Camp Creek Fire Update

|

Displaying blog entries 141-150 of 1911

|

The National Association of Realtors (NAR) is set to release its most recent Existing Home Sales (EHS) report tomorrow. This monthly release provides information on the volume of sales and price trends for homes that have previously been owned. In the upcoming release, it’ll likely say home prices are down. This may seem a bit confusing, especially if you’ve been following along and reading the blogs saying home prices have hit the bottom and have since rebounded.

So, why would this say home prices are falling when so many other price reports say they’re going back up? It all depends on the methodology of each one. NAR reports on the median home sales price, while some other sources use repeat sales prices. Here’s how those approaches differ.

The Center for Real Estate Studies at Wichita State University explains median sales prices like this:

“The median sale price measures the ‘middle’ price of homes that sold, meaning that half of the homes sold for a higher price and half sold for less . . . For example, if more lower-priced homes have sold recently, the median sale price would decline (because the “middle” home is now a lower-priced home), even if the value of each individual home is rising.”

Investopedia helps define what a repeat sales approach means:

“Repeat-sales methods calculate changes in home prices based on sales of the same property, thereby avoiding the problem of trying to account for price differences in homes with varying characteristics.”

As the quotes above say, the approaches can tell different stories. That’s why median home sales price data (like EHS) may say prices are down, even though the vast majority of the repeat sales reports show prices are appreciating again.

Bill McBride, Author of the Calculated Risk blog, sums the difference up like this:

“Median prices are distorted by the mix and repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices.”

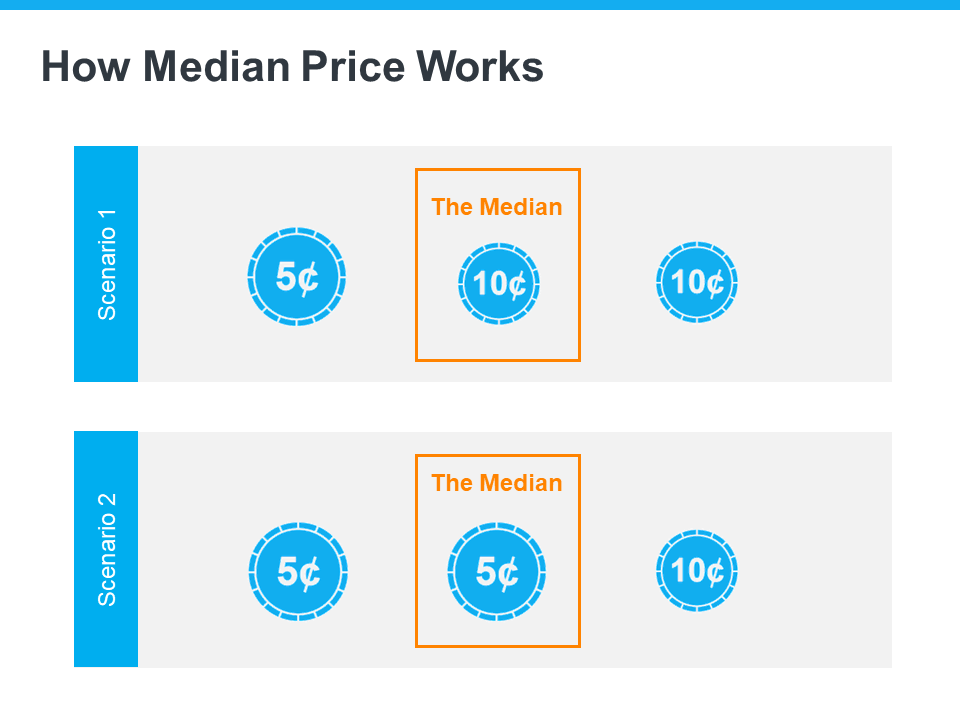

To drive this point home, here’s a simple explanation of median value (see visual below). Let’s say you have three coins in your pocket, and you decide to line them up according to their value from low to high. If you have one nickel and two dimes, the median value (the middle one) is 10 cents. If you have two nickels and one dime, the median value is now five cents.

In both cases, a nickel is still worth five cents and a dime is still worth 10 cents. The value of each coin didn’t change.

In both cases, a nickel is still worth five cents and a dime is still worth 10 cents. The value of each coin didn’t change.

That’s why using the median home sales price as a gauge of what’s happening with home values may be confusing right now. Most buyers look at home prices as a starting point to determine if they match their budgets. But most people buy homes based on the monthly mortgage payment they can afford, not just the price of the house. When mortgage rates are higher, you may have to buy a less expensive home to keep your monthly housing expense affordable.

That’s why a greater number of ‘less-expensive’ houses are selling right now – and that’s causing the median home sales price to decline. But that doesn’t mean any single house lost value.

When you see the stories in the media that prices are falling later this week, remember the coins. Just because the median home sales price changes, it doesn’t mean home prices are falling. What it means is the mix of homes being sold is being impacted by affordability and current mortgage rates.

For a more in-depth understanding of home price trends and reports, let’s connect.

Here's the latest announcement:

Board holding public hearings for short-term rental regulations. Public strongly encouraged to provide feedback; Rules would affect STRs in unincorporated areas The Board of County Commissioners has approved moving forward with a public hearing process to consider implementing rules and regulations regarding short-term rentals (STRs).

This action triggers two future public hearings on the proposed regulations. The next hearing is slated for during the board’s regular weekly Business Meeting September 7th at 10:00 a.m. The public is encouraged to provide testimony at these hearings. Residents and interested parties can do so either in-person or over Zoom. If the County Code is amended, the regulations will take effect only within the unincorporated areas of Clackamas County – there would be no effect on STRs located within city limits.

This program is considered to be a pilot program, and would be in effect for two years from the time of being enacted. Proposed changes Clackamas County currently has no STR regulations. Proposed regulations would require all STRs in unincorporated Clackamas County to register with the county. The process would be free and an in-home inspection would not be required.

When registering, the property owner and/or manager would certify that the property meets safety standards and that they will abide by the STR program rules. These include, but are not limited to: STR owners will continue to pay the county’s transient lodging tax (6%) The proposed STR regulations impose a .85% user fee on the total rental amount No STR may be publicly advertised for rent unless it has been registered with Clackamas County STRs shall comply with all building and fire standards STR registration identification numbers shall be included on any advertisement or rental platform Name/contact information of a party responsible for the STR shall be posted at all times while paying guests are on the property, in an area and size readily visible from the nearest public roadway. That person/company must be available 24/7 and able to respond to complaints within two hours. The number of STR occupants shall not exceed the number authorized in the registration. Twelve occupants is the maximum. Notice shall be clearly posted in the STR that identifies and informs occupants of the county's noise control ordinance Adequate parking – one off-street motor vehicle space per sleeping area – is required Vehicles shall never block access for emergency vehicles, access to the premise, or a parked motor vehicle. These violations, or other parking performed in a manner that violates the county's current parking and towing ordinance standards, may subject the offending vehicle to immediate tow. The proposed STR regulations do not apply to hotels, motels, bed and breakfast facilities, hostels, campgrounds, recreational vehicle camping facilities, or organizational camps

Violations

Clackamas County encourages any residents/parties to cooperate directly to resolve conflicts arising from an STR. First attempts to remedy violations should be to contact the posted STR representative. If that person does not respond within 24 hours or does not adequately remedy the issue, the county should be notified. Further details: Clackamas County reserves the right to immediately revoke registration if it determines an STR is a fire or life safety risk Clackamas County reserves the right to review pertinent financial records or visit the STR to ensure violations have been resolved at any reasonable time When noncompliance of the STR regulation is suspected, the county shall issue two warnings in writing An owner that operates an STR without an approved registration or while suspended shall be subject to penalties Next steps As this action is a potential county ordinance change, two public hearings at least 13 days apart are required. After that time if passed, the ordinance would be effective after 90 days or immediately if the Board declared an emergency. Before going into effect, the county would post the registration application online.

Interested parties can provide testimony during the public hearings at the two Business Meetings, and can also submit written comments for the record to [email protected] with the subject line “STR Regulation Comments.” The full proposed regulations can be found online. STR owners and interested parties with questions can contact:

Policy Advisors Caroline Hill or Everett Wild at

or

Future updates about the project and public hearings can be found at

.

Wondering if it still makes sense to sell your house right now? The short answer is, yes. Especially if you consider how few homes there are for sale today.

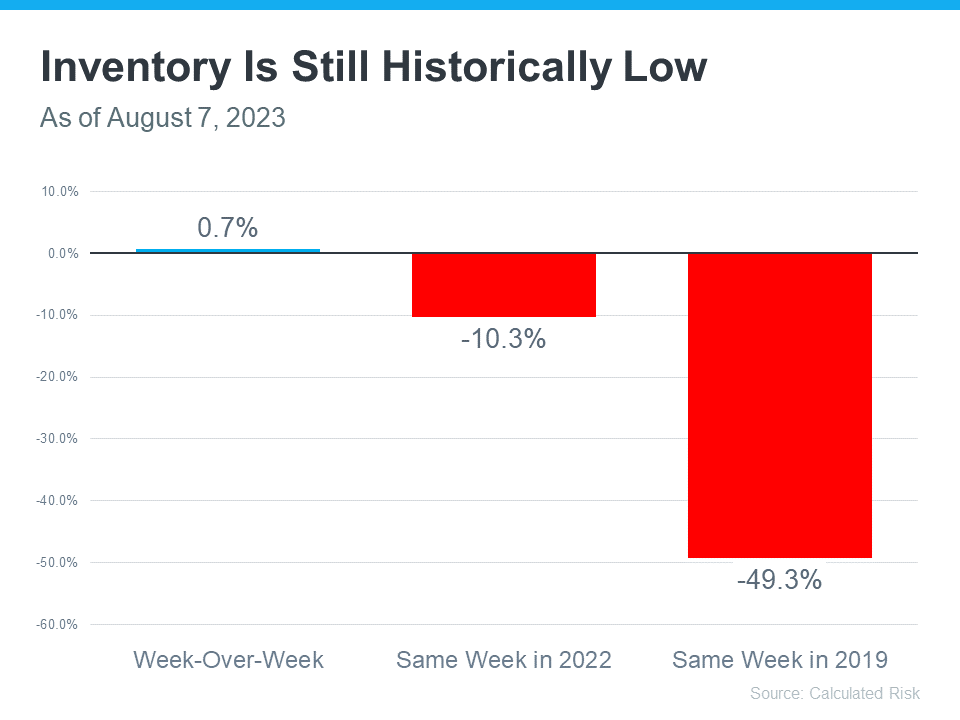

You may have heard inventory is low right now, but you may not fully realize just how low or why that’s a perk when you go to sell your house. This graph from Calculated Risk can help put that into perspective:

As the graph shows, while housing inventory did grow slightly week-over-week (shown in the blue bar), overall supply is still low (shown in the red bars). Compared to the same week last year, supply is down roughly 10% – and it was already considered low at that time. But, if you look further back, you’ll see inventory is down even more significantly.

As the graph shows, while housing inventory did grow slightly week-over-week (shown in the blue bar), overall supply is still low (shown in the red bars). Compared to the same week last year, supply is down roughly 10% – and it was already considered low at that time. But, if you look further back, you’ll see inventory is down even more significantly.

To gauge just how far off from normal today’s inventory is, let’s compare right now to 2019 (the last normal year in the market). When you compare the same week this year with the matching week in 2019, supply is about 50% lower. That means there are half the homes for sale now than there’d usually be.

The key takeaway? We’re still nowhere near what’s considered a balanced market. There’s plenty of demand for your house because there just aren’t enough homes to go around. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“There are simply not enough homes for sale. The market can easily absorb a doubling of inventory.”

So, if you want to list your house, know that there’s only about half the inventory there’d usually be in a more normal year. That means your house will be in the spotlight if you sell now and you may see multiple offers and a fast home sale.

With the number of homes for sale roughly half of what there’d usually be in a more normal year, you can rest assured there’s demand for your house. If you want to sell, let’s connect now so your house can shine above the rest while inventory is so low.

While this isn’t the frenzied market we saw during the ‘unicorn’ years, homes that are priced right are still selling quickly and seeing multiple offers right now. That’s because the number of homes for sale is still so low. Data from the National Association of Realtors (NAR) shows 76% of homes sold within a month and the average saw 3.5 offers in June.

To set yourself up to see advantages like these, you need to rely on an agent. Only an agent has the expertise needed to find the right asking price for your house. Here’s what’s at stake if that price isn’t accurate for today’s market value.

Price it too low and you might raise questions about your home’s condition or lead buyers to assume something is wrong with it. Not to mention, if you undervalue your house, you could leave money on the table, which decreases your future buying power.

On the other hand, price it too high and you run the risk of deterring buyers from ever touring it in the first place. When that happens, you may have to do a price drop to try to re-ignite interest in your house when it sits on the market for a while. But be aware that a price drop can be seen as a red flag for some buyers who will wonder why the price was reduced and what that means about the home.

A recent article from NerdWallet sums it up like this:

"Your house’s market debut is your first chance to attract a buyer and it’s important to get the pricing right. If your home is overpriced, you run the risk of buyers not seeing the listing . . . But price your house too low and you could end up leaving some serious money on the table. A bargain-basement price could also turn some buyers away, as they may wonder if there are any underlying problems with the house."

Think of pricing your home as a target. Your goal is to aim directly for the center – not too high, not too low, but right at market value.

Pricing your house fairly based on market conditions increases the chance you’ll have more buyers who are interested in purchasing it. That makes it more likely you’ll see multiple offers too. Plus, when homes are priced right, they still tend to sell quickly.

To get a high-level look into the potential downsides of over or underpricing your house and the perks that come with pricing it at market value, see the chart below:

So why is an agent essential in finding the right price? Your local agent has the skill and the insight necessary to find the market value of your home. They’ll use their expertise to determine a realistic listing price by assessing:

Pricing your house at market value is critical, so don’t rely on guesswork. Let’s connect to make sure your house is priced right for today’s market.

.jpeg)

$479,950

.jpeg)

.jpeg)

If you're looking for a top location on Still Creek with a beautiful cabin and an open floor plan, soaring windows, fireplace and wood stove, you've come to the right spot. A "TEN" location just steps to the water with an easy to get to wading spot. Comes furnished too!The cabin boasts a bedroom and bath on the main level with slider to the outside deck. Upstairs is a very spacious loft and two bedrooms with multiple beds and another bathroom! You can really sleep a lot of folks in this cabin and the convenience of a bath on each level is a huge bonus. Speaking of bonus, you can have internet at this location just in case you need to work remotely. The great room features vaulted ceilings with floor to ceiling windows in the living room, wood floors, stone fireplace and toe warming wood stove for cool nights. Recent upgrades include mini splits, new stainless steel appliances, quartz counters and tile flooring! There's even a washer and dryer in the mud room!Comes completely furnished too. The creekside deck is huge and sunny. It?s perfect for summer barbecues. Watch the salmon spawning in the fall from your deck. Still Creek is dog and kid friendly compared to other Mt. Hood waterways. It's rated #1 locally. The Rhododendron location is private and on a gated shared driveway. This spot is only 20 minutes to the slopes of Mt. Hood for skiing and snow boarding. Hike and mountain bike in the Mt. Hood National Forest out your front door. You can even walk to grocery stores, coffee and restaurants from this location. leased land cabins may not be used as primary residence or airbnb rentals. Only an hour from Portland and the airport, this is one of the nicest getaways you can find on Mt. Hood!

While the wild ride that was the ‘unicorn’ years of housing is behind us, today’s market is still competitive in many areas because the supply of homes for sale is still low. If you’re looking to buy a home this season, know that the peak frenzy of bidding wars is in the rearview mirror, but you may still come up against some multiple-offer scenarios.

Here are a few things to consider to help you put your best foot forward when making an offer on a home.

Rely on an agent who can support your goals and help you understand what’s happening in today’s housing market. Agents are experts in the local market and on the national trends too. They’ll use both of those areas of expertise to make sure you have all the information you need to move with confidence.

Plus, they know what’s worked for other buyers in your area and what sellers may be looking for in an offer. It may seem simple, but catering to what a seller needs can help your offer stand out. As an article from Forbes says:

"Getting to know a local realtor where you’re hoping to buy can also potentially give you a crucial edge in a tight housing market."

Having a clear budget in mind is especially important right now given the current affordability challenges. The best way to get a clear picture of what you can borrow is to work with a lender so you can get pre-approved for a home loan.

That’ll help you be more financially confident because you’ll have a better understanding of your numbers. It shows sellers you’re serious, too. And that can give you a competitive edge if you do get into a multiple-offer scenario.

It’s only natural to want the best deal you can get on a home. However, submitting an offer that’s too low does have some risks. You don’t want to make an offer that will be tossed out as soon as it’s received just to see if it sticks. As Realtor.com explains:

“. . . an offer price that’s significantly lower than the listing price, is often rejected by sellers who feel insulted . . . Most listing agents try to get their sellers to at least enter negotiations with buyers, to counteroffer with a number a little closer to the list price. However, if a seller is offended by a buyer or isn’t taking the buyer seriously, there’s not much you, or the real estate agent, can do.”

The expertise your agent brings to this part of the process will help you stay competitive and find a price that’s fair to you and the seller.

During the ‘unicorn’ years of housing, some buyers skipped home inspections or didn’t ask for concessions from the seller in order to submit the winning bid on a home. An article from Bankrate explains this isn’t happening as often today, and that’s good news:

“While the market has largely calmed down since then, sellers are still very much in the driver’s seat in this era of scarce housing inventory. It’s not as common for buyers to waive inspections anymore, but it does still happen. . . . It’s in the buyer’s best interest to have a home inspected . . . Inspections alert you to existing or potential problems with the home, giving you not just an early heads up but also a useful negotiating tactic.”

Fortunately, today’s market is different, and you may have more negotiating power than before. When putting together an offer, your trusted real estate advisor will help you think through what levers to pull and which ones you may not want to compromise on.

When you buy a home this summer, let’s connect so you have an expert on your side who can help you make your best offer.

Displaying blog entries 141-150 of 1911