What Experts Are Saying About Interest Rates

Displaying blog entries 1-3 of 3

Is this the perfect buying opportunitiy? Motivated sellers left and right and some of the best interest rates in 50 years? Sellers with their properties on the market right now going into winter are the most serious sellers of all!

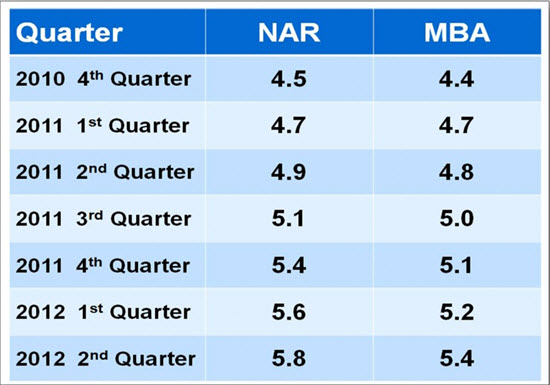

Rates can't be beat! Here are the predictions from the National Association of Realtors and the Mortgage Broker's Assocation for the next year plus:

So, to keep your monthly payment low and manageable, now is the time to make that purchase because even if prices go down, your monthly payment will be fixed at a lower unbelievable rate.

Why did interest rates pop up a quarter of a percent the past week? We were floating along at around 5% and now we are around 5.25% for a 30 year fixed.

It's the refis.

Rates went low and everyone rushed in to refi their home to take advantage of the low rates. So many lenders had let their staff go that now the system has clogged up and it may take three weeks to a month to get back to normal. Rates were raised to slow down the process and get rid of the clog.

Once the clog is gone we are hoping rates will drop back down again to the 5% 30 year fixed level. Keep your fingers crossed.

As I mentioned in a prior post, many of the current homeowners trying to get refianced will be disappointed by higher lending standards and lower home values.

I ran into a client recently who told me was in the middle of a refinance. They were charging him $400 for an appraisal and his value came in $50,000 less than his county tax value. He was shocked at the value of the appraisal.

Another client told me their refinance came back several times with additional conditions for the refinance. First a 'patched' roof was required, then a new roof was required before they would lend the money.

Lending has DRASTICALLY changed from just a year ago putting a new twist to all transactions that require lending- which are most of our sales.

I am trying to keep up with all of the changes through classes and continuing education but there are surprises around every bend.

If you have questions about refis or new loans, give me a call. If I can't answer your question I can put you in touch with the right resource who can.

Displaying blog entries 1-3 of 3