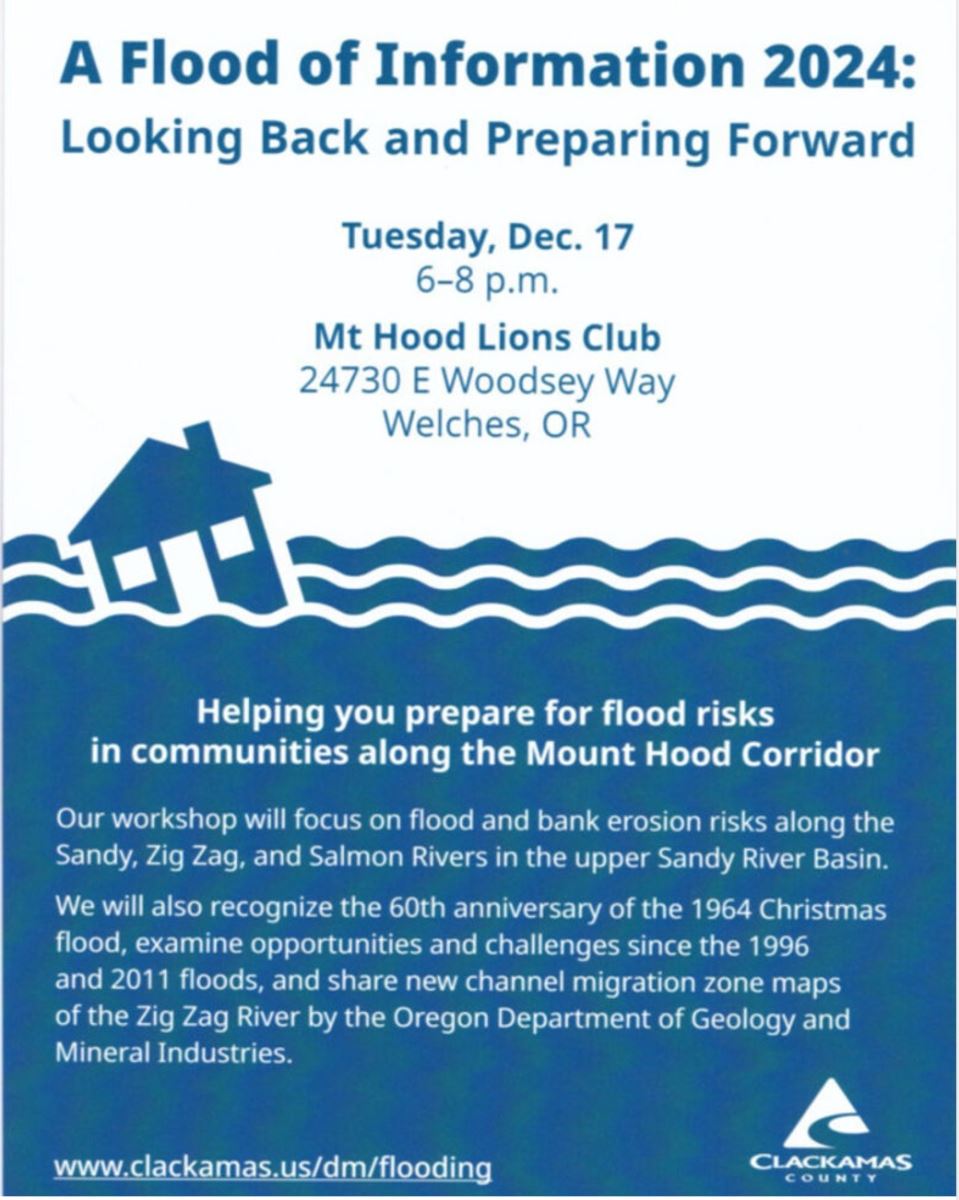

Flood Information on Mt. Hood

Displaying blog entries 31-40 of 1915

One of the biggest questions on everyone’s minds right now is: when will mortgage rates come down? After several years of rising rates and a lot of bouncing around in 2024, we’re all eager for some relief.

While no one can project where rates will go with complete accuracy or the exact timing, experts offer some insight into what we might see going into next year. Here’s what the latest forecasts show.

After a lot of volatility and uncertainty, the most updated forecasts suggest rates will start to stabilize over the next year, and should ease a bit compared to where they are right now (see graph below):

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“While mortgage rates remain elevated, they are expected to stabilize.”

It’s important to note that the timing and the pace of what happens with mortgage rates is one of the most challenging forecasts to make in the housing market. That’s because these forecasts hinge on a few key factors all lining up. So don’t be fooled, because while rates are expected to come down slightly, they’re going to be a moving target. And the ups and downs of ongoing economic drivers will likely stick around. Here’s a look at just a few of the things that’ll influence where they go from here:

Remember, these forecasts are based on the best information available right now. As new economic data comes out, experts will revise their projections accordingly. So, don’t try to time the market based on these forecasts alone.

Instead, the best thing you can do is focus on what you can control right now. Work on improving your credit score, put away any extra cash for your down payment, and automate your savings. All of these things will help you reach your homeownership goals even faster.

And be sure to connect with a trusted agent and a lender, so you always have the latest updates – and an expert opinion on what that means for your move.

If you’re planning to move and want to stay informed about where mortgage rates are heading, let’s connect.

With the holidays right around the corner, homeowners planning to move have a decision to make: sell now or wait? Some may even consider taking their house off the market until next spring. But is that the best choice? Because at this time of year, your home can really stand out.

Here's the thing: there are plenty of buyers out there who want to be in a new home by the holidays, and your house might be just what they’re looking for. As an article from Redfin says:

“. . . there is typically less inventory in the housing market this time of year, allowing your home to easily stand out among the available inventory. And though there are technically fewer buyers overall, the homebuyers that are looking are far more serious about finding a home within a specific timeframe. . . selling your home during the holidays might be your best present this year.”

Here are four key reasons you may not want to wait to sell your house.

1. Serious Buyers Are Looking Right Now

The holiday season doesn’t put a pause on the desire to own a home. Sure, some buyers might delay their search until next year, but others have a reason they need to move now. These buyers are highly motivated and ready to make a serious offer. As Investopedia says:

“Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer. Putting your home on the market at this time of year and attracting a serious buyer can often result in a quicker sale.”

2. You Have an Inventory Edge

While there are more homes coming to the market right now, overall, the number of houses available to buy is still low.

So, what does that mean for you? If you work with a trusted agent to price your house right, it could still sell pretty quickly. That’s because today’s buyers are on the hunt for quality options – and your home may be exactly what they’re searching for.

3. You Have Control Over Your Showings

Selling during the holidays doesn’t mean constantly disrupting your schedule. You have the flexibility to set up showings at times that work best for you. This is especially helpful during a busy season, and many buyers are likely to be more flexible with their schedules since they often have extra time off around the holidays.

Now, it’s always better to offer more flexible access to your house. But the reality is, you don’t have to stop the process entirely – especially when you have a great agent to help you navigate each step along the way.

4. Holiday Décor Can Make Your House Shine

For many buyers, a tastefully decorated home can create a warm, inviting atmosphere. It’s easy for them to imagine holiday gatherings and cozy nights in a space that feels just right. Keep your choices simple to let your home’s charm shine through. An article on holiday home-selling advises:

“If you’re selling around a holiday and have decorations up, make sure they accent—not overpower—a room. Less is more.”

There are plenty of good reasons to put (or keep) your house on the market during the holidays. Let’s connect to see if this is your moving season.

Chances are you’re hearing a lot about mortgage rates right now, and all you really want to hear is that they’re coming back down. And if you’ve seen headlines about the early November Federal Funds Rate cut by the Federal Reserve (The Fed), maybe you got hopeful mortgage rates would start to decline right away. Although some media sources may lead you to believe that the Fed’s actions determine mortgage rates, in reality, they don’t.

The truth is, the Fed, the job market, inflation, geopolitical changes, and a whole list of other economic factors influence mortgage rates, too. So, while recent actions from the Fed set the stage for mortgage rates to come down over time — it's going to be a gradual and, likely bumpy, process.

Here’s the best advice anyone can give you right now. While you may be tempted to wait for rates to fall, it’s really hard to try and time the market — there’s just too much that can have an impact. Instead, set yourself up for homebuying success by focusing on the factors you can control. Here’s what to prioritize if you’re looking to put your best foot forward.

Credit scores can play a big role in your mortgage rate. And the difference of just a few points can make a significant impact on your monthly payment. As an article from Bankrate explains:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

With rates where they are today, maintaining a good credit score is one of the keys to getting the best rate possible. To find out where your credit score stands and what you can do to give it a boost, reach out to a trusted loan officer.

There are many types of loans, and each one offers different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose. Talking to multiple lenders can help you better understand all of the options available to you.”

Work with your team of real estate professionals to see which loan types you may qualify for and figure out what will work best for you financially.

Just like with loan types, you have options when it comes to terms, or the length of your loan. As Freddie Mac says:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Lenders typically offer mortgages in 15, 20, and 30-year terms. And which term you go with has a direct impact on your rate. Talk to your lender about which one is right for your situation.

Remember, you can’t control what happens in the broader economy or when mortgage rates will come down. But there are actions you can take that could help you set yourself up for success.

Let’s connect to go over what you can now do that’ll make a difference when you’re ready to make your move.

Steiner Log Cabin Fixer

$649.000

Opportunity knocks to own 10.58 acres of land with a fixer upper Steiner log cabin. Classic Steiners are in high demand on Mt. Hood and this one has signature markers including wood floors, huge log beams, stone fireplace and half log stairway to the second level bedrooms. It’s just under 1500 square feet with three bedrooms and one bath. A garage and attached outbuildings are near the log home. Bring your repair skills and elbow grease. The property is zoned RRFF5 so could possibly be divined into two parcels. Buyer to complete all due diligence for RRFF5 zoning. The old owner at one time was starting a tree farm but that project has since gone to blackberries. Seller is selling the property completely as is, where is, and what is. Potential plus with this hidden Steiner gem.

.jpeg)

$400,000

.jpeg)

.jpeg)

This unique Zig Zag Riverfront location has a chalet style two bedroom cabin with the river rolling by right in front of the huge well built benched deck. This is the place to spend your summers enjoying the sounds of the river with friends and family. Remote work with ease with internet access at your cabin too. Entering the main living room you have a massive wall of windows with tons of natural light nearly filling up the entire cabin. The open floor plan also boasts a floor to ceiling brick fireplace for cozy fires after a day on the slopes only 10 minutes away! The dining area is shared with the living room and it’s perfect for playing board games or sharing meals.The kitchen, bathroom and a bedroom are on the main level. The kitchen has the essentials and is steps away from the living room. The bathroom has a tile shower. The main level bedroom has a closet and is tucked away from the main living areas. Right over the living room is a massive sleeping loft. The current owners have multiple beds to sleep all the kids with friends or has the potential of dividing space off for a second private bedroom. There’s views of the Zig Zag River from the loft. A huge bonus is the brand new propane furnace that was just installed this month! It heats up fast and you’ll be set for easy warm ups this winter. This cabin is just off the road down a driveway through two massive stone pillars that mark a shared driveway. The cabin is on the right with a garage/outbuilding. It has extra wide steps to a covered porch entry complete with benches. Located in the Mt. Hood National Forest on leased land and only 1.5 miles to grocery stores, restaurants and coffee! Cabins may be used as second homes but no "nightly rentals" allowed. Get out of that weekend traffic and hit the slopes early from here! Sellers have enjoyed this cabin for a very long time but it's time to move on to new adventures. Only 1 hr to PDX.

|

||||||||||||||

|

||||||||||||||

|

Displaying blog entries 31-40 of 1915