Thursday, November 6, 2008

by Liz Warren

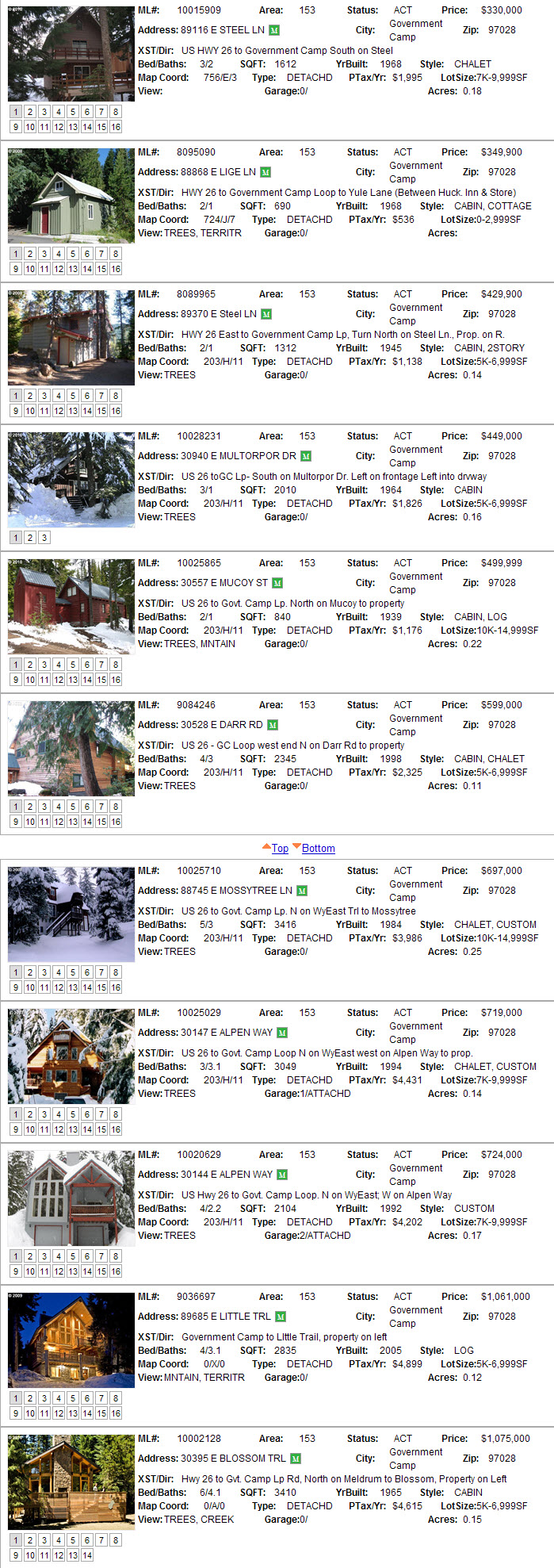

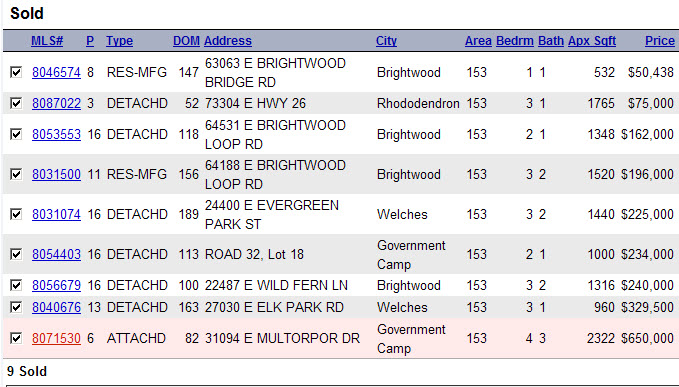

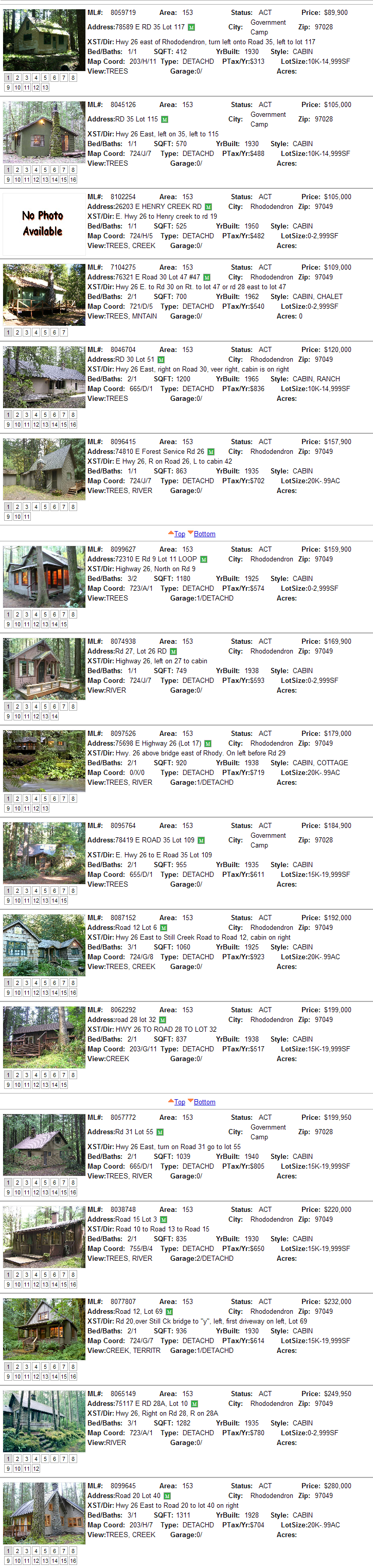

Looking to purchase a foreclosure in the Mt. Hood Area? foreclosures are popping up in Welches, Government Camp, Rhododendron and Brightwood.

Foreclosure and Short Sales Info

Over the last 24 months, Oregon went from number 2 to having the 23rd highest foreclosure rate on a national basis. As of September 2008 there have been 2,344 foreclosure filings which equivocate to 1 filing for every 644 housing units. Foreclosure filings are up 26% from August 08 and up 139% from September 2007. The majority of these distressed properties are located in the greater Portland metropolitan area.

In comparison, the state of California, which accounts for ~60% nationally of all foreclosure activity has 69,548 properties with foreclosure filings, equivocating to 1 in every 189 housing units. Washington has 1 foreclosure filing out of every 1,383 housing units.

Below are some comments from our partners that actively work in this arena.

- Most properties in foreclosure are so debt laden that they are reverting to the banks.

- An investor interested in buying a foreclosed property on the courthouse steps is not likely to get a good deal.

- Banks have not been discounting the debt on these properties in order to sell them.

- It can cost a bank anywhere from $30K-60K plus, to take back a house. This doesn’t include the cost of capital, refurbishment, marketing and sales costs.

- So why are banks taking the homes back?

- Some banks have been bundling multiple properties, with varying degrees of debt-to-market value ratios and selling them to large, institutional buyers. This seems to be easier and more profitable for the banks right now.

- In Multnomah County, who is buying foreclosed properties at this time? There are a few larger, private equity buyers and some individual investors.

- The SE & NE corridors have the greatest percentage of foreclosed properties at an average value of $125K-225K. However, more expensive properties are now entering the picture.

- So where are some of the opportunities now? Short Sales.

Short Sales - An option for those who have money & the time.

A short sale is where a property owner wants to sell their home but they have a higher mortgage debt on the property than the price they can sell the house for. First, seller and buyer must agree on a price and then they go to the lender with comparable homes sales data to support the decline in value plus a compelling story and documentation that proves the seller does not have the funds to pay off the entire mortgage due. Sound simple? Not really. Short Sales on average take 90-120 days to complete if successfully negotiated. Clients and real estate brokers should work with a professional who knows the ropes.

Investment property owners who sell under a Short Sale agreement should be aware of the new exclusionary rule coming that will tax all or a portion of the ‘gain’ the home seller realizes from a short sale closing.

A big thanks for sharing this information Kim:

Kim Dodge at Usher Financial (503) 595.1600