Top Four Reasons to Own a Home on Mt. Hood

Displaying blog entries 411-420 of 851

![Buyer Competition Is Good News for Sellers [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/04/01112239/20210402-MEM-1046x2046.png)

Today, some are afraid the real estate market is starting to look a lot like it did in 2006, just prior to the housing crash. One of the factors they’re pointing to is the availability of mortgage money. Recent articles about the availability of low down payment loans and down payment assistance programs are causing fear that we’re returning to the bad habits seen 15 years ago. Let’s alleviate these concerns.

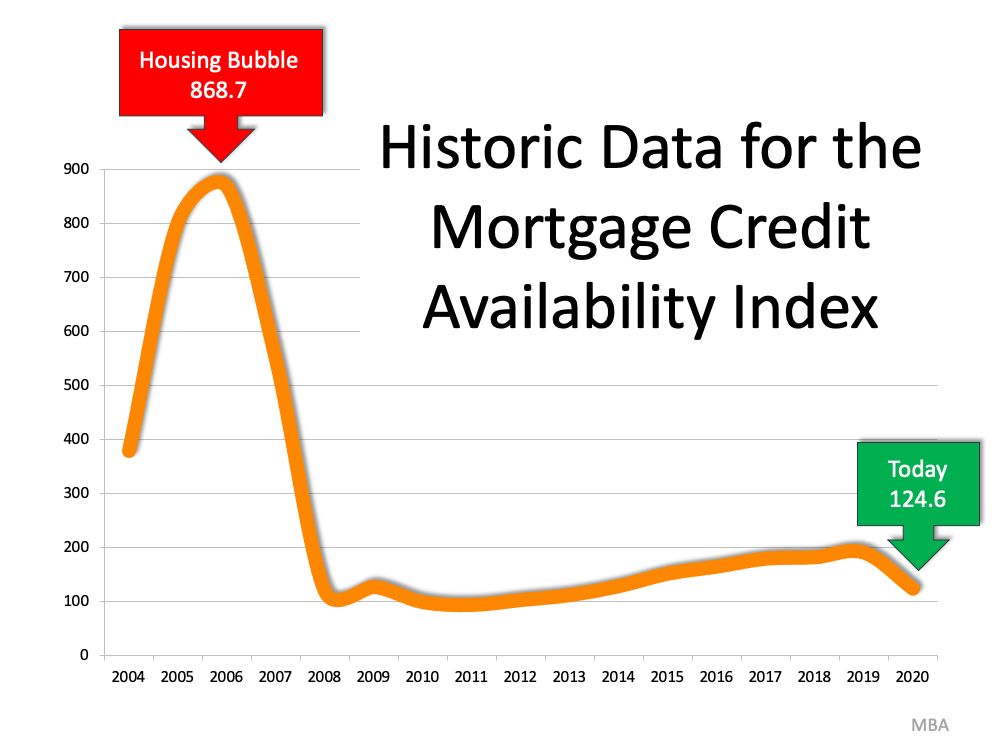

Several times a year, the Mortgage Bankers Association releases an index titled The Mortgage Credit Availability Index (MCAI). According to their website:

“The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit. The MCAI is…a summary measure which indicates the availability of mortgage credit at a point in time.”

Basically, the index determines how easy it is to get a mortgage. The higher the index, the more available mortgage credit becomes. Here’s a graph of the MCAI dating back to 2004, when the data first became available: As we can see, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI (to below 100) as mortgage money became almost impossible to secure. Thankfully, lending standards have eased somewhat since. The index, however, is still below 150, which is about one-sixth of what it was in 2006.

As we can see, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI (to below 100) as mortgage money became almost impossible to secure. Thankfully, lending standards have eased somewhat since. The index, however, is still below 150, which is about one-sixth of what it was in 2006.

The main reason was the availability of loans with extremely weak lending standards. To keep up with demand in 2006, many mortgage lenders offered loans that put little emphasis on the eligibility of the borrower. Lenders were approving loans without always going through a verification process to confirm if the borrower would likely be able to repay the loan.

Some of these loans offered attractive, low interest rates that increased over time. The loans were popular because they could be obtained quickly and without the borrower having to provide documentation up front. However, as the rates increased, borrowers struggled to pay their mortgages.

Today, lending standards are much tighter. As Investopedia explains, the risky loans given at that time are extremely rare today, primarily because lending standards have drastically improved:

“In the aftermath of the crisis, the U.S. government issued new regulations to improve standard lending practices across the credit market, which included tightening the requirements for granting loans.”

An example of the relaxed lending standards leading up to the housing crash is the FICO® credit score associated with a loan. What’s a FICO® score? The website myFICO explains:

“A credit score tells lenders about your creditworthiness (how likely you are to pay back a loan based on your credit history). It is calculated using the information in your credit reports. FICO® Scores are the standard for credit scores—used by 90% of top lenders.”

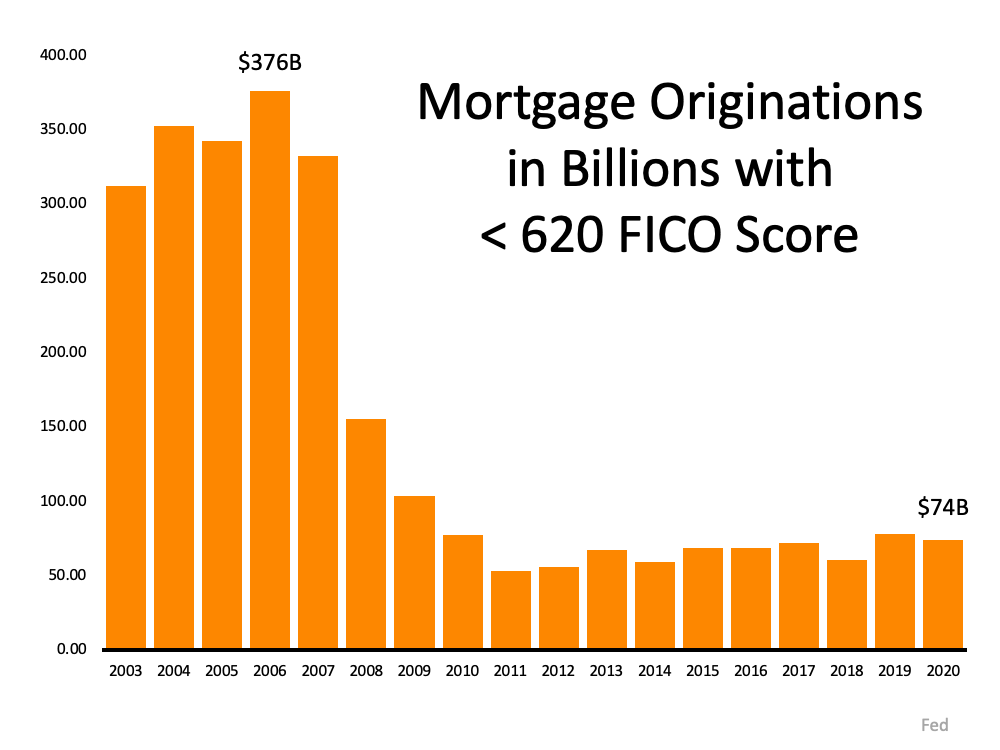

During the housing boom, many mortgages were written for borrowers with a FICO score under 620. Experian reveals that, in today’s market, lenders are more cautious about lower credit scores:

“Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future…Some lenders dislike those odds and choose not to work with individuals whose FICO® Scores fall within this range.”

There are definitely still loan programs that allow a 620 score. However, lending institutions overall are much more attentive about measuring risk when approving loans. According to Ellie Mae’s latest Origination Insight Report, the average FICO® score on all loans originated in February was 753.

The graph below shows the billions of dollars in mortgage money given annually to borrowers with a credit score under 620. In 2006, mortgage entities originated $376 billion dollars in loans for purchasers with a score under 620. Last year, that number was only $74 billion.

In 2006, mortgage entities originated $376 billion dollars in loans for purchasers with a score under 620. Last year, that number was only $74 billion.

In 2006, lending standards were much more relaxed with little evaluation done to measure a borrower’s potential to repay their loan. Today, standards are tighter, and the risk is reduced for both lenders and borrowers. These are two very different housing markets, so there’s no need to panic over today’s lending standards.

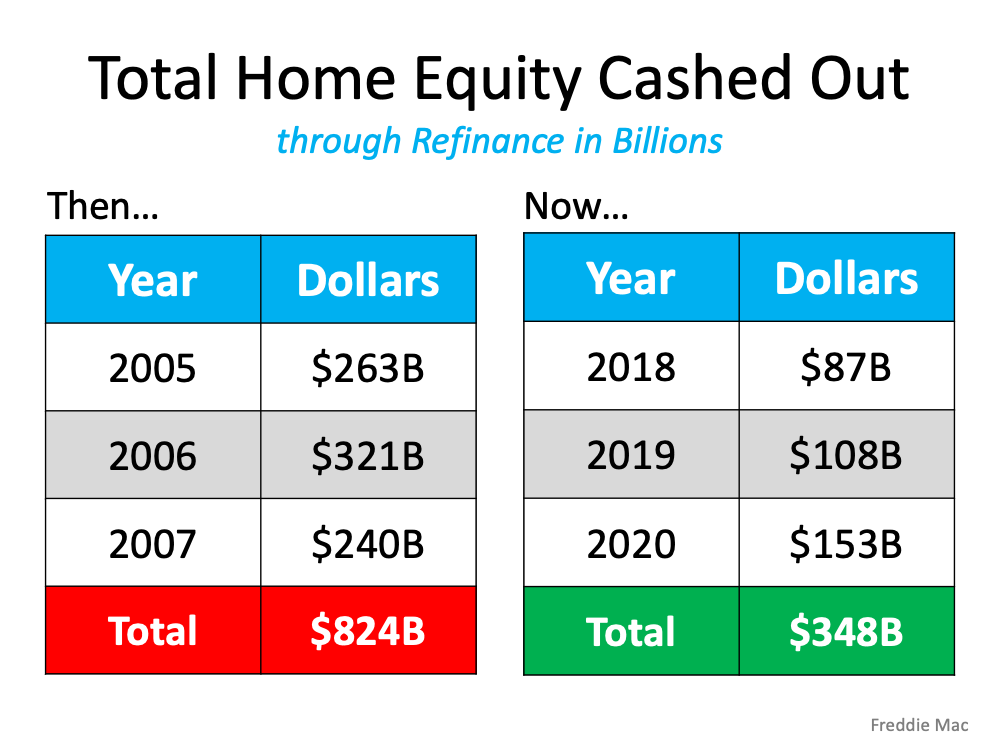

Freddie Mac recently released their Quarterly Refinance Statistics report which covers refinances through 2020. The report explains that the dollar amount of cash-out refinances was greater in 2020 than in recent years. A cash-out refinance, as defined by Investopia, is:

“a mortgage refinancing option in which an old mortgage is replaced for a new one with a larger amount than owed on the previously existing loan, helping borrowers use their home mortgage to get some cash.”

The Freddie Mac report led to articles like the one published by The Real Deal titled, House or ATM? Cash-Out Refinances Spiked in 2020, which reports:

“Americans treated their homes like ATMs last year, withdrawing $152.7 billion amid a cash-out refinancing spree not seen since before the 2008 financial crisis.”

Whenever you combine the terms “spiked,” “homes like ATMs,” and “financial crisis,” it conjures up memories of the housing crash we experienced in 2008.

However, that comparison is invalid for three reasons:

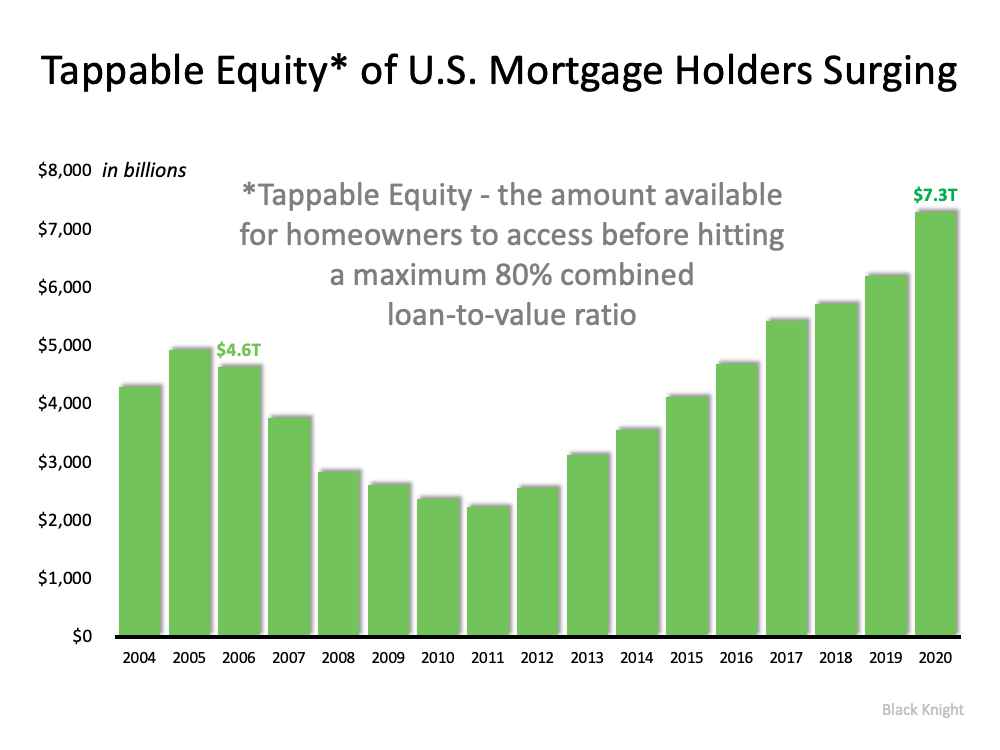

Mortgage data giant Black Knight just issued information on the amount of tappable equity U.S. homeowners with a mortgage have. Tappable equity is the amount of equity available for homeowners to use and still have 20% equity in their home. Here’s a graph showing the findings from their report: In 2006, directly before the crash, tappable home equity in the U.S. topped out at $4.6 trillion. Today, that number is $7.3 trillion.

In 2006, directly before the crash, tappable home equity in the U.S. topped out at $4.6 trillion. Today, that number is $7.3 trillion.

As Black Knight explains:

“At year’s end, some 46 million homeowners held a total $7.3 trillion in tappable equity, the largest amount ever recorded...That’s an increase of more than $1.1 trillion (+18%) since the end of 2019, the largest percentage gain since 2013 and – you guessed it – the largest dollar value gain in history, to boot. All in all, it works out to roughly $158,000 on average per homeowner with tappable equity, up nearly $19,000 from the end of 2019.”

In 2006, Americans cashed-out a total of $321 billion. In 2020, that number was less than half, totaling $153 billion. The $321 billion made up 7% of the total tappable equity in the country in 2006. On the other hand, the $153 billion made up only 2% of the total tappable equity last year.

Freddie Mac reports that 89% of refinances in 2006 were cash-out refinances. Last year, that number was less than half at 33%. As a percentage of those who refinanced, many more Americans lowered their equity position fifteen years ago as compared to last year.

It’s true that many Americans liquidated a portion of the equity in their homes last year for various reasons. However, less than half of them tapped their equity compared to 2006, and they cashed-out less than one-third of that available equity. Today’s cash-out refinance situation bears no resemblance to the situation that preceded the housing crash.

Here is the latest information on multiple listing for February 2021 real estate market on Mt. Hood. In February eight properties were available. Today we have four condos and homes on the market along with one ski lodge near Government Camp for over three million. Last month we saw an average of $445,500 sales price.

.jpg)

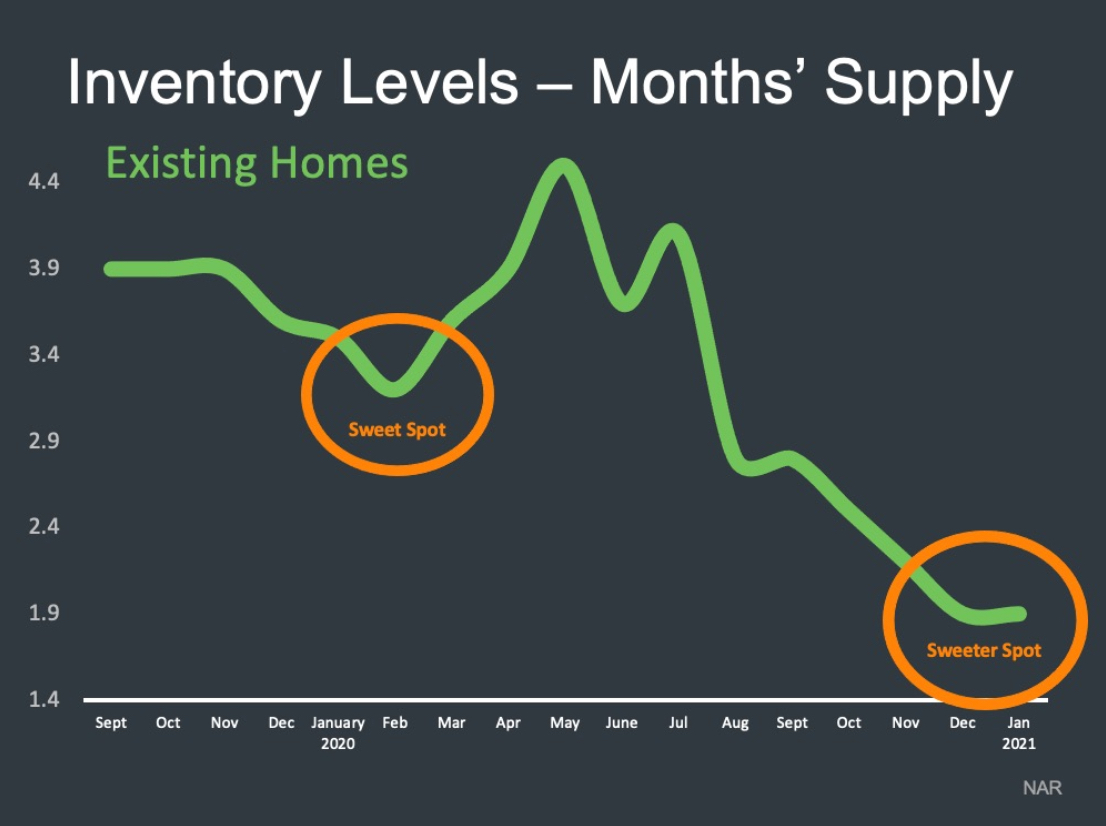

Check out this graphic showing last years inventory compared to this year from NAR, National Association of Realtors. This is what buyers are up against this year!

Last March, many involved in the residential housing industry feared the market would be crushed under the pressure of a once-in-a-lifetime pandemic. Instead, real estate had one of its best years ever. Home sales and prices were both up substantially over the year before. 2020 was so strong that many now fear the market’s exuberance mirrors that of the last housing boom and, as a result, we’re now headed for another crash.

However, there are many reasons this real estate market is nothing like 2008. Here are six visuals to show the dramatic differences.

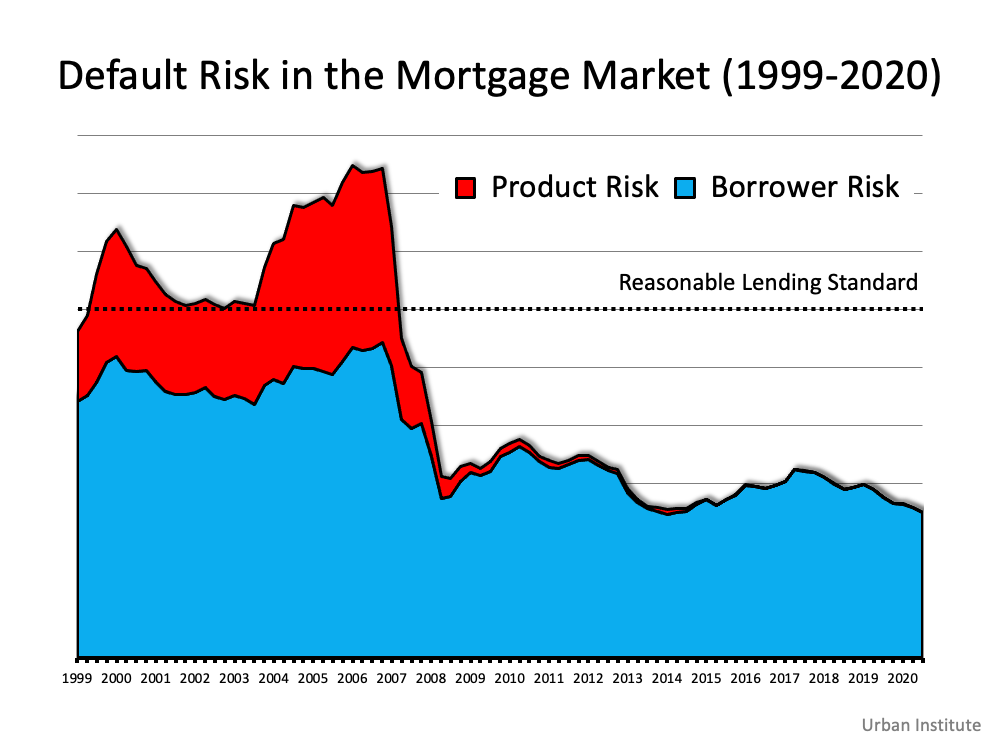

During the housing bubble, it was difficult not to get a mortgage. Today, it’s tough to qualify. Recently, the Urban Institute released their latest Housing Credit Availability Index (HCAI) which “measures the percentage of owner-occupied home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

The index shows that lenders were comfortable taking on high levels of risk during the housing boom of 2004-2006. It also reveals that today, the HCAI is under 5 percent, which is the lowest it’s been since the introduction of the index. The report explains:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

This is nothing like the last time.

This is nothing like the last time.

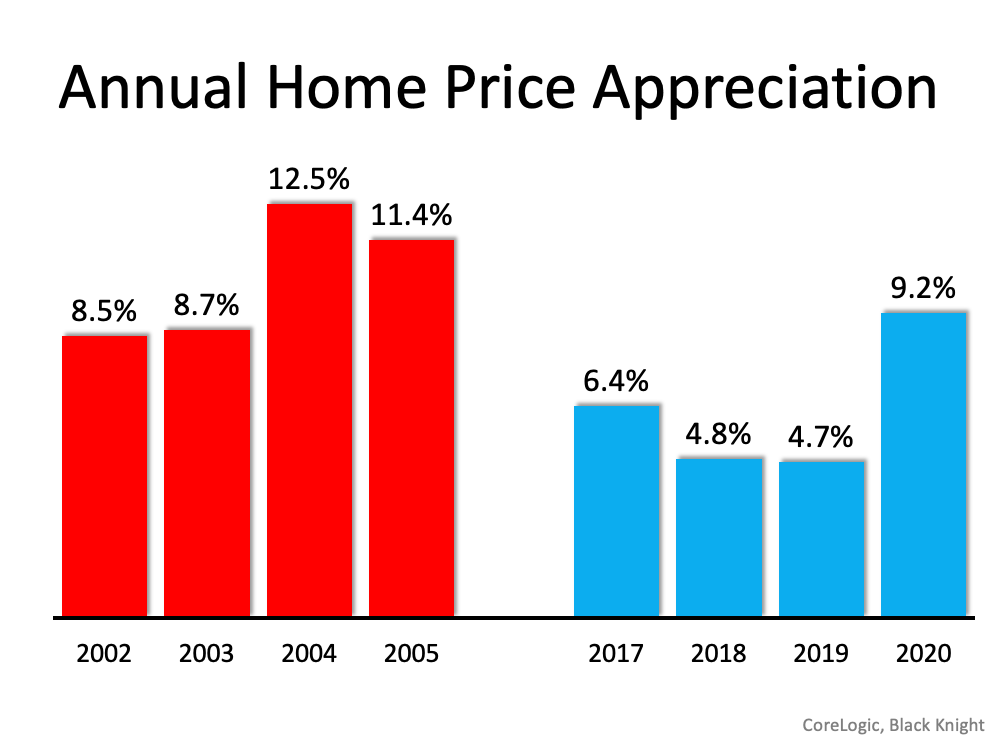

Below is a graph showing annual home price appreciation over the past four years compared to the four years leading up to the height of the housing bubble. Though price appreciation was quite strong last year, it’s nowhere near the rise in prices that preceded the crash. There’s a stark difference between these two periods of time. Normal appreciation is 3.8%. So, while current appreciation is higher than the historic norm, it’s certainly not accelerating out of control as it did in the early 2000s.

There’s a stark difference between these two periods of time. Normal appreciation is 3.8%. So, while current appreciation is higher than the historic norm, it’s certainly not accelerating out of control as it did in the early 2000s.

This is nothing like the last time.

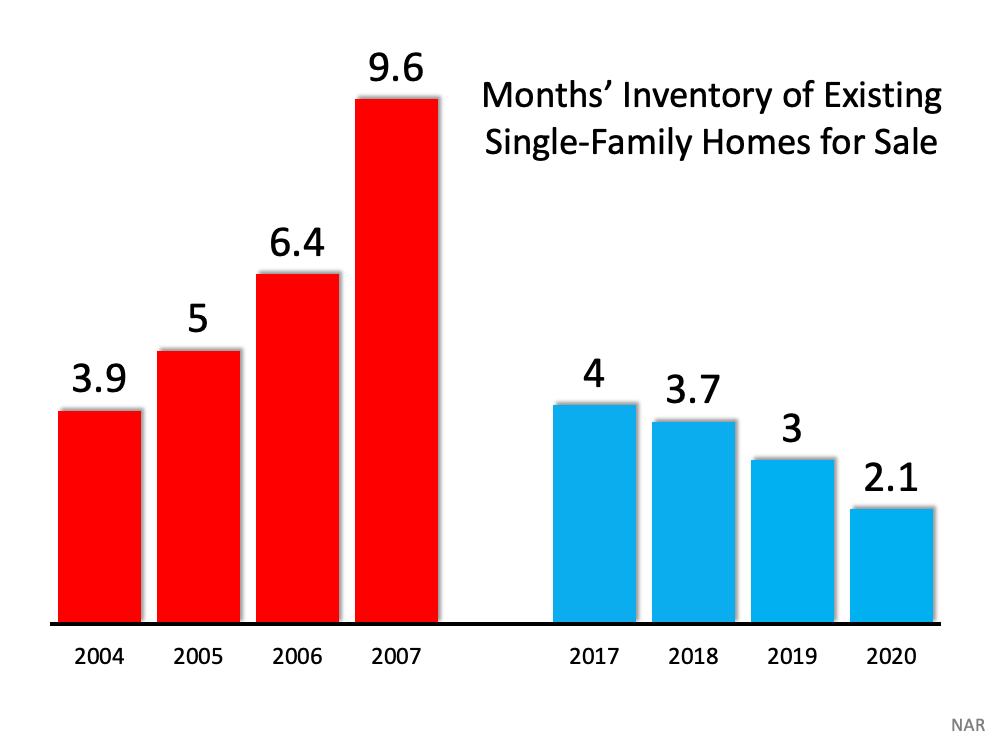

The months’ supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued appreciation. As the next graph shows, there were too many homes for sale in 2007, and that caused prices to tumble. Today, there’s a shortage of inventory, which is causing an acceleration in home values. This is nothing like the last time.

This is nothing like the last time.

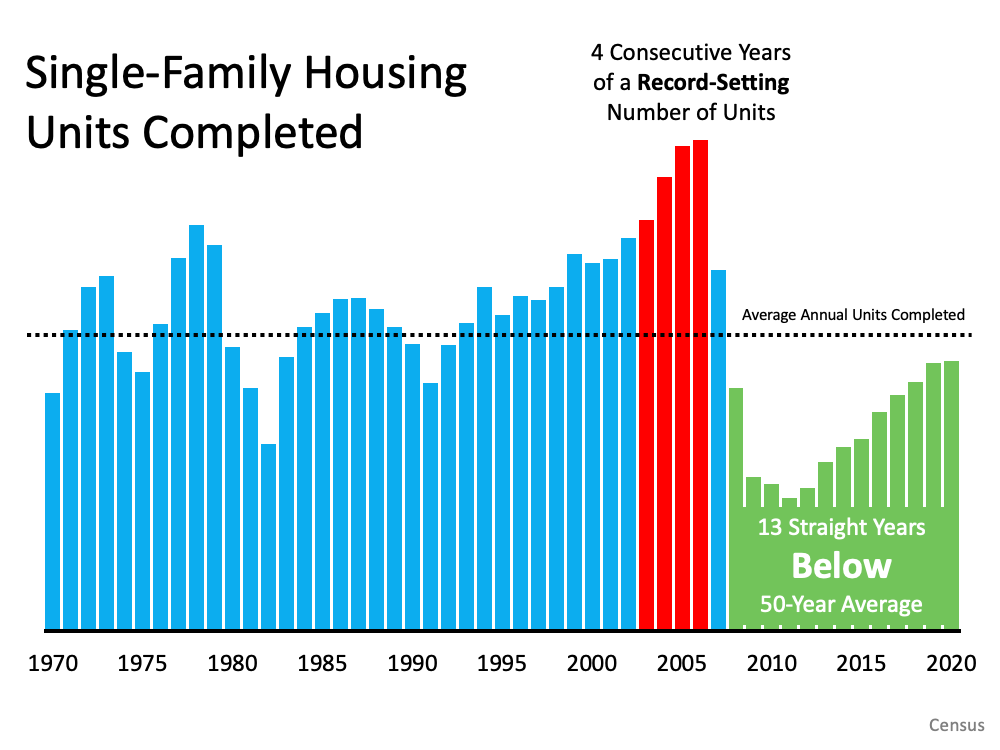

Some may think new construction is filling the void. However, if we compare today to right before the housing crash, we can see that an overabundance of newly built homes was a major challenge then, but isn’t now. This is nothing like the last time.

This is nothing like the last time.

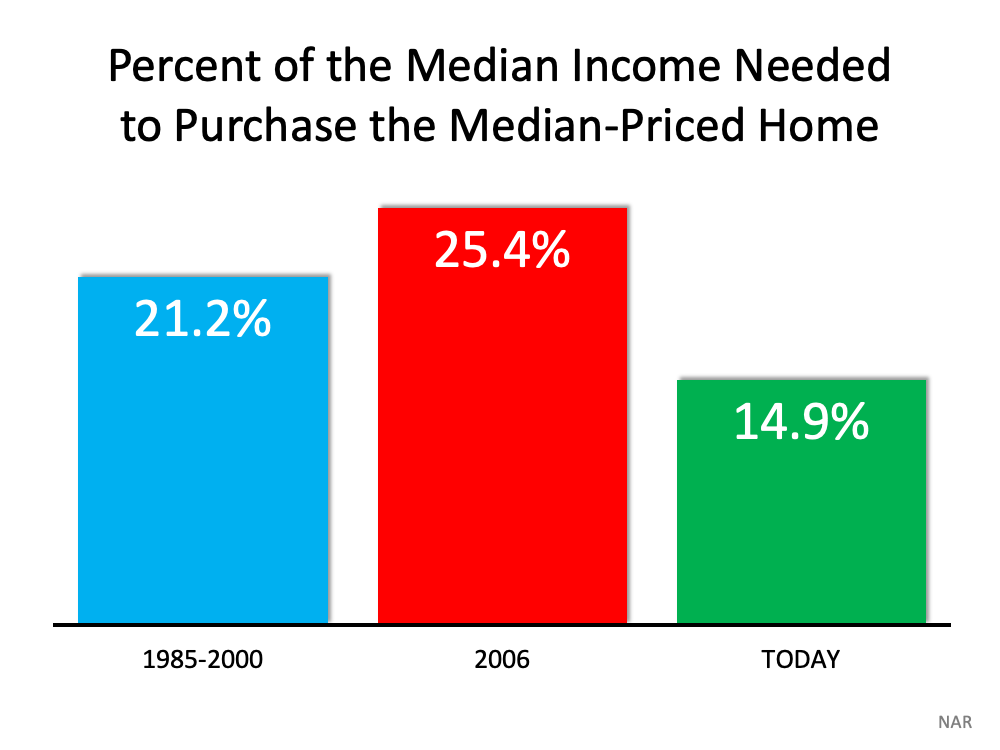

The affordability formula has three components: the price of the home, the wages earned by the purchaser, and the mortgage rate available at the time. Fifteen years ago, prices were high, wages were low, and mortgage rates were over 6%. Today, prices are still high. Wages, however, have increased, and the mortgage rate is about 3%. That means the average homeowner pays less of their monthly income toward their mortgage payment than they did back then. Here’s a chart showing that difference: As Mark Fleming, Chief Economist for First American, explains:

As Mark Fleming, Chief Economist for First American, explains:

“Lower mortgage interest rates and rising incomes correspond with higher house prices as home buyers can afford to borrow and buy more. If housing is appropriately valued, house-buying power should equal or outpace the median sale price of a home. Looking back at the bubble years, house prices exceeded house-buying power in 2006, but today house-buying power is nearly twice as high as the median sale price nationally.”

This is nothing like the last time.

In the run-up to the housing bubble, homeowners were using their homes as personal ATM machines. Many immediately withdrew their equity once it built up, and they learned their lesson in the process. Prices have risen nicely over the last few years, leading to over 50% of homes in the country having greater than 50% equity – and owners have not been tapping into it like the last time. Here’s a table comparing the equity withdrawal over the last three years compared to 2005, 2006, and 2007. Homeowners have cashed out almost $500 billion dollars less than before: During the crash, home values began to fall, and sellers found themselves in a negative equity situation (where the amount of the mortgage they owed was greater than the value of their home). Some decided to walk away from their homes, and that led to a wave of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of other homes in the area. With the average home equity now standing at over $190,000, this won’t happen today.

During the crash, home values began to fall, and sellers found themselves in a negative equity situation (where the amount of the mortgage they owed was greater than the value of their home). Some decided to walk away from their homes, and that led to a wave of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of other homes in the area. With the average home equity now standing at over $190,000, this won’t happen today.

This is nothing like the last time.

If you’re concerned that we’re making the same mistakes that led to the housing crash, take a look at the charts and graphs above to help alleviate your fears.

Please share the following link with your friends and family so they can tell their State Legislator to protect the Mortgage Interest Deduction:

https://bit.ly/2MEZZ70

Please attend the House Committee Hearing as well. Submitting your email and testifying will take just a few minutes of your time. We hope you'll help us — and tens of thousands of Oregonians.

![It’s a Sellers’ Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/02/25131035/20210226-MEM-1046x1503.png)

Displaying blog entries 411-420 of 851