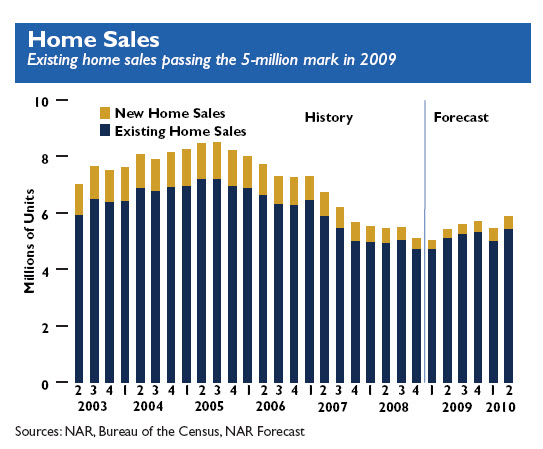

Here is some interesting information on the impact of real estate for the state of Oregon compiled by the National Association of Realtors through the Bureau of Economic Analysis.

The real estate industry accounted for 17.1% of the gross state product in 2007. “The Industry” includes everything from construction, lending, title services, moving trucks, brokerage, appraisals and other related services.

When a home is sold, $25,767 worth of income is generated into those services. An additional $5,000 is generated from painting, buying new furniture and other auxiliary events.

Once this income is generated there is the multiplier effect with an additional $14,927. This money is generated by eating out, going to movies and sporting events, giving to charity and other spending events generating sales and income.

As additional home sales are conducted a new home is usually constructed- one for every eight home sales. According to Macroeconomic Advisors for NAR, when a new home is constructed it creates 1/8th of new home value generating approximately $35,788 into the economy.

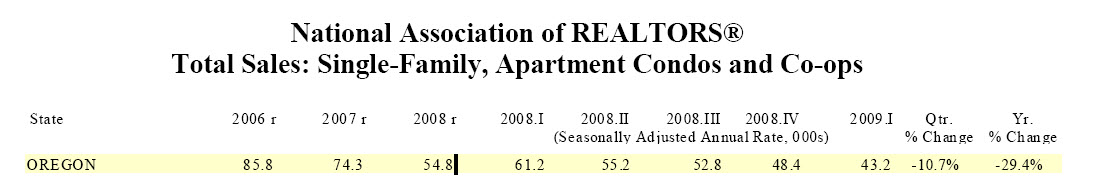

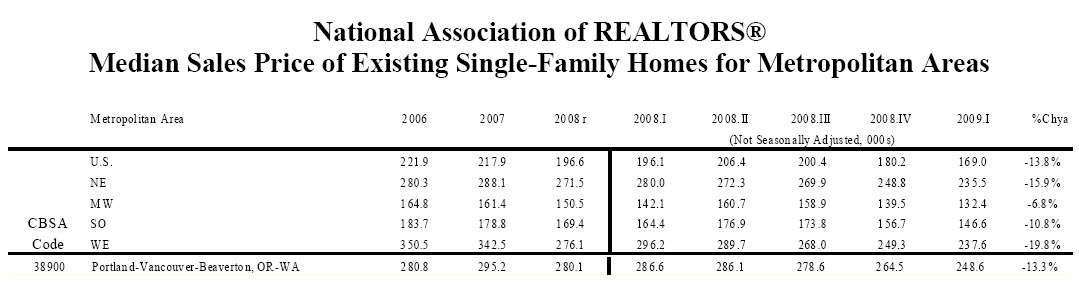

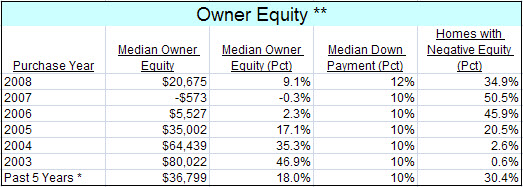

It becomes obvious looking at these numbers that the economic impact of the housing crisis is huge for Oregon. The slowdown has caused Oregon unemployment numbers to be some of the top in the nation!