This is the second in a two-part series on the history, changing terms and dysfunctionality of the Government Camp-Cooper Spur land exchange.

MT. HOOD — Drive up Highway 35 and turn onto Cooper Spur Road. Atop a winding, slick climb sits the inn, Crooked Tree Tavern, several cabins and the Cooper Spur Ski Area — a small slice of Mount Hood’s shoulders, contested since the 1970s. A microcosm of the push and pull between profitable development that serves recreational interests and environmental sanctity.

The United States Forest Service (USFS), Mt. Hood Meadows, Hood River County’s Board of Commissioners and conservation group Thrive Hood River have long pursued conflicting visions for these 770 acres, still owned by Meadows. There have been tense public meetings and consequential votes. Lawsuits followed by mediation sessions and more lawsuits. Delays and federal intervention all fixated on the Government Camp-Cooper Spur land exchange.

Last week, Columbia Gorge News unpacked the exchange’s early history and the “clean sweep” agreement, where Meadows would trade all its Cooper Spur property for rights to develop 120 acres in Government Camp, which USFS owns. The story also explained how the Omnibus Public Lands Act of 2009 and the Mt. Hood Cooper Spur Land Exchange Clarification Act of 2018 fit in.

Now for the more recent history, beginning after Thrive sued USFS in 2015 for unreasonably delaying the exchange and Congress passed the Clarification Act.

Disputed appraisals and changing terms

All land trades hinge on fair market appraisals, so USFS hired Richard Maloy from Alabama, who is certified in Oregon and works along the West Coast, to make those assessments. Maloy released his results in summer 2017, but Thrive and longtime partner Crag Law Center tapped Donald Palmer, another appraiser based in Portland, to evaluate his findings. Palmer identified such egregious errors that, after mediation, USFS ordered another round of appraisals, which came out in December 2019.

Like the previous round, Thrive again claimed that USFS grossly undervalued the land in Government Camp, which Maloy slated at around $5.7 million. Maloy used four comparable properties in West Salem, Camas, Vancouver and Ridgefield to land on the number, but Palmer found that Maloy failed to deduct unusable acres from two of the four properties, deflating the per acre value. He also violated basic principles of the Uniform Standards of Professional Appraisal Practice, according to Palmer.

“Maloy confirmed only one of the sales presented with the broker ... Relying on the deed documents does not provide you the necessary details regarding the physical characteristics of the site and financial aspects of the transaction,” Palmer wrote in his report. “Without confirming the sales data, the final conclusion is flawed.”

USFS contends the report did not include all sales information that Maloy considered.

The comparable sales were also located in areas with a different character and market than Government Camp, among other issues. Using the lowest range of Palmer’s estimate, he valued the land in Government Camp at $8.3 million and Meadows’ Cooper Spur holdings at $7.2 million, which Maloy listed at $9.1 million.

“Both internal agency experts and independent consultants reviewed the appraisal reports,” said Heather Ibsen, USFS public affairs officer for the Mt. Hood National Forest. “In their multiple reviews, experts concluded that the appraisals met standards required by federal laws, regulations and policies.”

“I don’t feel like [USFS] has done much to get value for the public,” said Heather Staten, former executive director of Thrive who led the nonprofit from 2015 until late 2021. “Normally when you have a land trade, both sides are trying to get a high value for their property or get a fair value. The Forest Service is just interested in following steps.”

While Thrive and USFS still disagree on their validity, those appraisals informed USFS’s Final Environmental Impact Statement (FEIS) on the Government Camp-Cooper Spur Land Exchange, an analysis of the proposed action and other alternatives, which was released in January 2021. Thrive objects to several aspects of the FEIS, but it generally advanced the clean sweep.

In February 2021, however, USFS released its Draft Record of Decision (ROD) under different terms: Meadows would retain 159 acres and ownership of the Cooper Spur Mountain Resort for rights to develop 67 acres in Government Camp, receiving only one parcel in the ski town instead of two as originally planned. While still operating the Cooper Spur Ski Area on a short-term extension, Meadows could seek the 40-year permit again, effectively leaving an open door for development on the north side.

“It’s at odds with what’s good for the community, what’s good for the mountain and the deal that they had previously struck,” said Staten. As laid out in the 2009 Omnibus Act, the deal would protect 2,701 acres of the Crystal Springs watershed and add 1,709 acres to Mt. Hood’s National Forest.

So, what occurred between the FEIS and ROD? How did USFS decide to reduce the land exchanged in Government Camp from 120 acres to 67 acres — from two parcels to one?

On May 5, 2021, USFS held a meeting to hear objections to the ROD, and Jesse Buss, an attorney for Thrive, asked that question. No complete recording of the meeting exists, but three people affiliated with Thrive who attended the meeting gave similar accounts independently.

Essentially, Thrive maintains that USFS said it was not an agency decision and promised to provide a more detailed explanation after consulting their notes. One week later, though, Thrive received an email from USFS saying they must file a Freedom of Information Act (FOIA) request to obtain that information.

Meadows spokesman Greg Leo disagreed and claimed the opposite. “Meadows played no role in that whatsoever. It was really a Forest Service determination based on the Forest Service’s work and the appraisals by the Forest Service of both pieces of land,” he said. Ibsen confirmed Leo’s comments and referred to the 2018 Clarification Act, which authorized the agency to exchange less federal or non-federal land “without limitation,” but only if it’s “necessary.”

When USFS formally responded to Thrive’s ROD objections, however, there was a slight distinction: “The private lands not included in the proposed exchange is property that Mt. Hood Meadows, following the 2019 appraisals, did not offer to convey and which the Forest Service is not authorized to ‘take’ under the exchange legislation,” wrote USFS.

In short, Thrive believes that Meadows intentionally sought only one parcel in Government Camp, creating a larger difference in conflict with the equal value clause of land exchanges, allowing the company to retain some land at Cooper Spur.

But the Federal Land Policy and Management Act (FLPMA) of 1976 also played a role. According to FLPMA, exchanges involving federal land must be for equal value, and if payment is needed to make up the difference, it must not exceed 25% of the federal land value. Using Maloy’s appraisals, the clean sweep would violate FLPMA. Using Palmer’s wouldn’t.

FLPMA further directs the acting authority to reduce any payment “to as small an amount as possible.” In May 2022, USFS issued its Final ROD negating the clean sweep.

“I think Mt. Hood Meadows is operating like a profit-motivated company,” said Staten, who stepped down as Thrive’s executive director just prior to the Final ROD. “They saw an opportunity to have their cake and eat it too.”

When asked about development at Cooper Spur, Leo said he couldn’t provide a specific answer until the exchange was completed, but affirmed any building would be consistent with Meadows’ core values of respecting Mount Hood and the environment.

Through FOIA requests, Thrive obtained a version of Meadows’ conceptual plans for the Cooper Spur Ski Area and the Cooper Spur Mountain Resort, created in 2017 and 2018, respectively. The ski area would grow from 50 to 296 acres, extend to the resort, include a new quad chairlift and have the capacity to park 775 cars. For the resort, Meadows considered adding an outdoor commercial spa, banquet hall, 83 camping areas and a 7,500-square-foot recreation area.

“It’s not beyond the limits of Mt. Hood Meadows to get a bill passed in the legislature,” said local orchardist Mike McCarthy. “They have worked over the years with the county and also with the state to get bills passed that allow them to have destination resorts.” McCarthy’s mother helped form Thrive and his family has owned land near Cooper Spur for generations.

Meadows’ Cooper Spur land is zoned Forest (F-1), a resource area primarily for timber harvesting while providing opportunities for agriculture, recreation and other uses. In 2001, Hood River County Commissioners wrote that destination resorts “should be pursued vigorously” in a related resolution and decided to allow the complexes as a conditional use later that year. The current zoning ordinance, amended in 2015, now prohibits destination resorts in F-1 Zones.

With the final decision in place, the Government Camp-Cooper Spur land exchange is nearly complete, but three court cases remain unresolved: one in Hood River County’s Circuit Court, another in the Court of Appeals in Salem and a third in Portland’s U.S. District Court. The trade will not move forward until those cases are closed.

The circuit court case, as Columbia Gorge News explained in last week’s edition, centers on the first land swap made in 2002, when Hood River County exchanged 614 acres of forest it owned near Cooper Spur with 786 acres Meadows held, leading to the entire dispute.

By accounting for land and timber value, but not commercial value that would come if Meadows built a destination resort at Cooper Spur, Thrive claims that exchange conflicts with Oregon Revised Statute 275.335 because the exchange wasn’t for equal value and the public never got a chance to challenge appraisals the county obtained.

Judge John Olson, serving in Hood River’s Circuit Court, denied most of Thrive’s claims in November 2023, but remanded the case back to county commissioners because it wasn’t clear they had actually reviewed the appraisals. After appealing Olson’s decision, Thrive, Meadows and the county began a mediation program administered by Oregon’s Court of Appeals in Salem, which will finish Feb. 20 barring another extension.

Commissioners reaffirmed the original land exchange last October, but Olson has yet to issue his supplemental judgment and will hold a hearing on Feb. 5. Beyond public interest arguments and equal value arguments, Thrive will also assert commissioners failed to adequately consult the public by not allowing comments during the meeting.

“It was a very narrow scope, the record was closed and taking public testimony would basically reopen the record, which was not advised,” said Commissioner Ed Weathers. He assured that Olson gave a very clear order and that the board followed it per the county’s legal counsel.

In the U.S. District Court, Thrive, local grower Mike McCarthy, Oregon Wild, the Sierra Club and other conservation groups argue their “aesthetic, recreational, scientific and spiritual interests” will be “adversely affected and irreparably injured” if USFS implements the exchange as written. In their view, USFS not only violated the 2005 settlement agreement, 2009 Omnibus Act and 2018 Clarification Act, but also the National Environmental Policy Act (NEPA).

NEPA offers direction on how federal agencies should evaluate the environmental impacts of proposed actions, and Thrive contends that USFS failed to consider an adequate range of alternatives, a NEPA requirement. For one, USFS didn’t declare which parcels of land would be exchanged in its FEIS, obscuring specific ecological consequences.

“The final mix of the Federal parcels and non-Federal parcels to be exchanged ... will be determined in the final Record of Decision,” wrote USFS.

Even with FLPMA stipulations, specifically the 25% rule, Thrive provided several options that would convey more land than USFS offered. The agency also failed to include any appraisal information in its FEIS, which the group says is critical to proving the necessity of exchanging less land as required by the 2018 Clarification Act. For these reasons and others, Thrive maintains that the FEIS “serves only to justify a decision already made.”

Ultimately, Thrive and USFS fundamentally disagree on the intent and language of the Omnibus and Clarification acts. While Thrive believes the acts mandate USFS to maximize the land exchanged, USFS maintains the Clarification Act “expressly allows” the parties to not undertake a clean sweep and exchange less land “without limitation,” overruling the good faith settlement made in 2005 and the specific provisions of the 2009 Omnibus Act.

Magistrate Judge Jeffrey Armistead will make the final decision in the district court, subject to review by an Article III judge. But that can't happen until the merits of the case are briefed and argued via a process called summary judgment. Briefing, however, is paused until USFS compiles a privilege log, a document that lists and describes withheld materials USFS considers “privileged” information.

The other parties and Armistead will review the privilege log to determine if additional, withheld materials must be added to the official case record. Thrive, USFS and Meadows have until Jan. 31 to submit a schedule for releasing the log, any related challenges and subsequent briefing on the merits. With arguments likely coming later this year, there is no timeline for Armistead’s decision.

A complicated relationship

In many ways, the Government Camp-Cooper Spur land exchange is like a divorce: Relationships eroded with time, third parties introduced more complications and everything eventually ended up in court. Meadows, USFS and Thrive simply can’t agree on how to split up the north side of Mount Hood, and both sides have different motivations.

“One of the narratives out there is we’re just unreasonable, we’re just crazy and we’re just pursuing this 20-year-old litigation out of a vendetta,” said McCarthy, a longtime Thrive member who owns land near Cooper Spur. “Well, we’ve proposed extremely generous compromise solutions just to get this done, and [Meadows] won’t engage.”

“That allegation is kind of disingenuous. Thrive has, multiple times, said that we should be driven out of Hood River County,” Leo, the spokesman for Meadows, responded. “We have tried to work with Thrive and similarly feel that we’ve been rebuffed when we’ve reached out.”

Looking back to 2005, Leo said Meadows supported the clean sweep agreement, but as USFS initiated the exchange, they came to understand that FLPMA requirements made some of the original terms moot. In his view, conflicts with FLPMA instigated the 2018 Clarification Act, which allowed USFS to exchange less land with proof that it was necessary.

“The bipartisan Clarification Act aimed to resolve the longstanding land dispute on Mount Hood so it wasn’t an either/or solution. Instead, it sought a win for both wilderness protections and responsible development that protected this natural treasure,” said Hank Stern, a spokesman for Sen. Ron Wyden.

Thrive no longer believes they’ll achieve the clean sweep, but the deal will still protect 2,701 acres of the Crystal Springs watershed and add 1,709 acres to Mt. Hood’s National Forest. Even more, the property Meadows will retain at Cooper Spur technically sits outside of the watershed, which provides to about 6,000 county residents. The company also plans to construct employee housing on the land in Government Camp. “Many generations of young people have come to the mountain to work and enjoy the mountain lifestyle, but also learn how to work in the hospitality business,” said Leo. “We bring, we think, economic benefits to all the people in Hood River County through having a viable tourism business.”

According to Greg Pack, the president and general manager of Meadows, the company employs around 120 people year-round, but that swells to about 1,200 during the winter months.

To make the most of Mount Hood, people need places to eat, rest and gather, which Thrive acknowledges. They also hope Meadows continues to operate the Cooper Spur Ski Area. Thrive just doesn’t want to see a massive expansion.

“The north side of the mountain is a really special place — it’s the place people go for backcountry, undeveloped recreation,” said Staten. “The community has spoken again and again that they want to keep the north side of Mount Hood special and a place for wilderness, quiet contemplation and not highly developed.”

Thus, as it has for so long, the Government Camp-Cooper Spur land exchange continues. Environmentalists in the pursuit of quaintness on one side. Economic and recreational interests on the other. A dispute that embodies the American West, the ball is in the courts.

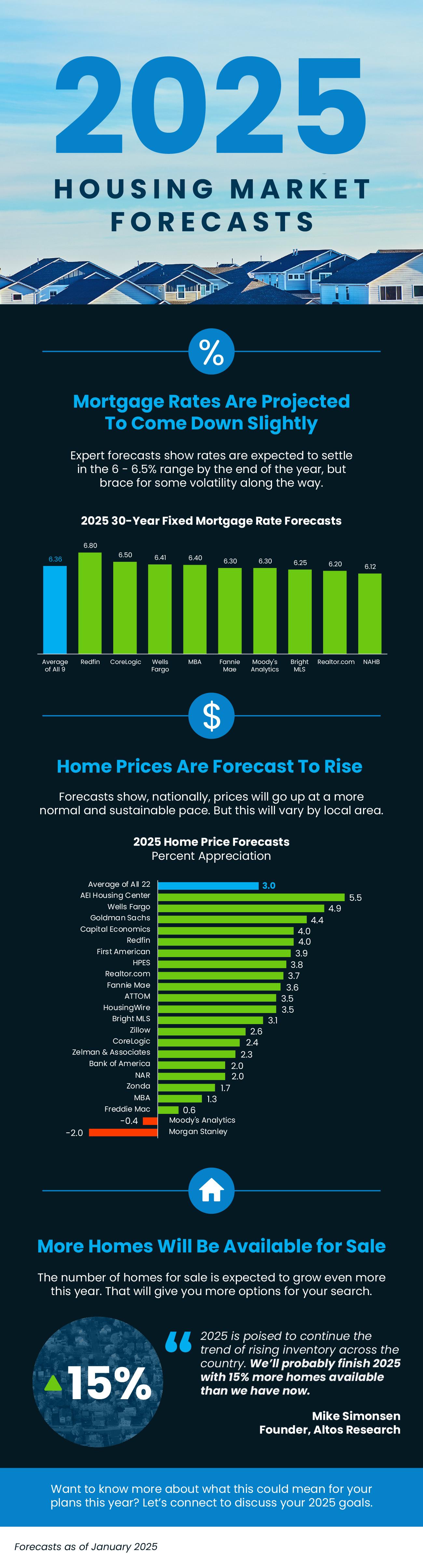

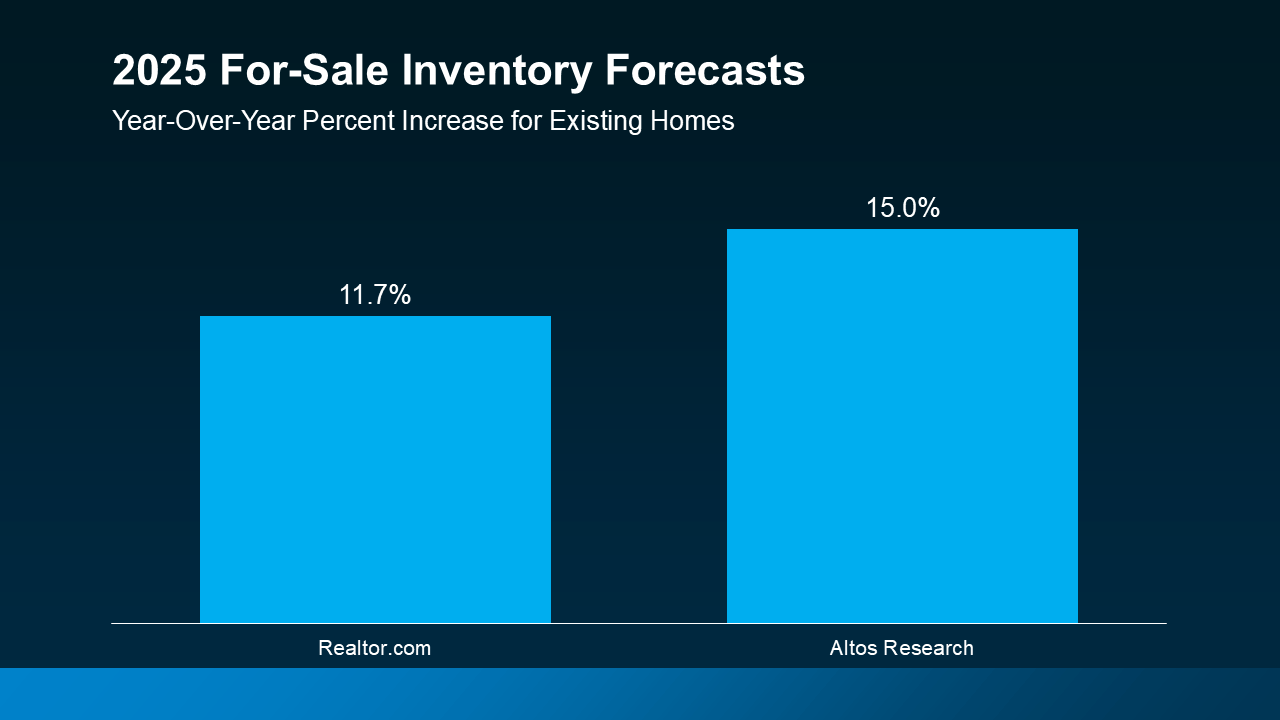

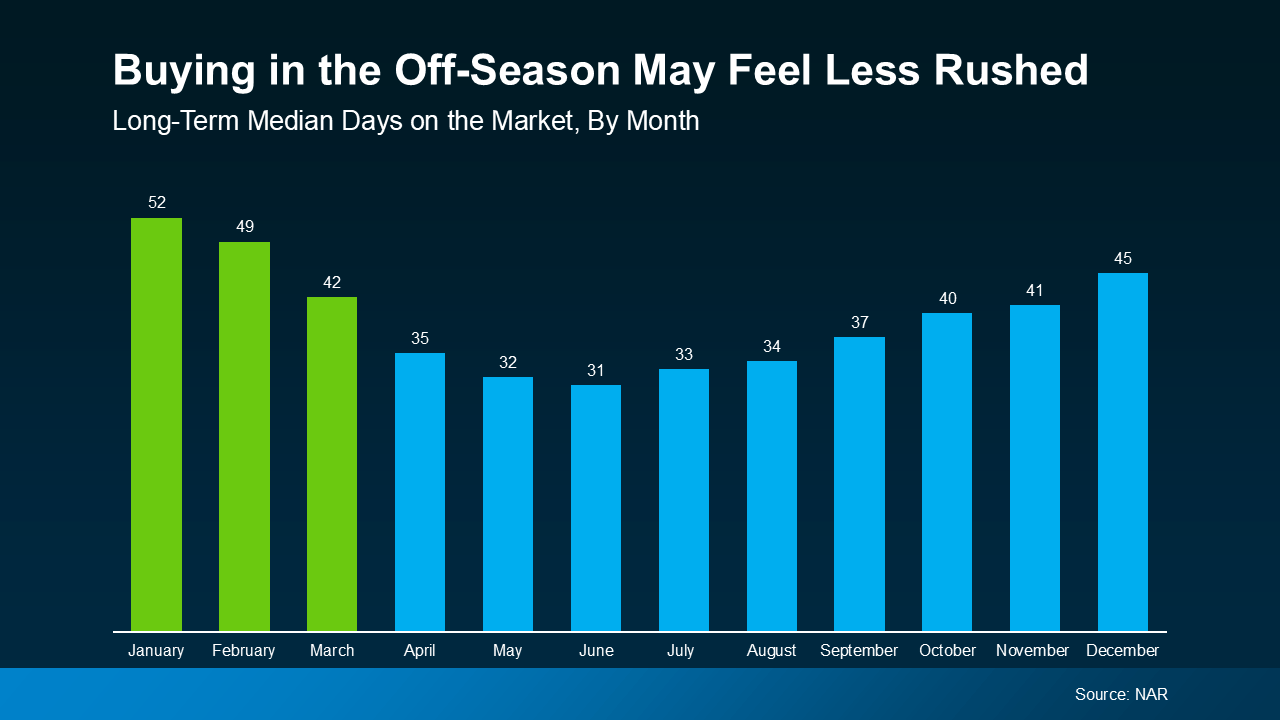

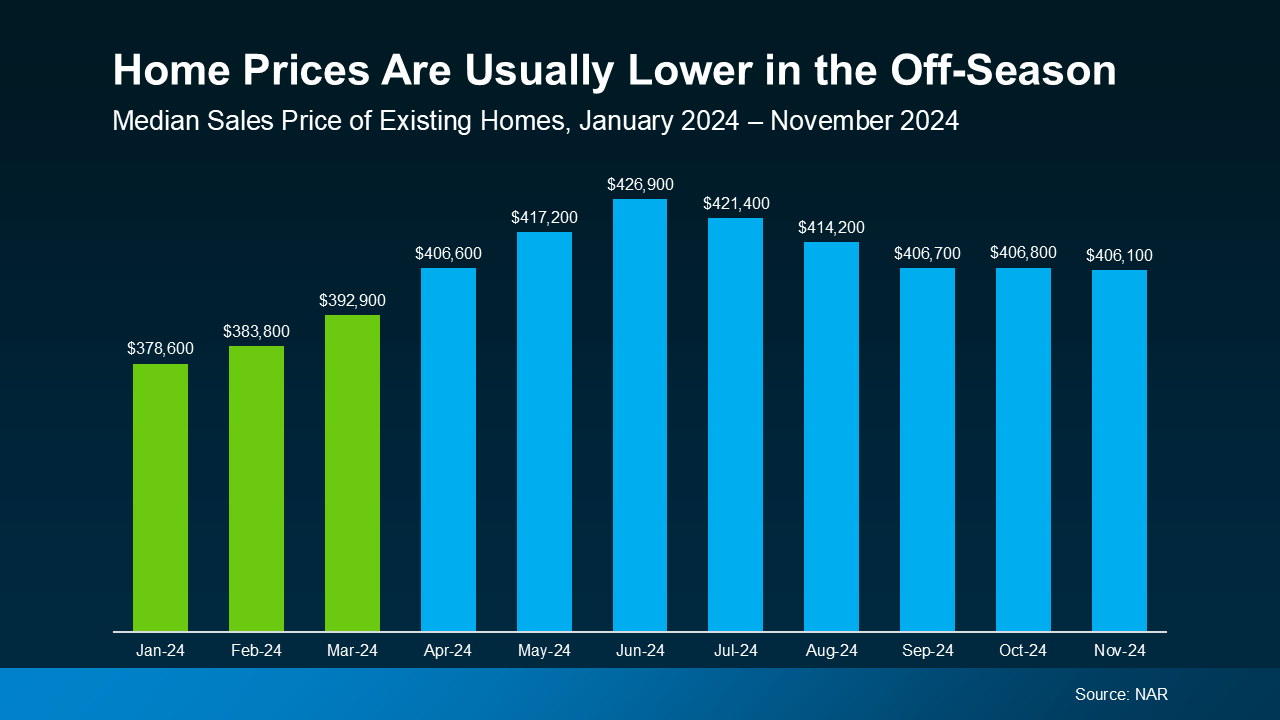

Here’s why this is so good for your search. If you haven’t seen a house with all the features you need, just know that, as the number of homes for sale grows, you’ll have more options to choose from. That means a better chance of finding a home that checks all your boxes. As Ralph McLaughlin, Senior Economist at Realtor.com, says:

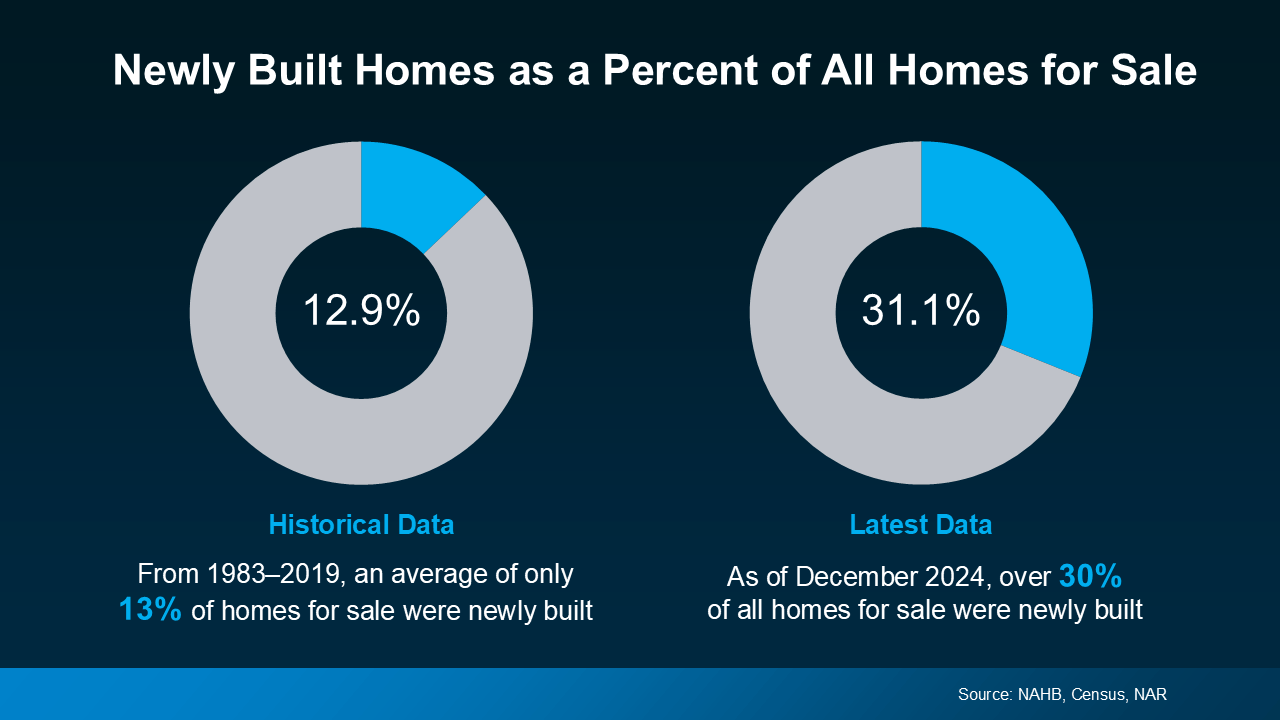

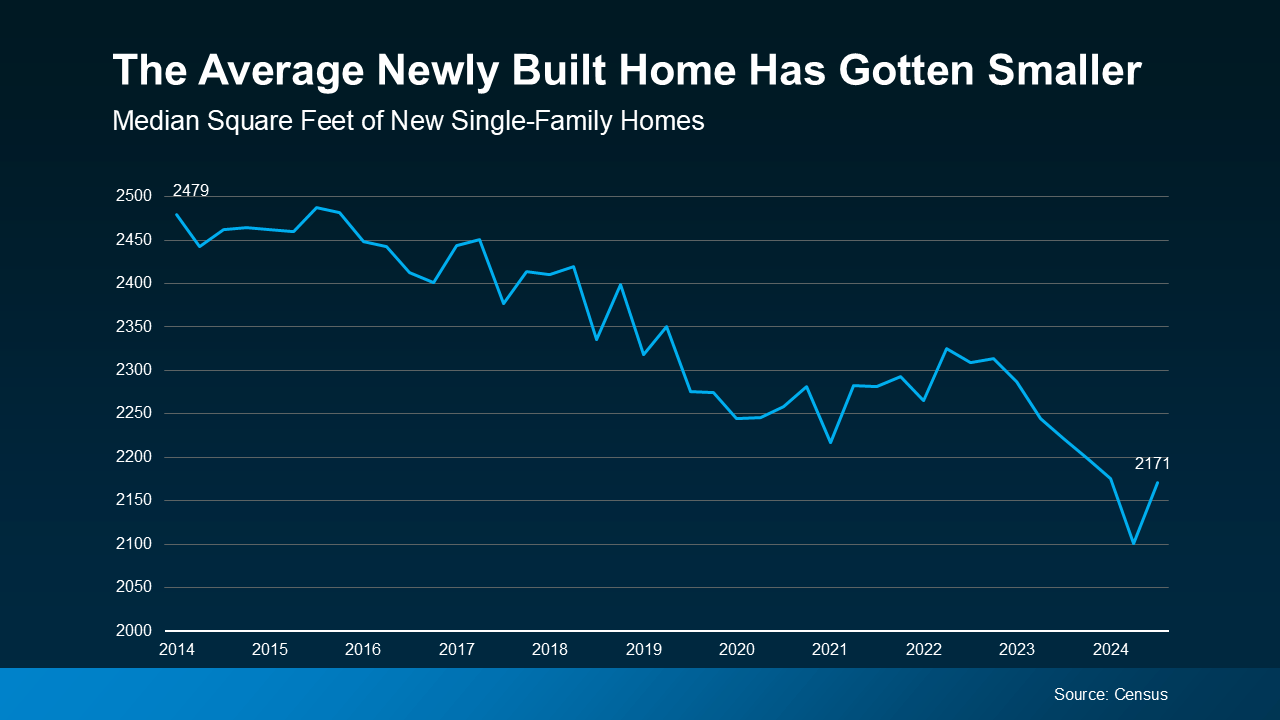

Here’s why this is so good for your search. If you haven’t seen a house with all the features you need, just know that, as the number of homes for sale grows, you’ll have more options to choose from. That means a better chance of finding a home that checks all your boxes. As Ralph McLaughlin, Senior Economist at Realtor.com, says: And the best part is, since builders have been focusing on smaller homes with lower price points, you may actually find out new builds are less expensive than you’d expect. So, while a lot of people write off new construction because it’s easy to assume the costs are way higher, lately, that price gap isn’t as big as you’d think. As CNET says:

And the best part is, since builders have been focusing on smaller homes with lower price points, you may actually find out new builds are less expensive than you’d expect. So, while a lot of people write off new construction because it’s easy to assume the costs are way higher, lately, that price gap isn’t as big as you’d think. As CNET says:

.jpeg)

.jpeg)

.jpeg)

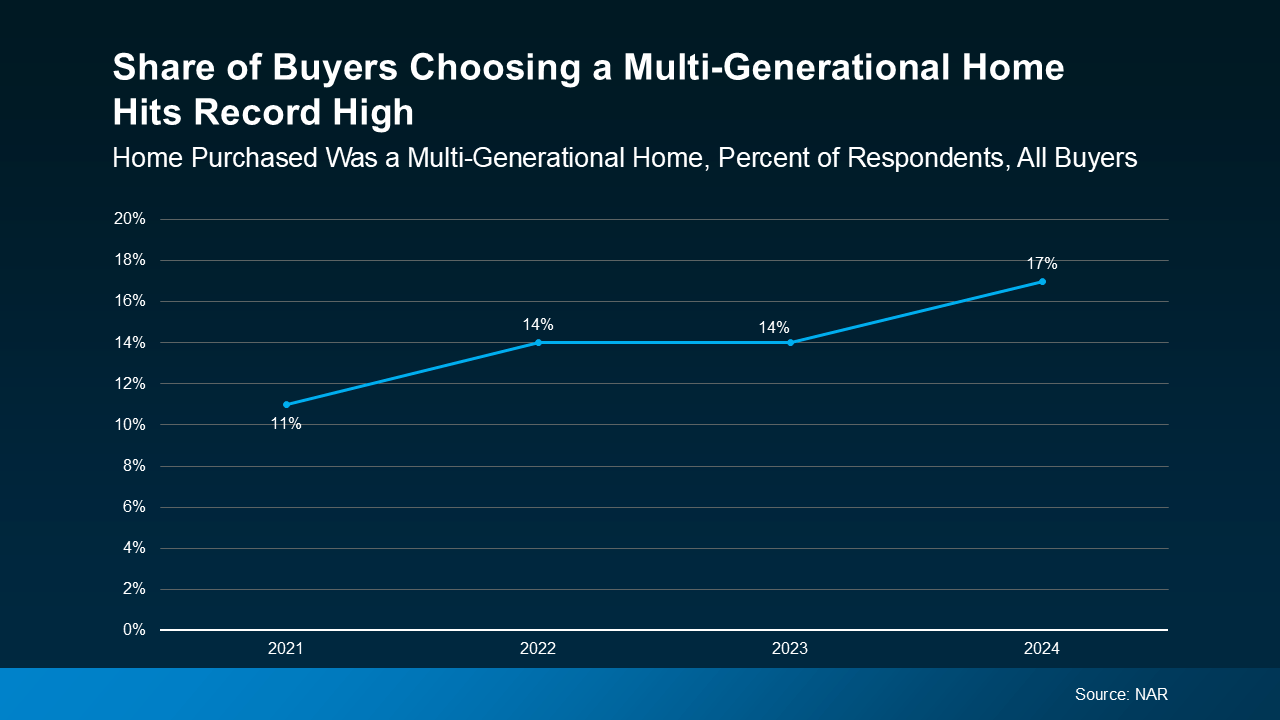

Top Benefits of Choosing a Multi-Generational Home

Top Benefits of Choosing a Multi-Generational Home