Real Estate Information

Mt. Hood Real Estate Blog

Liz Warren

Blog

Displaying blog entries 1-10 of 1913

The Most Common Concessions Homebuyers Get From Sellers On Mt. Hood

What You Need To Know About Homeowner’s Insurance

What You Need To Know About Homeowner’s Insurance

Homeowner’s insurance is a must-have to protect what’s probably your biggest investment – your home. And while you never want to think about worst-case scenarios, the right coverage is basically your safety net if something goes wrong. Here’s how it helps you.

- Covers Repairs and Rebuilding Costs: If your home is damaged by fire, storms, or other covered events, your policy helps pay for repairs or even a full rebuild.

- Protects Your Belongings: Many policies can also cover personal items like furniture, electronics, and clothing if they’re stolen or damaged.

- Provides Liability Coverage: If someone gets injured on your property, homeowner’s insurance can help cover medical bills or legal expenses.

In the simplest sense, it gives you peace of mind. Knowing you have protection against unexpected events helps you worry less. And with such a big purchase, having that reassurance is a big deal.

And while your first insurance payment will be wrapped into your closing costs, you’ll want this to be a part of your budget beyond closing day too. That’s because it's a recurring expense you’ll have once you get the keys to your home.

Here’s what you need to know to help you budget for this important part of homeownership today.

Costs and Claims Are Rising

In recent years, insurance costs have been climbing. According to Insurance.com, there are four big reasons behind the jump in premiums:

- More severe weather events and wildfires are leading to higher claims.

- Insurance companies are pulling out of high-risk areas, reducing options for homeowners in some states.

- Past rate increases haven’t kept up with the rise in claims.

- The cost to rebuild or repair homes has gone up due to higher material and labor costs.

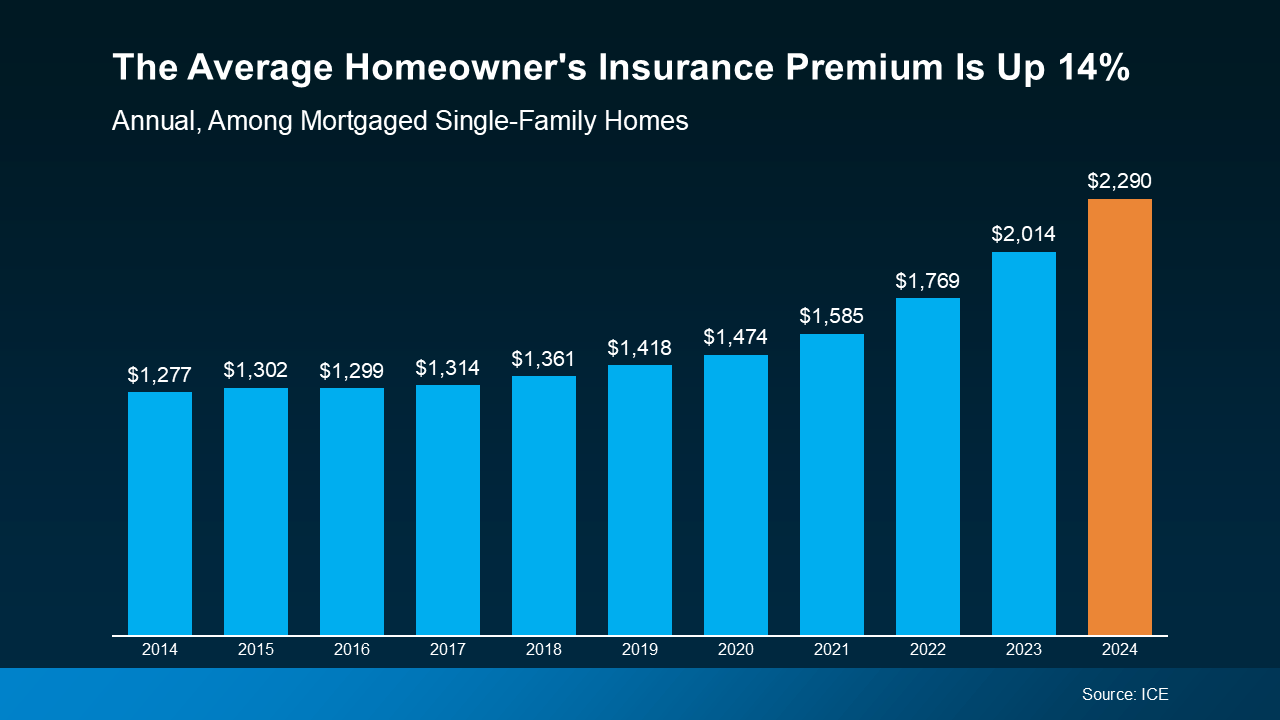

Basically, disasters are happening more often, repairs cost more, and insurers have to adjust their rates to keep up. Data from ICE Mortgage Technology helps paint the picture of how the average yearly premium has climbed over the last decade (see graph below):

What You Can Do About It

Homeowner’s insurance is a must to protect your home and your investment. But with costs rising, you’ll want to do your homework to balance the best coverage you can get at the best price possible.

Homeowner’s insurance rates vary widely based on location, provider, and coverage. Shop around and compare quotes before settling on a policy. And don’t forget to ask about discounts. Things like security systems or bundling with auto insurance could help lower your insurance costs.

Bottom Line

When you’re planning to buy a home, it’s important to look beyond just your mortgage payment. You’ll also want to budget for your homeowner’s insurance policy. It gives you a lot of protection against the unexpected. And while it’s true those costs are rising, there are things you can do to try to get the best price possible.

What’s your biggest concern when it comes to budgeting for homeownership? Let’s talk through it and make sure you’re set up for success.

Should I Buy a Home Right Now? Experts Say Prices Are Only Going Up

Should I Buy a Home Right Now? Experts Say Prices Are Only Going Up

At one point or another, you’ve probably heard someone say, “Yesterday was the best time to buy a home, but the next best time is today.”

That’s because nationally, home values continue to rise. And with mortgage rates still stubbornly high and home prices going up, you may be holding out for prices to fall or trying to time the market for that perfect rate. But here’s the truth: waiting for the right moment could cost you in the long run.

Home Prices Are Still Rising – Just at a More Normal Pace

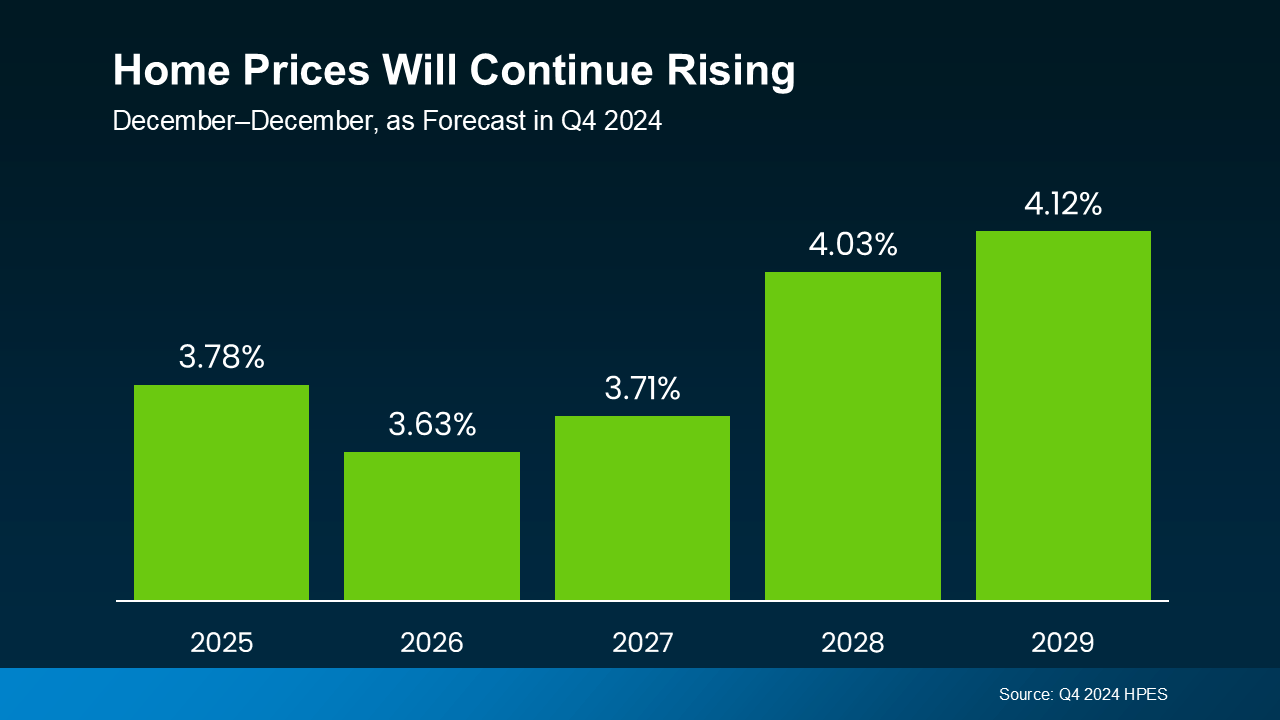

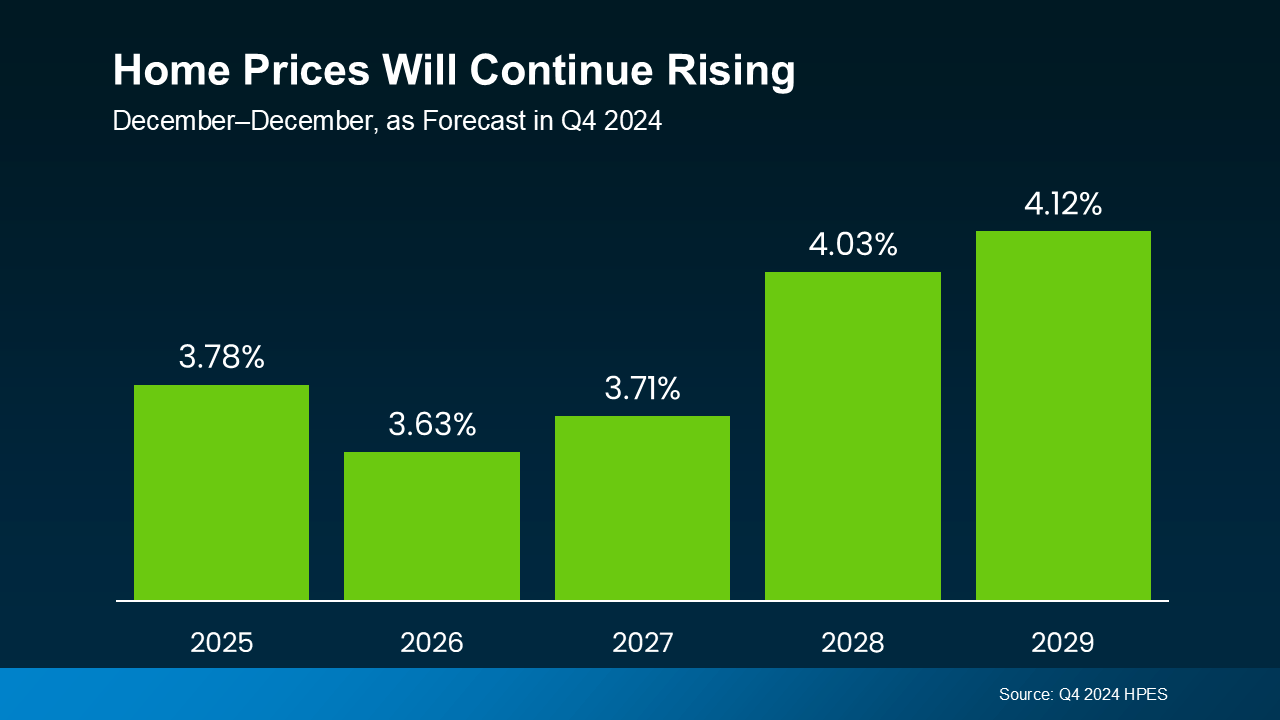

The idea that prices will drop dramatically is wishful thinking in most markets. According to the Home Price Expectations Survey from Fannie Mae, industry analysts are saying prices are projected to keep rising through at least 2029.

While we’re no longer seeing the steep spikes of previous years, experts project a steady and sustainable increase of around 3-4% per year, nationally. And the good news is, this is a much more normal pace – a welcome sign for hopeful buyers (see graph below):

What This Means for You

What This Means for You

While it’s tempting to wait it out for prices or mortgage rates to decline before you buy, here’s what you’ll need to consider if you do.

- Tomorrow’s home prices will be higher than today’s. The longer you wait, the more that purchase price will go up.

- Waiting for the perfect mortgage rate or a price drop may backfire. Even if rates dip slightly, rising home prices could still make waiting more expensive overall.

- Buying now means building equity sooner. Home values are rising, which means your investment starts growing as soon as you buy.

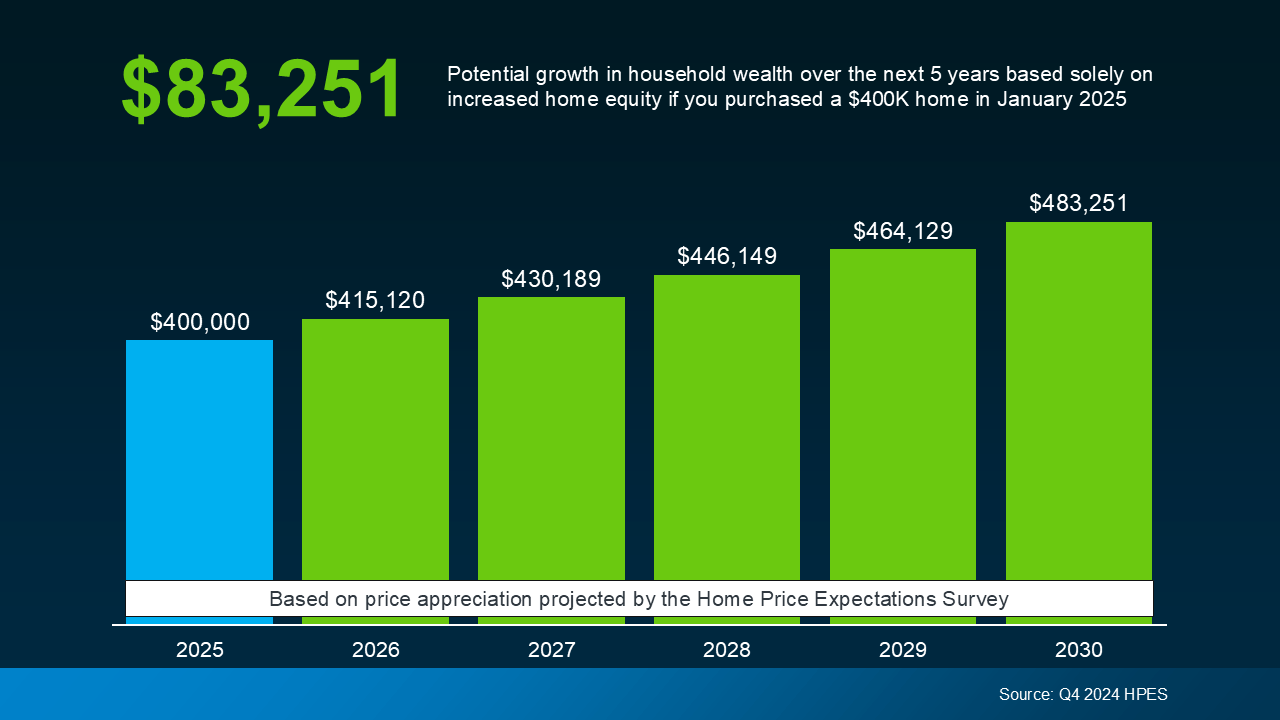

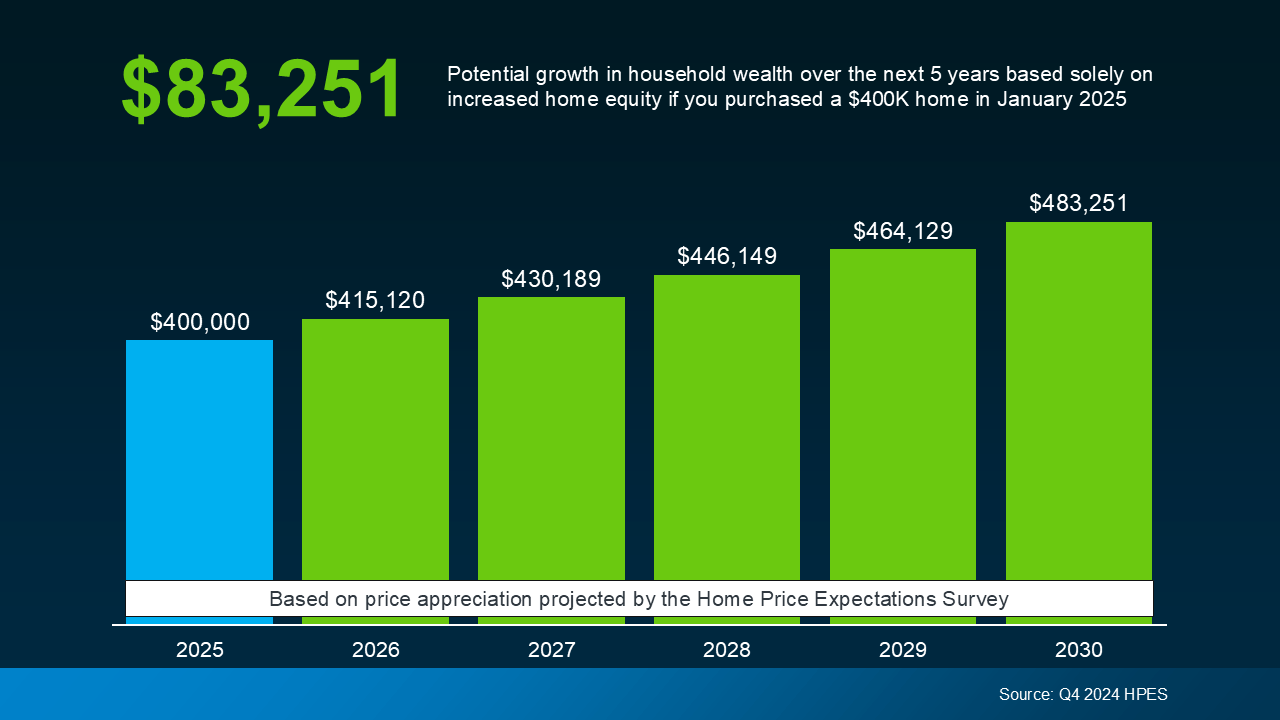

Let’s put real numbers into this equation. If you purchase a $400,000 home today, based on these price forecasts, it’s expected to go up in value by more than $83,000 over the next five years. That’s some serious money back in your pocket instead of being left on the sidelines (see graph below):

Why Aren’t Prices Dropping? It’s All About Supply and Demand

Why Aren’t Prices Dropping? It’s All About Supply and Demand

Even though there are more homes for sale right now than there were at this time last year, or even last month, there still aren’t enough of them on the market for all the buyers who want to purchase them. And that puts continued upward pressure on prices. As Redfin puts it:

"Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand."

While every market is different, most areas will continue to see moderate price growth. Some may level off a bit, but a major national drop? Not likely.

Bottom Line

Time in the Market Beats Timing the Market

If you’re debating whether to buy now or wait, remember this: real estate rewards those who get in the market, not those who try to time it perfectly.

Yes, today’s housing market has its challenges, but there are ways to make it work —exploring different neighborhoods, considering smaller condos or townhomes, asking your lender about alternative financing, or tapping into down payment assistance programs. The key is making a move when it makes sense for you rather than waiting for a perfect scenario that may never arrive.

Want to take a look at what’s happening with prices in our local market? Whether you're ready to buy now or just exploring your options, having a plan in place can set you up for success.

Rising Inventory Means This Spring Could Be Your Moment

Rising Inventory Means This Spring Could Be Your Moment

Want to know two reasons this spring might finally be your time to buy? Inventory has grown and sellers may be more willing to negotiate as a result. That means you’ve got more options and more power than buyers have had in years. Let’s break it down.

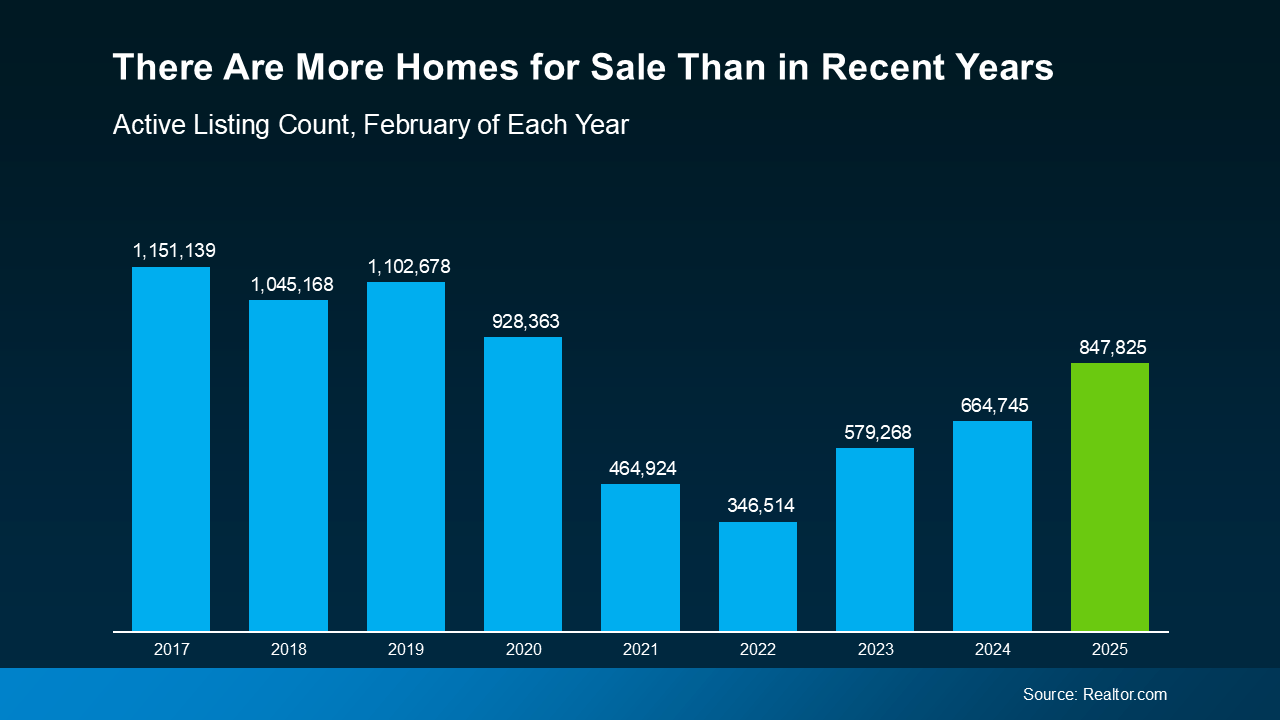

1. You Have More Homes To Choose From

The number of homes for sale this February was higher than it’s been in any of the past five Februarys – and that’s great news for your home search. The graph below uses the latest data from Realtor.com to show the supply of homes on the market has grown by 27.5% in just the last year:

More choices for your search is a good thing – and experts also say that inventory is projected to continue rising this year, which is even better. It means it should be easier to find something that checks your most important boxes. But that’s not all this does for you. Danielle Hale, Chief Economist at Realtor.com, explains some of the other perks of more inventory, beyond just having more homes to consider:

More choices for your search is a good thing – and experts also say that inventory is projected to continue rising this year, which is even better. It means it should be easier to find something that checks your most important boxes. But that’s not all this does for you. Danielle Hale, Chief Economist at Realtor.com, explains some of the other perks of more inventory, beyond just having more homes to consider:

“Buyers will not only have more home options . . . but they are also likely to find somewhat lower asking prices and more time to make decisions – all buyer-friendly factors as we inch closer to the busy homebuying season.”

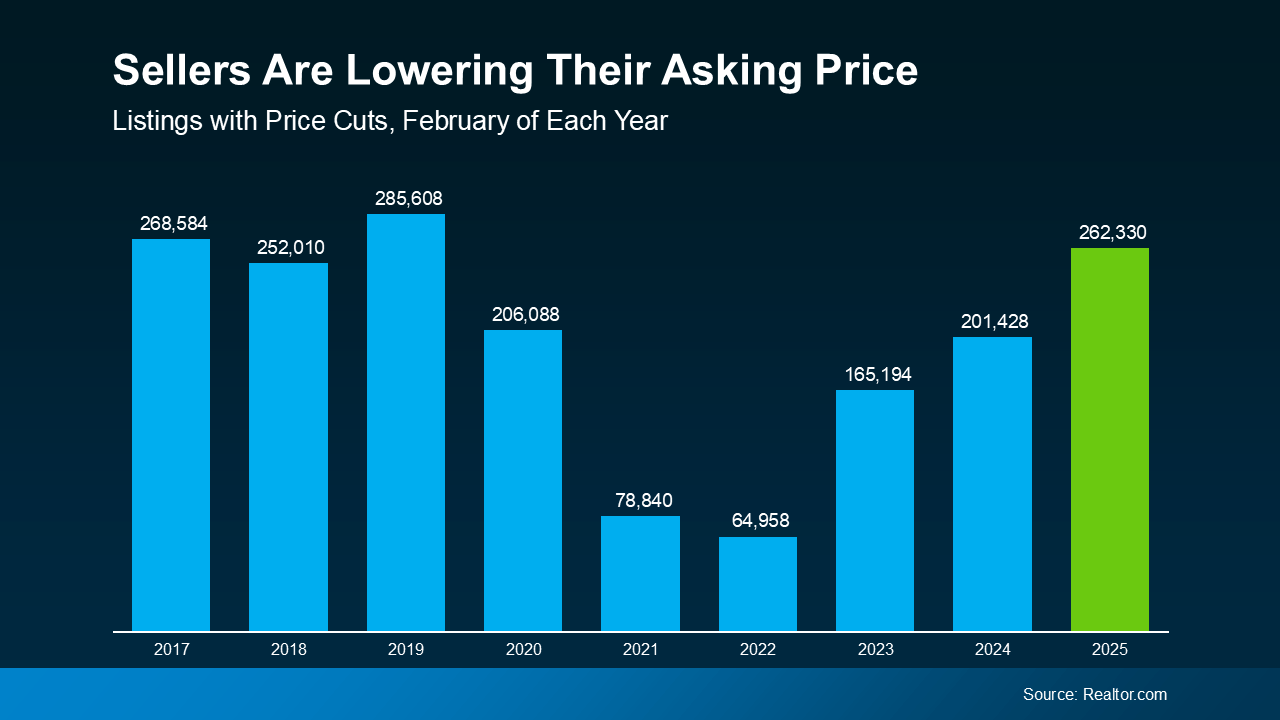

2. You May Find Sellers Are Doing Price Cuts

Now that buyers have more options, some homes are sitting on the market a little longer – especially those that were priced too high from the start. And the result is more sellers are having to drop their prices to draw buyers back in. Just take a look at the numbers.

According to Realtor.com, the number of listings with price reductions has gone up compared to the last few years (see graph below):

This is a sign sellers are more willing to compromise today. If you look back to more normal years in the market (2017–2019), you’ll see that the number of price cuts happening today is much closer to what’s typical – and for most buyers, that’s a big relief.

This is a sign sellers are more willing to compromise today. If you look back to more normal years in the market (2017–2019), you’ll see that the number of price cuts happening today is much closer to what’s typical – and for most buyers, that’s a big relief.

What does that mean for you? It could give you a better chance to negotiate – whether that’s on price, closing costs, or even repairs. While not every seller will adjust their price, more of them are willing to do it – giving you more leverage than buyers have in quite a while.

Bottom Line

If you’ve been on the sidelines, waiting for the right time to buy, this spring could be the opening you’ve been hoping for.

Of course, every market is different, and working with a local expert can help you work through your options. If you want to talk about what’s happening in our area or get started on your home search, let’s connect.

How does today’s rising inventory impact your homebuying plans?

Is the Housing Market Starting To Balance Out?

Is the Housing Market Starting To Balance Out?

For years, sellers have had the upper hand in the housing market. With so few homes for sale and so many people who wanted to purchase them, buyers faced tough competition just to get an offer accepted. But now, inventory is rising, and things are starting to shift in many areas.

So, is the market finally balancing out? And does that mean buyers will have it a bit easier now? Here’s what you need to know.

What Makes It a Buyer’s Market or a Seller’s Market?

It all comes down to how many homes are for sale in an area compared to how many buyers want to buy there. That’s what ultimately determines who has the most leverage.

- A Seller’s Market is when there are more buyers than homes available, so sellers hold the power. This leads to rising prices, multiple offers, and homes selling quickly – often above the asking price – because there isn’t enough to go around.

- A Buyer’s Market is when there are more homes than buyers. In this case, the tables turn. Sellers may have to offer concessions and incentives, or negotiate more to get a deal done. That’s because buyers have more choices and can take their time making decisions.

You can see this play out over time using data from the National Association of Realtors (NAR) in the graph below:

Where the Market Stands Now

Where the Market Stands Now

While it’s still a seller’s market in many places, buyers in certain locations have more leverage than they’ve had in years. And that’s thanks to how much inventory has grown lately. As Lance Lambert, Co-Founder of ResiClub, explains:

"Among the nation’s 200 largest metro area housing markets, 41 markets ended January 2025 with more active homes for sale than they had in pre-pandemic January 2019. These are the places where homebuyers will be able to find the most leverage or market balance in 2025."

Here’s a look at some of the strongest seller’s markets and buyer’s markets today, according to that research:

Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.

Clever strategies can make buying in a seller’s market easier – and vice versa. And that’s exactly why you need to hire a pro. A local real estate agent knows their market like the back of their hand. They’re super familiar with what the supply and demand balance looks like and how to help their clients get a deal done either way. So, as long as you have a skilled pro by your side, it doesn’t really matter if your town is on the list or not.

With their expertise, you’ll be able to plan ahead and buy (or sell) no matter what the market looks like.

Bottom Line

With inventory rising, the market may be starting to balance out – but it all depends on where you want to buy or sell.

Are you wondering if buyers or sellers have the upper hand in our area? Let’s connect so you can find out.

Mortgage Rates Hit Lowest Point So Far This Year

Mortgage Rates Hit Lowest Point So Far This Year

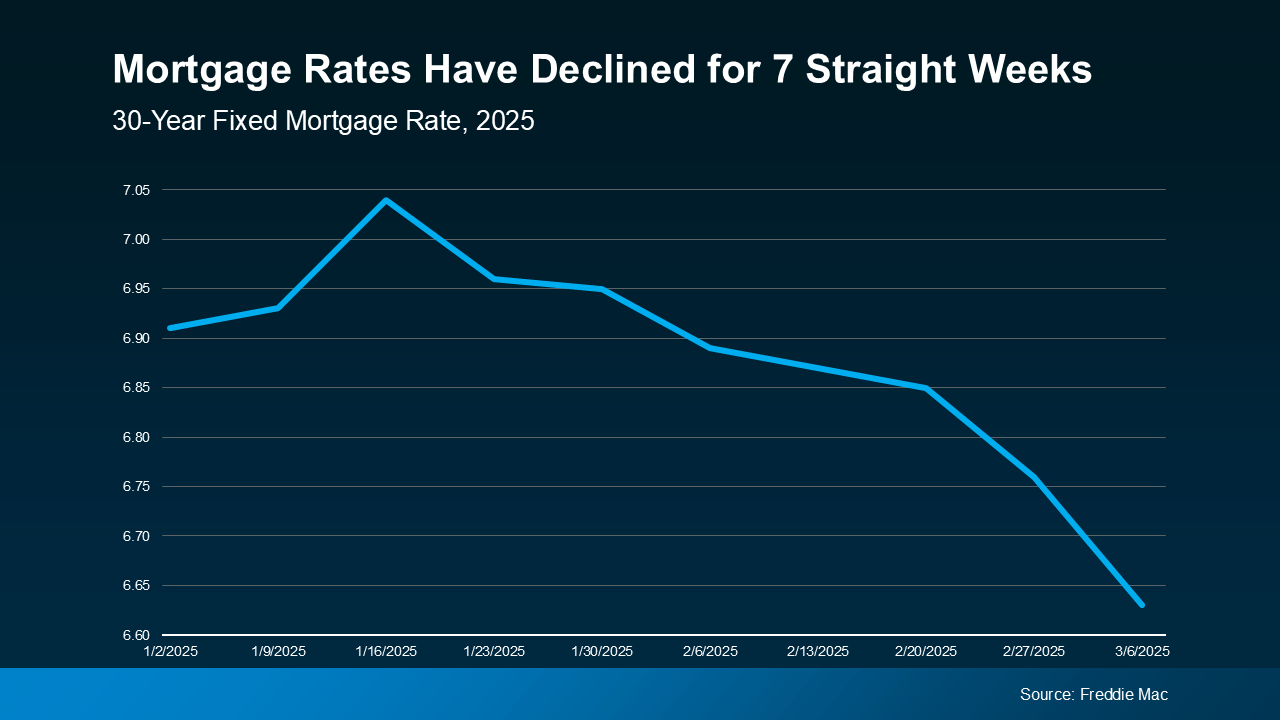

If you’ve been holding off on buying a home because of high mortgage rates, you might want to take another look at the market. That’s because mortgage rates have been trending down lately – and that gives you a chance to jump back in.

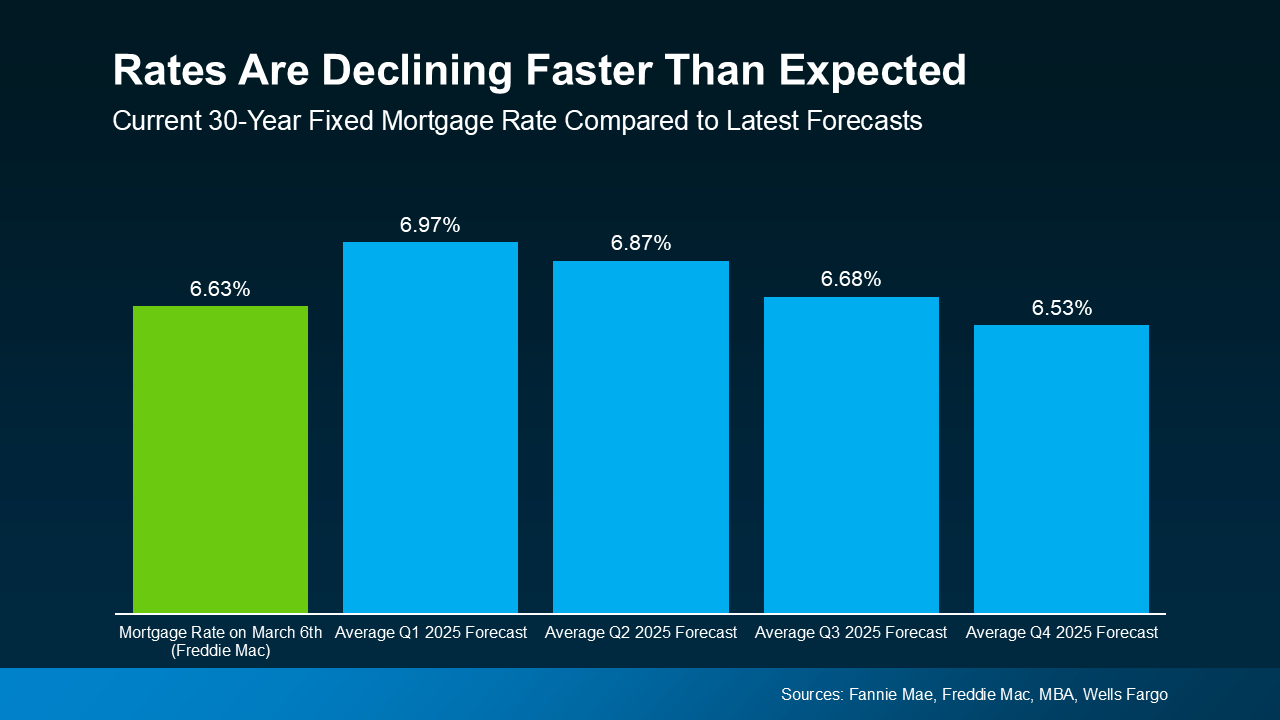

Mortgage rates have been declining for seven straight weeks now, according to data from Freddie Mac. And the average weekly rate is now at the lowest level so far this year (see graph below):

While that may not sound like a significant shift, it is noteworthy. Because the meaningful drop from over 7% to the mid-6’s can change your mindset when it comes to buying a home. Especially when the forecasts said we wouldn’t hit this number until roughly Q3 of this year (see graph below):

While that may not sound like a significant shift, it is noteworthy. Because the meaningful drop from over 7% to the mid-6’s can change your mindset when it comes to buying a home. Especially when the forecasts said we wouldn’t hit this number until roughly Q3 of this year (see graph below):

Why Are Rates Coming Down?

According to Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), recent economic uncertainty is playing a role in pushing rates lower:

"Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024."

And the timing of this recent decline is great because it gives you a little bit of relief going into the spring market. Just remember, mortgage rates can be a quickly moving target, so you should expect some volatility going forward. But the window you have as they’re coming down right now might be the sweet spot for your purchasing power now.

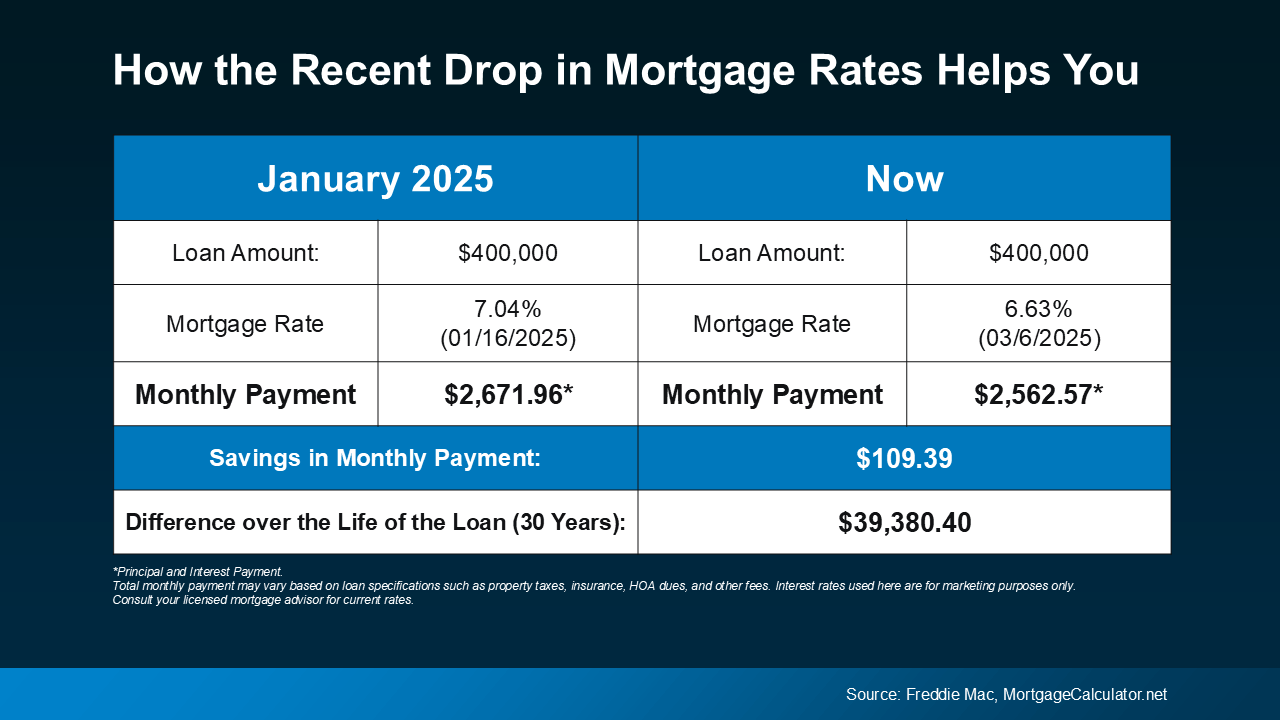

What Lower Rates Mean for Your Buying Power

Even small changes in rates can make a difference to your monthly payment. Here’s how the math shakes out. The chart below shows what a monthly payment (principal and interest) would look like on a $400K home loan if you purchased a house when rates were 7.04% back in mid-January (this year’s mortgage rate high), versus what it could look like if you buy a home now (see below):

In just a matter of weeks, the anticipated payment on a $400K loan has come down by over $100 per month. That’s a significant savings. When you’re making a decision as big as buying a home, every bit counts.

In just a matter of weeks, the anticipated payment on a $400K loan has come down by over $100 per month. That’s a significant savings. When you’re making a decision as big as buying a home, every bit counts.

Just remember, shifts in the economy drove rates down faster than expected. But that can change, making rates volatile in the days and months ahead. So, if you’re waiting for rates to fall further before you buy, think hard about the current window of opportunity if you’re ready to act.

Bottom Line

Mortgage rates have dipped, giving buyers a bit more immediate breathing room. If you’ve been waiting for rates to ease before jumping in, this could be your window.

Would a lower monthly payment make buying a home feel more doable for you? Let’s break down the numbers and find out.

Should I Buy A Home on Mt. Hood Right Now?

Should I Buy a Home Right Now? Experts Say Prices Are Only Going Up

At one point or another, you’ve probably heard someone say, “Yesterday was the best time to buy a home, but the next best time is today.”

That’s because nationally, home values continue to rise. And with mortgage rates still stubbornly high and home prices going up, you may be holding out for prices to fall or trying to time the market for that perfect rate. But here’s the truth: waiting for the right moment could cost you in the long run.

Home Prices Are Still Rising – Just at a More Normal Pace

The idea that prices will drop dramatically is wishful thinking in most markets. According to the Home Price Expectations Survey from Fannie Mae, industry analysts are saying prices are projected to keep rising through at least 2029.

While we’re no longer seeing the steep spikes of previous years, experts project a steady and sustainable increase of around 3-4% per year, nationally. And the good news is, this is a much more normal pace – a welcome sign for hopeful buyers (see graph below):

What This Means for You

What This Means for You

While it’s tempting to wait it out for prices or mortgage rates to decline before you buy, here’s what you’ll need to consider if you do.

- Tomorrow’s home prices will be higher than today’s. The longer you wait, the more that purchase price will go up.

- Waiting for the perfect mortgage rate or a price drop may backfire. Even if rates dip slightly, rising home prices could still make waiting more expensive overall.

- Buying now means building equity sooner. Home values are rising, which means your investment starts growing as soon as you buy.

Let’s put real numbers into this equation. If you purchase a $400,000 home today, based on these price forecasts, it’s expected to go up in value by more than $83,000 over the next five years. That’s some serious money back in your pocket instead of being left on the sidelines (see graph below):

Why Aren’t Prices Dropping? It’s All About Supply and Demand

Why Aren’t Prices Dropping? It’s All About Supply and Demand

Even though there are more homes for sale right now than there were at this time last year, or even last month, there still aren’t enough of them on the market for all the buyers who want to purchase them. And that puts continued upward pressure on prices. As Redfin puts it:

"Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand."

While every market is different, most areas will continue to see moderate price growth. Some may level off a bit, but a major national drop? Not likely.

Bottom Line

Time in the Market Beats Timing the Market

If you’re debating whether to buy now or wait, remember this: real estate rewards those who get in the market, not those who try to time it perfectly.

Yes, today’s housing market has its challenges, but there are ways to make it work —exploring different neighborhoods, considering smaller condos or townhomes, asking your lender about alternative financing, or tapping into down payment assistance programs. The key is making a move when it makes sense for you rather than waiting for a perfect scenario that may never arrive.

Want to take a look at what’s happening with prices in our local market? Whether you're ready to buy now or just exploring your options, having a plan in place can set you up for success.

Displaying blog entries 1-10 of 1913

Categories

- Government Camp Real Estate (715)

- Mt Hood Inspiration-Morning Coffee (256)

- Mt. Hood 1031 Tax Exchanges (67)

- Mt. Hood Economic Conditions (788)

- Mt. Hood Local Events (364)

- Mt. Hood Mortgage and Financing Information (381)

- Mt. Hood National Forest Cabins (477)

- Mt. Hood New Properties on Market (309)

- Mt. Hood Sales Information (353)