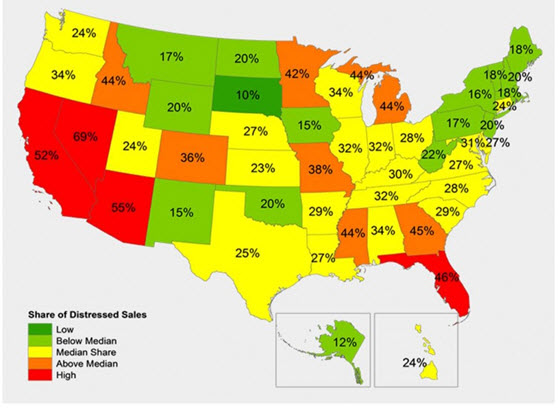

Mt. Hood Foreclosures-Facing Foreclosure? Read This

If you are facing a Mt. Hood foreclosure you may want to pay attention to this recent article in the Oregonian concerning a delay of many foreclosures going to court. This could delay your foreclosure for a while and as the court reviews these cases, some of our Oregon laws could make you liable for the difference in what you owe to the lender and what your home actually sells for.

How did this happen? Well, last year Federal judges started blocking foreclosures because the lenders did not follow procedures properly. If your mortgage was sold many times (and most have- through MERS*) the requirement is that each sale of that mortgage is to be recorded in the County that the sale takes place. MERS eliminated that "recording" process and these Federal judges are calling that process invalid because they did not follow the law's requirements.

Call your lender and be sure of the dates for foreclosure because you may be premature in your move out of your home.

*What is MERS and what does it mean to me in an Oregon foreclosure?