Housing Forecasts For Mt. Hood in 2025

Displaying blog entries 41-50 of 793

Have you ever heard the phrase: don’t believe everything you hear? That’s especially true if you’re thinking about buying or selling a home in today’s housing market. There’s a lot of misinformation out there. And right now, making sure you have someone you can go to for trustworthy information is extra important.

If you partner with a real estate agent, they can clear up some common misconceptions and reassure you by backing them up with research-driven facts. Here are just a few misconceptions they can help disprove.

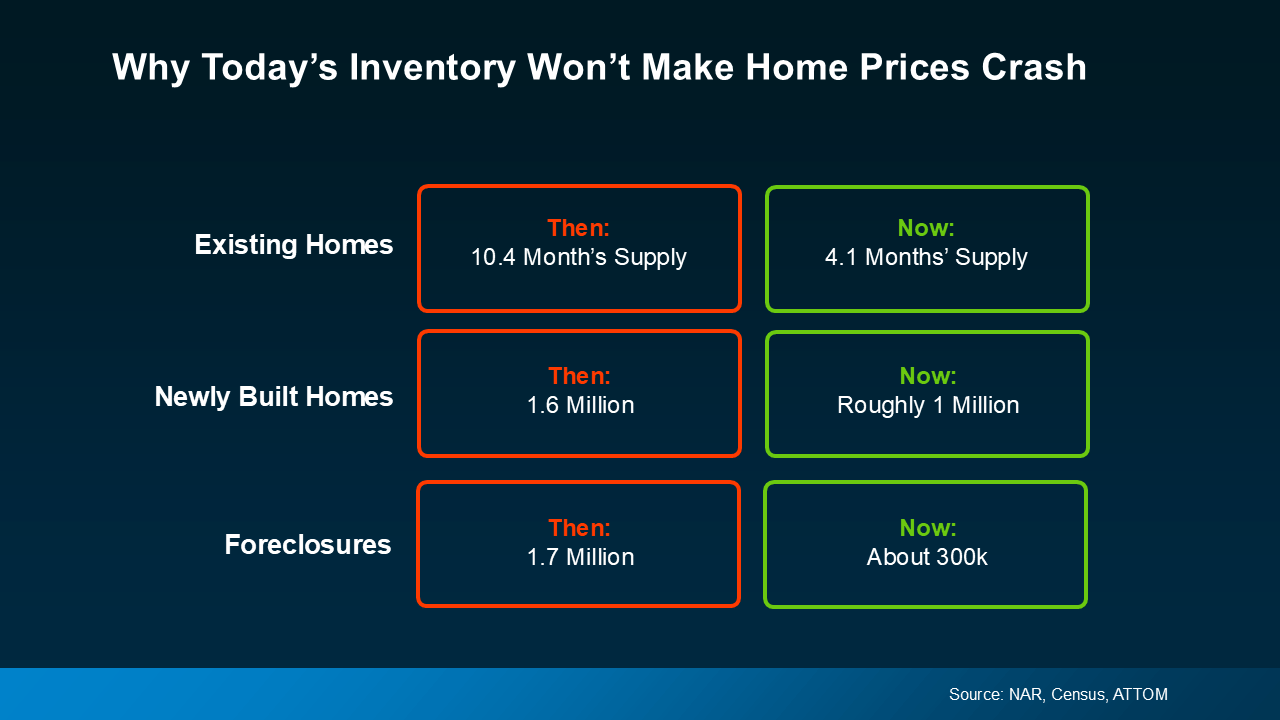

If you’ve heard home prices are going to come crashing down, it’s time to look at what’s actually happening. While prices vary by local market, there’s a lot of data out there from numerous sources that shows a crash is not going to happen. Back in 2008, there was a dramatic oversupply of homes that led to prices crashing. Across the board, there’s an undersupply of homes for sale today. That makes this market a whole different scenario (see chart below):

So, if you think waiting will score you a deal, know that data shows there’s not a crash on the horizon, and waiting isn’t going to pay off the way you’d hoped.

So, if you think waiting will score you a deal, know that data shows there’s not a crash on the horizon, and waiting isn’t going to pay off the way you’d hoped.

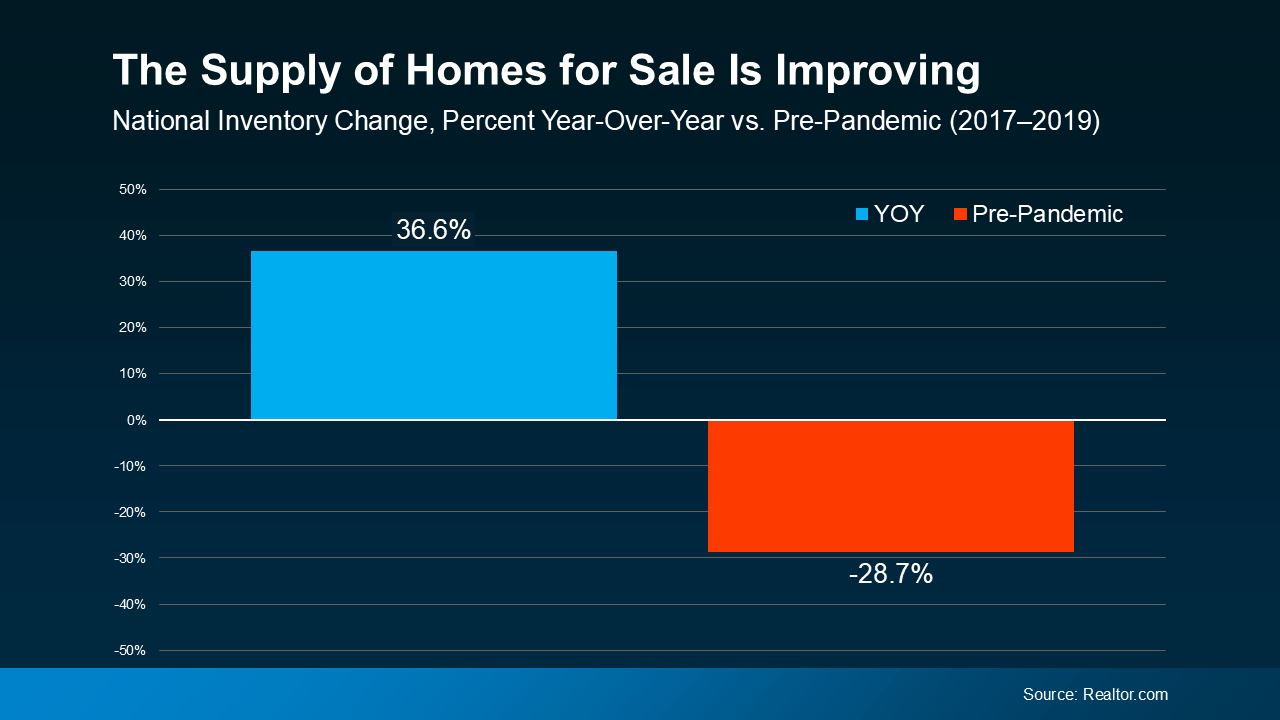

If this nagging fear about finding the right home if you move is still holding you back, you probably haven’t talked with an expert real estate agent lately. Throughout the year, the supply of homes for sale has grown. Data from Realtor.com helps put this into context. While there are still fewer homes on the market than in a more normal year like 2019, inventory is still above where it was at this time last year (see graph below):

So, if you’re remembering all that media coverage about record-low supply during the pandemic, you can rest a bit easier. While the market isn’t back to normal just yet, inventory is moving in a healthier direction. And that means as your options improve, you can let go of this now outdated myth because finding a home to buy won’t feel quite so impossible anymore.

So, if you’re remembering all that media coverage about record-low supply during the pandemic, you can rest a bit easier. While the market isn’t back to normal just yet, inventory is moving in a healthier direction. And that means as your options improve, you can let go of this now outdated myth because finding a home to buy won’t feel quite so impossible anymore.

Many people still believe you need a 20% down payment to buy a home. To show just how widespread this myth is, Fannie Mae says:

“Approximately 90% of consumers overstate or don’t know the minimum required down payment for a typical mortgage.”

And if you look at the data from the National Association of Realtors (NAR), you can see the typical homeowner isn’t putting down as much as you might expect (see graph below):

First-time homebuyers are typically only putting down 6%. That’s far less than the 20% so many people think they need. And if you’re looking at that graph and you’re more focused on how the number for repeat buyers is closer to 20%, here’s what you need to realize. That’s only because they have so much equity built up in their current house that can be used to make a larger down payment for their next move.

This goes to show you don’t have to put 20% down, unless it’s specified by your loan type or lender. Many people put down a lot less. Not to mention, depending on the type of home loan you get, you may only need to put 3.5% or even 0% down. So, if you’re buying your first home, you likely don’t need nearly as much for your down payment as you may think.

If you put your move on pause because you heard one or more of these myths yourself, it’s time to talk to a trusted agent. An expert agent has more data and the facts, just like this, to reassure you and help break through any misconceptions that may be holding you back.

If you have questions about what you’re hearing or reading, let’s connect. You deserve to have someone you can trust to get the facts.

In today's housing market, many sellers are making a critical mistake: overpricing their houses. This common error can lead to a home sitting on the market for a long time without any offers. And when that happens, the homeowner may have to drop their asking price to try to re-ignite buyer interest.

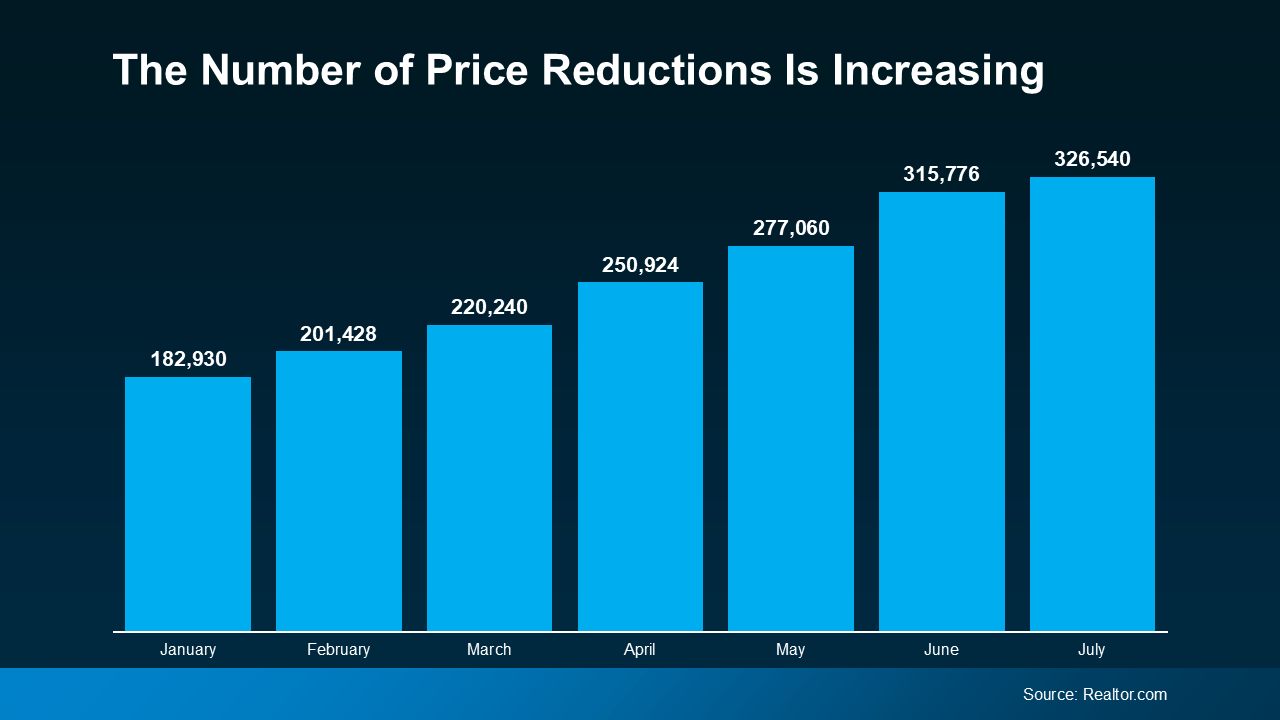

Data from Realtor.com shows the number of homeowners realizing this mistake and doing a price reduction is climbing (see graph below):

If you’re thinking about making a move yourself, here’s what you need to know. The best way to avoid making a costly mistake is to work with a trusted real estate agent to find the right price. Here’s a look at what’s at stake if you don’t.

If you’re thinking about making a move yourself, here’s what you need to know. The best way to avoid making a costly mistake is to work with a trusted real estate agent to find the right price. Here’s a look at what’s at stake if you don’t.

Understanding current market conditions is key to accurate pricing. You don’t want to set your asking price based on what happened during the pandemic. The market has moderated a lot since then, so it’s far better to align your price with today’s reality.

Real estate agents stay updated on market trends and how they impact the pricing strategy for your house.

Another misstep is pricing it based on what you want to make on the sale, and not necessarily current market value. You may see other homes in your neighborhood selling for top dollar and assume yours can do the same. But you may not be considering differences in size, condition, and features. For example, maybe that other house is waterfront or has a finished basement. To sum it up, Bankrate explains:

“How do you find that sweet spot of pricing for profit but not overpricing? The expertise of your agent can be truly valuable here. A knowledgeable agent will understand fair market value in your area, how much your house is worth and how much you might reasonably expect to get for it in the current market.”

An agent will do a comparative market analysis (CMA) to make sure your house is compared with truly similar properties to get an accurate look at how it should be priced.

Another common, yet misguided strategy is to price your house high on purpose, so you have more room to negotiate down during the sale. But this can backfire. A price that seems too high often deters potential buyers from even considering the home. So rather than leaving room for negotiation, what you’ll actually be doing is turning buyers away. U.S. News Real Estate explains:

“You want to sell your house for top dollar, but be realistic about the value of the property and how buyers will see it. If you've overpriced your home, chances are you'll eventually need to lower the number, but the peak period of activity that a new listing experiences is already gone.”

An agent can help you set a fair price that attracts buyers and encourages more competitive offers.

Overpricing your home can have serious consequences. A knowledgeable real estate agent brings an objective perspective, in-depth market knowledge, and a strategic approach to pricing.

Let’s connect so you can avoid making a pricing mistake that’ll cost you.

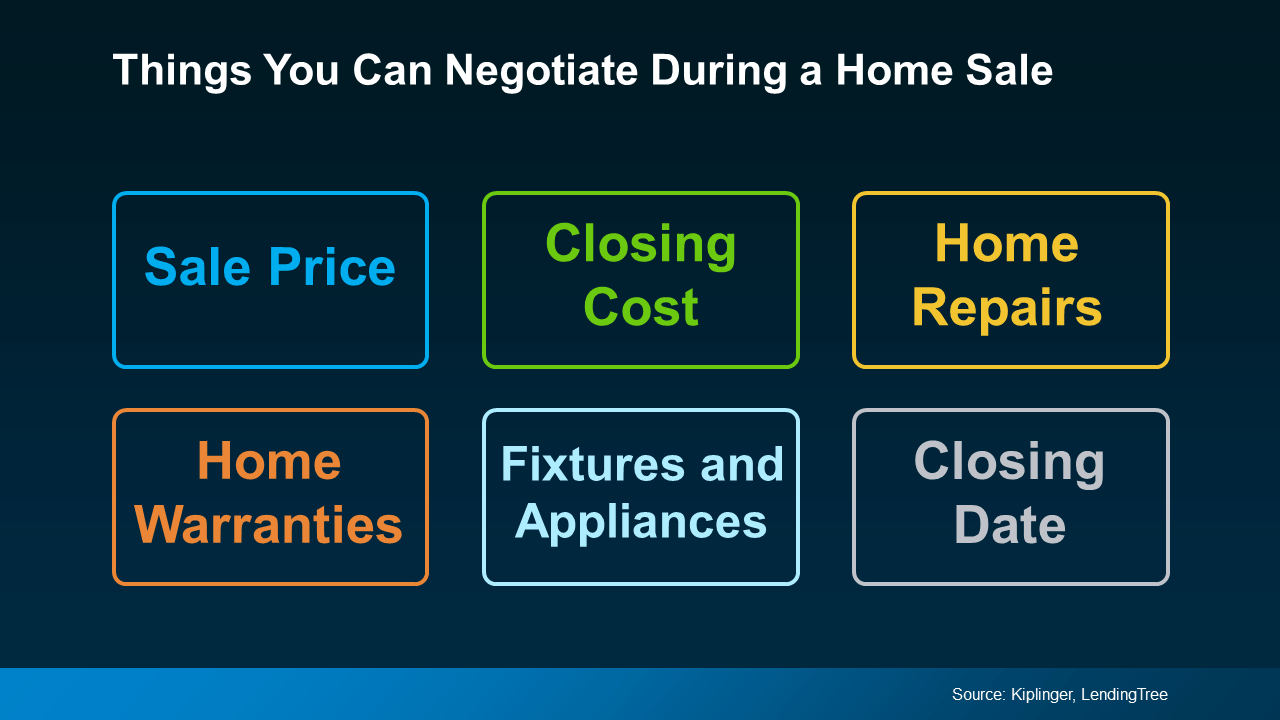

If you haven’t already heard, homebuyers are regaining some negotiating power in today’s market. And while that doesn’t make this a buyer’s market, it does mean buyers may be able to ask for a little more. So, sellers need to be ready for that possibility and know what they’re willing to negotiate.

Whether you’re looking to buy or sell a house, here’s a quick rundown of potential negotiations that may pop up during your transaction. That way, you’re prepared no matter which side of the deal you’re on.

Most things in a home purchase are on the negotiation table. Here’s a list of just a few of those options, according to Kiplinger and LendingTree:

One thing is true whether you’re a buyer or a seller, and that’s how much your agent can help you throughout the process. Your agent is your go-to for any back-and-forth. They’ll handle the conversations and advocate for your best interests along the way. As Bankrate says:

“Agents have expert negotiating skills. Without one, you must negotiate the terms of the contract on your own.”

They may also be able to uncover what the buyer or seller is looking for in their discussions with the other agent. And that insight can be really valuable at the negotiation table.

Buyers are regaining a bit of negotiation power in today’s market. Buyers, knowing what levers you can pull will help you feel confident and empowered going into your purchase. Sellers, having a heads up of what they may ask for gives you the chance to think through what you’ll be willing to offer.

Want to chat more about what to expect and the options you have? Let’s connect.

If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing.

While home prices are still appreciating in most areas, they’re climbing at a slower pace because higher mortgage rates are putting a squeeze on buyer demand. At the same time, the supply of homes for sale is growing. That means buyers have more options and your house may not stand out as much, if it’s not priced right.

Those two factors combined are why the asking price you set for your house is more important today than it has been in recent years.

And some sellers are finding that out the hard way. That’s leading to more price reductions. Mike Simonsen, Founder and President of ALTOS Research, explains:

“Looking at the price reductions data set . . . It all fits in the same pattern of increasing supply and homebuyer demand that is just exhausted by high mortgage rates. . . As home sellers are faced with less demand than they expected, more of them have to reduce their prices.”

That’s because they haven’t adjusted their expectations to today’s market. Maybe they’re not working with an agent, so they don’t know what’s happening around them. Or they’re not using an agent who prioritizes being a local market expert. Either way, they aren’t basing their pricing decision on the latest data available – and that’s a miss.

If you want to avoid making a pricing mistake that could turn away buyers and delay your sale, you need to work with an agent who really knows your local market. If you lean on the right agent, they’ll help you avoid making mistakes like:

In the end, accurate pricing depends on current market conditions – and only an agent has all the data and information necessary to find the right price for your house. The right agent will use that expertise to develop a pricing strategy that’s based on current market conditions and designed to get your house sold. That way you don’t miss the mark.

The right asking price is even more important today than it’s been over the last few years. To avoid making a costly mistake, let’s work together.

You want your house to sell fast. And you may be wondering how long the whole process is going to take. One way to get your answer? Work with a local real estate agent.

They have the expertise to tell you how quickly homes are selling in your area and what’s impacting timelines for other sellers. That way you have realistic expectations and can work together to come up with a plan that’s based on today’s market.

Here’s a high-level overview of just one of the factors a great agent will walk you through – the supply of homes for sale and how that impacts your process.

Over the past few months, the number of homes for sale has increased. This is good news when you move because it means you’ll have more options as you search for your next home. But it also means buyers have more to choose from, so if your house doesn’t stand out – it may take a bit longer to sell.

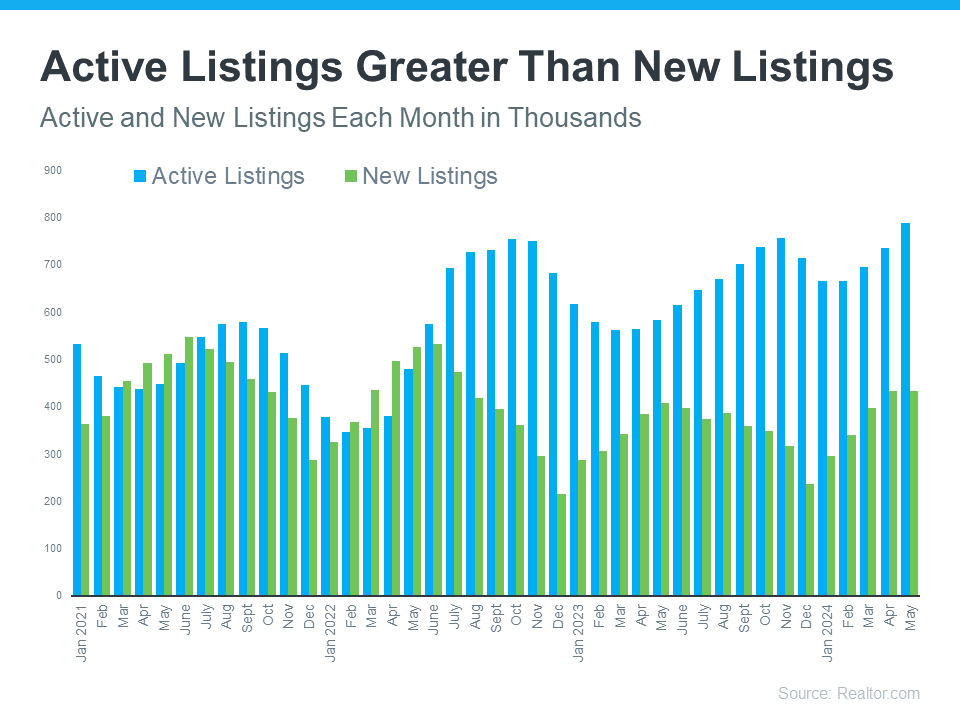

Available inventory is made up of new listings (homes that were just put up for sale) and active listings (homes that were already on the market but haven’t sold yet). And if you look at data from Realtor.com you can see a good portion of the recent growth is from active listings that are sticking around (see the blue bars in the graph below):

Think of the homes on the market like loaves of bread for sale in a bakery. When a fresh batch of bread is put out, everyone wants the newest and hottest one. But if a loaf sits there too long, it starts to get stale, and fewer people want to buy it.

The same goes for homes. New listings are the freshest and most sought-after. But if a home isn’t priced correctly, doesn’t show well, or it doesn’t have an effective sales or marketing strategy behind it, it can sit on the market and become less appealing to buyers over time.

Timing is important to you. You want to get this done, fast. By leaning on a pro, they’ll make sure your listing is fresh and doesn’t stick around long enough to go stale. As the National Association of Realtors (NAR) explains:

“Home sellers without an agent are nearly twice as likely to say they didn’t accept an offer for at least three months; 53% of sellers who used an agent say they accepted an offer within a month of listing their home.”

Your agent will factor the recent inventory growth into their plan and create a customized selling strategy for your house. The supply of homes for sale can vary a lot by area. So they’ll do things like share their valuable insights into what’s happening with supply in your market, help you price your home correctly, and create a marketing plan that gets your home noticed.

Don’t let your listing get stale—reach out to a real estate agent today to make sure your listing is fresh and appeals to buyers from the start. It makes a big difference.

If you want your house to sell fast, you need to work with a pro. Let’s connect so you’ve got someone who understands the current market trends and how to build a strategy around those factors, so your house is set up to sell quickly.

Summer is officially here and that means it’s the perfect time to start planning where you want to vacation and unwind this season. If you’re excited about getting away and having some fun in the sun, it might make sense to consider if owning your own vacation home is right for you.

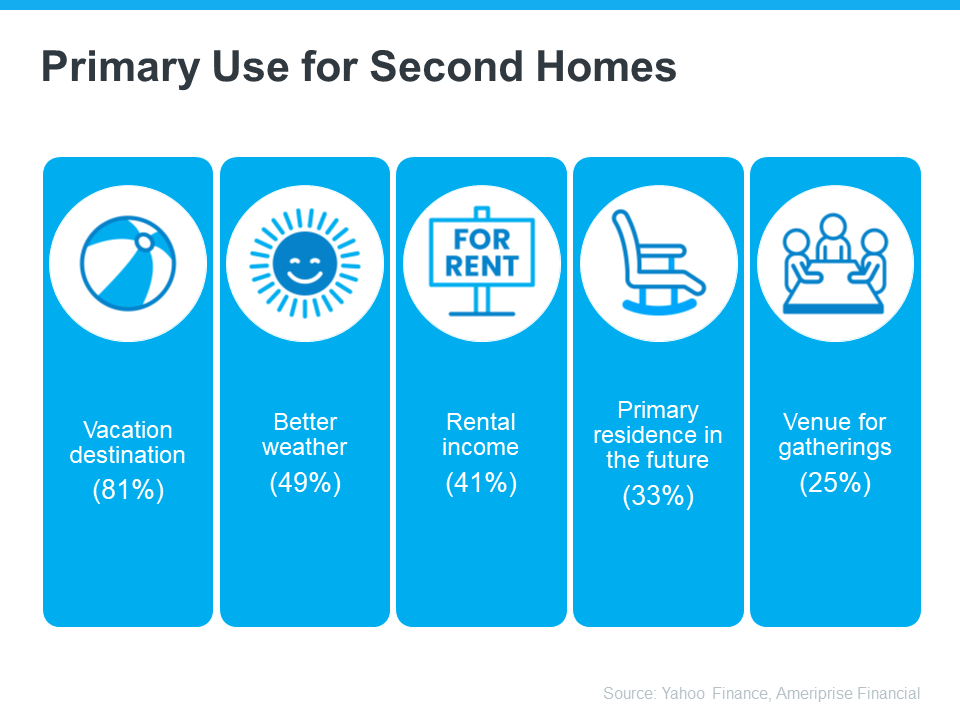

An Ameriprise Financial survey sheds light on why people buy a second, or vacation, home (see below):

And you don’t have to be wealthy to buy a vacation home. Bankrate shares two tips for how to make this dream more achievable for anyone who’s interested:

If the idea of basking in the sun at your very own vacation home sounds appealing, you might want to start looking now. Summer's when everyone's trying to buy their slice of paradise, so it’s best to start early.

Your first move is to team up with a real estate agent. They know all the ins and outs of the area you want to be in, and which homes you should look at. Plus, they can give you the lowdown on everything you need to know about having a second home and how it can benefit you. The same article from Bankrate says:

“Buying real estate in a new area — or even one you’ve vacationed in for many years — requires expert guidance. That makes it a good idea to work with an experienced local lender who specializes in loans for vacation homes and a local real estate professional. Local lenders and Realtors will understand the required rules and specifics for the area you are buying, and a local Realtor will know what properties are available.”

If the idea of owning your own vacation home appeals to you, let’s chat.

Displaying blog entries 41-50 of 793