Silver Tsunami May Change the 2024 Market

Will a Silver Tsunami Change the 2024 Housing Market?

Have you ever heard the term “Silver Tsunami” and wondered what it's all about? If so, that might be because there’s been lot of talk about it online recently. Let's dive into what it is and why it won't drastically impact the housing market.

What Does Silver Tsunami Mean?

A recent article from HousingWire calls it:

“. . . a colloquialism referring to aging Americans changing their housing arrangements to accommodate aging . . .”

The thought is that as baby boomers grow older, a significant number will start downsizing their homes. Considering how large that generation is, if these moves happened in a big wave, it would affect the housing market by causing a significant uptick in the number of larger homes for sale. That influx of homes coming onto the market would impact the balance of supply and demand and more.

The concept makes sense in theory, but will it happen? And if so, when?

Why It Won’t Have a Huge Impact on the Housing Market in 2024

Experts say, so far, a silver tsunami hasn’t happened – and it probably won't anytime soon. According to that same article from HousingWire:

“. . . the silver tsunami’s transformative potential for the U.S. housing market has not yet materialized in any meaningful way, and few expect it to anytime soon.”

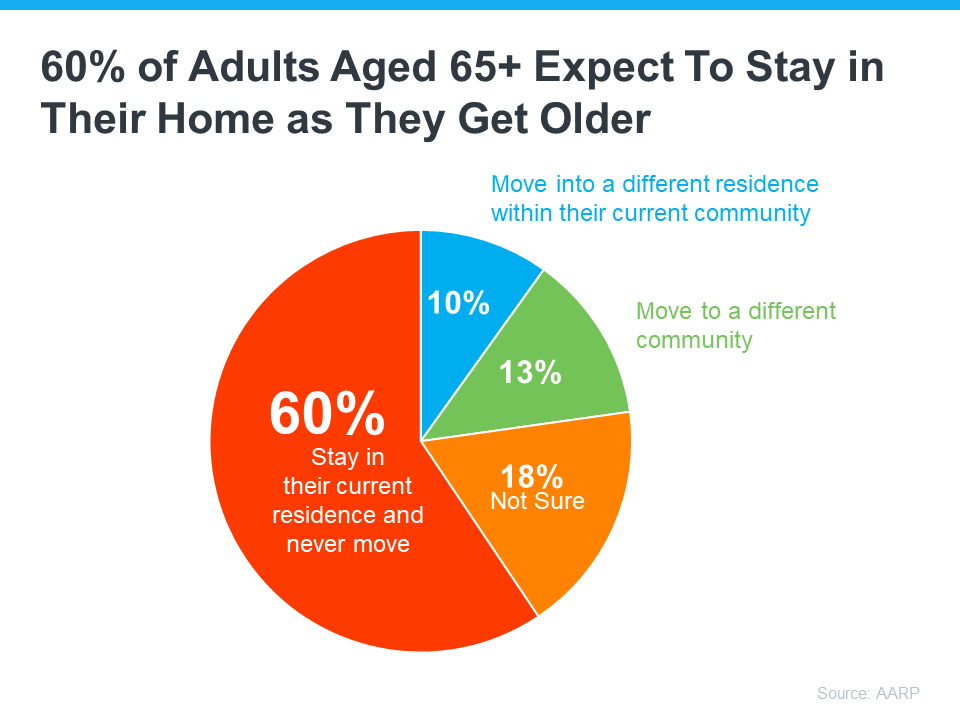

Here’s just one reason why. Many baby boomers don’t want to move. Data from the AARP shows over half of the surveyed adults ages 65 and up plan to stay put and age in place in their current home rather than move (see chart below):

Clearly, not every baby boomer is planning to sell or move – and even those who do won’t do it all at once. Instead, it will be more gradual, happening slowly over time. As Mark Fleming, Chief Economist at First American, says:

“Demographics are never a tsunami. The baby boomer generation is almost two decades of births. That means they're going to take about two decades to work their way through.”

Bottom Line

If you’re worried about a Silver Tsunami shaking up the housing market, don’t be. Any impact from baby boomers moving will be gradual over many years. Fleming sums it up best:

“Demographic trends, they don't tsunami. They trickle.”