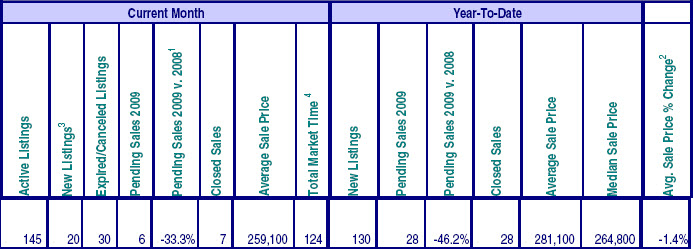

According to recent news events, things are improving slightly in the home sales department in the US. Well, perhaps a little. But, what is really selling? If you take a look at the first quarter numbers, according to NAR, the National Association of Realtors, half of all home sales were to first time home buyers.

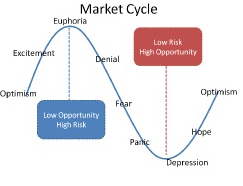

It's also known that half of all sales in the first quarter were foreclosures and short sales. So, we have investors picking up foreclosers and short sales and first time home buyers picking up the rest. These sales are homes at the bottom of the pricing scale causing the median price of homes to decrease at a rapid rate. The mid and high end price ranges are not moving causing these homes to continue to decline in pricing.

Sure sales have increased in California, Florida and Nevada. These are states that have the most inventory and depressed prices in the US. Investors and first time home buyers are starting to work this inventory over but when will the recovery hit the rest of the pricing ranges? Stay tuned.