Real Estate Information Archive

Blog

Displaying blog entries 11-20 of 784

Affordability Improving in 2026 According to Experts

Expert Forecasts Point to Affordability Improving in 2026

Wondering what to expect from the housing market in 2026? You’re not the only one. For the past few years, affordability has been the biggest barrier standing between most people and their next move. And a lot of buyers and sellers have been holding their breath waiting for things to get better. The good news? It’s finally happening.

In 2025, affordability was the best it’s been in 3 years. And experts agree the momentum will keep going in 2026. And that’s based on their analysis of the key factors shaping the housing market in the year ahead: mortgage rates, inventory, and home prices.

Lower Mortgage Rates Are Already Here

Mortgage rates have already come down from their peak. By some counts, they dropped by almost a full percentage point over the course of the last year. And that’s a big deal, even if it doesn’t sound like it. But how low will they go? And should you wait for them to come down more? Here’s your answer.

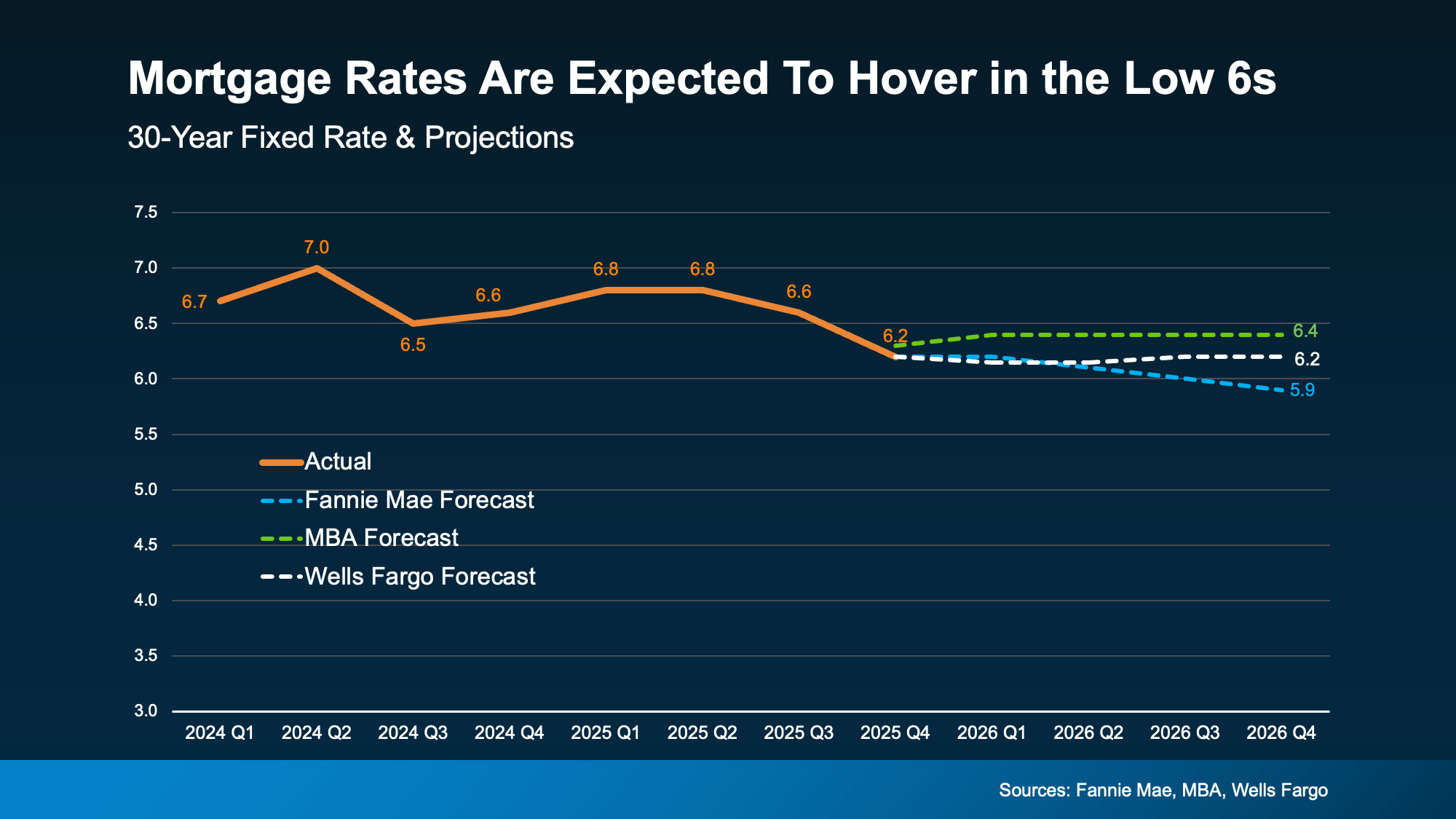

Forecasts suggest they’ll stay pretty much where they are now and hover in the low 6% range throughout 2026 (see graph below):

Where they go from here really depends on what happens with the economy, the job market, and any changes in monetary policy the Fed makes in the year ahead. The important thing is, they’re already lower than they were just one year ago and that’s ideal if you’re planning a 2026 move.

Where they go from here really depends on what happens with the economy, the job market, and any changes in monetary policy the Fed makes in the year ahead. The important thing is, they’re already lower than they were just one year ago and that’s ideal if you’re planning a 2026 move.

- For buyers: A lower rate reduces monthly payments and increases buying power. And, that combo helps more people qualify for homes that previously felt just out of reach.

- For sellers: It may be time to accept that rates in the 6s are the new normal. And if you need to move, it’s doable, especially with your equity.

Even More Options Are on the Way

In 2025, the number of homes for sale improved by about 15%. As inventory rose, buyers regained things they hadn’t had in years: options, time to consider those options, and negotiating leverage. That helped restore more balance to the housing market.

Not to mention, the inventory gains are a big piece of what’s helped price growth slow down – which in turn improves affordability.

While the inventory gains this year aren’t expected to be as steep, experts at Realtor.com say the supply of homes for sale should grow by another 8.9% this year.

- For buyers: That means even more choice and more negotiating power.

- For sellers: Pricing your house right will be essential to draw in buyers.

Home Price Growth Is Slowing to a More Sustainable Pace

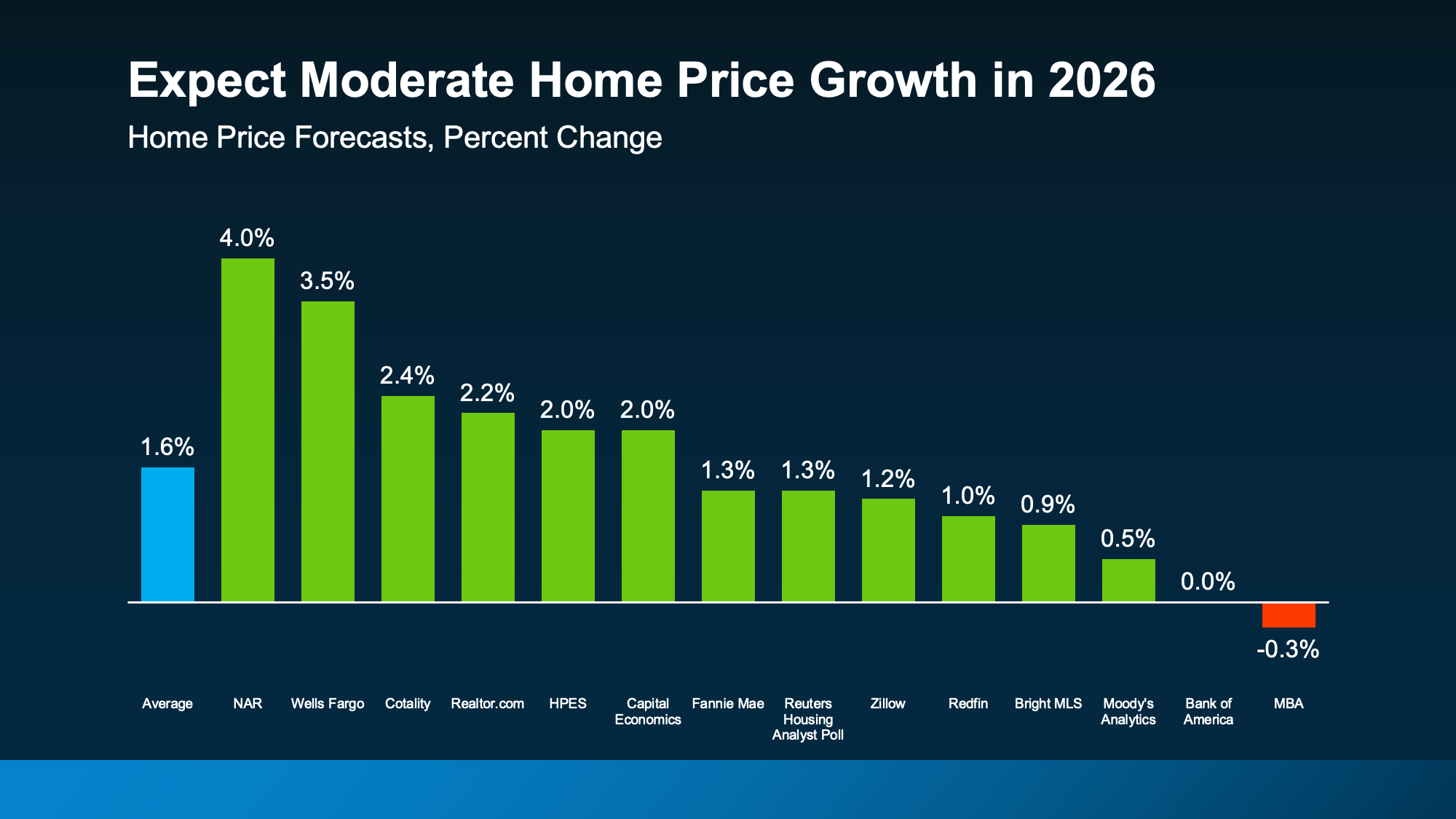

With more homes for sale, there isn’t as much upward pressure on prices right now. And we’ve seen that shake out over the past year. Even so, the overwhelming majority of experts say, nationally, prices will continue rising in the year ahead – just at a slower pace. On average, they say prices will rise by 1.6% in 2026 (see graph below):

And that's reassuring if you've been fed content on social media saying prices are going to come crashing down. But here’s what you need to remember most about this. It’s going to vary a lot by area.

And that's reassuring if you've been fed content on social media saying prices are going to come crashing down. But here’s what you need to remember most about this. It’s going to vary a lot by area.

So, lean on a local agent for the latest on what’s happening where you are. Some markets will see prices rise more than this. Others may see prices come down slightly. It really all depends on conditions in your local market

But overall, prices will continue to rise at the national level. And that’s good for the market as a whole. As Realtor.com explains:

“For homebuyers and sellers, the shift signals a more balanced market—one where price growth steadies, rate relief offers breathing room, and negotiating power tilts subtly toward buyers.”

- For buyers: Expect more moderate price growth, not the sudden and intense spikes just a few short years ago. That gives you fewer surprises and more predictability, which makes budgeting a whole lot easier.

- For sellers: This slower price growth restores balance without putting your equity at risk. And that’s a win.

More Homes Will Sell

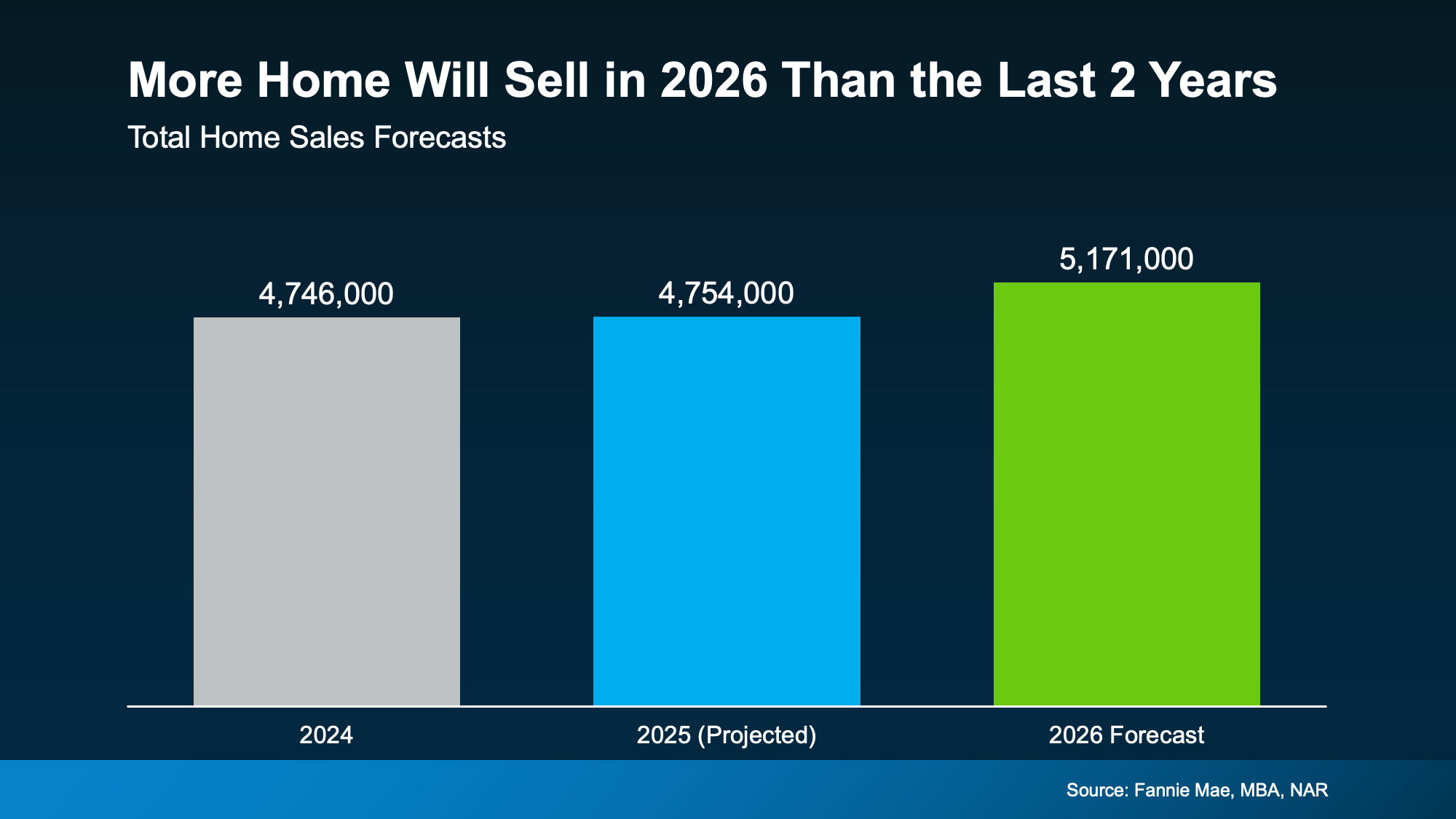

All of this adds up to a better affordability equation in 2026. And that’s exactly why experts are saying we should see more homes sell (and more people buy) this year.

As Mischa Fisher, Chief Economist at Zillow, says:

As Mischa Fisher, Chief Economist at Zillow, says:

“Buyers are benefiting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand. Each group should have a bit more breathing room in 2026.”

The bottom line is, more people are finally going to be able to make their move this year. So, the question is: will you be one of them? The market is giving you an opportunity you haven’t had in a while. Maybe it’s time to take advantage of it.

Bottom Line

Affordability won't change suddenly overnight. But, with several key trends working together, it should slowly and steadily improve in the months ahead.

That’s exactly why, in 2026, you should see a market with more balance, more predictability, and more breathing room than you’ve had in years.

Want more information about the opportunities unlocking in our local market?

Let’s chat.

Thinking about Selling Your House As-Is on Mt. Hood?

Thinking about Selling Your House As-Is? Read This First.

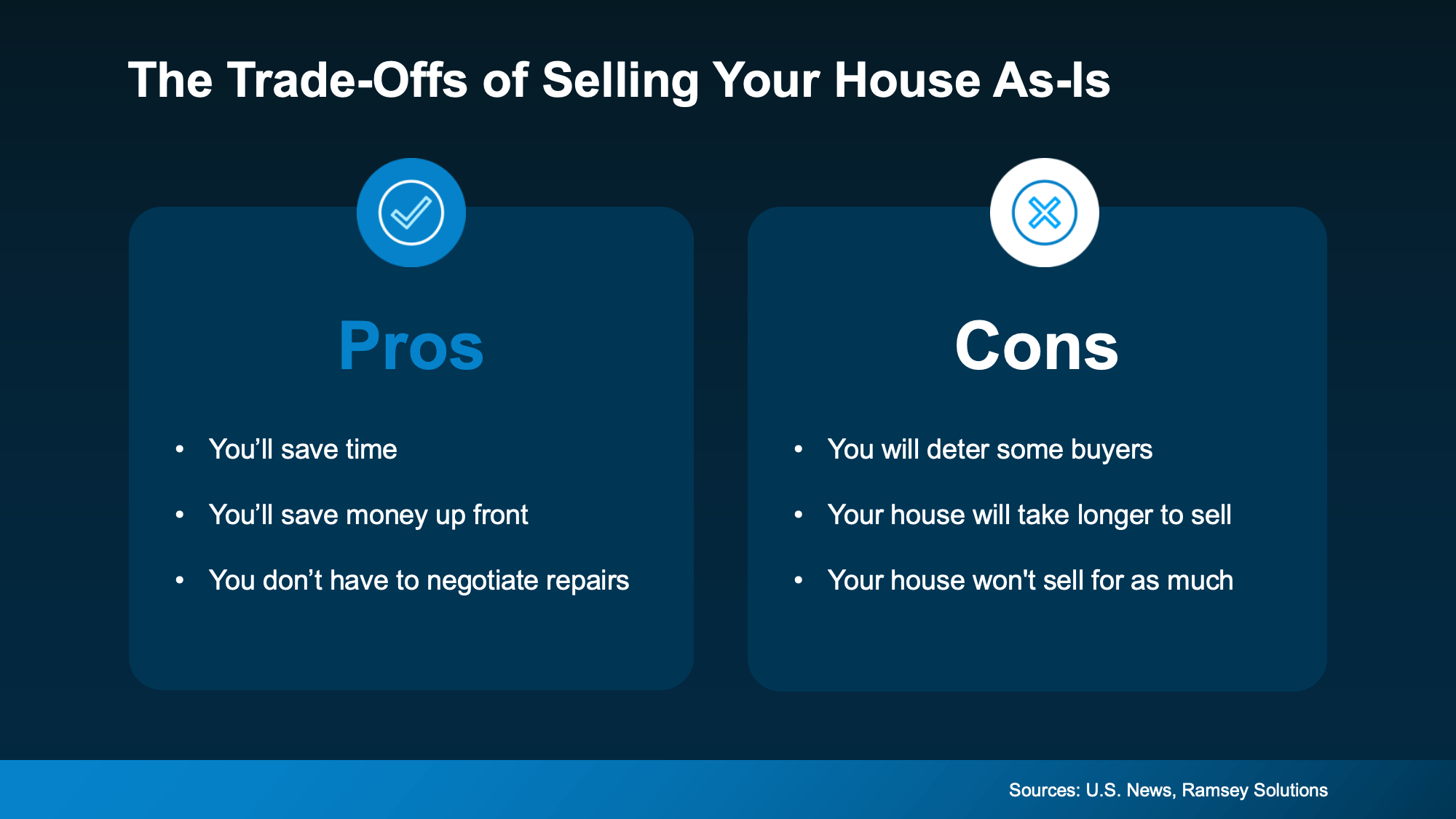

If you’re thinking about selling your house this year, you may be torn between two options:

- Do you sell it as-is and make it easier on yourself? No repairs. No effort.

- Or do you fix it up a bit first – so it shows well and sells for as much as possible?

In 2026, that decision matters more than it used to. Here’s what you need to know.

More Competition Means Your Home’s Condition Is More Important Again

Over the past year, the number of homes for sale has been climbing. And this year, a Realtor.com forecast says it could go up another 8.9%. That matters. As buyers gain more options, they also re-gain the ability to be selective. So, the details are starting to count again.

That’s one reason most sellers choose to make some updates before listing.

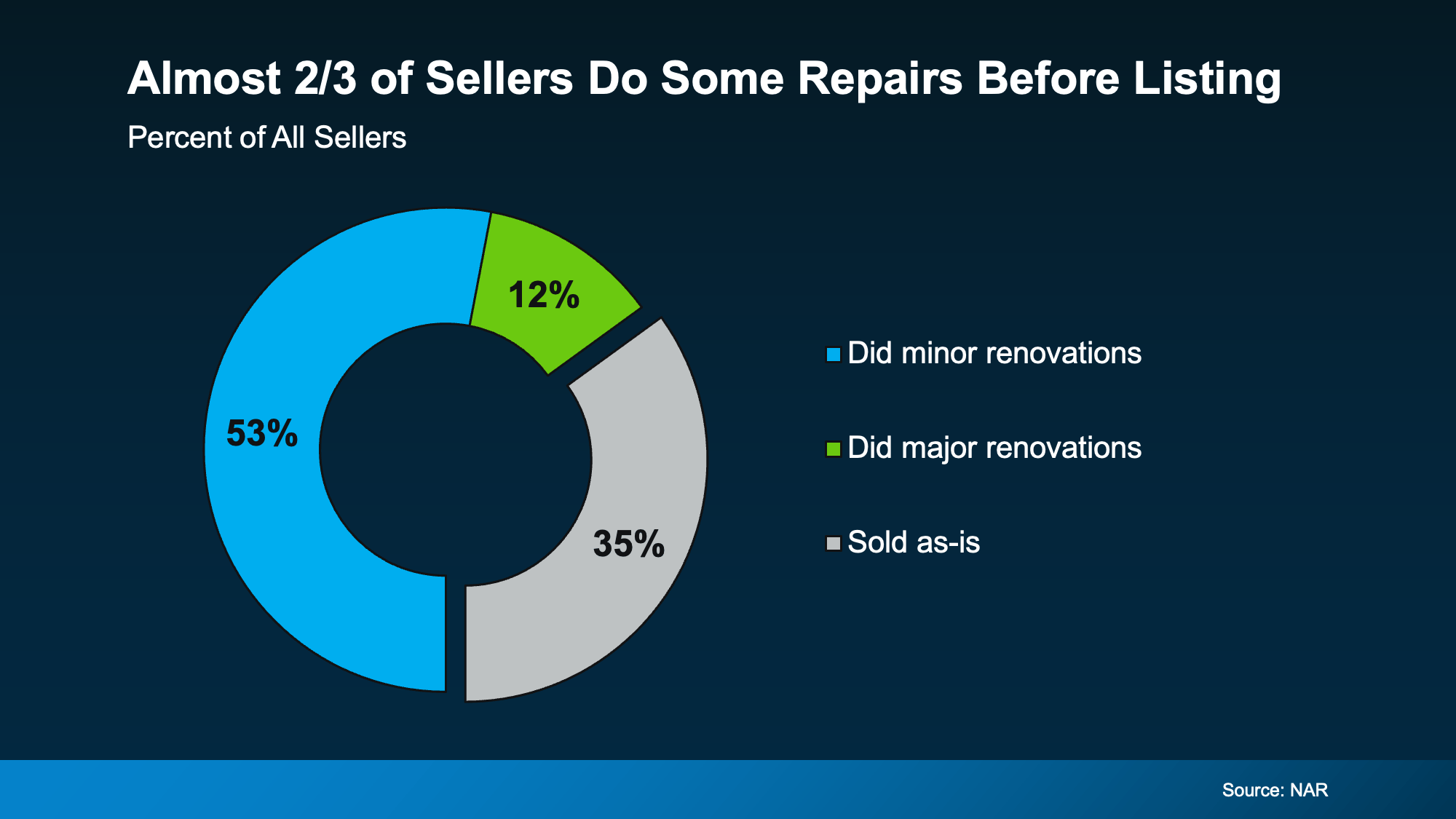

According to a recent study from the National Association of Realtors (NAR), two-thirds of sellers (65%) completed minor repairs or improvements before selling (the blue and the green in the chart below). And only one-third (35%) sold as-is:

What Selling As-Is Really Means

Selling as-is means you’re signaling upfront that you won’t handle repairs before listing or negotiate fixes after inspection. That can definitely simplify things on your end, but it also narrows your buyer pool.

Homes that are move-in ready typically attract more buyers and stronger offers. On the flip side, when a home needs work, fewer buyers are willing to take it on. That can mean fewer showings, fewer offers, more time on the market, and often a lower final price.

It doesn’t mean your house won’t sell – it just means it may not sell for as much as it could have.

How an Agent Can Help

How an Agent Can Help

So, what should you do? The answer isn’t one-size-fits-all. It’s going to depend a lot on your house and your local market.

And that’s why working with an agent is a must. The right agent will help you weigh your options and anticipate what your house may sell for either way – and that can be a key factor in your final decision.

- If you choose to sell as-is: They’ll call attention to the best features, like the location, size, and more, so it’s easy for buyers to see the potential, not just the projects.

- If you decide to make repairs: Your agent can pinpoint what's really worth the time and effort based on your budget and what buyers care about the most.

The good news is, there's still time to get repairs done. Typically speaking, the spring is the peak homebuying season, so there are still several months left before buyer demand will be at its seasonal high. That means you have time to make some repairs, without rushing or stressing, and still hit the listing sweet spot.

The choice is yours. No matter what you end up picking, your agent will market your house to draw in as many buyers as possible. And in today’s market, that expertise is going to be worth it.

Bottom Line

While selling as-is can still make sense in certain situations, in some markets today, it may cost you. So, no, you don’t have to make repairs before you list. But you may want to.

To make sure you’re considering all your options and making the best choice possible, let's have a quick conversation about your house.

More Buyers Moving on Mt. Hood in 2026

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Momentum is quietly building in the housing market. New data from NerdWallet shows more Americans are starting to think about buying a home again. Last year, 15% of respondents said they planned to buy a home in the next 12 months. This year, that number rose to 17%.

That 2% increase might not sound like a big jump, but in a market where buyer demand has been cooling for the past few years, it’s a sign things are starting to shift. More people are feeling ready (or at least closer to ready) to take the leap and buy a home in 2026.

And if you’re in that camp and buying a home is on your goal sheet this year, this is your nudge to connect with a local agent and a trusted lender to start laying the groundwork now.

Planning To Move in Early 2026? Start with These 4 Steps

If you’re eager to get the ball rolling right away, here's what to tackle first:

- Get pre-approved. A pre-approval gives you a real understanding of your buying power and what your payment could be at today’s rates. But keep in mind, Experian says most pre-approvals are only good for 30-90 days, so this step makes the most sense as you’re ready to get serious.

- Run the numbers. Look closely at all your expenses to come up with your budget. Consider what you’re spending on other bills and what your monthly mortgage payment would be once you buy. That way you go in with open eyes and you don’t stretch too far.

- Define your non-negotiables. Once you know the numbers work, figure out your must-haves. This includes your desired location, commute, layout, school district, lifestyle needs, etc. Getting clear on these now makes decisions easier once you start looking at homes.

- Choose your agent early. Look at reviews online and talk to multiple agents to find one you trust that you also click with. The right agent does more than show homes. They help you understand pricing, competition, timing, and strategy before you ever write an offer.

Thinking about Buying Later in the Year? This Is Still Your Window To Prepare

Even if buying feels like a late-2026 goal, this moment still matters. The buyers who feel the most confident later are usually the ones who quietly prepared earlier.

That doesn’t mean big financial commitments or major lifestyle changes. It just means setting yourself up so you’re ready when the timing is right. Here are a few low-stress ways to do that:

- Work on your credit. While you don't need to have perfect credit to buy a home, your score can have an impact on your loan terms and even your mortgage rate. So, working to bring up your score has its perks. Paying down debt now and making payments on time can help bring your score up.

- Automate your savings. If you have to remember to transfer money into your homebuying savings manually, you may forget to do it. So, you may want to set up automatic transfers to drive consistency and remove the temptation to spend the money elsewhere.

- Lean into your side hustles: Do you have a gig you do (or have done before) to net some extra cash? Taking on part-time work, freelance jobs, or picking up a side hustle can help give your savings a boost.

- Put any unexpected cash to good use: If you get any sudden windfalls, like a tax refund, bonus, inheritance, or cash gift from family, put it toward your house fund. You’ll thank yourself later.

The common thread here? The right prep work makes a difference.

Bottom Line

If buying a home in 2026 is on your radar, let’s start the conversation today. Not to rush a decision, but to make sure you know how to get ready for your moment.

Because every move (whether it’s next year or later) is smoother when it starts with a plan. And if you need help coming up with one that works, let’s connect.

Homeowners Selling with a Real Estate Agent Just Hit a New High

Reasons To Be Optimistic About the 2026 Housing Market on Mt. Hood

Reasons To Be Optimistic About the 2026 Housing Market

If a move is on your radar for 2026, there’s a lot more working in your favor than there has been in a while.

After a stretch where many people felt stuck, 2026 is shaping up to be a year with more balance, more options, and more clarity for people who want to make a move. Not because the market is suddenly “easy,” but because several key conditions are shifting.

Here’s what the experts are saying you have to look forward to.

Danielle Hale, Chief Economist at Realtor.com:

“After a challenging period for buyers, sellers and renters, 2026 should offer a welcome, if modest, step toward a healthier housing market.”

The National Association of Realtors (NAR):

“Top economists have one word to sum up the housing market for 2026: opportunity. Lower mortgage rates and a rising supply of homes are expected to open up the housing market . . . something the real estate industry and potential home buyers and sellers have been waiting for, following three years of stagnation.”

Mark Fleming, Chief Economist at First American:

“. . . for the first time in several years, the underlying forces are finally aligned toward gradual improvement. Mortgage rates may drift down only slowly, but income growth exceeding house price appreciation will provide a boost to house-buying power — even in a higher-rate world. Affordability won’t snap back overnight, but like a ship finally catching a steady tailwind, it’s now sailing in the right direction.”

Mischa Fisher, Chief Economist at Zillow:

“Buyers are benefiting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand. Each group should have a bit more breathing room in 2026.”

Why Local Insight Matters More Than Ever

Just remember, while the national outlook is improving, conditions will still be different based on where you live. Some markets will move faster than others. Some will see stronger price growth. Others will remain flat. As Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“Market performance will hinge on local economic conditions, making 2026 one of the most geographically divided markets we’ve seen in years.”

That’s why understanding what’s happening in your specific area is key. The national trends set the stage, but local dynamics determine how they play out for you. And that's why you need an agent.

Bottom Line

If you want to talk through what’s expected for our local market and which trends you’ll want to take advantage of, let’s connect.

Is January the Best Time to Buy a House on Mt. Hood?

Is January the Best Time To Buy a Home?

You may not want to put your homebuying plans into hibernation mode this winter. While a lot of people assume spring is the ideal time to buy a house, new data shows January may actually be the best time of year for budget-conscious buyers.

Kind of surprising, right? Here’s why January deserves a serious look.

1. Prices Tend To Be Lower This Time of Year

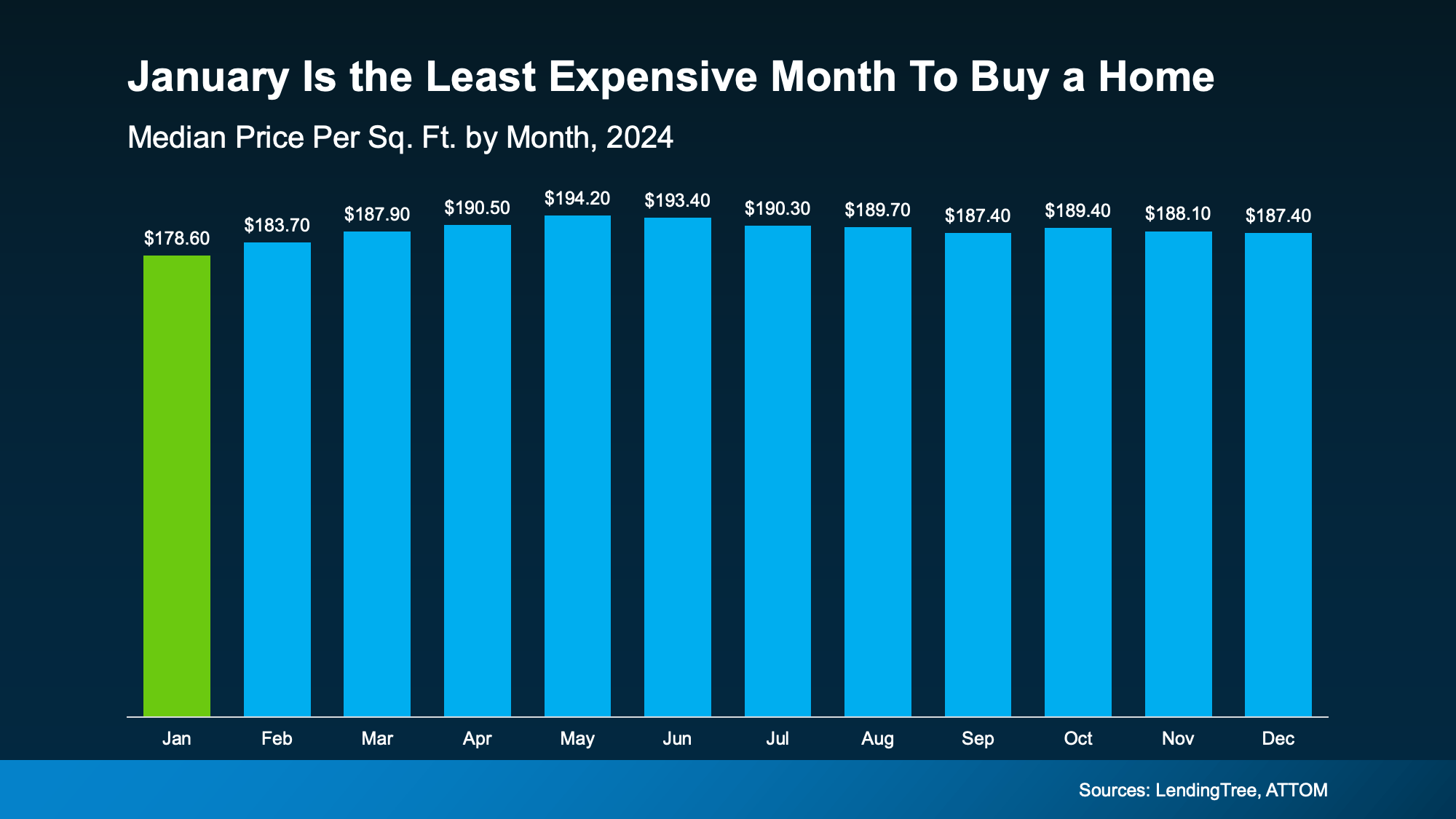

Lending Tree says January is the least expensive month to buy a home. And there’s something to that. January has historically offered one of the lowest price-per-square-foot points of the entire year. But the spring? That’s when demand (and prices) usually peak. And that’s not speculation – it's a well-known trend based on years of market data.

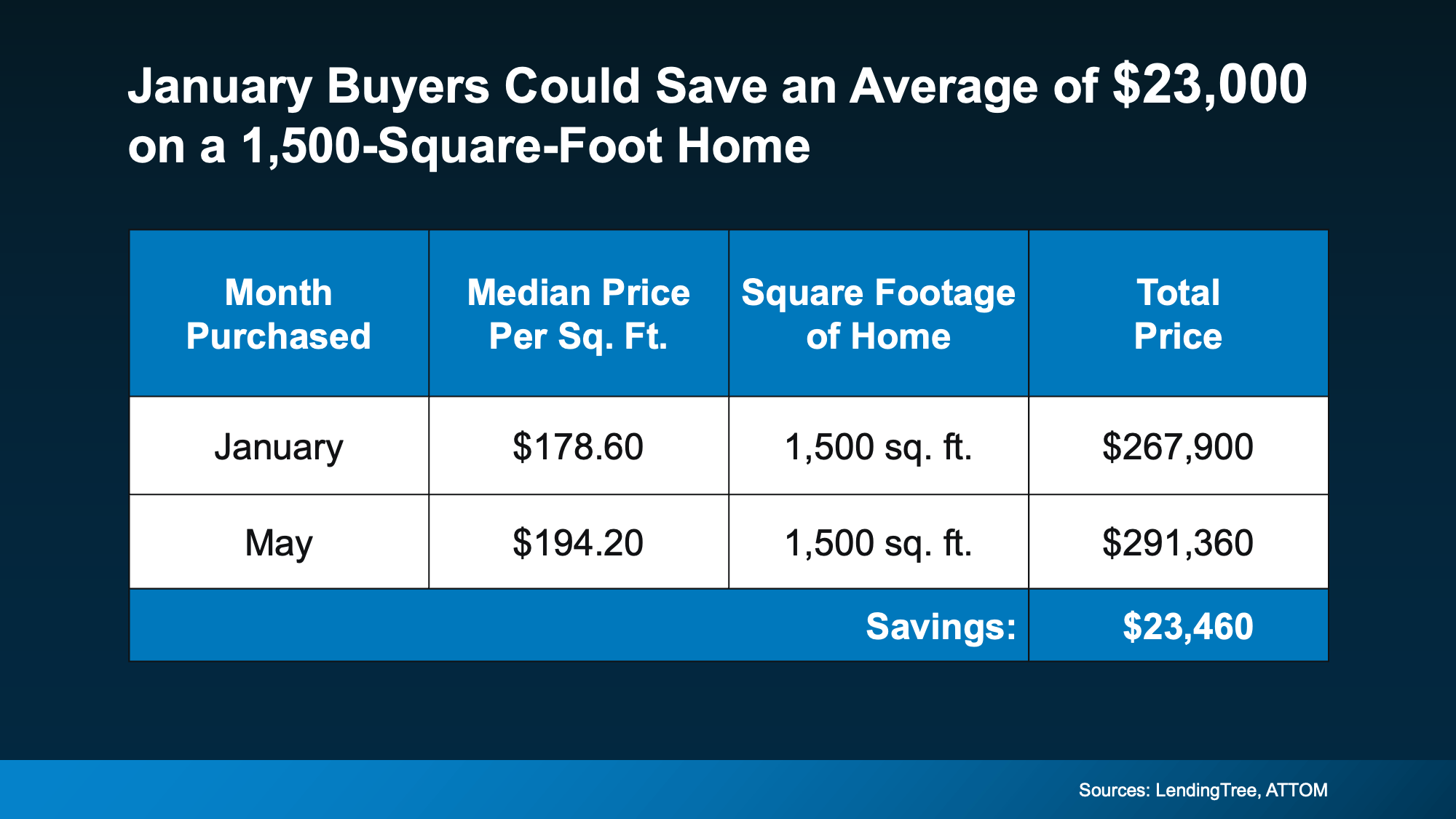

So, how much less are we talking? Here’s a look at the numbers. According to the last full year of data, for the typical 1,500 square foot house, buyers who closed on their home in January paid around $23,000 less compared to those who bought in May. And that general trend typically holds true each year (see chart below):

So, how much less are we talking? Here’s a look at the numbers. According to the last full year of data, for the typical 1,500 square foot house, buyers who closed on their home in January paid around $23,000 less compared to those who bought in May. And that general trend typically holds true each year (see chart below):

Now, your number is going to depend on the price, size, and type of the home you’re buying. But the trend is clear. For today’s buyers, it's meaningful savings, especially when affordability is still tight for so many households.

Now, your number is going to depend on the price, size, and type of the home you’re buying. But the trend is clear. For today’s buyers, it's meaningful savings, especially when affordability is still tight for so many households.

2. Fewer Buyers and More Motivated Sellers

And why do buyers typically save in the winter? It’s simple. Winter is one of the slowest times in the housing market each year. Both buyers and sellers tend to pull back, thinking it’s better to wait until spring. And that means:

- You face less competition

- You’re less likely to get into a multiple offer scenario

- Sellers are more willing to negotiate (since there aren’t as many buyers)

With fewer buyers in the market, you can take your time browsing.

But winter doesn’t just thin out the pool of buyers, it also reveals which sellers truly need to sell. Because fewer people are house hunting during the colder months, sellers who really need to move tend to be more open to negotiating. As Realtor.com explains:

“Less competition means fewer bidding wars and more power to negotiate the extras that add up: closing cost credits, home warranties, even repair concessions. . . these concessions can end up knocking thousands of dollars off the price of a home.”

This can include everything from price cuts to covering closing costs, adjusting timelines, and more. It doesn’t mean you’ll automatically get discounts on every home. But it does mean you’re more likely to be taken seriously and given room to negotiate.

Should You Wait for Spring?

Here’s the real takeaway. When you remove the pressure and frenzy that comes with the busy spring season, it becomes much easier to get the home you want at a price that fits your budget.

But if you wait until spring, more buyers will be in the market. So, waiting could actually mean you spend more and you’d have to deal with more stress.

Now, only you can decide the right timing for your life, but don't assume you should wait for warmer weather before you move.

Buying in January gives you: less competition, potentially lower prices, and more motivated sellers. And those are three perks you’re not going to see if you wait until spring.

Bottom Line

If you’ve been thinking about taking the next step, this season might give you more opportunity than you think.

Curious what buying in January could look like for you? Let’s take a closer look at your numbers and the homes that are available in our area.

Is Buyer Demand Picking Back Up? What Mt. Hood Sellers Should Know.

Is Buyer Demand Picking Back Up? What Sellers Should Know.

The housing market hasn’t felt this energized in a long time – and the numbers backing that up are hard to ignore. Mortgage rates have eased almost a full percentage point this year, and that shift is starting to wake up buyers.

Home loan applications have risen. Activity has picked up. And sellers who step in early could benefit from the momentum long before the competition catches on.

Let’s take a look at what’s happening behind the scenes and how you can take advantage of it.

When Rates Come Down, Buyer Activity Goes Up

In today’s market, buyer demand is closely tied to what happens with mortgage rates. As rates come down, applications for home loans go up. Rick Sharga, Founder and CEO of the CJ Patrick Company, explains it like this:

“We’re in an incredibly rate-sensitive environment today, and every time we’ve seen mortgage rates drop into the low-to-mid 6% range, we’ve seen an influx of buyers hit the market.”

And that’s exactly what the data shows. More people who were sidelined are applying for mortgages again now that borrowing costs have come down. Of course, that’s going to ebb and flow just like rates ebb and flow. But the bigger picture is, there’s been improvement as a whole since rates started coming down.

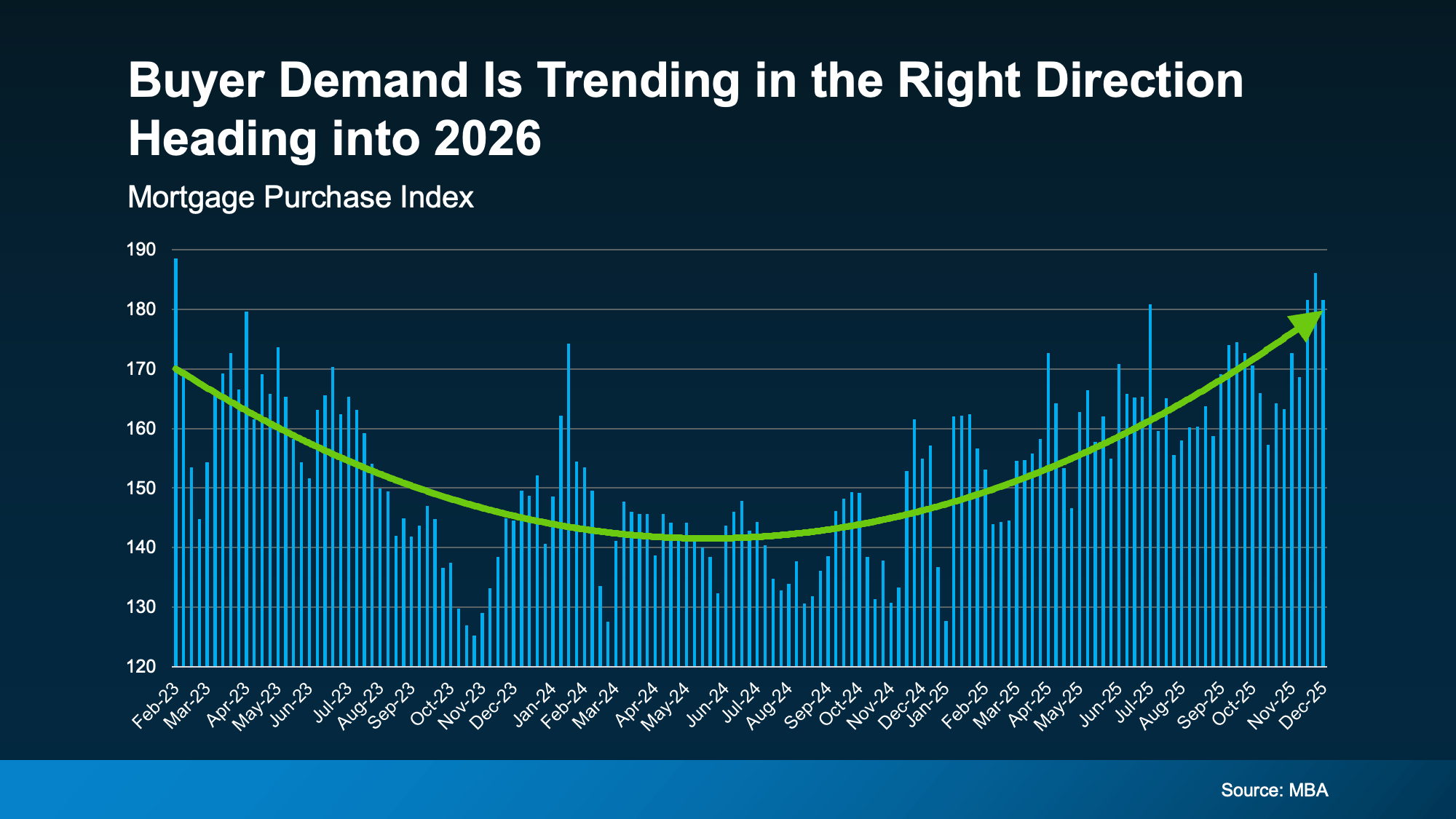

In fact, the Mortgage Bankers Association (MBA) shows the Mortgage Purchase Index is hovering at the highest level so far this year:

And that's not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into 2026:

And that's not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into 2026:

And just in case you were wondering, it’s not just pent-up demand coming out of the government shutdown that slowed some of the processing of government loans for a month or so. If you look back at the last graph, you’ll see the steady build-up of momentum throughout the entire year.

And just in case you were wondering, it’s not just pent-up demand coming out of the government shutdown that slowed some of the processing of government loans for a month or so. If you look back at the last graph, you’ll see the steady build-up of momentum throughout the entire year.

The big takeaway for you is this. Now that rates have come down, buyers are starting to ease back into the game. And that’s turning into real contracts on homes just like yours.

Home Sales Are Rebounding

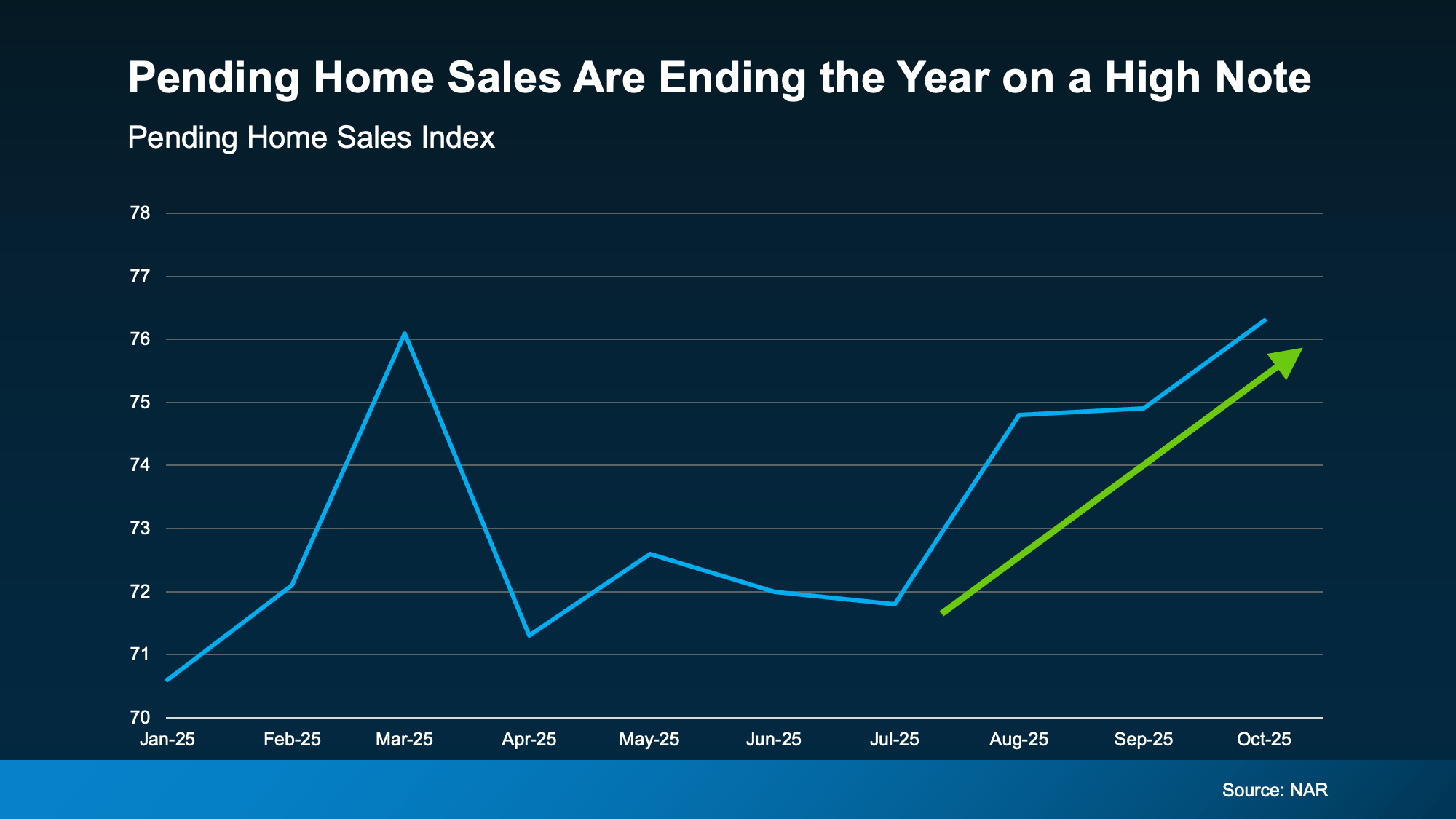

Just to really drive home that this is trending in a good direction, the most recent report from the National Association of Realtors (NAR) shows pending home sales (homes that are under contract) are picking up too. The Pending Home Sales Index is also at the highest it’s been all year (see graph below):

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

Pending home sales are a leading indicator of where actual sales are going. If more homes are going under contract, it’s a good sign more homes will actually close over the next two months, ultimately boosting sales. This could be part of why experts project home sales will inch higher in 2026 than they were in 2025 or in 2024.

Of course, this may ebb and flow a bit as we see some year-end volatility with mortgage rates. But, it shouldn’t be enough to change this overall trend. Expert forecasts say rates should stay pretty much where they are throughout 2026. That means the stage is set for this momentum to continue going into the new year.

What This Means for You

Here’s the opportunity. Selling now means:

- More buyer demand. As affordability improves, you could see more buyer traffic and home showings (if your house is priced and staged right). And the best part? The buyers who are re-engaging feel like they’ve already waited too long for this moment. So, they’ll be eager to move.

- Being ahead of the curve. Listing sooner rather than later puts you ahead of the game, before other sellers realize something's shifted.

Whether you’ve been putting off selling because you thought buyers weren’t buying, or you took your house off the market because you weren’t getting any bites, this is your sign to act.

Bottom Line

Want to know what's happening with buyer activity in our area, and what it could mean if you want to sell your house in the new year?

Let’s talk about getting your house listed in early 2026, so you can take advantage of this momentum building in the market.

Displaying blog entries 11-20 of 784

Categories

- (0)

- Government Camp Real Estate (783)

- Mt Hood Inspiration-Morning Coffee (256)

- Mt. Hood 1031 Tax Exchanges (80)

- Mt. Hood Economic Conditions (853)

- Mt. Hood Local Events (370)

- Mt. Hood Mortgage and Financing Information (432)

- Mt. Hood National Forest Cabins (539)

- Mt. Hood New Properties on Market (311)

- Mt. Hood Sales Information (361)