ReKey Your New Home

Displaying blog entries 1631-1640 of 1987

This is not a misprint! Seller says it must go before the end of the year! This is a very affordable property in Government Camp that comes completely furnished, turn key ready for occupancy. The price was slashed $30,000!

Today's price is $350,000. Sleep the entire ski team in this cozy cabin which boasts a huge living room, fireplace, pelet stove and more.

NO OUTRAGEOUS ASSOCIATION FEES

saving you thousands a year!

|

|

The Clackamas County Tax Assessor's Town Hall Meeting will be Novemeber 7. 2009 at 1:30 to 3:00 PM. to answer your questions about property taxes. The meeting will be held at the Hoodland Community Center at 25400 E. Salmon River Road, Welches.

Put your seatbelts on. The property tax bills are coming. Welches, Brightwood, Government Camp and Rhododendron and all Oregon Trail School District property owners are putting funds towards the long overdue high school which has been sorely needed for over fifteen years. Before your head hits the floor and the smelling salts are out you may want to read this Clackamas County Press Release for an explanation of why the taxes are going up substantially.

It's too bad by delaying the inevitable need for so many years the costs have increased substantially for the new high school project.

Read about the bond funds for the school district.

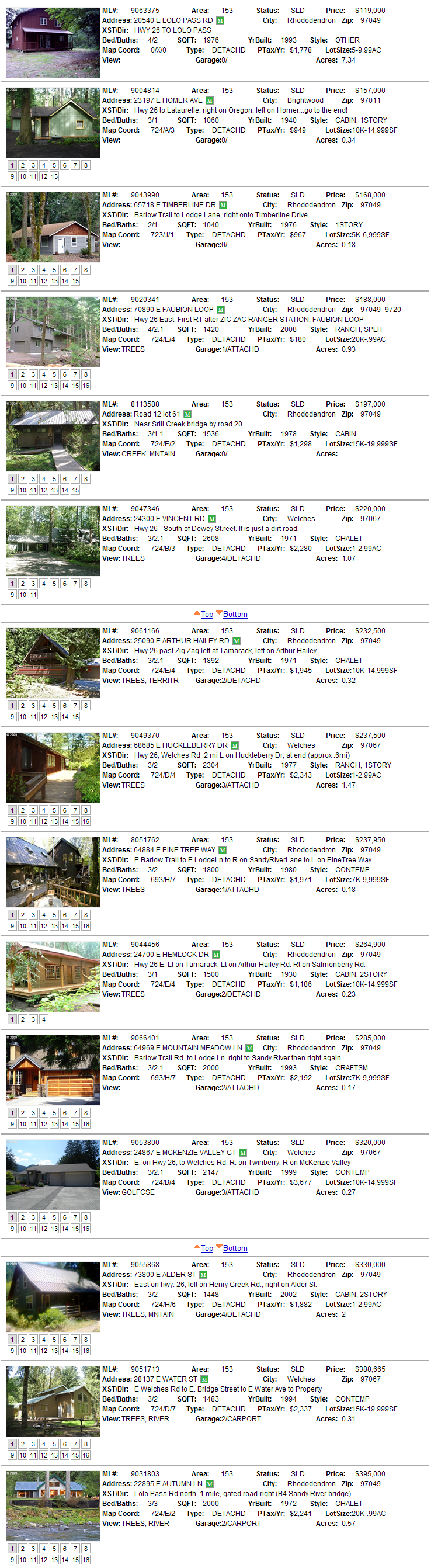

July and August pending sales proved to be substantial for the year with the biggest number of closings to date in September. It's been over a year since we have seen a monthly total of fifteen sales! Although there were none in the over $400.000 range, there were a few in the $300,000 area. Only one forest service cabin closed after the August flurry of sales. On a very positive note, only two of the fifteen sales were bank foreclosures.

Media reports indicate the third quarter of 2009 saw the greatest number of foreclousre filings yet. We are fortunate that the numbers of foreclosures have not hit levels in other states from 50 to 80% of their entire sales numbers.

Here are September's sales:

LEARNING TO FLY!

In the 1930's and 1940's, there were numerous women's magazines. Ladies' Home Journal and Good Housekeeping were two of them. They showed women in the role of the day - housekeeping. They suggested the number of times per week the home should be dusted, scrubbed, organized, and otherwise kept spotless. They suggested ways to look good when the "man of the house" arrived home from a tough day at the office. In short, those magazines and their publishers set up an impossible regimen of expectations for their readers.

Many of us know women who have spent much of their lives trying to live up to the model housewife role prescribed by those magazines. The trouble is, many of them have (or had) dreams of their own, like wanting to write, or to travel, or to participate in the freedoms only men then enjoyed.

Today, any of us can achieve our dreams. All too often, however, we are still denied our destiny by the expectations set by others. We are bombarded by radio, TV, CD, DVD, and WWW messages that insist we follow their example, their guidelines, or their models. We allow our dreams to wither and die - waiting in line for their turn to blossom - never receiving the water of encouragement needed to grow and bloom.

What about your dreams? Need some encouragement to help you "think outside the box?" Begin by spending time with others who have already achieved their dreams. Leave your nay-sayer acquaintances behind. Read inspiring biographies. Pick up a copy of "Think & Grow Rich" or "The Seven Habits of Highly Effective People." If you haven't yet learned to "fly," pick up "Jonathan Livingston Seagull" or "Illusions" by Richard Bach.

As Jonathan says in the book, "Don't believe what your eyes are telling you. All they show is limitation. Look with your understanding, find out what you already know, and you'll see the way to fly!"

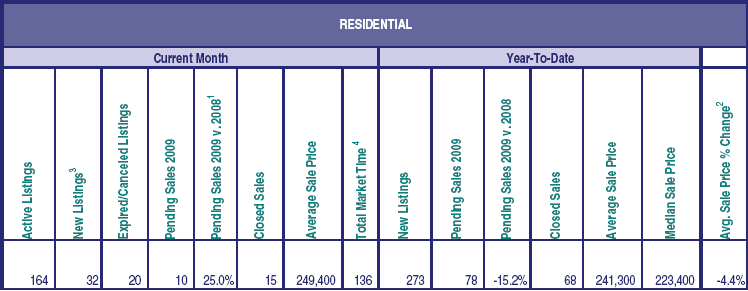

The multiple listing service has recently published their September sales statistics. Here are the numbers for the mountain:

Did you know that approximately one in three people who apply for a mortgage loan or refinance last year were denied approval according to the Federal Reserve? Overall, loan applications and originations were cut in half in 2008 compared with 2006!

Walk-aways are increasing! Despite postitive news on increased sales and in some areas, prices even going upward, many owners according to Housing Predictor will walk away from their mortgages if housing prices continue to fall. In fact, a recent survey indicates one in three owners will walk away.

When I think about the housing crisis and tsunami of foreclosures that have hit the market I think about Sub-prime Mortgages. This was the first wave of loans that caused foreclosures according to the media. There are many myths that surround sub prime loans and this recent commentary of 10 sub-prime mythes published by the Cleavland Federal Reserve, Senior Research Economist, Yuliya Demyanyk.

Displaying blog entries 1631-1640 of 1987