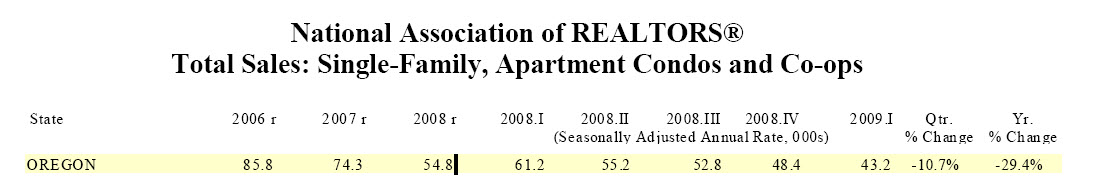

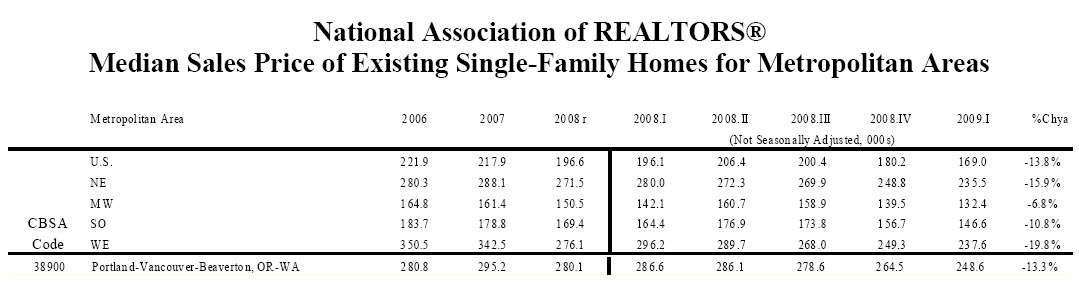

What are predictions for the 2009 market on Mt. Hood? Well, it isn’t easy to come up with a steadfast answer on this one. Nationally many experts are predicting things will turn around in the second half of the year.

The Case-Shiller pricing index tells us that in at least 20 metro areas prices are currently at March 2004 levels- down about 18%. More foreclosures than 2008 will hit the market due to adjusting adjustable mortgages. We are seeing a few foreclosures and short sales hit our mountain market.

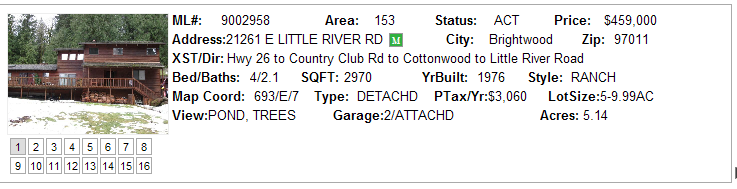

Here is a short sale that popped up today. Five acres of land, which typically can’t be found for under $200,000 with a large home for less than $500,000

The greatest percentage of sales in our local market is the second home sales. As discretionary income for this purchase, folks have the option to wait and buy at their leisure. Considering the limited amount of land the mountain has to offer for ownership, there couldn’t be a better time to take advantage of this inventory with future population impacts coming to the Portland metro area.

Historically we usually don’t see the unique combination of low home prices and low interest rates so this is an exceptional time to invest in the mountain. Typically interest rates are higher when home prices are low and some buyers are recognizing this fact.

Keep checking back to see how this year unfolds!