Attention Mt Hood Landlords Concerning New Legislation on Eviction Moratorium

Displaying blog entries 431-440 of 847

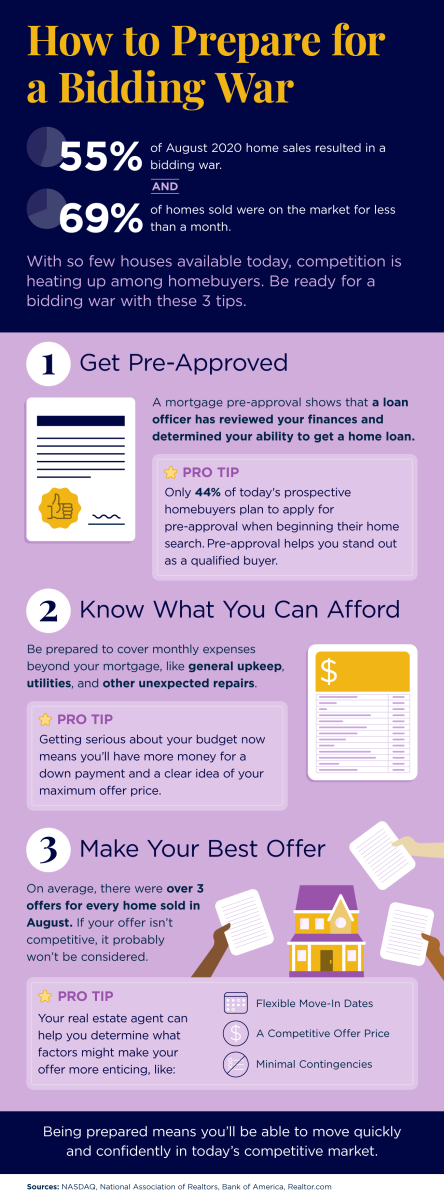

If you are buying in todays market on Mt. Hood with multiple offers on nearly every property that comes for sale between Government Camp to Brightwood, you'll need to have this information to make that purchase.

![Winning as a Buyer in a Sellers’ Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/12/08151044/20201211-MEM-1046x2448.png)

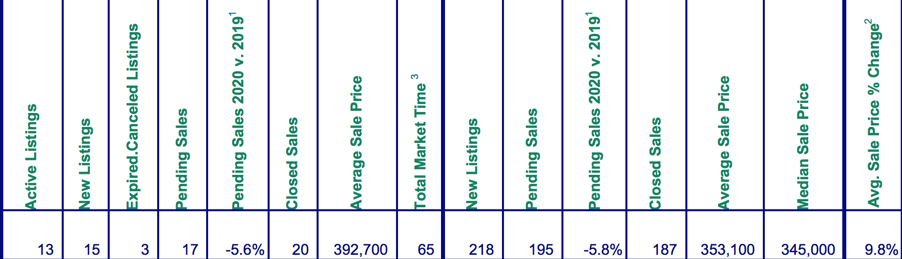

Latest Mt.Hood sales statistics are out directly from the multiple listing service for November 2020. Twenty properties closed in November and this number should slow down over winter due to only eleven homes and condos currently for sale. The average sales price continues to creep up to $392,700 for the month. Average sales price change is nearly 10% over last year! Pending sales are down nearly 6% from last year. That's a surprise since we don't have any inventory I would think that number would be substantially higher.

As we head into our winter market. Demand is still skyrocketing with the greatest sellers market the mountain has ever seen.

Vacation homes are selling quickly right now, with more people looking to work from home and get away at the same time. If you’re ready to sell your mountain rental, Call me to explore your options while the market’s hot on Mt. Hood! We ONLY have 10 properties for sale from Government Camp to Brightwood so now is the time to make TOP DOLLAR on your property.

Today’s real estate market has high buyer interest and low housing inventory. With so many buyers competing for a limited number of homes, it’s more important than ever to know the ins and outs of making a confident and competitive offer. Here are five keys to success for this important stage in the homebuying process.

A recent article from Freddie Mac offers guidance on making an offer on a home in today’s market. Right off the bat, it points out how emotional this can be for buyers and why trusted professionals can help you stay focused on the most important things:

“Remember to let your homebuying team guide you on your journey, not your emotions. Their support and expertise will keep you from compromising on your must-haves and future financial stability.”

Your real estate professional should be your primary source for answers to the questions you have when you’re ready to make an offer.

Having a complete understanding of your budget and how much house you can afford is essential. The best way to know this is to reach out to your lender to get pre-approved for a loan early in the homebuying process. Only 44% of today’s prospective homebuyers are planning to apply for pre-approval, so be sure to take this step so you stand out from the crowd. It shows sellers you’re a serious, qualified buyer and can give you a competitive edge if you enter a bidding war.

According to the Realtors Confidence Index, published monthly by the National Association of Realtors (NAR), the average property being sold today is receiving more than three offers and is only on the market for a few weeks. These are both results of today’s competitive market, showing how important it is to stay agile and vigilant in your search. As soon as you find the right home for your needs, be prepared to work with your agent to submit an offer as quickly as possible.

It’s only natural to want the best deal you can get on a home. However, Freddie Mac also warns that submitting an offer that’s too low can lead sellers to doubt how serious you are as a buyer. Don’t submit an offer that will be tossed out as soon as it’s received. The expertise your agent brings to this part of the process will help you stay competitive:

“Your agent will work with you to make an informed offer based on the market value of the home, the condition of the home and recent home sale prices in the area.”

After submitting an offer, the seller may accept it, reject it, or counter it with their own changes. In a competitive market, it’s important to stay nimble throughout the negotiation process. Your position can be strengthened with an offer that includes flexible move-in dates, a higher price, or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). There are, however, certain contingencies you don’t want to forego. Freddie Mac explains:

“Resist the temptation to waive the inspection contingency, especially in a hot market or if the home is being sold ‘as-is’, which means the seller won’t pay for repairs. Without an inspection contingency, you could be stuck with a contract on a house you can’t afford to fix.”

Today’s competitive market makes it more important than ever to make a strong offer on a home, and a trusted expert can help you rise to the top along the way.

This year’s record-low mortgage rates sparked high demand among homebuyers. Current homeowners, however, haven’t put their houses on the market so quickly. This makes finding a home to buy today challenging for many potential buyers. With an obstacle like this, those searching for their dream homes may be pressing pause on their searches as we approach the end of the year, but that could be a big mistake for many hopeful house hunters. Here’s why.

According to the most recent Housing Trends Report from the National Association of Home Builders (NAHB):

“The length of time spent searching for a home continues to grow.”

The report indicates that 62% of buyers now spend 3 months or more looking for a home, an increase from 58% one year ago. A primary cause for the delay is the heavy competition today’s buyers face when making an offer on a home. Based on recent data from the National Association of Realtors (NAR), the average house in today’s market receives 3.4 offers before it’s sold. This means for every buyer who purchases a home, there are on average two or three buyers who have to begin their search all over again.

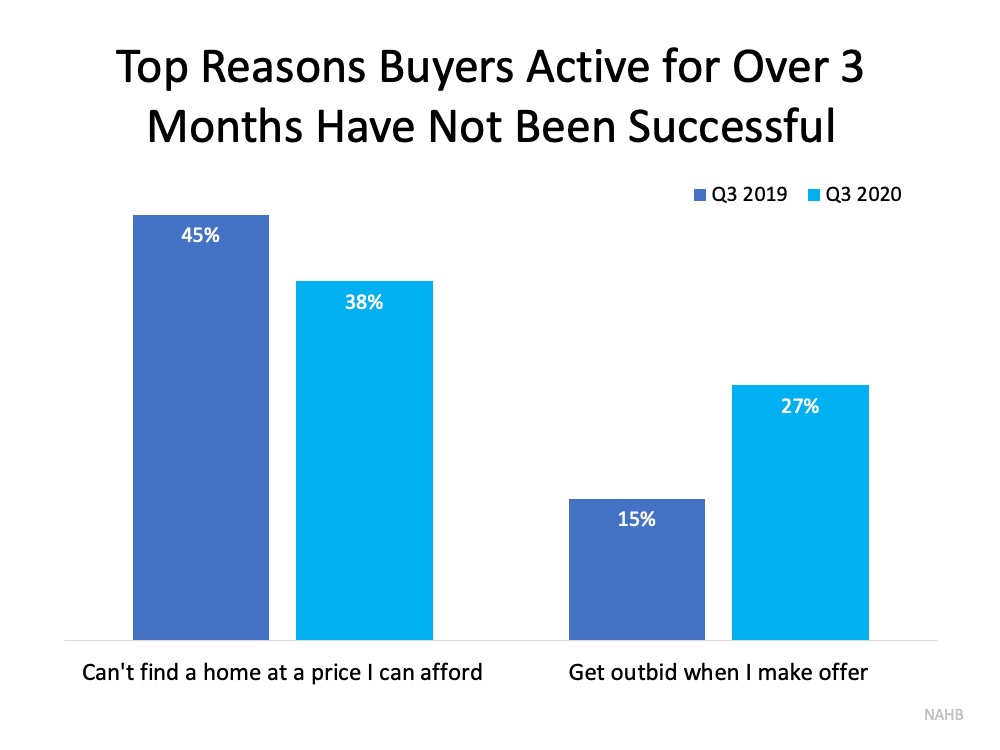

Compared to this time last year, the NAHB report shows that buyers are having more success finding homes in their price range. However, it also notes the percentage of buyers saying they’re getting outbid when they make an offer has jumped from 15% to 27%. Buyers are indicating that bidding wars are a major obstacle to finding their dream home (See graph below): If this is a challenge you’re up against in your home search, you’re not alone. Feeling stuck in the process can be frustrating, but if there’s ever been a year to power through, this is the one. NAHB noted:

If this is a challenge you’re up against in your home search, you’re not alone. Feeling stuck in the process can be frustrating, but if there’s ever been a year to power through, this is the one. NAHB noted:

“Difficulties finding a home to buy will likely lead 20% of active buyers to give up until next year or later. That share is up from 15% a year earlier.”

Experts anticipate home prices will continue to rise into 2021, and the incredibly low interest rates we’ve seen this year are also forecasted to increase as the economy strengthens. Hopeful homebuyers who decide to hold off on their search until there’s less competition run the risk of finding a more expensive housing market when they start looking again. If affordability is a key motivator behind your decision to buy a home, this winter is still the best time to make it happen.

Bidding wars may be one of the greatest challenges buyers face in today’s housing market, but they shouldn’t be a deal-breaker. Having the right expert on your side throughout the buying process will give you the advantage you need when it comes to finding the right home and making a competitive offer. If you’re ready to buy this winter, let’s connect to discuss how to position yourself for success.

Here's a great opportunity to get an affordable Christmas tree in the Mt. Hood National Forest. The forests are open and all you need is a permit. You may purchase a permit for up to five trees per household! Permits are only $5.00 per tree!!!!!!

Here are the locations where your permit can be purchased direct from the Mt. Hood National Forest website:

Here are the locations where your permit can be purchased direct from the Mt. Hood National Forest website:

Tygh Valley General Store, 57715 Tygh Valley Road, Tygh Valley, OR. 541-483-2324

Open Monday-Friday 7:00 a.m. to 6:00 p.m., Saturday & Sunday 8:00 a.m. to 6:00 p.m.

Kramers Market, 121 Main Street, Dufur, OR. 541-467-2455

Open Monday-Saturday 7:00 a.m. to 7:00 p.m., Sunday 8:00 a.m. to 7:00 p.m.

Wamic Market and Supply, 57016 Wamic Market Rd. Wamic, Or, 97063. 541-544-2333

Open 7 days a week – 8:00 a.m. - 6:00 p.m.

Tum-A-Lum Lumber, 408 Hwy 35, Hood River, OR. 541-386-1001

Open Monday-Friday, 7:00 a.m. to 6:30 p.m., Saturday 8:00 a.m. to 5:00 p.m., Sunday 8:00 a.m. to 4:00 p.m.

Estacada Tackle Shop, 210 SE Hwy 224, Estacada, OR. 503-630-7424

Open 7 days a week 6:00 a.m. to 10:00 p.m.

Estacada True Value Hardware, 310 SE Main St, Estacada, OR. 503-630-3769

Open Monday-Saturday 8 a.m. to 7 p.m., Sun 9a.m. to 5p.m.

ACE Heritage Hardware, 39181 Pioneer Boulevard, Sandy, OR. 503-668-8731

Open Monday-Saturday 8:00 a.m. to 6:00 p.m., Sunday 9:00 a.m. to 5:00 p.m.

Hoodland Thriftway, 68280 Highway 26, Welches, OR. 503-622-3244

Open Daily: 7:00 a.m. to 11:00 p.m.

Mt. Hood Village Market, 73265 Highway 26, Rhododendron, OR 97049. 503-622-4652. Open Daily: 6:00 a.m. to 10:00 p.m.

Welches Mountain Building Supply, 67250 Highway 26, Welches, OR 97067. 503-622-3000. Open Daily: 8:00 a.m. - 6:00 p.m.

Sportsman’s Warehouse, 9401 SE 82nd Ave, Portland, OR. 503-777-8700

Open Monday-Saturday 9:00 a.m.-9:00 p.m., Sunday 10:00 a.m. - 6:00 p.m.

What's becoming common place in the Mt. Hood real estate market? It's a bidding war and it's happening on nearly every property that hits the market. Demand has far outstripped supply from Brightwood to Government Camp. There's only 18 properties for sale in the Mt. Hood area. If you are a buyer in today's market, you need to be prepared. Here are a few tips!

Displaying blog entries 431-440 of 847