Make Your House the Top Thing on Every Buyer’s Mt. Hood Wish List This Season

Make Your House the Top Thing on Every Buyer’s Mt. Hood Wish List This Season

With the holidays right around the corner, homeowners planning to move have a decision to make: sell now or wait? Some may even consider taking their house off the market until next spring. But is that the best choice? Because at this time of year, your home can really stand out.

Here's the thing: there are plenty of buyers out there who want to be in a new home by the holidays, and your house might be just what they’re looking for. As an article from Redfin says:

“. . . there is typically less inventory in the housing market this time of year, allowing your home to easily stand out among the available inventory. And though there are technically fewer buyers overall, the homebuyers that are looking are far more serious about finding a home within a specific timeframe. . . selling your home during the holidays might be your best present this year.”

Here are four key reasons you may not want to wait to sell your house.

1. Serious Buyers Are Looking Right Now

The holiday season doesn’t put a pause on the desire to own a home. Sure, some buyers might delay their search until next year, but others have a reason they need to move now. These buyers are highly motivated and ready to make a serious offer. As Investopedia says:

“Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer. Putting your home on the market at this time of year and attracting a serious buyer can often result in a quicker sale.”

2. You Have an Inventory Edge

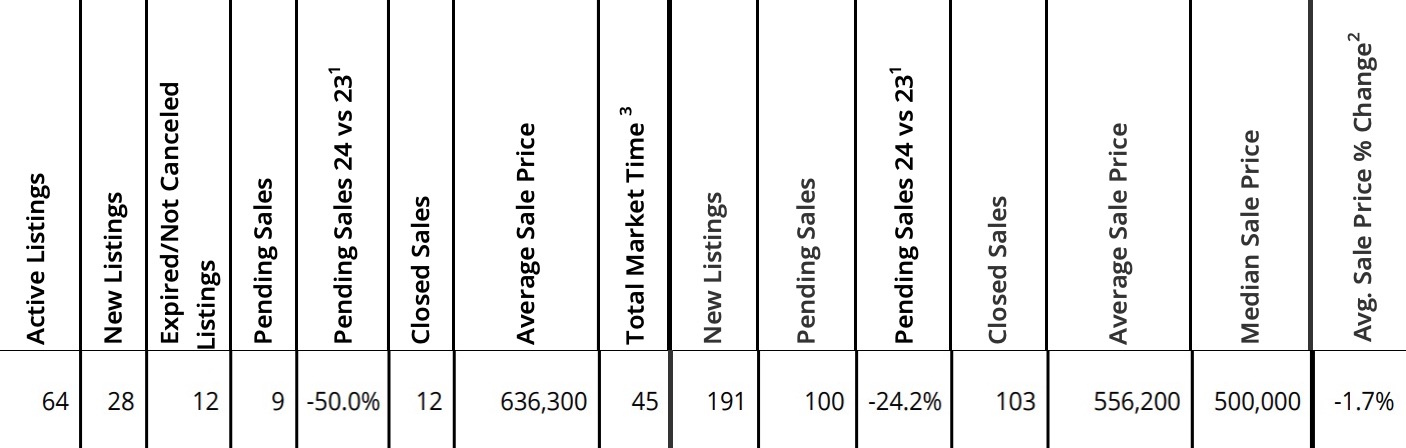

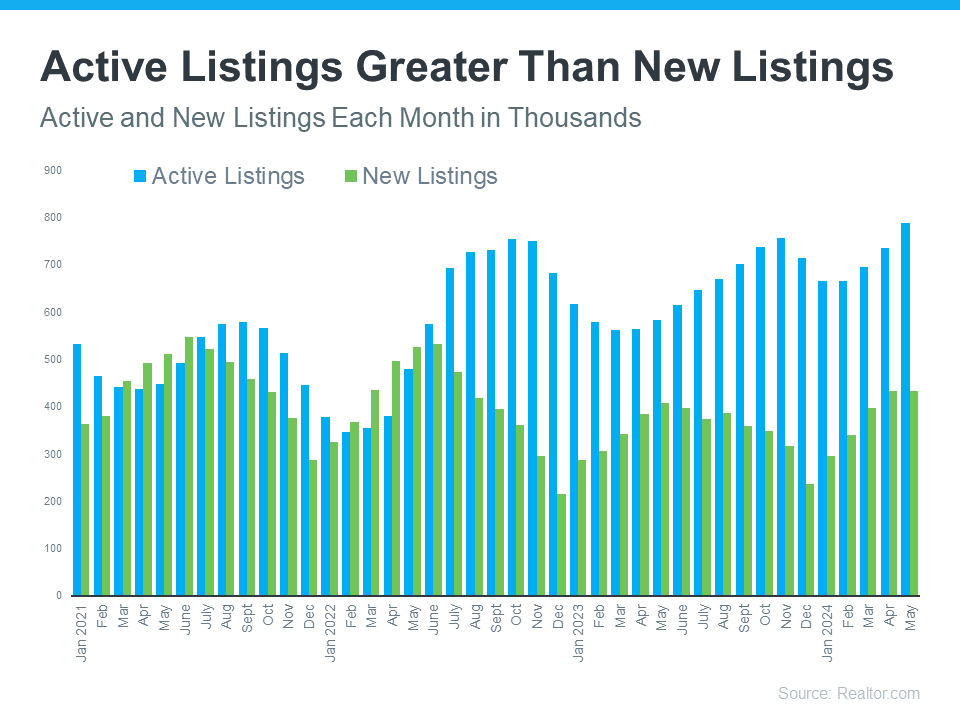

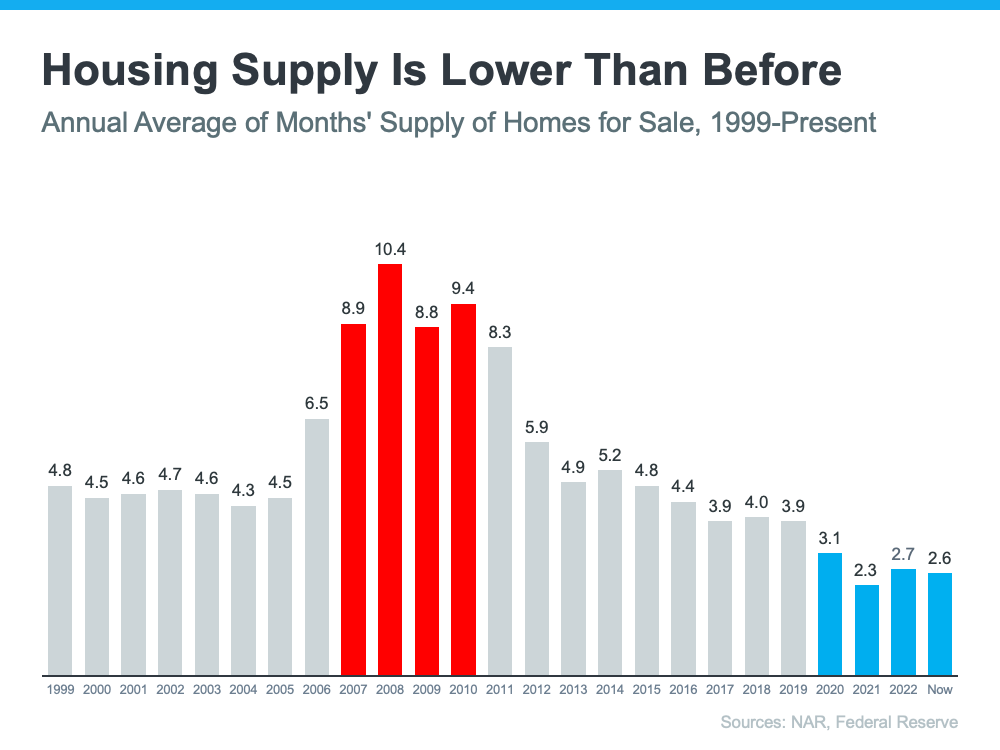

While there are more homes coming to the market right now, overall, the number of houses available to buy is still low.

So, what does that mean for you? If you work with a trusted agent to price your house right, it could still sell pretty quickly. That’s because today’s buyers are on the hunt for quality options – and your home may be exactly what they’re searching for.

3. You Have Control Over Your Showings

Selling during the holidays doesn’t mean constantly disrupting your schedule. You have the flexibility to set up showings at times that work best for you. This is especially helpful during a busy season, and many buyers are likely to be more flexible with their schedules since they often have extra time off around the holidays.

Now, it’s always better to offer more flexible access to your house. But the reality is, you don’t have to stop the process entirely – especially when you have a great agent to help you navigate each step along the way.

4. Holiday Décor Can Make Your House Shine

For many buyers, a tastefully decorated home can create a warm, inviting atmosphere. It’s easy for them to imagine holiday gatherings and cozy nights in a space that feels just right. Keep your choices simple to let your home’s charm shine through. An article on holiday home-selling advises:

“If you’re selling around a holiday and have decorations up, make sure they accent—not overpower—a room. Less is more.”

Bottom Line

There are plenty of good reasons to put (or keep) your house on the market during the holidays. Let’s connect to see if this is your moving season.