- Disclaimer: This guide is not meant to be a resource for tax advice but instead a resource for basic information concerning only certain aspects of the new tax code and how they may impact the real estate market. You should get tax advice from your accountant or tax preparer who will explain how the entire tax code will affect your personal return.

This information comes immediately after the new tax code became law. Some of the information may be revised as the analysis of the new law evolves.

When the tax code was originally being overhauled by the House and the Senate, there were three major proposals being considered that would have substantially impacted the residential real estate market:

- Changing the requirements for the exclusion of gain on the sale of a principal residence

- The reduction on the limit of the Mortgage Interest Deduction (MID)

- The elimination of the State and Local Tax deduction (SALT) which includes property taxes

Let’s look how the tax code has evolved from the original proposal, and decipher what impact experts believe it may have on the housing market.

1. Exclusion of gain on sale of a principal residence

Original Proposal: Owners would need to live in their house for at least 5 out of the last 8 years to claim this exemption. Under the former tax framework, a typical owner, who has lived in their house for at least 2 years out of the last 5 years, would pay nothing in capital gain taxes if they sell the house.

The New Tax Code: No change. The “at least 2 years out of the last 5 years” requirement is unchanged.

Impact on the Market: None.

2. Mortgage Interest Deduction

Original Proposal: Reduce the limit on the mortgage interest deduction (MID) amount from $1,000,000 to $500,000.

The New Tax Code: Reduces limit on deductible mortgage debt to $750,000 for new loans taken out after 12/14/17. Current loans up to $1 million are grandfathered.

Impact on the Market: Assuming a 20% down payment, this reduction in the MID will impact buyers that are purchasing a home between the prices of $938,000 and $1,250,000. Any home under the lower price is still covered and any home over the higher price was not covered under the former tax code either.

What does that mean to the market? Experts disagree. Calculated Risk’s Bill McBride:

“I think the impact of reducing the MID from a maximum of $1 million in mortgage debt to $750 thousand in mortgage debt will have very little impact on the housing market.”

On the other hand, Capital Economics claims:

“The impact on expensive homes could be detrimental, with a limit on the mortgage interest deduction raising taxes for those that itemize.”

3. State and Local Taxes (SALT)

Original Proposal: The elimination of the state and local tax deduction (which includes property taxes).

The New Tax Code: Allows an itemized deduction of up to $10,000 for the total of state and local property taxes and income or sales taxes.

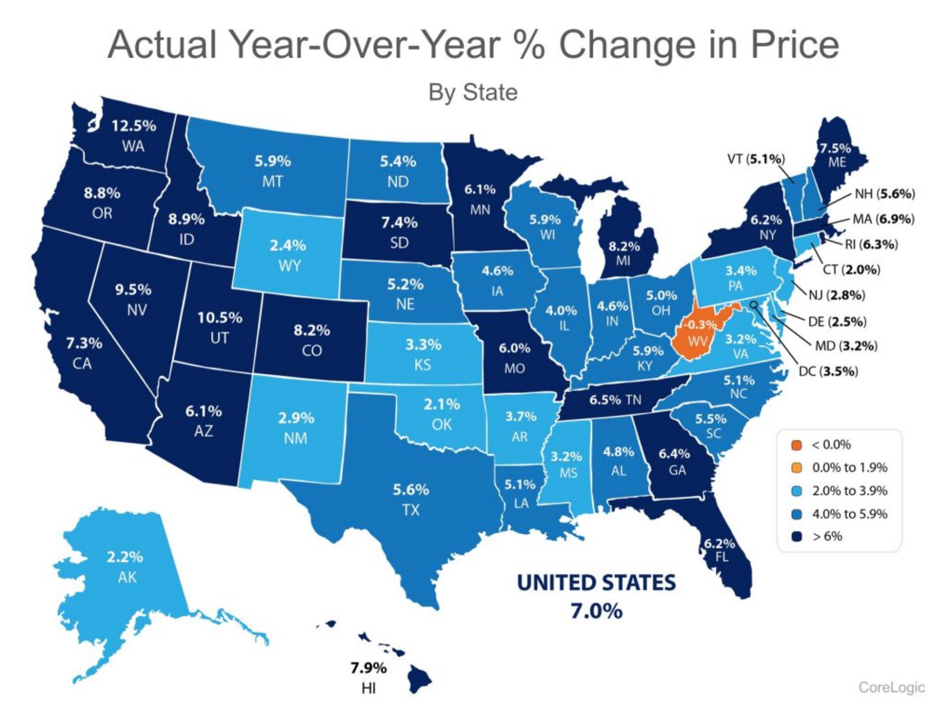

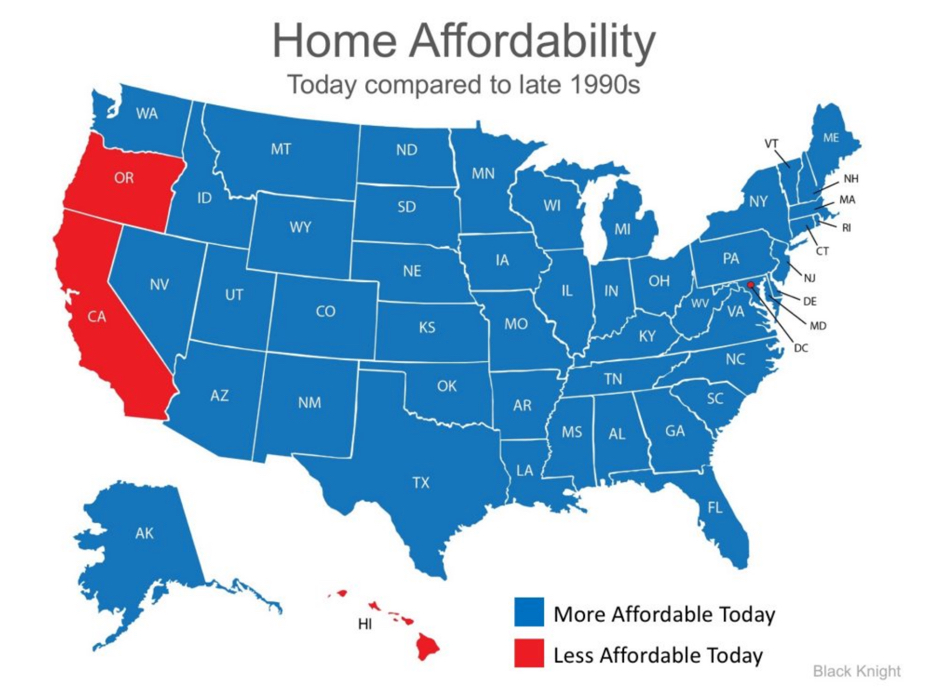

Impact on the Market: Most experts agree that higher taxed regions will be impacted as homeowners in those communities now have a cap on these deductions.

Calculated Risk’s Bill McBride stated:

“SALT will have an impact on housing in some areas. Some people might choose to live in one state over another (if they have a choice), based on taxation. This could impact demand in certain states – especially for the middle and upper-middle class homeowners.”

Mark Zandi of Moody’s Analytics said:

“The impact on house prices is much greater for higher-priced homes, especially in parts of the country where incomes are higher and there are thus a disproportionate number of itemizers, and where homeowners have big mortgages and property tax bills.”

What will be the overall impact on the housing market?

For most of the country, the new tax code will not have a negative impact on the market. As Capital Economics reports:

“Given most households will see an overall tax cut, and potential buyers are likely to put that saving towards their home, we doubt it will have a significant detrimental impact on the housing market.”

There is also no doubt that some higher priced, higher taxed regions will be affected more than others. However, most experts agree that other portions of the tax code will favor the high-end buyer and seller, and this might mitigate many concerns. McBride explains:

“The corporate tax cuts (and other tax cuts) will mostly benefit the wealthy, and this will be a positive for high end real estate.”

What does this all mean to you?

To know for sure, you should sit with your accountant or financial planner and explore how all the aspects of the new code will impact your family.

Most families consider homeownership an essential part of the American Dream, and don’t purchase a home based solely on the tax advantages. The main reasons they buy a home are personal (they just got married, they are looking for a good place to raise children, they want to be near friends and family, they want to better enjoy their retirement, etc.). This will never change.

Looking at the new tax code, Mr. McBride’s opinion makes the most sense:

“There will be some negative impact based on SALT, but overall the impact of these policy changes on housing will be minimal.”