Price it Right

Selling Your House? Make Sure You Price It Right.

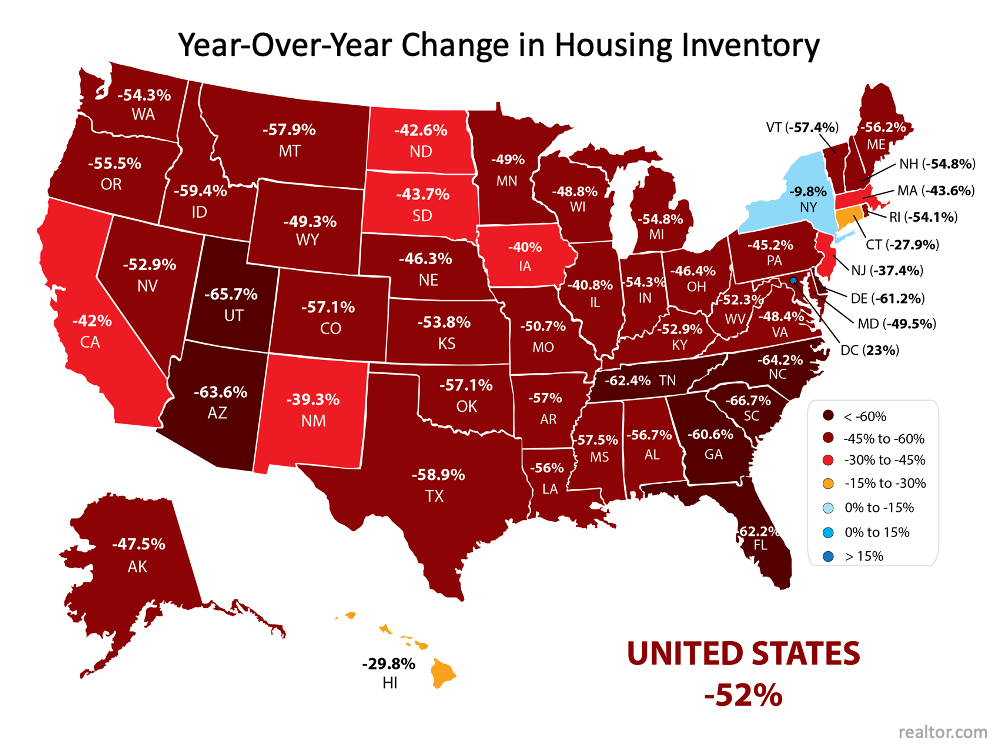

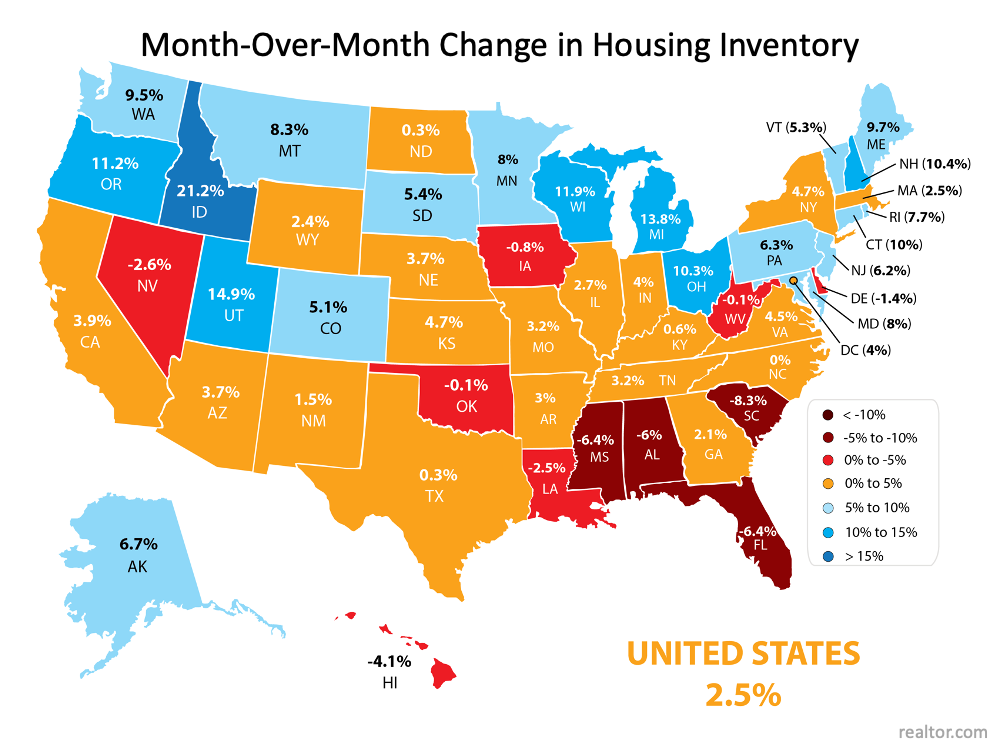

There’s no denying we’re in a sellers’ market. With low inventory and high buyer demand, homes today are selling above the asking price at a record rate. According to the latest Realtors Confidence Index Survey from the National Association of Realtors (NAR):

- Homes typically sell within 17 days (compared to 26 days one year ago).

- The average home sold has five offers to pick from.

- 54% of offers are over the asking price.

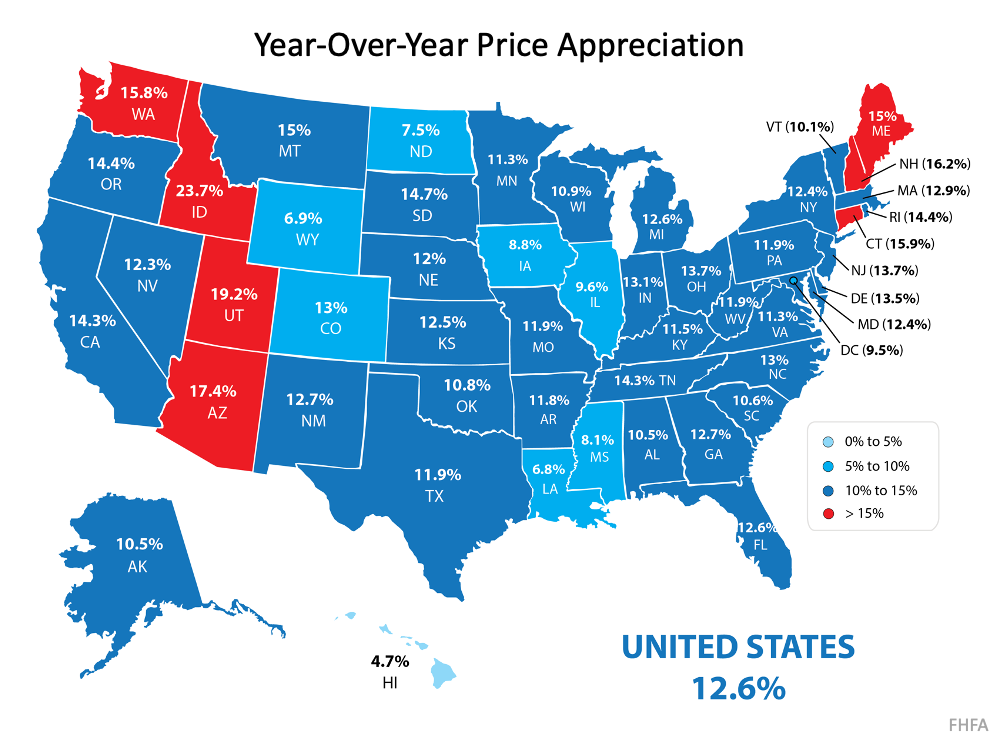

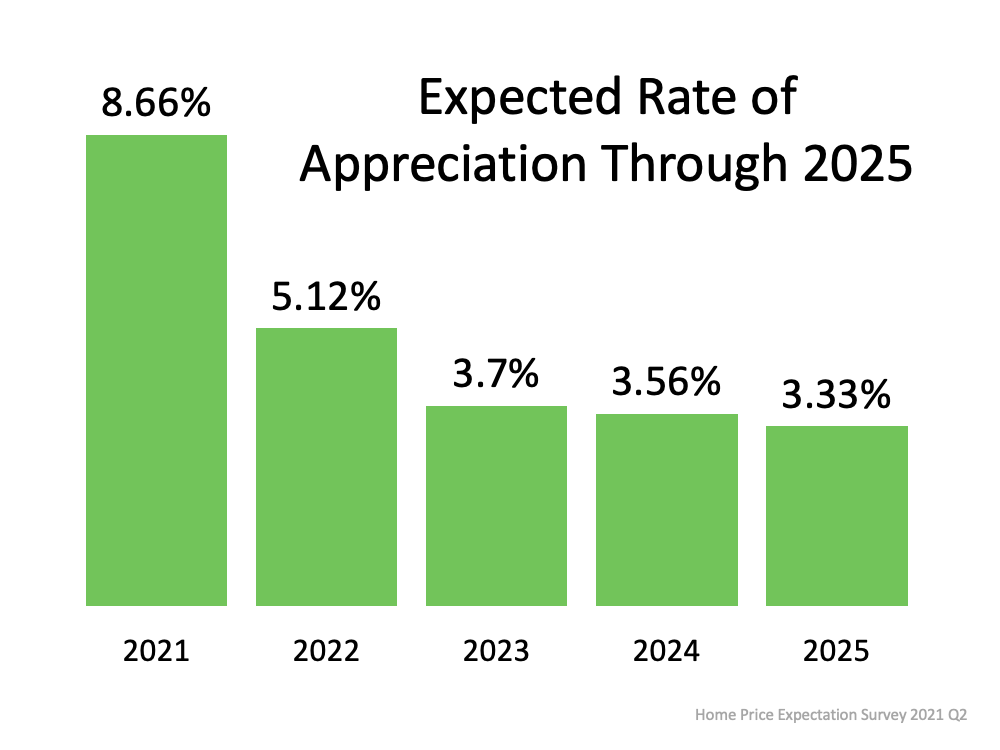

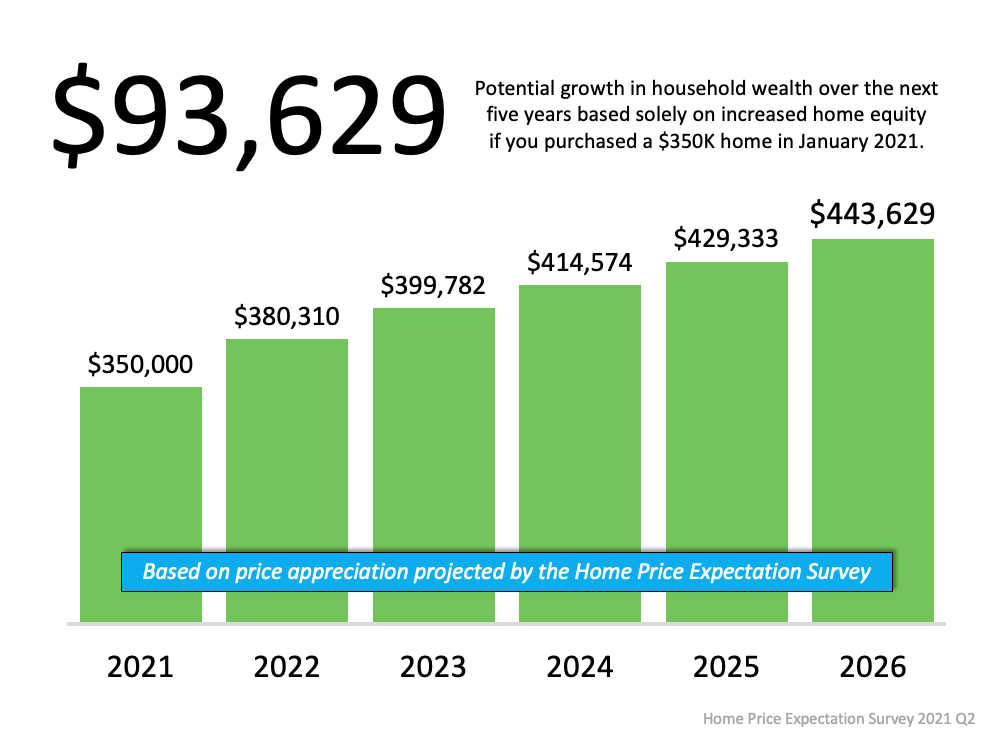

Because so many buyers are competing for so few homes, bidding wars are driving up home prices. According to an average of leading expert projections, existing home prices are expected to increase by 8.9% this year.

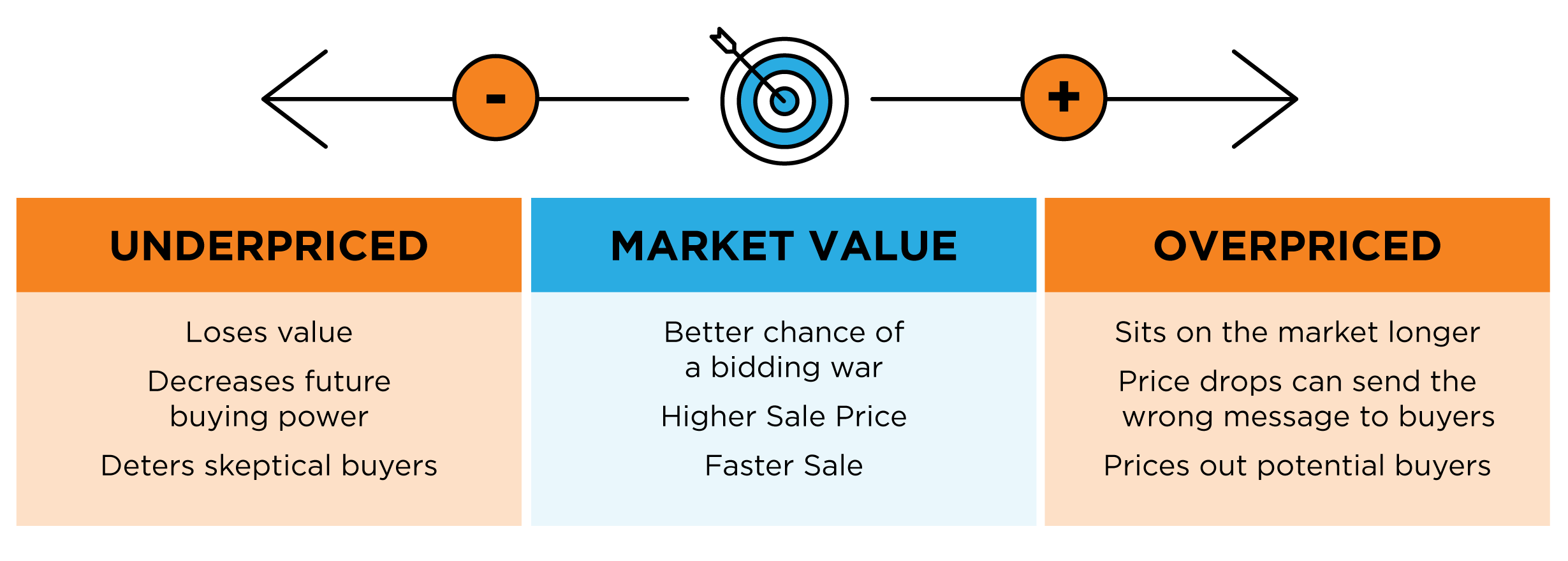

Yet even in today’s red-hot sellers’ market, it’s important to price your house right. While it may be tempting to price your house on the high side to capitalize on this trend, doing so could limit your house’s potential.

Why Pricing Your House Right Matters

Here’s the thing – a high price tag doesn’t mean you’re going to cash in big on the sale. While you may be trying to maximize your return, the tradeoff may be steep. A high list price is more likely to deter buyers, sit on the market longer, or require a price drop that can raise questions among prospective buyers.

Instead, focus on setting a price that’s fair. Real estate professionals know the value of your home. By pricing your house based on its current condition and similar homes that have recently sold in your area, your agent can help you set a price that’s realistic and obtainable – and that’s good news for you and for buyers. When you price your house right, you increase your home’s visibility, which drives more buyers to your front door. The more buyers that tour your home, the more likely you’ll have a multi-offer scenario to create a bidding war. When multiple buyers compete for your house, that sets you up for a bigger win.

When you price your house right, you increase your home’s visibility, which drives more buyers to your front door. The more buyers that tour your home, the more likely you’ll have a multi-offer scenario to create a bidding war. When multiple buyers compete for your house, that sets you up for a bigger win.

Bottom Line

When it comes to pricing your house, working with a local real estate professional is essential. Let’s connect so we can optimize your exposure, your timeline, and the return on your investment, too.

![Homebuyers: Hang in There [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/06/24105823/20210625-MEM-1046x2093.png)