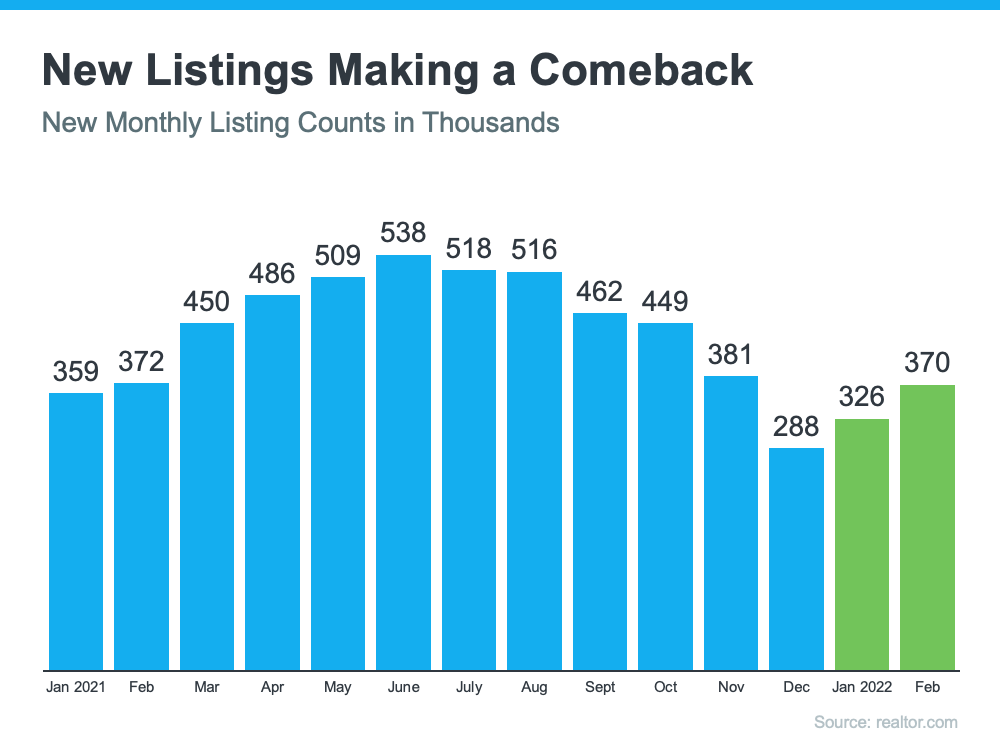

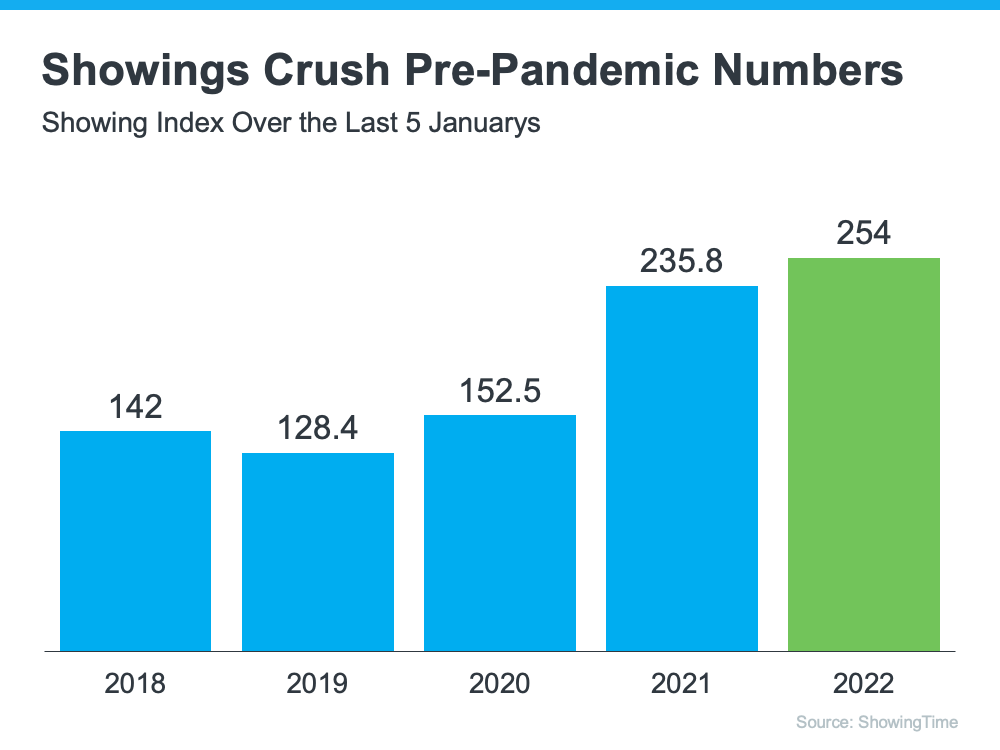

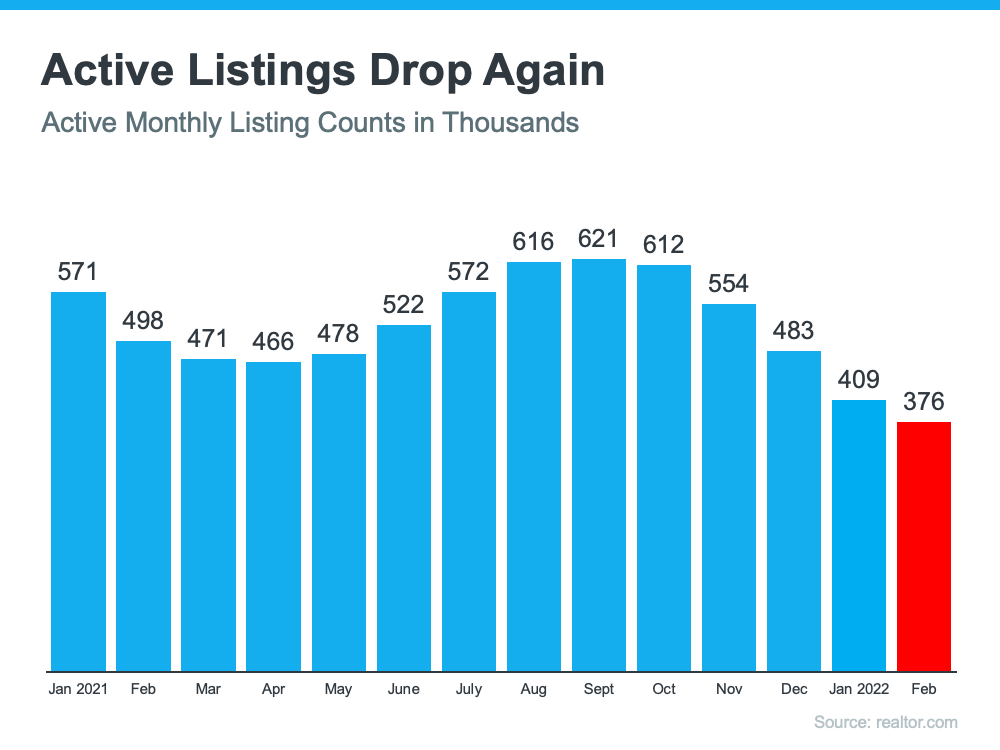

2. Housing Inventory Will Increase

There may be some relief coming for buyers searching for a home to purchase. Realtor.com recently reported that the number of newly listed homes has grown for each of the last two months. Also, the National Association of Realtors (NAR) just announced the months’ supply of inventory increased for the first time in eight months. The inventory of existing homes usually grows every spring, and it seems, based on recent activity, the next 90 days could bring more listings to the market.

If you’re a buyer who has been frustrated with the limited supply of homes available for sale, it looks like you could find some relief this spring. However, be prepared to act quickly if you find the right home.

If you’re a seller, listing now instead of waiting for this additional competition to hit the market makes sense. Your leverage in any negotiation during the sale will be impacted as additional homes come to market.

3. Home Prices Will Rise

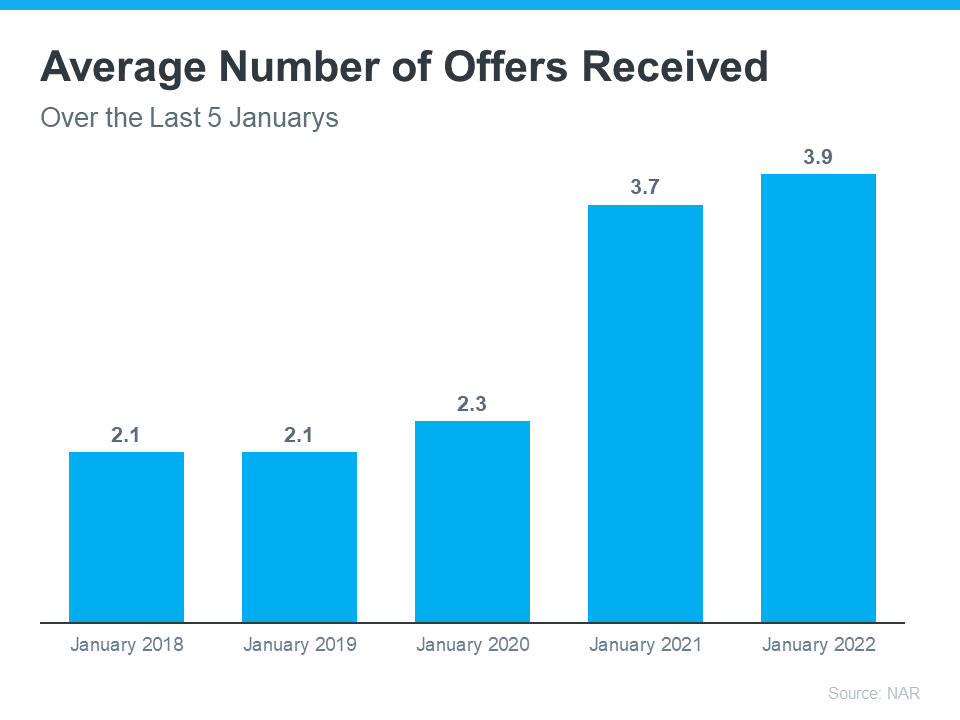

Prices are always determined by supply and demand. Though the number of homes entering the market is increasing, buyer demand remains very strong. As realtor.com explains in their most recent Housing Report:

“During the final two weeks of the month, more new sellers entered the market than during the same time last year. . . . However, with 5.8 million new homes missing from the market and millions of millennials at first-time buying ages, housing supply faces a long road to catching up with demand.”

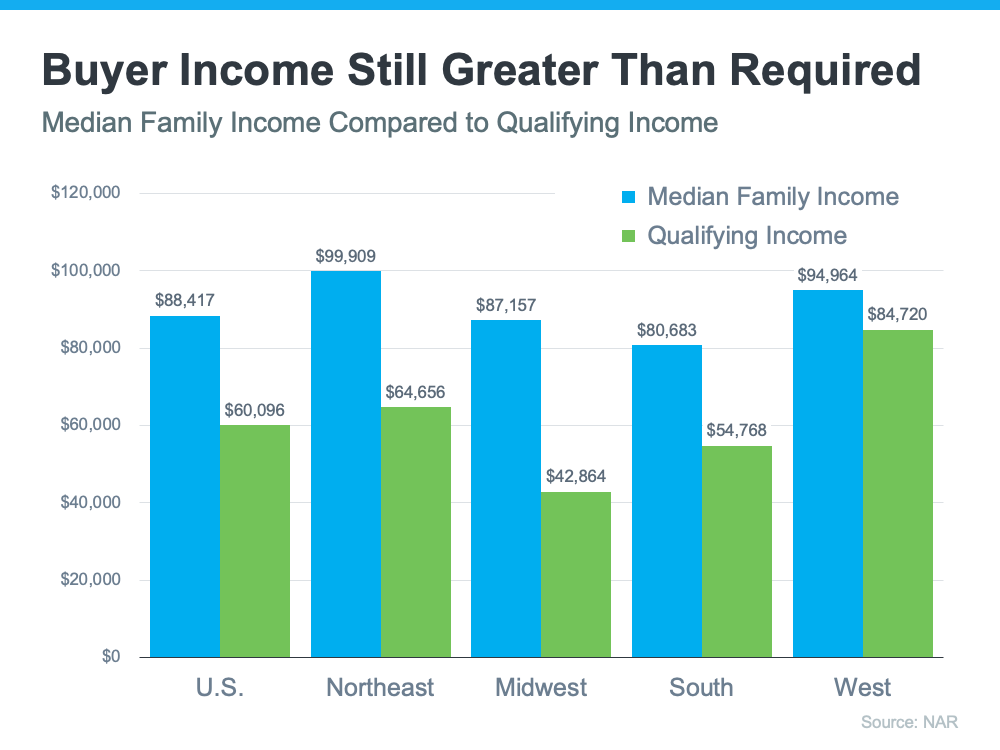

What does that mean for you? With the demand for housing still outpacing supply, home prices will continue to appreciate. Many experts believe the level of appreciation will decelerate from the high double-digit levels we’ve seen over the last two years. That means prices will continue to climb, just at a more moderate pace. Most experts are predicting home prices will not depreciate.

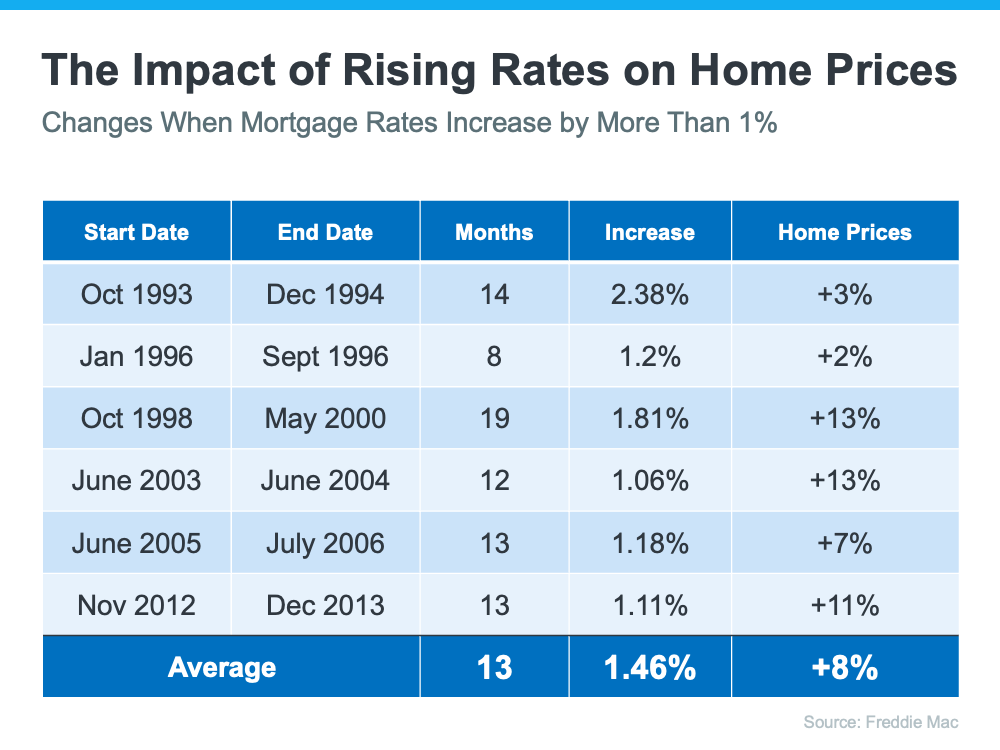

Won’t Increasing Mortgage Rates Cause Home Prices To Fall?

While some people may believe a 1% increase in mortgage rates will impact demand so dramatically that home prices will have to fall, experts say otherwise. Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae, says:

“What I will caution against is making the inference that interest rates have a direct impact on house prices. That is not true.”

Freddie Mac studied the impact that mortgage rates increasing by at least 1% has had on home prices in the past. Here are the results of that study:

As the chart shows, mortgage rates jumped by at least 1% six times in the last thirty years. In each case, home values increased.

So again, if you’re a first-time buyer or a repeat buyer, waiting to buy likely means you’ll pay more for a home later in the year (as compared to its current value).

Bottom Line

There are three things that seem certain going into the spring housing market:

- Mortgage rates will continue to rise

- The selection of homes available for sale will modestly improve

- Home prices will continue to appreciate, just at a slightly slower pace

If you’re thinking of buying, act now before mortgage rates and home prices increase further. If you’re thinking of selling, your best bet may be to sell soon so you can beat the increase in competition that’s about to come to market.

.jpeg)

.jpeg)

.jpg)

![The Difference Between Renting and Owning [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/02/24130106/20220225-MEM-1046x2279.png)