Wednesday, January 7, 2009

by Liz Warren

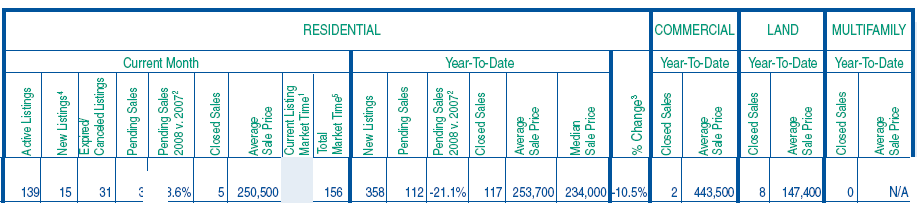

No doubt about it, the crazy snow pilling up, melting snow and rain, falling trees and branches and a general lack of accessibility will be reflected in fewer pending and sold properties showing up in January. From Government Camp, which was buried with snow and constantly battling power outages closing down local ski areas to Welches, Brightwood and Rhododendron, it was a rough winter holiday season. People just couldn't get around on the roads let alone view properties.

The clean up has begun and most roads are easy to navigate so showings are happening and buyers are back. Rivers and creeks are dabbling at high water levels. Many basements are flooded and finally, everyone has their power back on.

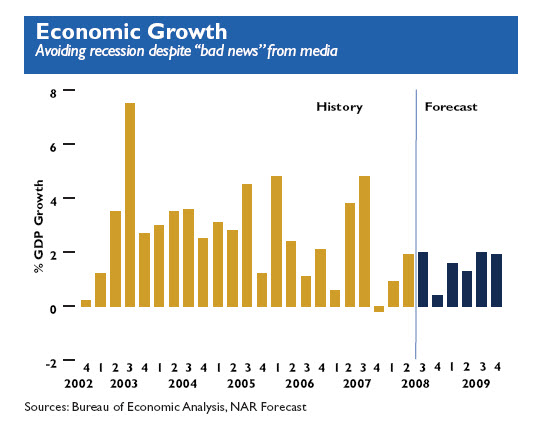

As we shake all of this off, 2009 should be one for adjustments as major price reductions are rampant in the multiple listing service. Some owners have dropped their prices nearly 40% chasing the market down.

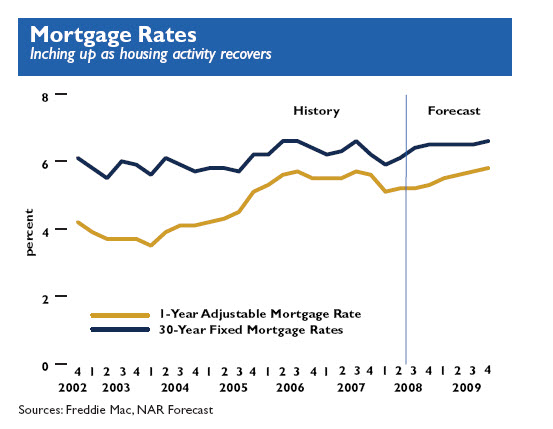

Buyers have rarely had so much inventory to choose from and with rates hovering around 5%, opportunity knocks!

FHA loans have increased their down payment qualifications to 3.5% down. FHA loans numbers have increased significantly from the past couple of years.

Speaking of incredible rates, this is currently causing a rush to refinance. Mortgage brokers are busy getting folks into incredibly affordable loans. If you have a lot of equity in your home, this is a great time to pull that down payment out for a second home purchase.

Well, it's back to work for me now that the power and internet are working again!