Housing Market Graphs Showing Why This Will Not Be Like 2008

Displaying blog entries 421-430 of 785

The Coronavirus (COVID-19) has caused massive global uncertainty, including a U.S. stock market correction no one could have seen coming. While much of the news has been about the effect on various markets, let’s also acknowledge the true impact it continues to have on lives and families around the world.

With all this uncertainty, how do you make powerful and confident decisions in regard to your real estate plans?

The National Association of Realtors (NAR) anticipates:

“At the very least, the coronavirus could cause some people to put home sales on hold."

While this is an understandable approach, it is important to balance that with how it may end up costing you in the long run. If you’re considering buying or selling a home, it is key to educate yourself so that you can take thoughtful and intentional next steps for your future.

For example, when there’s fear in the world, we see lower mortgage interest rates as investors flee stocks for the safety of U.S. bonds. This connection should be considered when making real estate decisions.

According to the National Association of Home Builders (NAHB):

“The Fed’s action was expected but perhaps not to this degree and timing. And the policy change was consistent with recent declines for interest rates in the bond market. These declines should push mortgage interest rates closer to a low 3% average for the 30-year fixed rate mortgage.”

This is exactly what we’re experiencing right now as mortgage interest rates hover at the lowest levels in the history of the housing market.

At this point in time, we have not seen any impact in the Mt. Hood real estate market. In fact, with lower interest rates many of our buyers are refinancing their primary homes, pulling out cash and purchasing their second homes to take advantage of this opportunity.

The full impact of the Coronavirus is still not yet known. It is in times like these that working with an informed and educated real estate professional can make all the difference in the world.

Rents in the United States have been skyrocketing since 2012. This has caused many renters to face a tremendous burden when juggling their housing expenses and the desire to save for a down payment at the same time. The recent stabilization of rental prices provides a great opportunity for renters to save more of their current income to put toward the purchase of a home.

Just last week the Joint Center of Housing Studies of Harvard University released the America’s Rental Housing 2020 Report. The results explain the financial challenges renters are experiencing today,

“Despite slowing demand and the continued strength of new construction, rental markets in the U.S. remain extremely tight. Vacancy rates are at decades-long lows, pushing up rents far faster than incomes. Both the number and share of cost-burdened renters are again on the rise, especially among middle-income households.”

According to the most recent Zillow Rent Index, which measures the estimated market-rate rent for all homes and apartments, the typical U.S. rent now stands at $1,600 per month. Here is a graph of how the index’s median rent values have climbed over the last eight years:

There seems, however, to be some good news on the horizon. Four of the major rent indices are all reporting that rents are finally beginning to stabilize in all rental categories:

1. The Zillow Rent Index, linked above, only rose 2.6% over the last year.

2. RENTCafé’s research team also analyzes rent data across the 260 largest cities in the United States. The data on average rents comes directly from competitively rented, large-scale, multi-family properties (50+ units in size). Their 2019 Year-End Rent Report shows only a 3% increase in rents from last year, the slowest annual rise over the past 17 months.

3. The CoreLogic Single Family Rent Index reports on single-family only rental listing data in the Multiple Listing Service. Their latest index shows how overall year-over-year rent price increases have slowed since February 2016, when they peaked at 4.2%. They have stabilized around 3% since early 2019.

4. The Apartment List National Rent Report uses median rent statistics for recent movers taken from the Census Bureau American Community Survey. The 2020 report reveals that the year-over-year growth rate of 1.6% matches the rate at this time last year; it is just ahead of the 1.5% rate from January 2016. They also explain how “the past five years also saw stretches of notably faster rent growth. Year-over-year rent growth stood at 2.6% in January 2018, and in January 2016 it was 3.3%, more than double the current rate.”

It seems tenants are getting a breather from the rapid rent increases that have plagued them for almost a decade.

If you're looking for local monthly rentals on Mt. Hood, you might want to try these two resources:

Mountain Retreats at 503-622-3212 in Brightwood or Welches Mountain Properties at 503-622-4275 right in Welches.

Rental expenses are beginning to moderate, and at the same time, average wages are increasing. That power combination may allow renters who dream of buying a home of their own an opportunity to save more money to put toward a down payment. That’s sensational news!

Give me a call or drop me an email if you would like more into on how to get a pre-approval for buying!

The Clackamas County Board of Commissioners will hold a public hearing on draft regulations for short-term/vacation rental properties in unincorporated Clackamas County at the Board business meeting scheduled for 6 p.m., Thursday, Jan. 30, on the 4th floor of the Public Services Building, 2051 Kaen Road, Oregon City.

The draft regulations are available for public review at www.clackamas.us/planning/str. People who have comments but are not able to attend the Jan. 30 hearing are welcome to submit their comments by email or US Mail to Senior Planner Martha Fritzie at [email protected] or Planning & Zoning, Development Services Building, 150 Beavercreek Road, Oregon City, OR 97045.

A second public hearing on the draft regulations and Board action is planned for the Board Business Meeting at 10 a.m., Thursday, Feb. 13.

Clackamas County defines a short-term rental, or vacation rental, as a dwelling unit, or portion of a dwelling unit, that is rented to any person or entity for lodging or residential purposes, for a period of up to 30 consecutive nights.

The draft regulations include provisions for short-term rental owners to register with the county and pay a fee, and for enforcement of the regulations to be carried out by either the Sheriff’s Office or Code Enforcement, depending on the issue. Key components of the proposed regulations include rules regarding maximum occupancy, off-street parking, garbage pick-up, quiet hours, and fire and safety requirements. The regulations would only apply outside of city limits in unincorporated Clackamas County.

More information is available on the project website at https://www.clackamas.us/planning/str.

In a market where current inventory is low, it’s normal to think buyers might be willing to give up a few desirable features in their home search in order to make finding a house a little easier. Don’t be fooled, though – there’s still an interest in the market for some key upgrades. Here’s a look at the two surprising things buyers seem to be searching for in today’s market, and how they’re impacting new home builds.

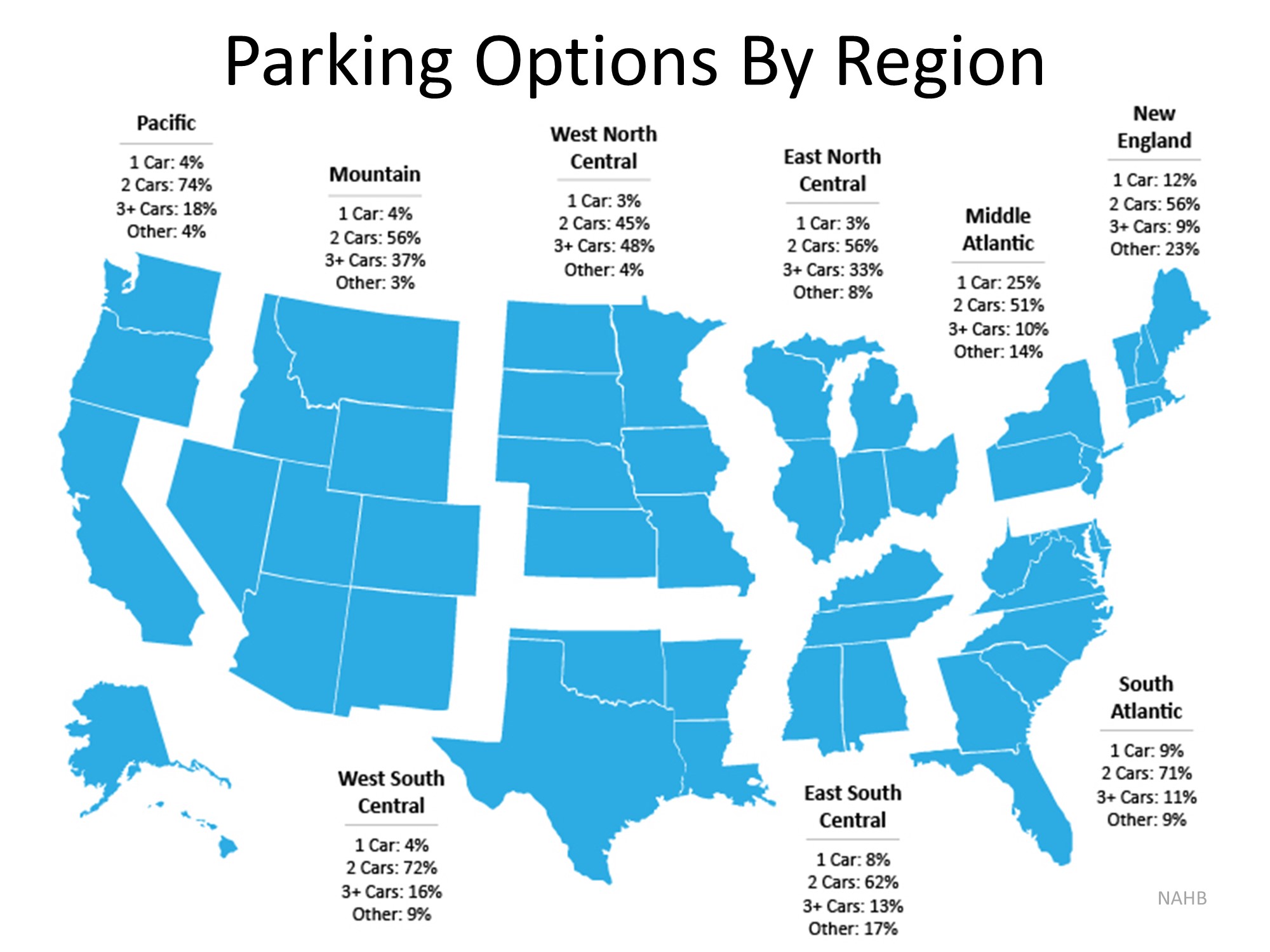

The National Association of Home Builders (NAHB) recently released an article showing the percentage of new single-family homes completed in 2018. The data reveals,

The following map represents this breakdown by region: Evidently, a garage is something homebuyers are looking for in their searches, but that’s not all.

Evidently, a garage is something homebuyers are looking for in their searches, but that’s not all.

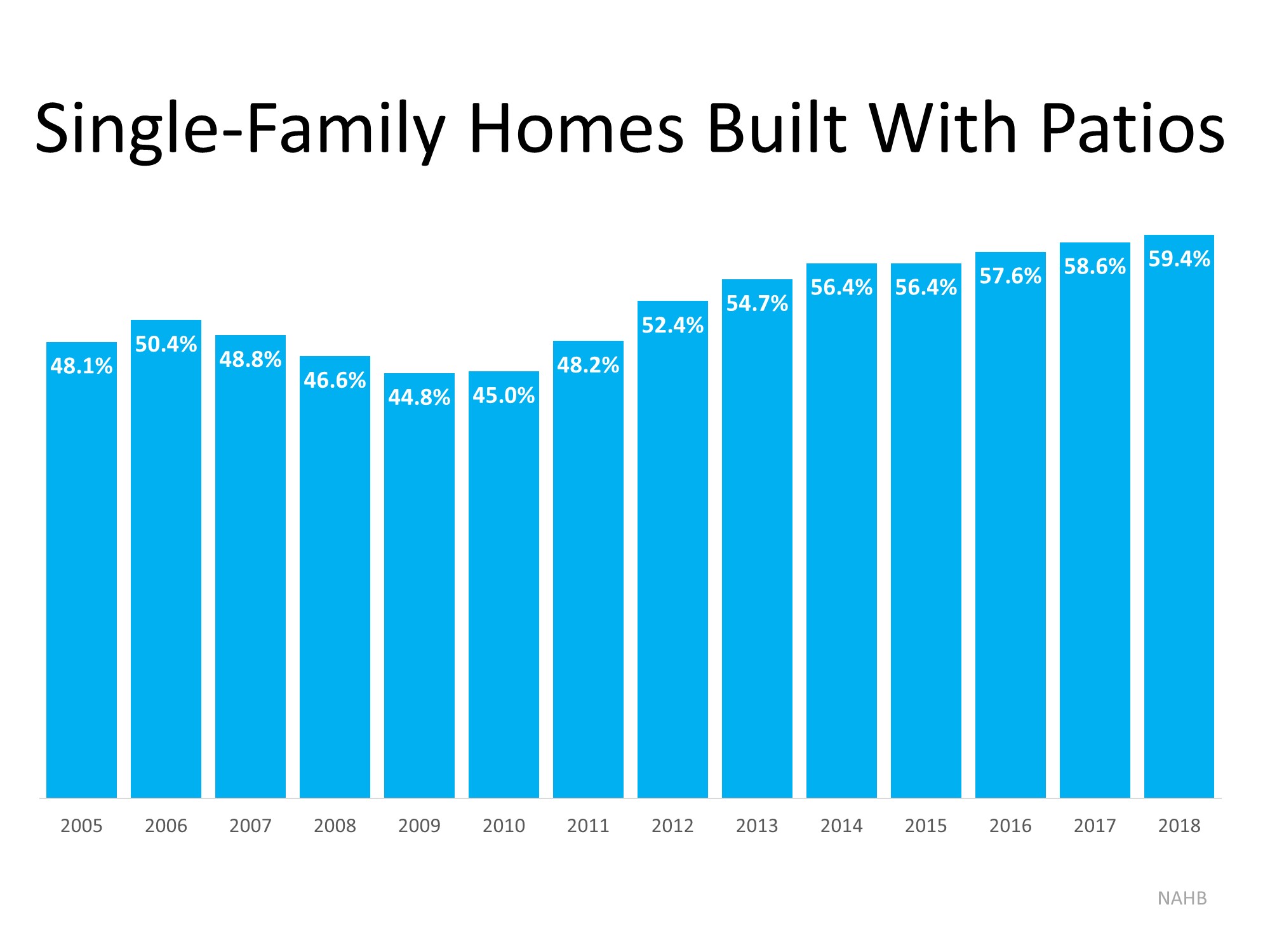

Patios are on the radar for buyers as well. Community areas are often common amenities in new neighborhoods, but as it turns out, private outdoor spaces are quite desirable too. NAHB also found that,

“Of the roughly 876,000 single-family homes started in 2018, 59.4% came with patios…This is the highest the number has been since NAHB began tracking the series in 2005.”

As shown in the graph below, the number of new homes built with patios has been increasing for the past 9 years. Clearly, they’re a desirable feature for new homeowners too.

Homebuyers are looking for garage space and outdoor patio living. If you’re a homeowner thinking of selling a house with these amenities, it appears buyers are willing to spring for those key features. Let’s get together today to determine the current value and demand for your home.

Displaying blog entries 421-430 of 785