Real Estate Information

Mt. Hood Real Estate Blog

Liz Warren

Blog

Displaying blog entries 511-520 of 1919

Bidding Wars in the Mt. Hood Real Estate Market

How to Prepare for a Bidding War on Mt. Hood

![How to Prepare for a Bidding War [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/10/15140756/20201016-MEM-1046x2827.png)

Some Highlights

- With so few houses available on the market today, being ready for a bidding war is essential for prospective homebuyers.

- From pre-approval to making your best offer, here are three tips to make sure you can act quickly and confidently when you find the perfect home.

- Let’s connect today to be sure you have the guidance you need as the competition for homes heats up this season.

Updated Info on Mt. Hood Short Term Vacation Rentals

Yesterday the Board of County Commissioners approved a schedule for public hearings and meetings on proposed code changes to allow for and regulate short-term/vacation rentals. The public will have a chance to comment either in writing or at any of the hearings, all of which will be held on Zoom.

· Public meetings on establishing a registration program and regulations in the County Code for short-term rentals:

- 10 a.m., Thursday, Nov. 5: Board of Commissioners business meeting -- first reading; public comments welcome

- 10 a.m., Thursday, Nov. 19: Board of Commissioners business meeting -- second reading; public comments welcome

· Public hearings on permitting short-term rentals in unincorporated Clackamas County by amending the county’s Zoning & Development Ordinance (ZDO)

- 6:30 p.m., Monday, Nov. 23: Planning Commission meeting and public hearing; public testimony welcome

- 9:30 a.m., Wednesday, Dec. 9: Board of Commissioners Land Use Hearing; public testimony welcome

· 10 a.m., Thursday, Dec. 17: Board scheduled to take action on the proposed ZDO amendments at its regular business meeting

People who have comments but are not able to attend a hearing are welcome to submit their comments by email or US Mail, before the hearing, to Principal Planner Martha Fritzie at [email protected] or Planning & Zoning, Development Services Building, 150 Beavercreek Road, Oregon City, OR 97045.

You can see the Oct. 13 Board policy session here and read the staff report here.

The draft regulations and details of upcoming public hearings are available at www.clackamas.us/planning/str. Information on how to connect to meetings and hearings on Zoom will be posted one week before each event.

We’ll keep you posted about any additional or changed information on this process. Thank you.

Ellen Rogalin, Community Relations Specialist

Clackamas County Public & Government Affairs

Transportation & Development | Business & Community Services

503-742-4274 | 150 Beavercreek Road, Oregon City, OR 97045

Office hours: 9 am – 6 pm, Monday-Friday

Proposed Regulations for Short Term/vacation Rentals in Unincorporated Clackamas County

Here is the latest update on vacation rental study by Clackamas County:

Good afternoon,

After months of delay because of the COVID-19 pandemic and the wildfires, the Clackamas County Board of Commissioners has scheduled a policy session on short-term rental regulations for 3 p.m., Tuesday, Oct. 13, to review the major points of the draft regulations and set public hearings. The tentative plan is to hold public hearings and have the Board take action before the end of 2020, with any new regulations going into effect on July 1, 2021.

More details are in the staff report for the meeting. You can connect to the Zoom meeting to observe and see the staff report athttps://www.clackamas.us/meetings/bcc/presentation/2020-10-13-1.

As you may remember, the draft regulations were first created in 2019 at the request of the Board of Commissioners, in response to the increasing number of residents who use their homes for short-term or vacation rentals. The regulations include provisions for short-term rental owners to register with the county and pay a fee, and for enforcement of the regulations to be carried out by either the Sheriff’s Office or Code Enforcement, depending on the issue.

Clackamas County defines a short-term rental, or vacation rental, as a dwelling unit, or portion of a dwelling unit, that is rented to any person or entity for lodging or residential purposes, for a period of up to 30 consecutive nights.

Key components of the proposed regulations include rules regarding maximum occupancy, off-street parking, garbage pick-up, quiet hours, and fire and safety requirements. All short-term rentals would be subject to the same regulations, except that short-term rental properties inside the Portland metropolitan urban growth boundary would be required to be the owner’s primary residence or located on the same tract as the owner's primary residence. (The owner would not be required to be there when the short-term rental was occupied.) Details are available online at www.clackamas.us/planning/str.

For more information, contact Principal Planner Martha Fritzie at [email protected] or 503-742-4529.

You received this email because you have expressed an interest in regulations for short-term rentals in unincorporated Clackamas County. If you no longer wish to receive these emails, please let me know. Thank you.

Ellen Rogalin, Community Relations Specialist

Clackamas County Public & Government Affairs

Transportation & Development | Business & Community Services

503-742-4274 | 150 Beavercreek Road, Oregon City, OR 97045

Office hours: 9 am – 6 pm, Monday-Friday

Pricing Your Home

Why Pricing Your House Right Is Essential

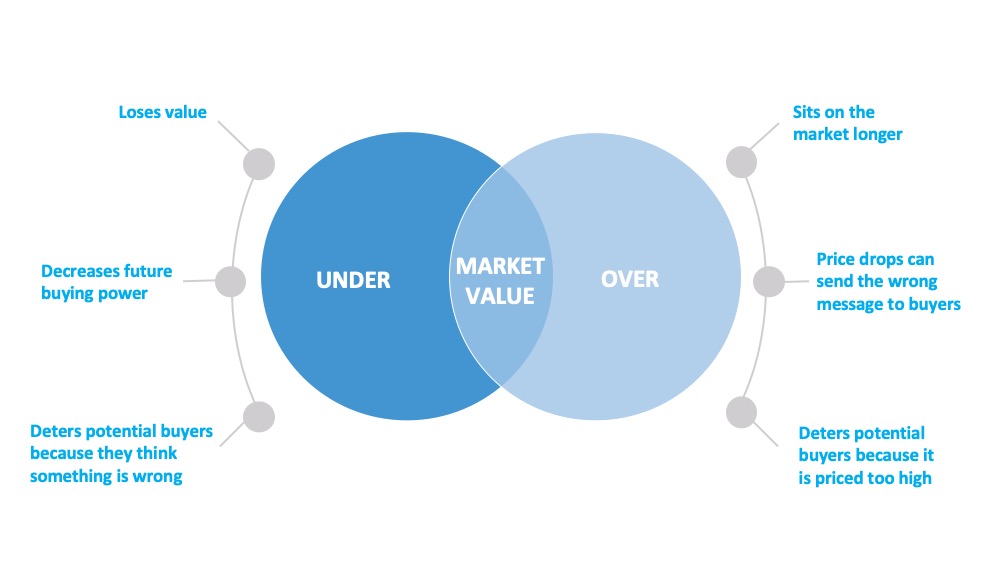

In today’s real estate market, setting the right price for your house is one of the most valuable things you can do.

According to the U.S. Economic Outlook by the National Association of Realtors (NAR), existing home prices nationwide are forecasted to increase 4.7% in 2020 and 4.1% in 2021. This means experts anticipate home values will continue climbing into next year. Today, low inventory is largely keeping prices from depreciating. Danielle Hale, Chief Economist at realtor.com, notes:

“Looking at the sheer number of buyers, low mortgage rates, and limited sellers, the strength of home prices–which are now growing at the highest pace since January 2018–makes sense.”

When it comes to pricing your home, the goal is to increase visibility and drive more buyers your way. Instead of trying to win the negotiation with one buyer, you should price your house so that demand is maximized and more buyers want to take a look.

How to Price Your Home

As a seller, you might be thinking about pricing your house on the high end while so many of today’s buyers are searching harder than ever just to find a home to purchase. You’re thinking, higher price, greater profit, right? But here’s the thing – a high price tag does not mean you’re going to cash in big on the sale. It’s actually more likely to deter buyers and have them looking at the houses your neighbors are selling instead.

Even today, when the advantage tips toward sellers because there are so few houses for sale, your house is more likely to sit on the market longer or require a price drop that can send buyers running in the other direction if it isn’t priced just right.

A Trusted Real Estate Professional Will Help

It’s important to make sure your house is priced correctly by working in partnership with a trusted real estate professional. When you price it competitively, you won’t be negotiating with one buyer over the price. Instead, you’ll have multiple buyers competing for the home, and that’s what ultimately increases the final sale price.

The key is making sure your house is priced to sell immediately. That way, it will be seen by the most buyers. More than one of them may be interested, and your house will be more likely to sell at a competitive price.

Bottom Line

If you're thinking about listing your house this fall, let’s discuss how to price it right so you can maximize your exposure and your return.

Mt. Hood Panabode Log Cabin

Refurbished Panabode log cabin located in Welches Oregon right on the golf course at the Mt. Hood Oregon Resort. Two bedroom, two baths with vaulted ceilings, open floor plan, and fireplace. Radiant zonal heat, upgraded kitchen with granite island and counter tops. Covered deck to enjoy the outdoors! $387,000.

.jpeg)

Low Inventory May Impact the Mt. Hood Housing Market This Fall

Low Inventory May Impact the Mt. Hood Housing Market This Fall

Real estate continues to be called the ‘bright spot’ in the current economy, but there’s one thing that may hold the housing market back from achieving its full potential this year: the lack of homes for sale.

Buyers are actively searching for and purchasing homes, looking to capitalize on today’s historically low interest rates, but there just aren’t enough houses for sale to meet that growing need. Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates have hit another record low due to a late summer slowdown in the economic recovery…These low rates have ignited robust purchase demand activity…However, heading into the fall it will be difficult to sustain the growth momentum in purchases because the lack of supply is already exhibiting a constraint on sales activity.”

According to the National Association of Realtors (NAR), right now, unsold inventory sits at a 3.1-month supply at the current sales pace. To have a balanced market where there are enough homes for sale to meet buyer demand, the market needs inventory for 6 months. Today, we’re nowhere near where that number needs to be. If the trend continues, it will get even harder to find homes to purchase this fall, and that may slow down potential buyers. Danielle Hale, Chief Economist at realtor.com, notes:

“The overall lack of sustained new listings growth could put a dent in fall home sales despite high interest from home shoppers, because new listings are key to home sales.”

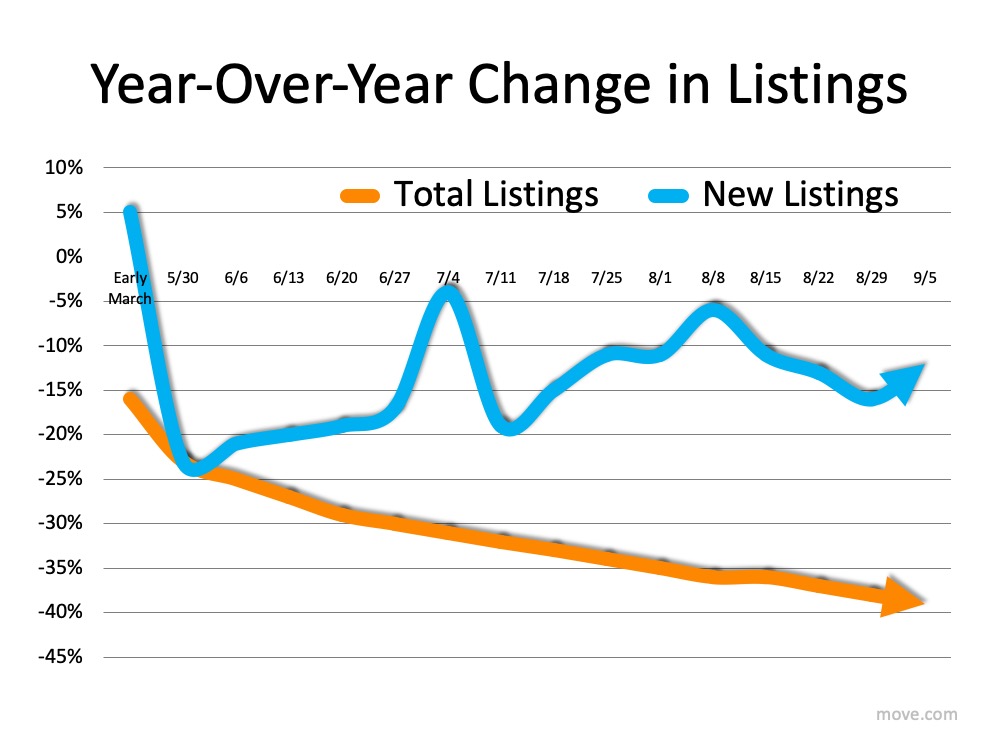

The realtor.com Weekly Recovery Report keeps an eye on the number of listings coming into the market (houses available for sale) and the total number of listings staying in the market compared to the previous year (See graph below): Buyers are clearly scooping up homes faster than they’re being put up for sale. The number of total listings (the orange line) continues to decline even as new listings (the blue line) are coming to the market. Why? Javier Vivas, Director of Economic Research at realtor.com, notes:

Buyers are clearly scooping up homes faster than they’re being put up for sale. The number of total listings (the orange line) continues to decline even as new listings (the blue line) are coming to the market. Why? Javier Vivas, Director of Economic Research at realtor.com, notes:

“The post-pandemic period has brought a record number of homebuyers back into the market, but it’s also failed to bring a consistent number of sellers back. Homes are selling faster, and sales are still on an upward trend, but rapidly disappearing inventory also means more home shoppers are being priced out. If we don’t see material improvement to supply in the next few weeks, we could see the number of transactions begin to dwindle again even as the lineup of buyers continues to grow.”

Does this mean it’s a good time to sell your Mt. Hood property?

Yes. If you’re thinking about selling your house, this fall is a great time to make it happen. There are plenty of buyers looking for homes to purchase because they want to take advantage of low interest rates. Realtors are also reporting an average of 3 offers per house and an increase in bidding wars, meaning the demand is there and the opportunity to sell for the most favorable terms is in your favor as a seller. There are only nineteen properties for sale in Welches, Brightwood, Rhododendron and Government Camp!

Bottom Line

If you’re considering selling your house, this is the perfect time to connect so we can talk about how you can benefit from the market trends in our local area.

Mt. Hood Homes In Demand with Urban Moves to More Open Spaces

Two New Surveys Indicate Urban to Suburban Lean

There has been much talk around the possibility that Americans are feeling less enamored with the benefits of living in a large city and now may be longing for the open spaces that suburban and rural areas provide.

In a recent Realtor Magazine article, they discussed the issue and addressed comments made by Lawrence Yun, Chief Economist for the National Association of Realtors (NAR):

“While migration trends were toward urban centers before the pandemic, real estate thought leaders have predicted a suburban resurgence as home buyers seek more space for social distancing. Now the data is supporting that theory. Coronavirus and work-from-home flexibility is sparking the trend reversal, Yun said. More first-time home buyers and minorities have also been looking to the suburbs for affordability, he added.”

NAR surveyed agents across the country asking them to best describe the locations where their clients are looking for homes (they could check multiple answers). Here are the results of the survey:

- 47% suburban/subdivision

- 39% rural area

- 25% small town

- 14% urban area/central city

- 13% resort community/recreational area

According to real estate agents, there’s a strong preference for less populated locations such as suburban and rural areas.

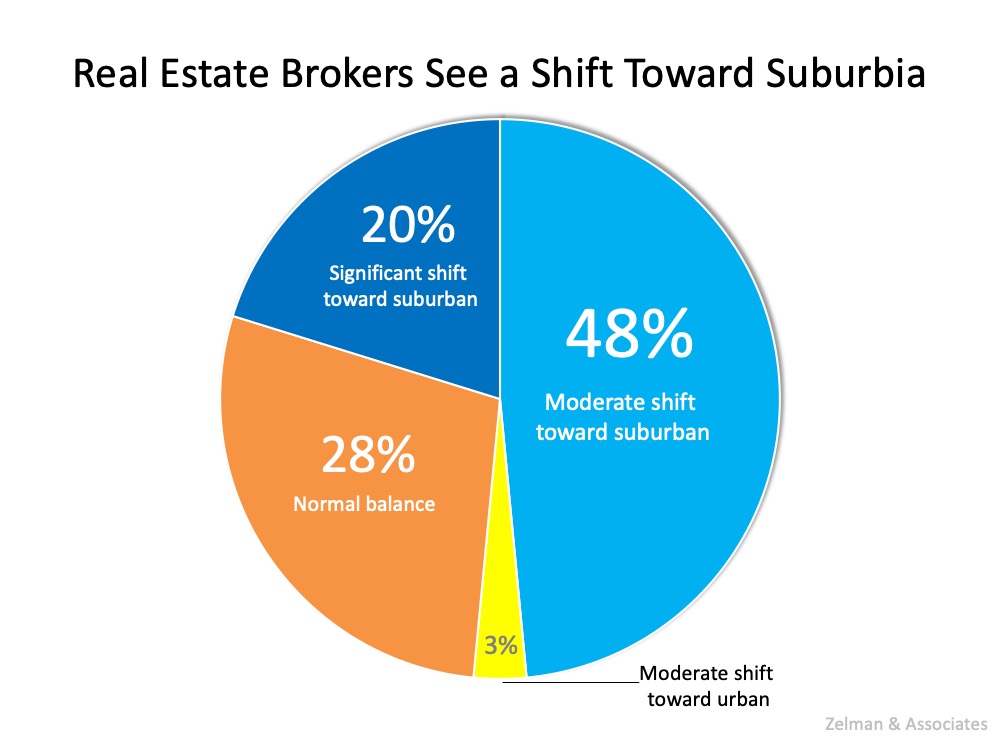

Real Estate Brokers and Owners Agree

Zelman & Associates surveys brokers and owners of real estate firms for their monthly Real Estate Brokers Report. The last report revealed that 68% see either a ‘moderate’ or ‘significant’ shift to more suburban locations. Here are the results of the survey:

The trend can be seen in the Mt. Hood area. Inventory is at an all time low historically. Only 19 properties are currently for sale in the area. Eight are condos and the rest are single family homes. The mountain has 34 pending sales from Government Camp to Brightwood. If there ever was a seller's market, this is it!

Bottom Line

No one knows if this will be a short-term trend or an industry game-changer. For now, there appears to be a migration to more open environments.

Displaying blog entries 511-520 of 1919

Categories

- Government Camp Real Estate (720)

- Mt Hood Inspiration-Morning Coffee (256)

- Mt. Hood 1031 Tax Exchanges (68)

- Mt. Hood Economic Conditions (793)

- Mt. Hood Local Events (364)

- Mt. Hood Mortgage and Financing Information (386)

- Mt. Hood National Forest Cabins (482)

- Mt. Hood New Properties on Market (309)

- Mt. Hood Sales Information (353)