Real Estate Information Archive

Blog

Displaying blog entries 261-270 of 432

Mortgage Deduction Under Attack! Contact Representative Anna Williams

Please share the following link with your friends and family so they can tell their State Legislator to protect the Mortgage Interest Deduction:

https://bit.ly/2MEZZ70

Please attend the House Committee Hearing as well. Submitting your email and testifying will take just a few minutes of your time. We hope you'll help us — and tens of thousands of Oregonians.

Registration link: https://survey.sjc1.qualtrics.com/jfe/form/SV_eA8h0SGRGNOSPZA

Hearing link: https://olis.oregonlegislature.gov/liz/2021R1/Committees/HHOUS/2021-03-11-08-00/Agenda

Testifying is simple. Here are three easy steps:

- Click here and fill out your information. Be sure to select "I want to testify" for HB 2758

- Click "register" and you'll be sent a link to the email address you used

- At 8 a.m on March 11, Log In with the email information they sent and be ready to testify when called upon!

- Representative Anna Williams

What Will Mortgage Rates Do On Mt. Hood in 2021?

Will Low Mortgage Rates Continue through 2021?

.jpeg)

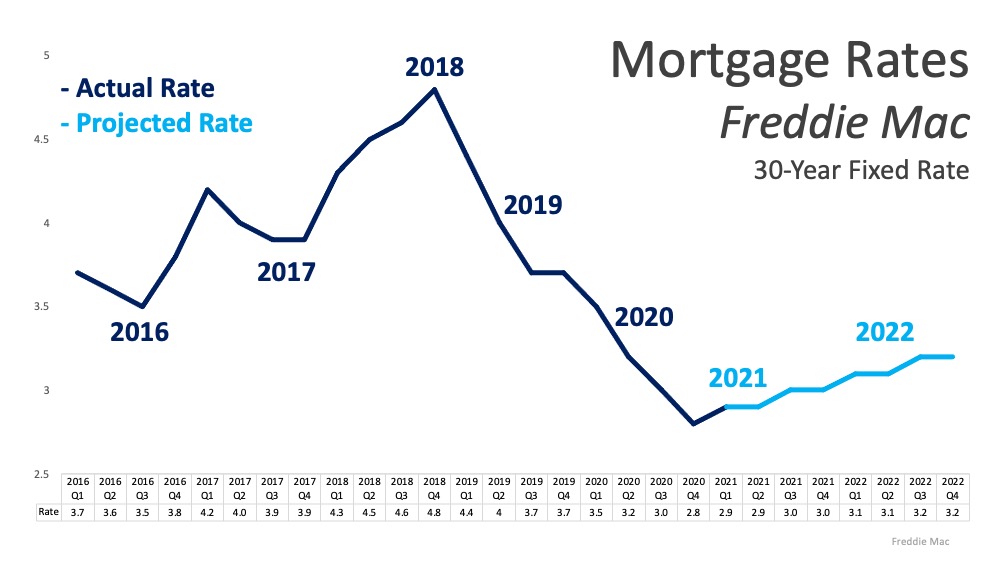

With mortgage interest rates hitting record lows so many times recently, some are wondering if we’ll see low rates continue throughout 2021, or if they’ll start to rise. Recently, Freddie Mac released their quarterly forecast, noting:

“The average 30-year fixed-rate mortgage hit a record low over a dozen times in 2020 and the low interest rate environment is projected to continue through this year. We expect interest rates to average below 3% through the end of 2021. While this is a modest rise from 2020 averages, the recent vote by the Federal Reserve to keep interest rates anchored near zero should keep rates low.”

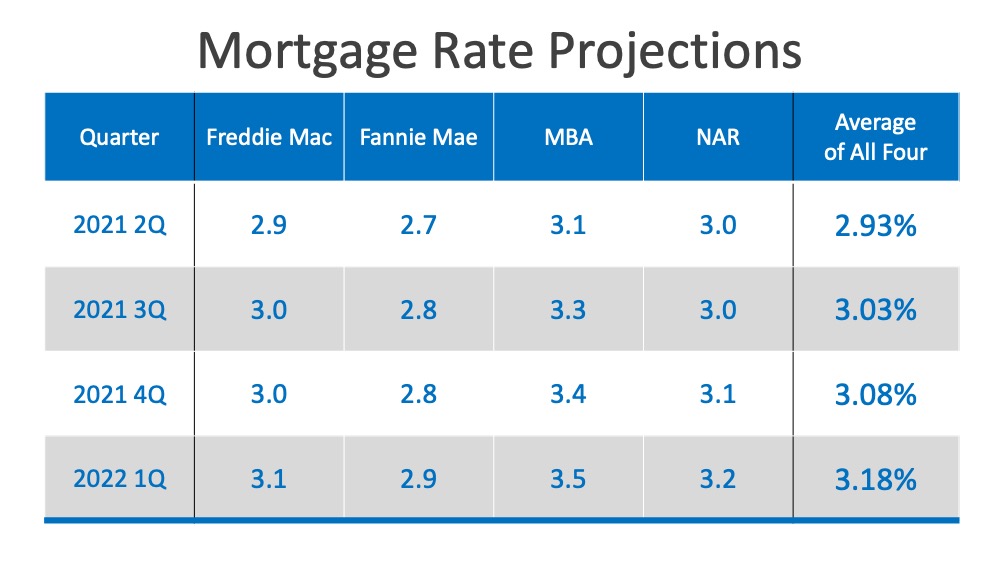

As shown in the graph below, Freddie Mac is projecting low rates going forward with a modest rise that’s expected to continue through 2022. Freddie Mac isn’t the only authority forecasting low rates with a slight rise. Fannie Mae, The Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) also anticipate low rates with a small increase as 2021 continues on. Here’s the quarterly breakdown of their projections and how they’re expected to play out over the next year:

Freddie Mac isn’t the only authority forecasting low rates with a slight rise. Fannie Mae, The Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) also anticipate low rates with a small increase as 2021 continues on. Here’s the quarterly breakdown of their projections and how they’re expected to play out over the next year: It’s important to note that, while a small change in interest rates can have a substantial impact on monthly mortgage payments, these rates are still incredibly low compared to where they were just a couple of years ago.

It’s important to note that, while a small change in interest rates can have a substantial impact on monthly mortgage payments, these rates are still incredibly low compared to where they were just a couple of years ago.

What does this mean for buyers?

Low mortgage rates are creating an outstanding opportunity for current homebuyers to get more for their money while staying within their budget. As the economy gets stronger and we recover from the challenges of 2020, it’s natural for rates to potentially rise in response to a healthier economy. Mark Fleming, Chief Economist at First American, reminds us:

“Rising interest rates reduce house-buying power and affordability, but are often a sign of a strong economy, which increases home buyer demand. By any historic standard, today’s mortgage rates remain historically low and will continue to boost house-buying power and keep purchase demand robust.”

With low rates fueling activity among hopeful buyers, there are a lot of people who are highly motivated and looking for homes to purchase right now. In this environment, it can be challenging to find a home to buy, so a local real estate agent will be key to your success if you’re thinking of buying too. Working with a trusted real estate professional to navigate the process while rates are in your favor might be the best move you can make.

Bottom Line

If you’re ready to buy a home, it may be wise to make your move before mortgage rates begin to rise. Let’s connect to discuss how today’s low rates can create more opportunities for you this year.

We're Not in a Housing Bubble on Mt. Hood

3 Reasons We’re Definitely Not in a Housing Bubble on Mt. Hood

Home values appreciated by about ten percent in 2020, and they’re forecast to appreciate by about five percent this year. This has some voicing concern that we may be in another housing bubble like the one we experienced a little over a decade ago. Here are three reasons why this market is totally different.

1. This time, housing supply is extremely limited

The price of any market item is determined by supply and demand. If supply is high and demand is low, prices normally decrease. If supply is low and demand is high, prices naturally increase.

In real estate, supply and demand are measured in “months’ supply of inventory,” which is based on the number of current homes for sale compared to the number of buyers in the market. The normal months’ supply of inventory for the market is about 6 months. Anything above that defines a buyers’ market, indicating prices will soften. Anything below that defines a sellers’ market in which prices normally appreciate.

Between 2006 and 2008, the months’ supply of inventory increased from just over 5 months to 11 months. The months’ supply was over 7 months in twenty-seven of those thirty-six months, yet home values continued to rise.

Months’ inventory has been under 5 months for the last 3 years, under 4 for thirteen of the last fourteen months, under 3 for the last six months, and currently stands at 1.9 months – a historic low.

Remember, if supply is low and demand is high, prices naturally increase.

2. This time, housing demand is real

During the housing boom in the mid-2000s, there was what Robert Schiller, a fellow at the Yale School of Management's International Center for Finance, called “irrational exuberance.” The definition of the term is, “unfounded market optimism that lacks a real foundation of fundamental valuation, but instead rests on psychological factors.” Without considering historic market trends, people got caught up in the frenzy and bought houses based on an unrealistic belief that housing values would continue to escalate.

The mortgage industry fed into this craziness by making mortgage money available to just about anyone, as shown in the Mortgage Credit Availability Index (MCAI) published by the Mortgage Bankers Association. The higher the index, the easier it is to get a mortgage; the lower the index, the more difficult it is to obtain one. Prior to the housing boom, the index stood just below 400. In 2006, the index hit an all-time high of over 868. Again, just about anyone could get a mortgage. Today, the index stands at 122.5, which is well below even the pre-boom level.

In the current real estate market, demand is real, not fabricated. Millennials, the largest generation in the country, have come of age to marry and have children, which are two major drivers for homeownership. The health crisis is also challenging every household to redefine the meaning of “home” and to re-evaluate whether their current home meets that new definition. This desire to own, coupled with historically low mortgage rates, makes purchasing a home today a strong, sound financial decision. Therefore, today’s demand is very real.

Remember, if supply is low and demand is high, prices naturally increase.

3. This time, households have plenty of equity

Again, during the housing boom, it wasn’t just purchasers who got caught up in the frenzy. Existing homeowners started using their homes like ATM machines. There was a wave of cash-out refinances, which enabled homeowners to leverage the equity in their homes. From 2005 through 2007, Americans pulled out $824 billion dollars in equity. That left many homeowners with little or no equity in their homes at a critical time. As prices began to drop, some homeowners found themselves in a negative equity situation where the mortgage was higher than the value of their home. Many defaulted on their payments, which led to an avalanche of foreclosures.

Today, the banks and the American people have shown they learned a valuable lesson from the housing crisis a little over a decade ago. Cash-out refinance volume over the last three years was less than a third of what it was compared to the 3 years leading up to the crash.

This conservative approach has created levels of equity never seen before. According to Census Bureau data, over 38% of owner-occupied housing units are owned ‘free and clear’ (without any mortgage). Also, ATTOM Data Solutions just released their fourth quarter 2020 U.S. Home Equity Report, which revealed:

“17.8 million residential properties in the United States were considered equity-rich, meaning that the combined estimated amount of loans secured by those properties was 50 percent or less of their estimated market value…The count of equity-rich properties in the fourth quarter of 2020 represented 30.2 percent, or about one in three, of the 59 million mortgaged homes in the United States.”

If we combine the 38% of homes that are owned free and clear with the 18.7% of all homes that have at least 50% equity (30.2% of the remaining 62% with a mortgage), we realize that 56.7% of all homes in this country have a minimum of 50% equity. That’s significantly better than the equity situation in 2008.

Bottom Line

This time, housing supply is at a historic low. Demand is real and rightly motivated. Even if there were to be a drop in prices, homeowners have enough equity to be able to weather a dip in home values. This is nothing like 2008. In fact, it’s the exact opposite.

What's the Truth About Downpayments To Buy Your Mt. Hood Home?

Appraisals Vs. Home Inspections on Mt. Hood

What’s the Difference between an Appraisal and a Home Inspection?

If you’re planning to buy a home, an appraisal is an important step in the process. It’s a professional evaluation of the market value of the home you’d like to buy. In most cases, an appraisal is ordered by the lender to confirm or verify the value of the home prior to lending a buyer money for the purchase. It’s also a different step in the process from a home inspection, which assesses the condition of the home before you finalize the transaction. Here’s the breakdown of each one and why they’re both important when buying a home.

Home Appraisal

The National Association of Realtors (NAR) explains:

“A home purchase is typically the largest investment someone will make. Protect yourself by getting your investment appraised! An appraiser will observe the property, analyze the data, and report their findings to their client. For the typical home purchase transaction, the lender usually orders the appraisal to assist in the lender’s decision to provide funds for a mortgage.”

When you apply for a mortgage, an unbiased appraisal (which is required by the lender) is the best way to confirm the value of the home based on the sale price. Regardless of what you’re willing to pay for a house, if you’ll be using a mortgage to fund your purchase, the appraisal will help make sure the bank doesn’t loan you more than what the home is worth.

This is especially critical in today’s sellers’ market where low inventory is driving an increase in bidding wars, which can push home prices upward. When sellers are in a strong position like this, they tend to believe they can set whatever price they want for their house under the assumption that competing buyers will be willing to pay more.

However, the lender will only allow the buyer to borrow based on the value of the home. This is what helps keep home prices in check. If there’s ever any confusion or discrepancy between the appraisal and the sale price, your trusted real estate professional will help you navigate any additional negotiations in the buying process.

Home Inspection

Here’s the key difference between an appraisal and an inspection. MSN explains:

“In simplest terms, a home appraisal determines the value of a home, while a home inspection determines the condition of a home.”

The home inspection is a way to determine the current state, safety, and condition of the home before you finalize the sale. If anything is questionable in the inspection process – like the age of the roof, the state of the HVAC system, or just about anything else – you as a buyer have the option to discuss and negotiate any potential issues or repairs with the seller before the transaction is final. Your real estate agent is a key expert to help you through this part of the process.

Bottom Line

The appraisal and the inspection are critical steps when buying a home, and you don’t need to manage them by yourself. Let’s connect today so you have the expert guidance you need to navigate through the entire home buying process.

Displaying blog entries 261-270 of 432

Categories

- (0)

- Government Camp Real Estate (781)

- Mt Hood Inspiration-Morning Coffee (256)

- Mt. Hood 1031 Tax Exchanges (80)

- Mt. Hood Economic Conditions (851)

- Mt. Hood Local Events (369)

- Mt. Hood Mortgage and Financing Information (430)

- Mt. Hood National Forest Cabins (537)

- Mt. Hood New Properties on Market (311)

- Mt. Hood Sales Information (361)