Mt. Hood Home Prices Will Rise Over the Next 5 Years

Experts Project Home Prices Will Rise over the Next 5 Years

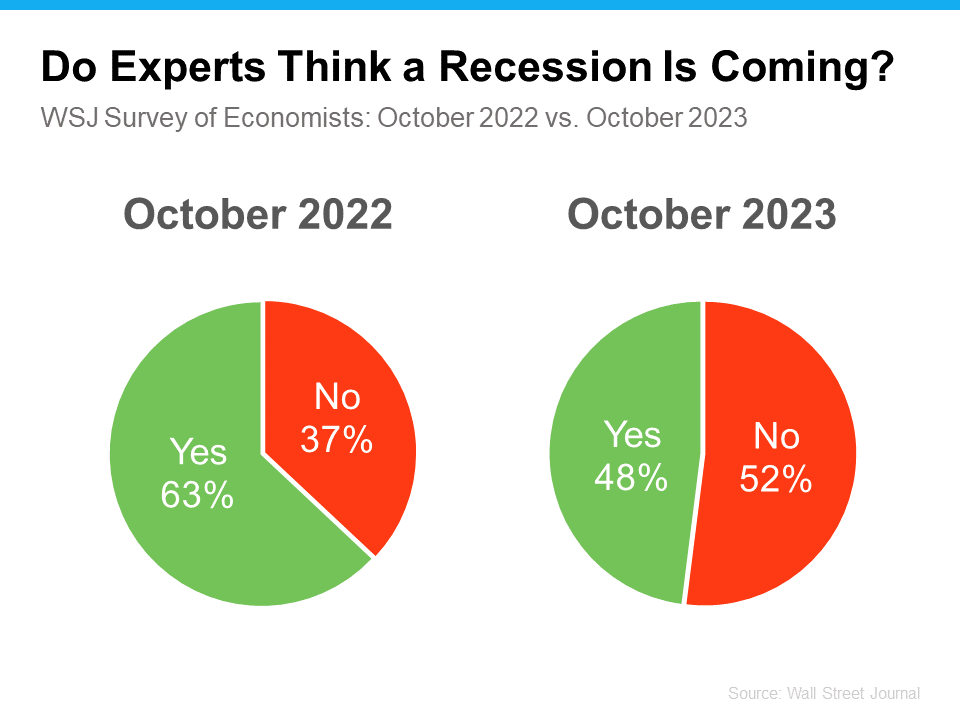

Even with so much data showing home prices are actually rising in most of the country, there are still a lot of people who worry there will be another price crash in the immediate future. In fact, a recent survey from Fannie Mae shows that 23% of consumers think prices will fall over the next 12 months. That’s nearly one in four people who are dealing with that fear – maybe you’re one of them.

To help ease that concern, here’s what the experts say will happen with home prices not just next year, but over the next five years.

Experts Project Ongoing Appreciation

While seeing a small handful of expert opinions may not be enough to change your mind, hopefully, a larger group of experts will reassure you. Here’s that larger group.

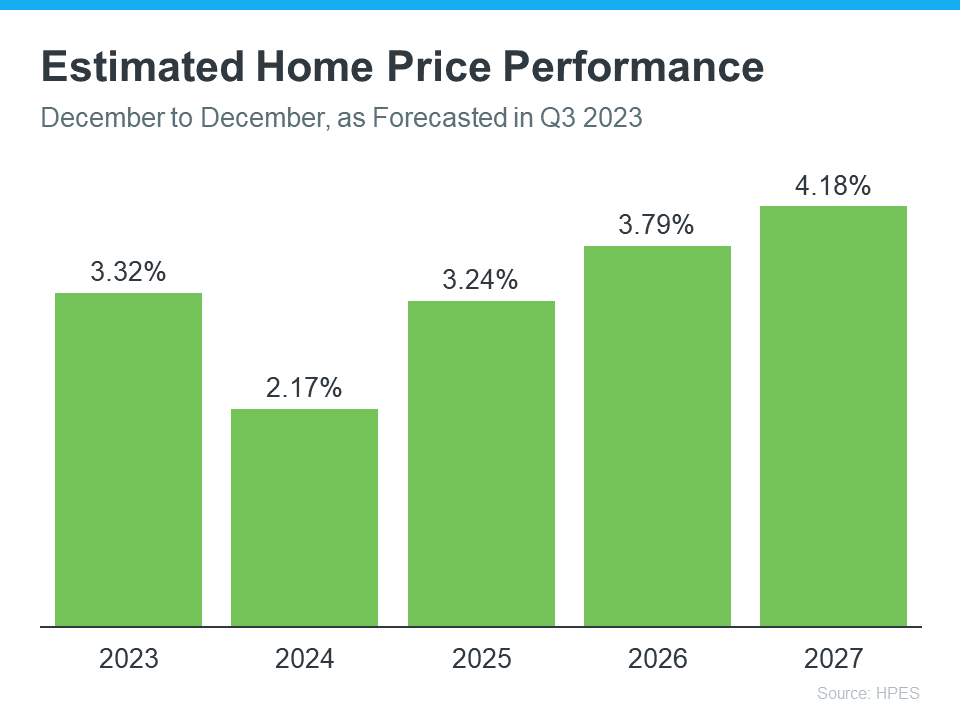

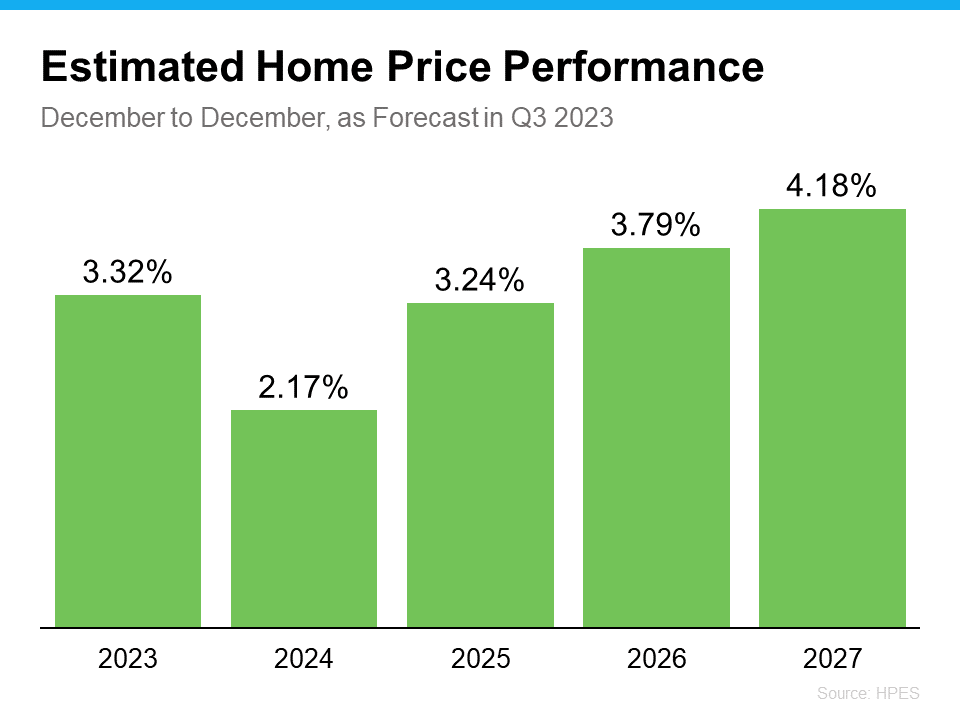

The Home Price Expectation Survey (HPES) from Pulsenomics is a great resource to show what experts forecast for home prices over a five-year period. It includes projections from over 100 economists, investment strategists, and housing market analysts. And the results from the latest quarterly release show home prices are expected to go up every year through 2027 (see graph below):

And while the projected increase in 2024 isn’t as large as 2023, remember home price appreciation is cumulative. In other words, if these experts are correct after your home’s value rises by 3.32% this year, it should go up by another 2.17% next year.

If you’re worried home prices are going to fall, here’s the big takeaway. Even though prices vary by local area, experts project they’ll continue to rise across the country for years to come at a pace that’s more normal for the market.

What Does This Mean for You?

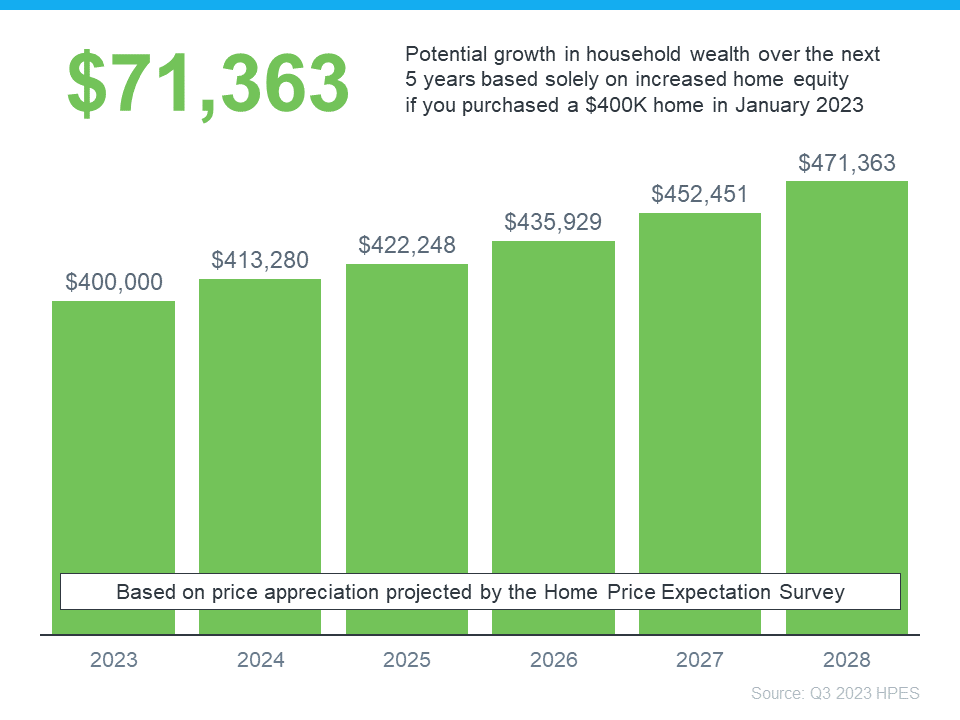

If you’re not convinced yet, maybe these numbers will get your attention. They show how a typical home’s value could change over the next few years using the expert projections from the HPES. Check out the graph below:

In this example, let’s say you bought a $400,000 home at the beginning of this year. If you factor in the forecast from the HPES, you could potentially accumulate more than $71,000 in household wealth over the next five years.

Bottom Line

If you’re someone who’s worried home prices are going to fall, rest assured a lot of experts say it’s just the opposite – nationally, home prices will continue to climb not just next year, but for years to come. If you have any questions or concerns about what’s next for home prices in our local area, let’s connect.