Mt. Hood Real Estate Multiple Listing Numbers are in for June 2011

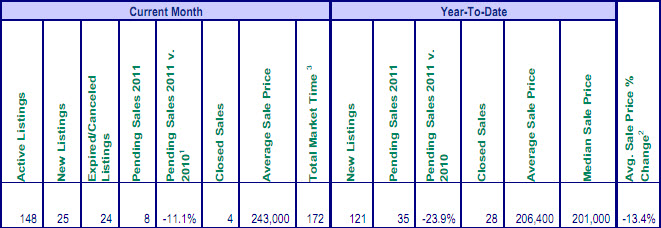

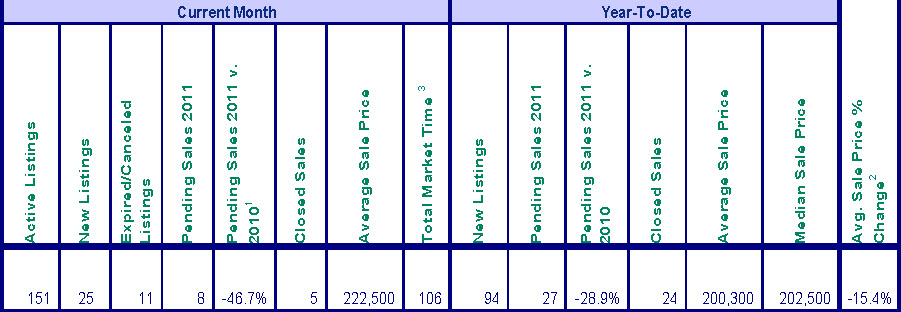

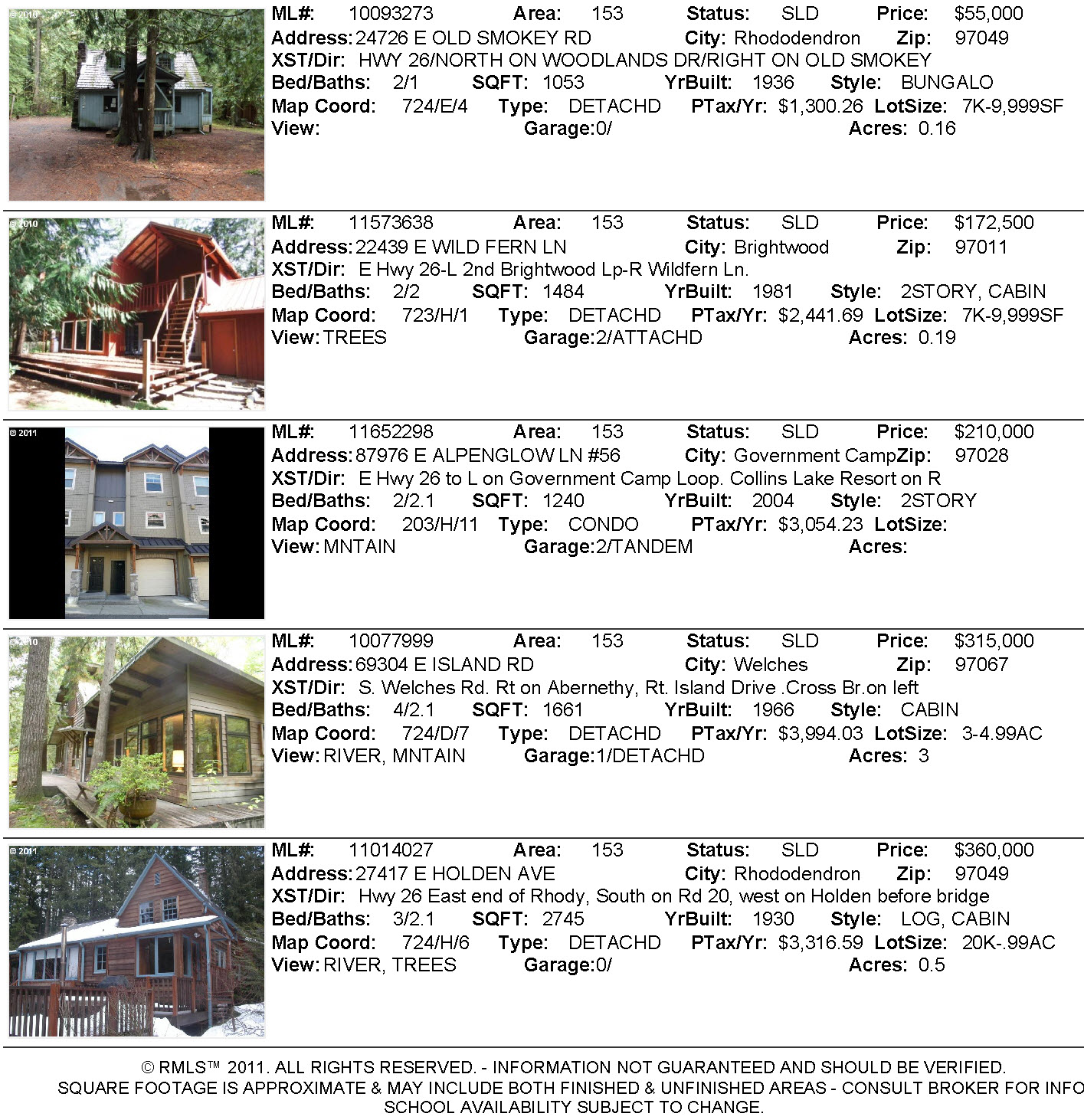

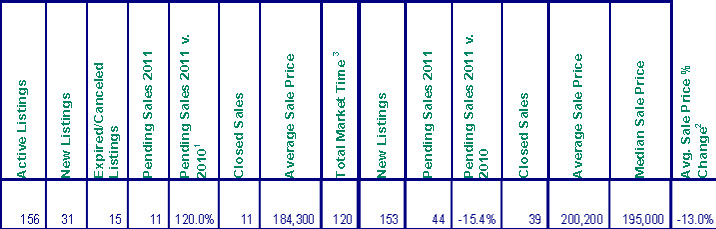

The multiple listing service just came out with the Mt. Hood area statistics for June. This is for sales including Government Camp, Welches, Rhododendron and Brightwood. Number of sales were substantially up to eleven sales! Total sales since the beginning of the year hit 39.

Summer has finally arrived and many sellers have placed their properties on the market for the prime summer season. Incredible deals are available with many motivated sellers. It's the perfect time to purchase while interest rates are low making homes more affordable. This could be a once in a generation opportunity according to CBS Money Watch.