Supply and Demand in the Mt. Hood Real Estate Market

How Supply and Demand Can Impact Your Buying and Selling Goals in the Mt. Hood Market

In today’s Mt. Hood housing market, there are far more buyers looking for homes than sellers listing their houses. Based on the concept of supply and demand, this means home prices will naturally rise. Why is that? When there are more people trying to buy an item than there are making that item available for sale, that drives prices up. And that’s exactly the case in today’s housing market. So, knowing what’s happening with the inventory of homes for sale and the demand for housing is crucial for today’s buyers and sellers.

Nationally, Demand Is High and Supply Is Very Low

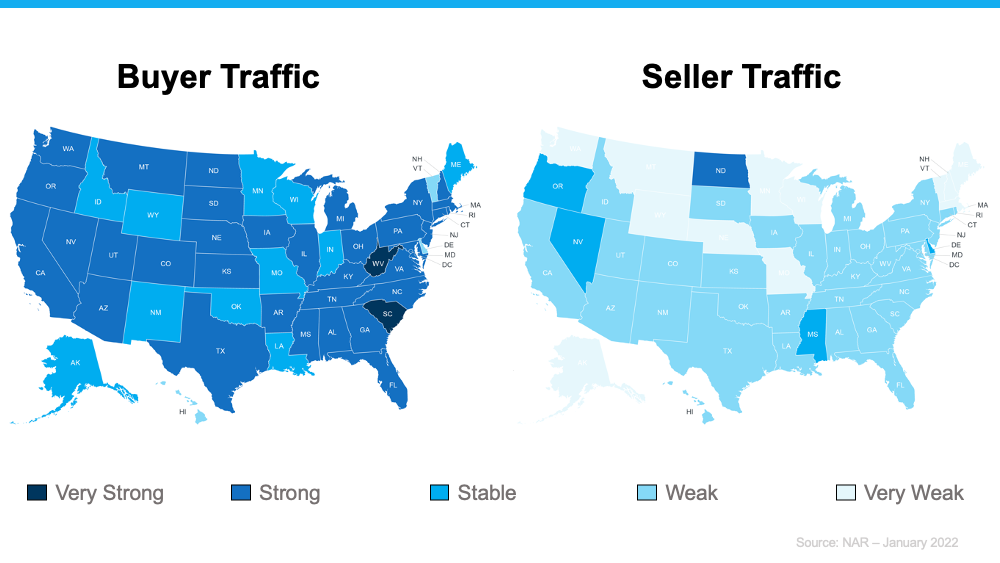

The latest buyer and seller activity data from the National Association of Realtors (NAR) indicates buyer traffic heavily outweighs seller traffic today, as shown in the maps below. There are far darker blues (strong buyer activity) on the left and much lighter blues (weak seller activity) on the right. In other words, this shows how the demand for homes is significantly greater than what’s available to purchase.

What Does This Mean if You’re a Mt. Hood Seller?

Supply is struggling to keep pace with demand. In fact, the inventory of homes for sale recently hit an all-time low. That gives you an incredible advantage when you sell your house. With so few listings, it’s likely more potential buyers will view your house – especially if you work with an agent to price it right. That means there’s a high chance you’ll receive multiple offers or buyers will enter a bidding war for your house. And that dynamic can drive the sale price of your home up.

What Does This Mean if You’re a Buyer?

As a buyer with fewer options available, you’re likely to see more competition, so you need to be strategic to win. First, make sure you have a trusted professional on your side. Your real estate agent will help you understand your local market and work with you to act quickly when the time is right. Even when it’s challenging to find a home, you can still succeed as a buyer today if you have a trusted advisor on your side every step of the way.

Bottom Line

Whether you’re a homebuyer, seller, or both, knowledge truly is power. Let’s connect today so you can better understand what’s happening in our local market and achieve your home buying and selling goals this year.